Where Is The 199A Deduction Taken On Form 1040

Where Is The 199A Deduction Taken On Form 1040 - Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). •applies to individuals and certain trusts and estates. The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized deductions. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section.

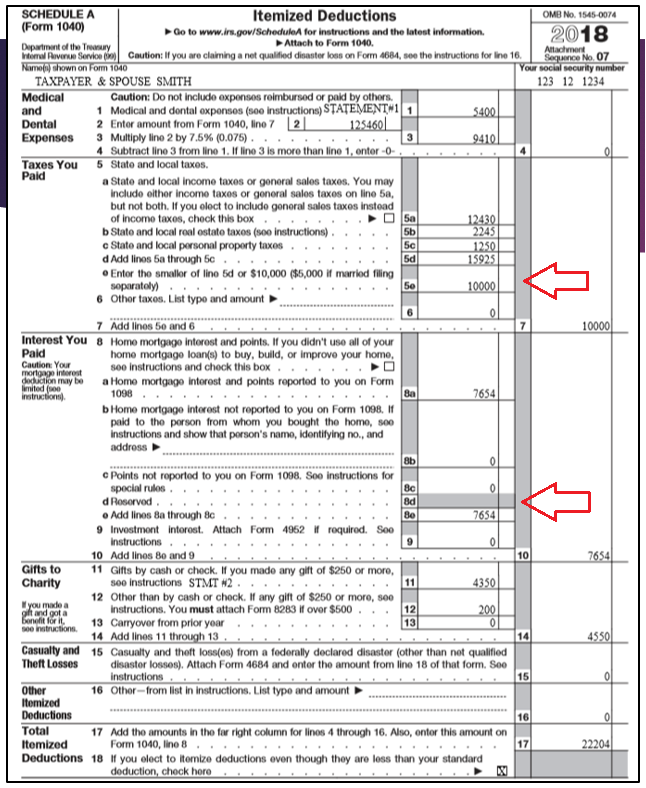

The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized deductions. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. •applies to individuals and certain trusts and estates. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi).

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized deductions. •applies to individuals and certain trusts and estates.

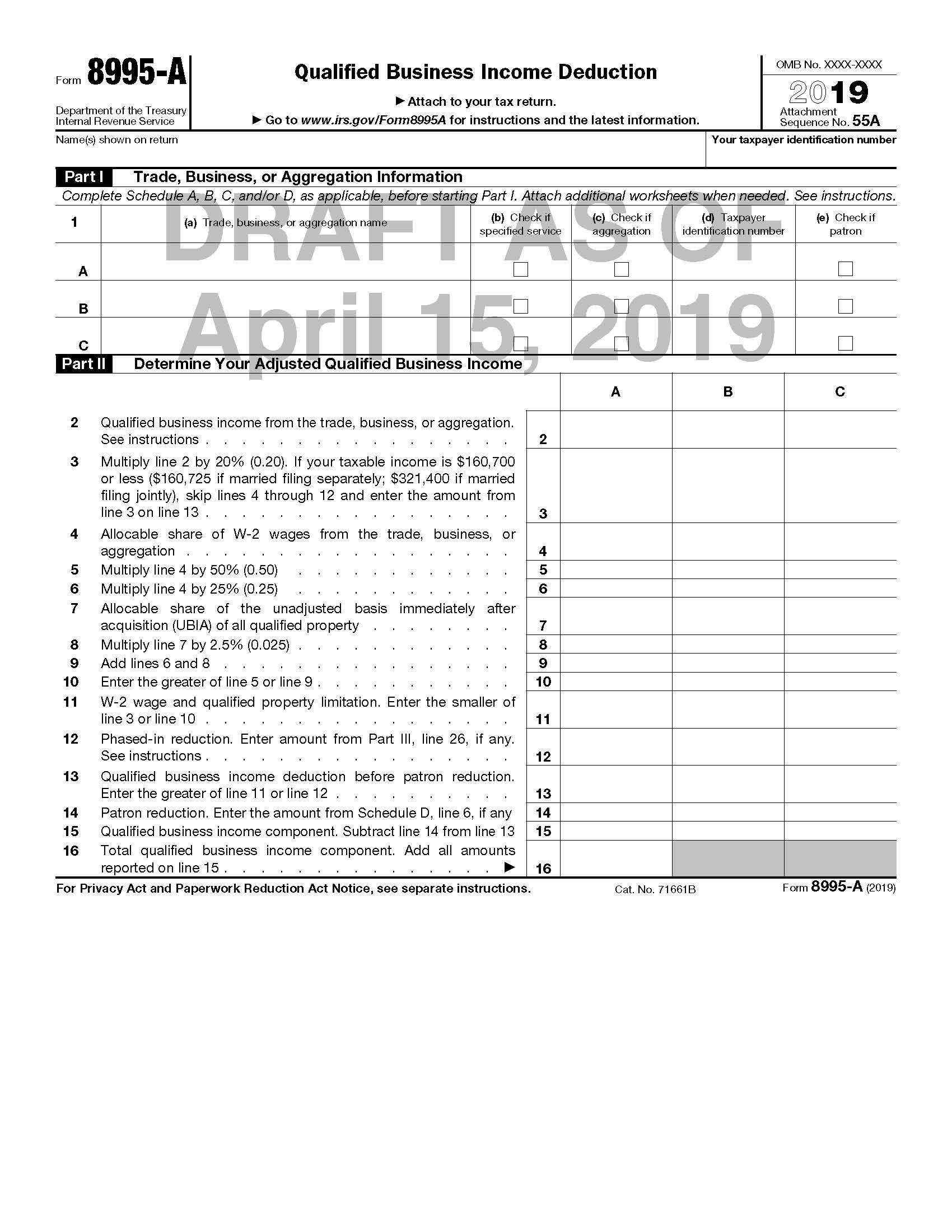

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. •applies to individuals and certain trusts and estates. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). The deduction may be claimed on the form 1040, after.

What Is A 199a Tax Form

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized deductions. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter.

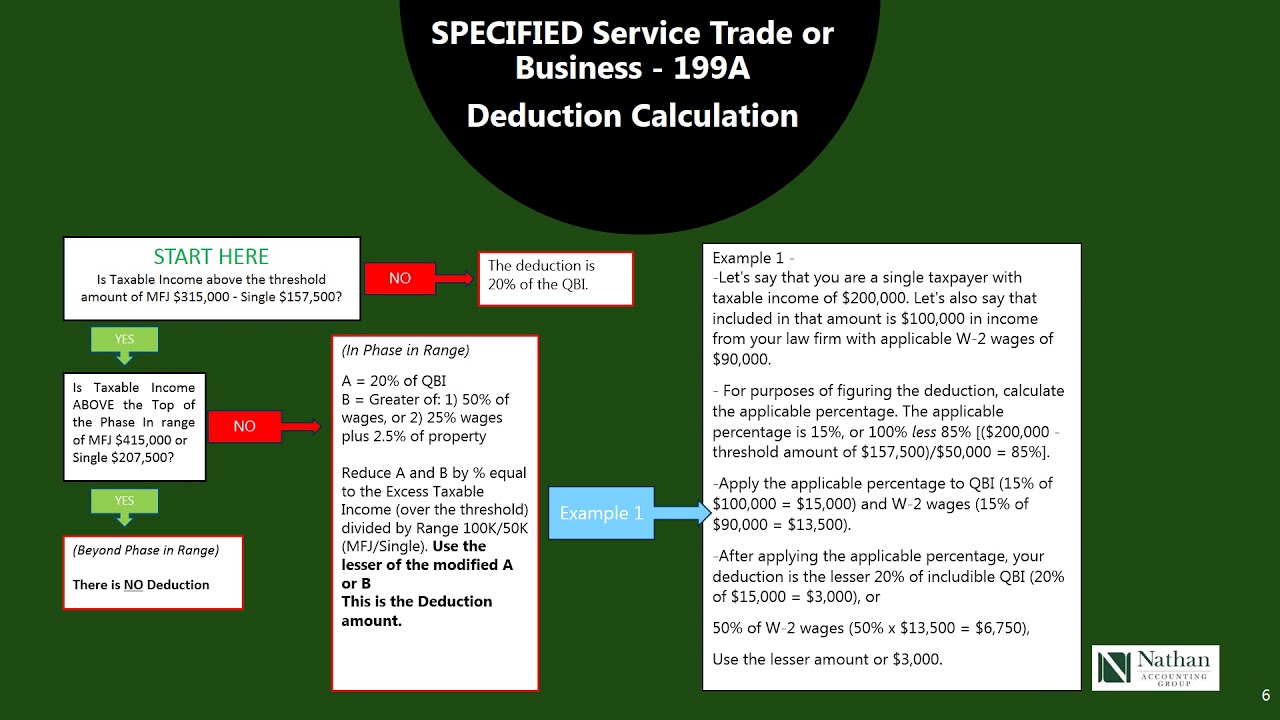

PassThru Entity Deduction 199A Explained & Made Easy to Understand

•applies to individuals and certain trusts and estates. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). The deduction may be claimed on the form 1040, after.

The Accidental CFO The Section 199A Deduction by Chris and Trish Meyer

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the.

199A Worksheet By Activity Form Printable Calendars AT A GLANCE

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the.

2018 Tax Reform “Tax Cuts and Jobs Act” ppt download

If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the.

ICYMI Proposed Regulations Clarify the IRC Section 199A Deduction

•applies to individuals and certain trusts and estates. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. The deduction may be claimed on the form 1040, after.

How is the Section 199A Deduction determined? QuickReadBuzzQuickReadBuzz

The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized deductions. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for.

199A Worksheet By Activity Form Printable And Enjoyable Learning

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). •applies to individuals and certain trusts and estates. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section. The deduction may be claimed on the form 1040, after.

Irs Form 199a Deduction Worksheet

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized deductions. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter.

If You Have Any Adjustments To Unadjusted Basis Immediately After Acquisition For Depreciable Assets Enter Them In The New Section.

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). •applies to individuals and certain trusts and estates. The deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized deductions.