What Is The Sales Tax Rate In Hillsborough County Florida

What Is The Sales Tax Rate In Hillsborough County Florida - There are a total of 362. The current sales tax rate in hillsborough county, fl is 7.5%. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The hillsborough county sales tax rate is 1.5%. Look up the current rate for a specific address using the same geolocation technology that powers the. There is no applicable city tax or. Florida sales and use tax in the. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax.

730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. There are a total of 362. Look up the current rate for a specific address using the same geolocation technology that powers the. Florida sales and use tax in the. There is no applicable city tax or. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The hillsborough county sales tax rate is 1.5%. The current sales tax rate in hillsborough county, fl is 7.5%. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax.

There is no applicable city tax or. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. Look up the current rate for a specific address using the same geolocation technology that powers the. The current sales tax rate in hillsborough county, fl is 7.5%. There are a total of 362. The hillsborough county sales tax rate is 1.5%. Florida sales and use tax in the.

Hillsborough County Commercial Lease Sales Tax Rate Reduced by Recent

There are a total of 362. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value..

Florida Property Tax Increase 2024 Janel

There is no applicable city tax or. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. Florida sales and use tax in the. The hillsborough county sales tax rate is 1.5%.

The Hillsborough County, Florida Local Sales Tax Rate is a minimum of 7.5

There is no applicable city tax or. There are a total of 362. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The current sales tax rate in hillsborough county, fl is 7.5%. The 7.5% sales tax rate in tampa consists of 6% florida state.

Hillsborough County Tax Rate 2024 Ajay Lorrie

Florida sales and use tax in the. The hillsborough county sales tax rate is 1.5%. Look up the current rate for a specific address using the same geolocation technology that powers the. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. 730 rows florida has state sales tax of 6%, and allows local governments to collect.

Florida Sales Tax Free Days 2024 Idell Lavinia

Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. The current sales tax rate in hillsborough county, fl is 7.5%. There are a total of 362. Look up the current rate for a specific address using the same geolocation technology that powers the. Florida sales and use tax in the.

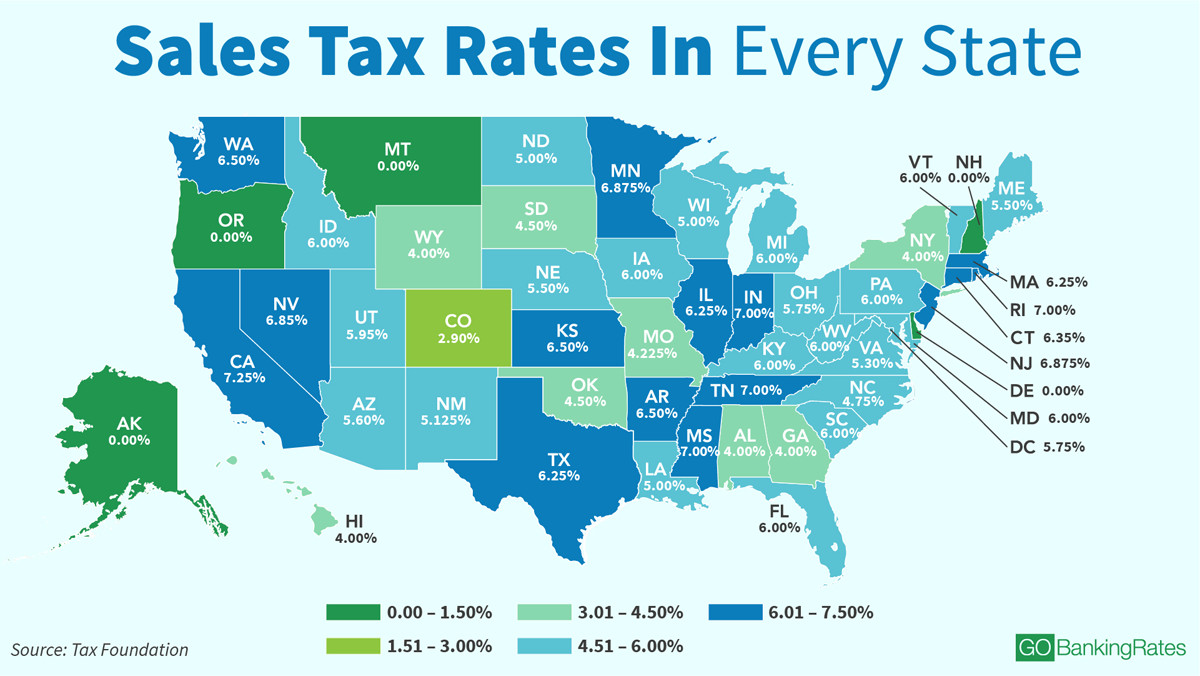

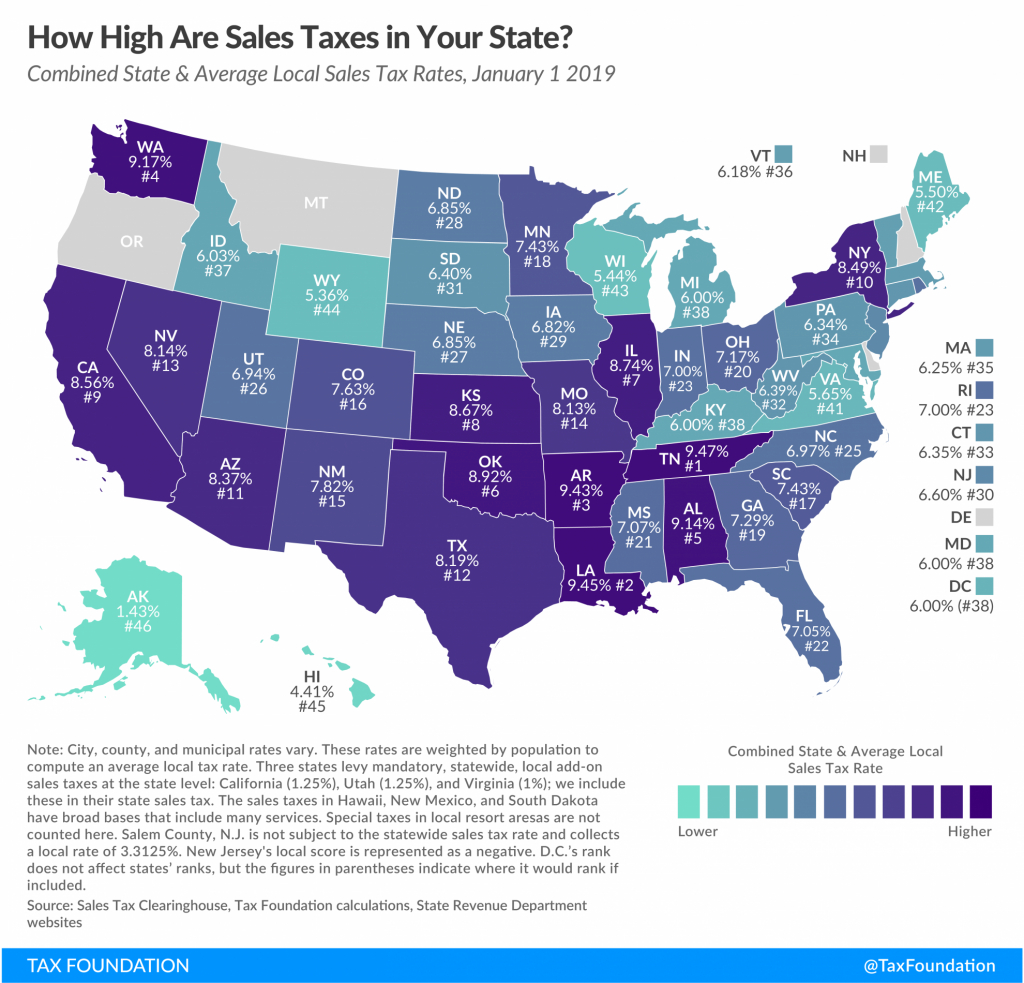

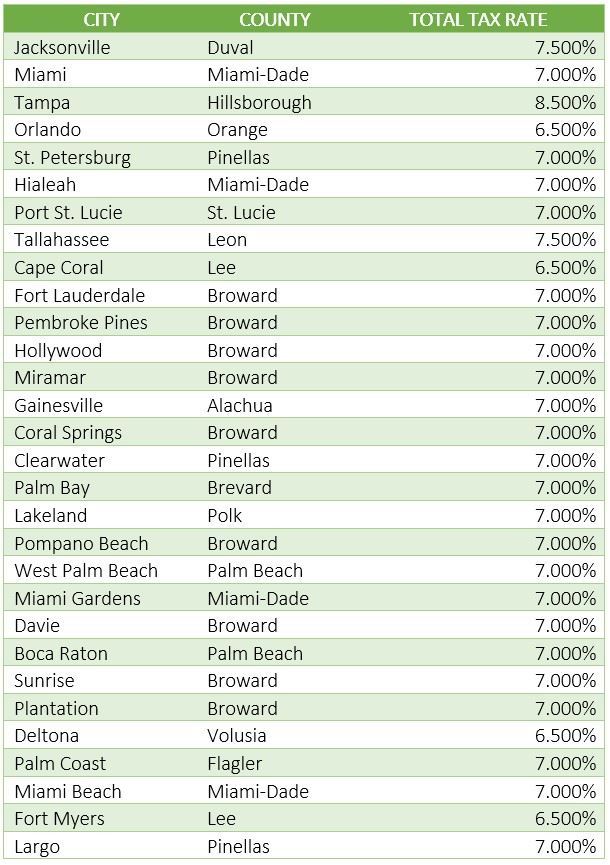

Florida Sales Tax By County 2024 Cele Meggie

The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. The current sales tax rate in hillsborough county, fl is 7.5%. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. Florida sales and use tax in the. There are a total of.

Hillsborough County Sales Tax 2024 Milli Suzanne

730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. There are a total of 362. Florida sales and use tax in the. The current sales tax rate in hillsborough county, fl is.

Ramsey Solutions (RamseySolutions) on Flipboard

The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax. Hillsborough county residents currently pay a 1.5% discretionary sales surtax on the first $5,000 of taxable value. There is no applicable city tax or. 730 rows florida has state sales tax of 6%, and allows local governments to collect a.

Hillsborough County Sales Tax Rates US iCalculator™

There is no applicable city tax or. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. 730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. There are a total of 362. Florida sales and use tax in the.

Hillsborough County Residents Currently Pay A 1.5% Discretionary Sales Surtax On The First $5,000 Of Taxable Value.

730 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The hillsborough county sales tax rate is 1.5%. Florida sales and use tax in the. There is no applicable city tax or.

Look Up The Current Rate For A Specific Address Using The Same Geolocation Technology That Powers The.

The current sales tax rate in hillsborough county, fl is 7.5%. Click for sales tax rates, hillsborough county sales tax calculator, and printable sales. There are a total of 362. The 7.5% sales tax rate in tampa consists of 6% florida state sales tax and 1.5% hillsborough county sales tax.