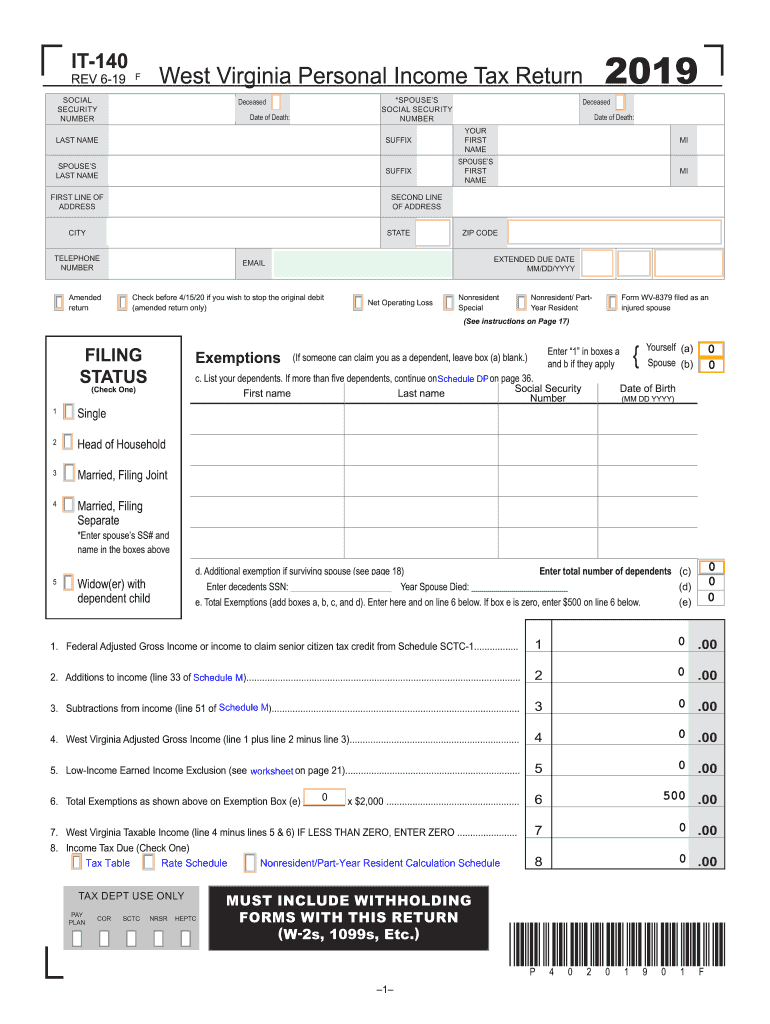

West Virginia State Income Tax Form

West Virginia State Income Tax Form - Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. We last updated the west virginia.

Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. We last updated the west virginia.

We last updated the west virginia. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold.

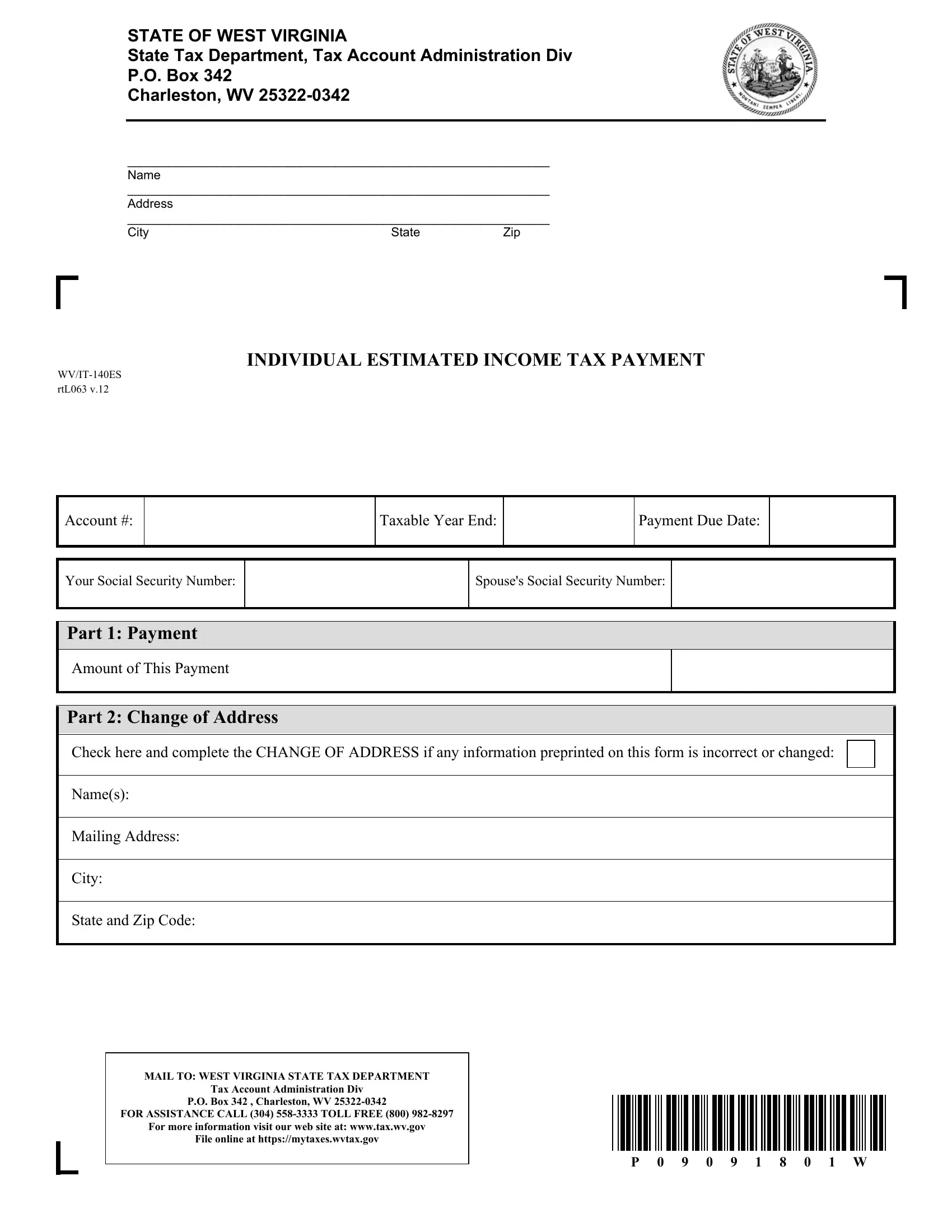

West Virginia Estimated Tax PDF Form FormsPal

Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. We last updated the west virginia. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is.

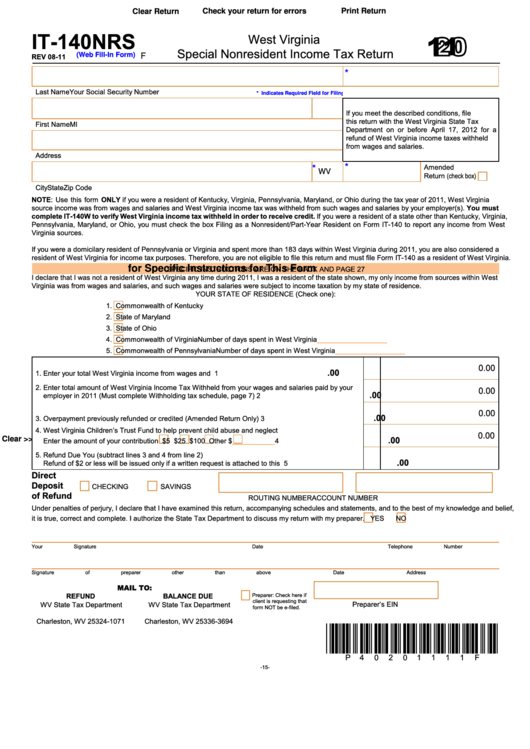

Fillable Form It140nrs West Virginia Special Nonresident Tax

We last updated the west virginia. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is.

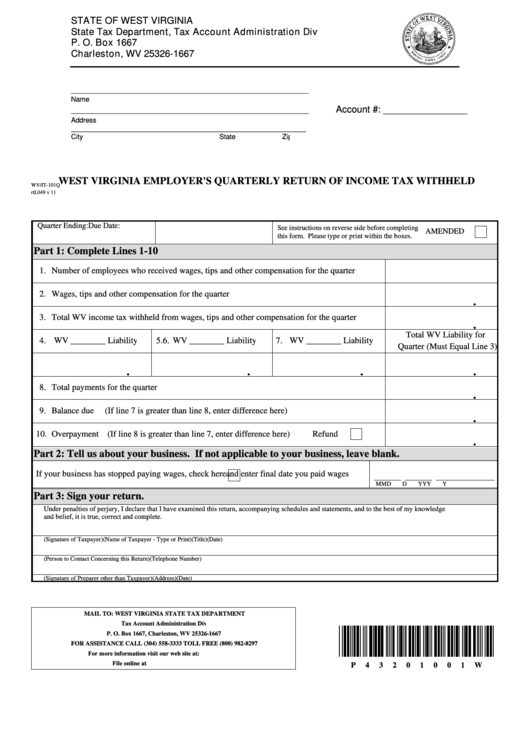

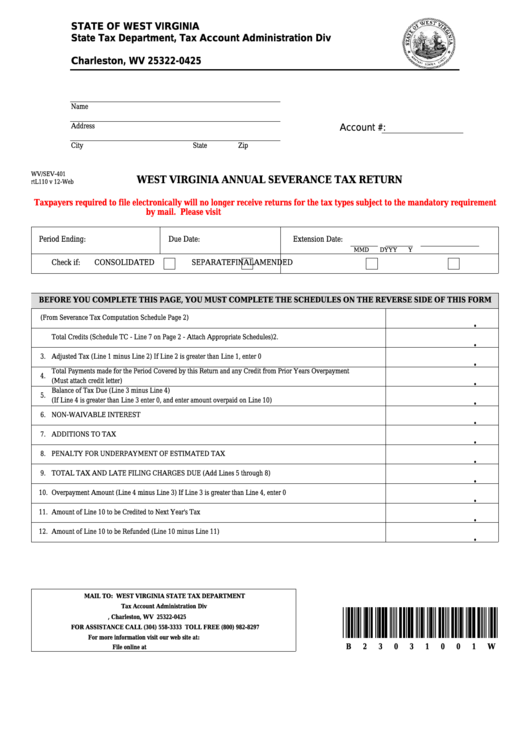

West Virginia Employer'S Quarterly Return Of Tax Withheld West

Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. We last updated the west virginia.

Virginia Tax Rate Complete with ease airSlate SignNow

Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. We last updated the west virginia. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is.

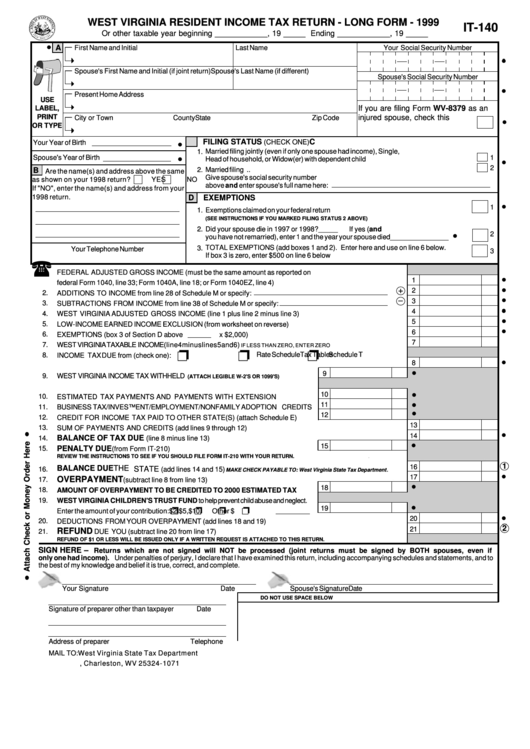

Form It140 West Virginia Resident Tax Return Long Form

Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. We last updated the west virginia.

Fillable And Printable West Virginia Tax Forms Printable Forms Free

Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. We last updated the west virginia.

PAYING WEST VIRGINIA STATE TAXES YouTube

Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. We last updated the west virginia.

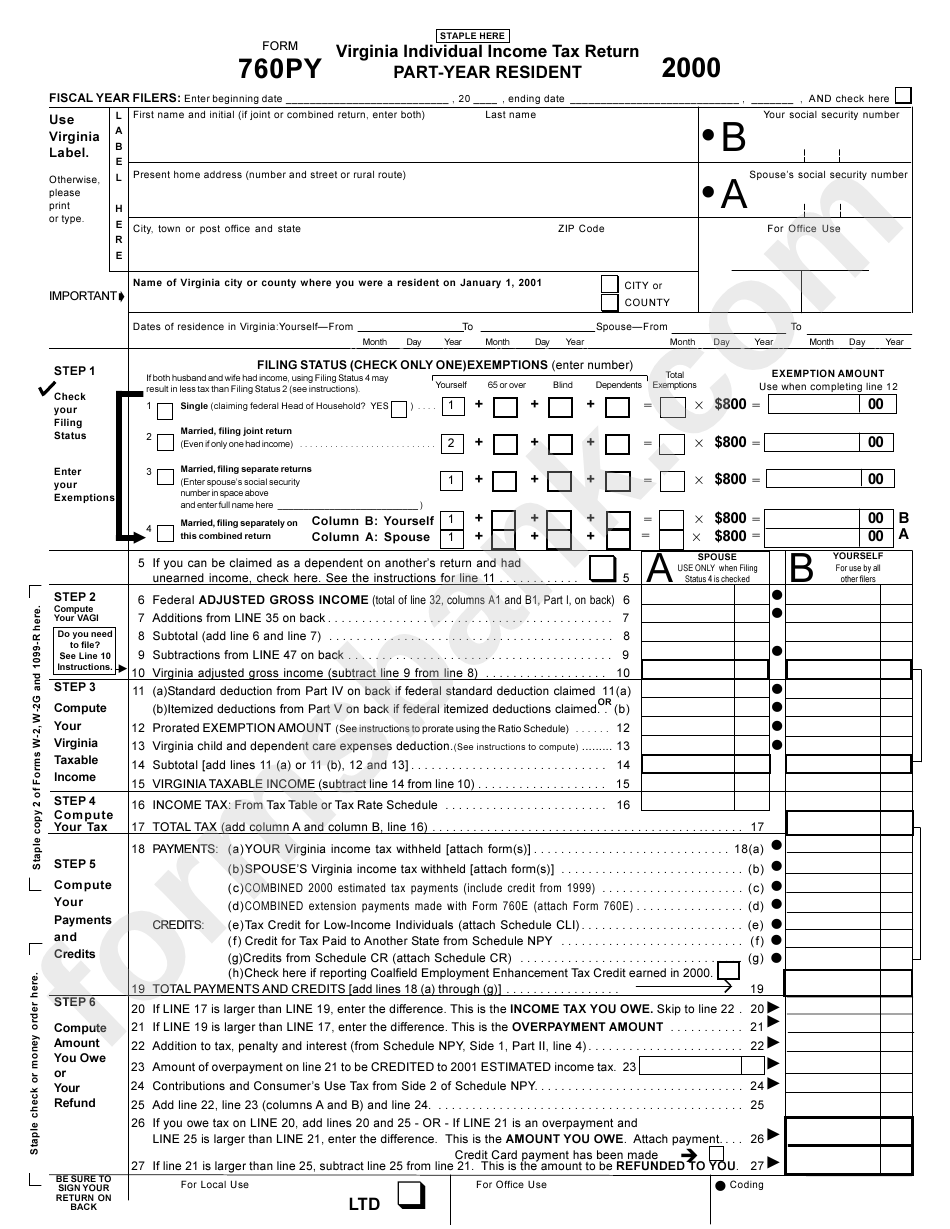

Virginia Printable Tax Forms Printable Forms Free Online

We last updated the west virginia. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold.

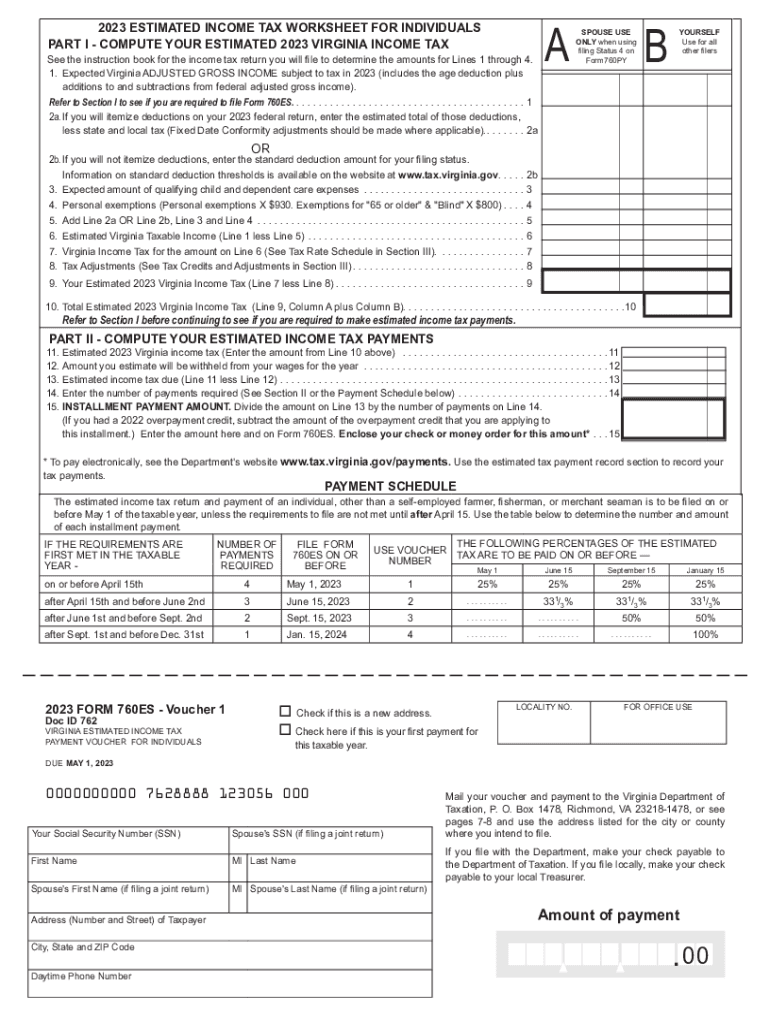

Virginia Estimated Tax Payments 2023 Rate

We last updated the west virginia. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold.

Wv state tax forms Fill out & sign online DocHub

Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. We last updated the west virginia.

We Last Updated The West Virginia.

Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is.