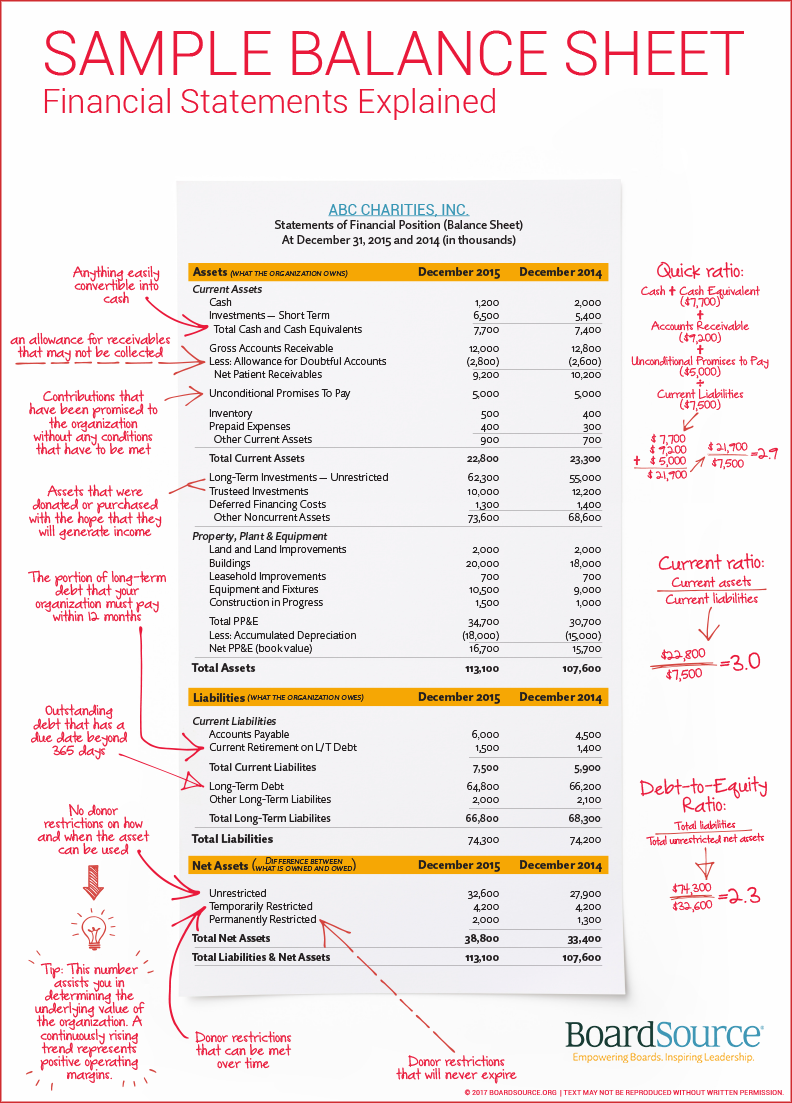

Unrealized Gains And Losses Balance Sheet

Unrealized Gains And Losses Balance Sheet - The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

Take the Fear out of Financial Statements

The security investment will be present on the balance sheet, its value will change depending on the price in the capital market. The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement.

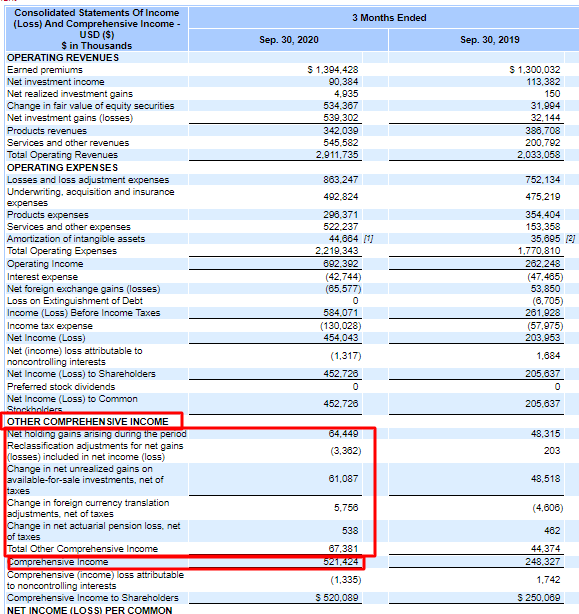

Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT)

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

SVB highlights 620 billion hole at U.S. banks Fortune

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

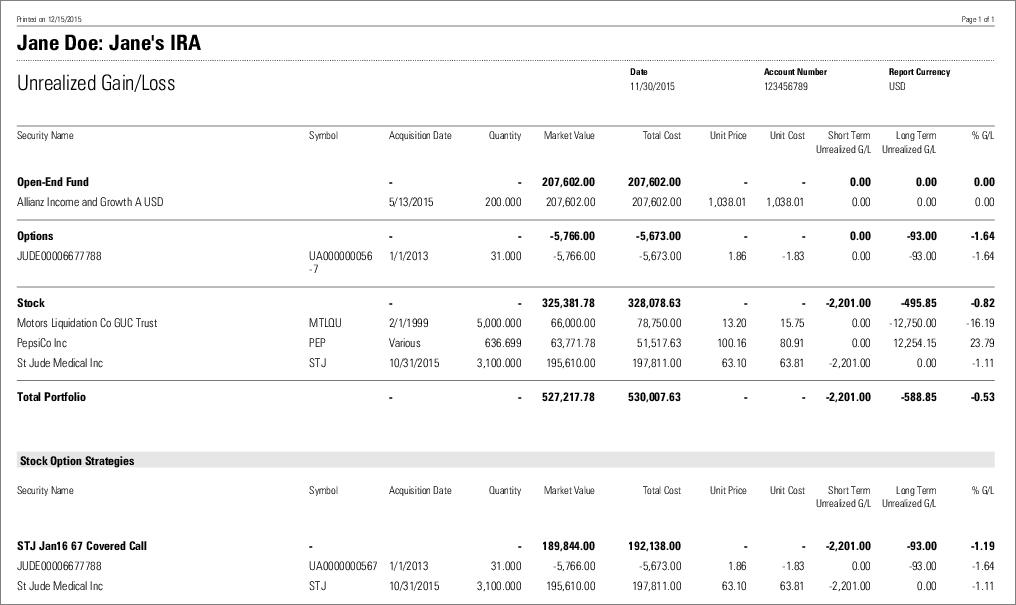

Sample Unrealized Gain/Loss Report

The security investment will be present on the balance sheet, its value will change depending on the price in the capital market. The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement.

Beautiful Negative Payroll Liabilities Balance Sheet Market Value On

The security investment will be present on the balance sheet, its value will change depending on the price in the capital market. The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement.

Unrealized gain and loss Step by step guide to record unrealized

The security investment will be present on the balance sheet, its value will change depending on the price in the capital market. The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement.

Unrealized Gains and Losses (Explained , Examples)

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

Unbelievable Gaap Accounting For Unrealized Gains And Losses Where Does

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

Four US Banking Giants Now Have 205,000,000,000 in Unrealized Losses

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

Accounting for unrealised forex gain loss form

The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

The Full Amount Of The Gain Or Loss During The Holding Period Is Reported As “Realized Gain Or Loss” On The Income Statement.

The security investment will be present on the balance sheet, its value will change depending on the price in the capital market.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)