Tn Sales Tax Exempt Form

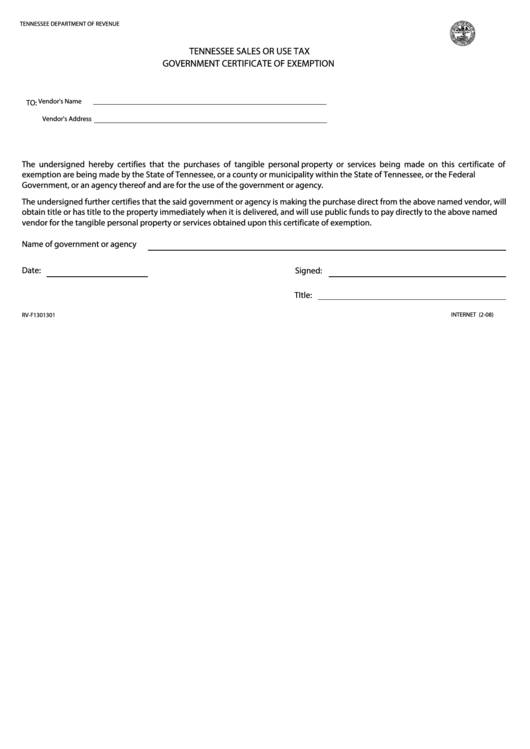

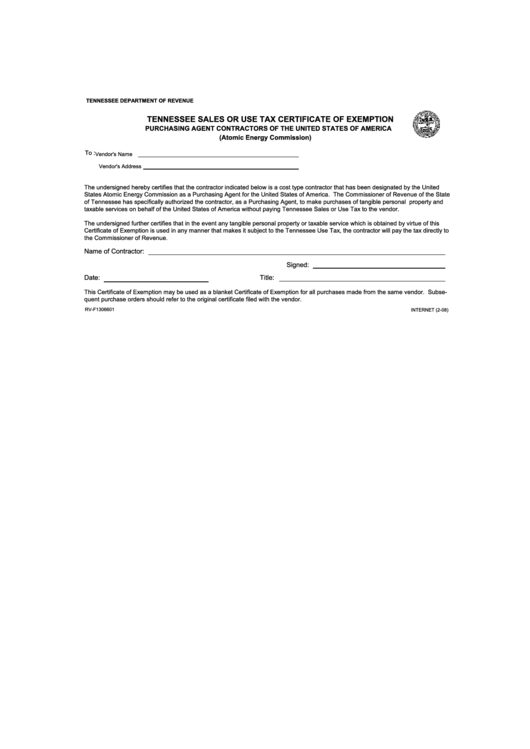

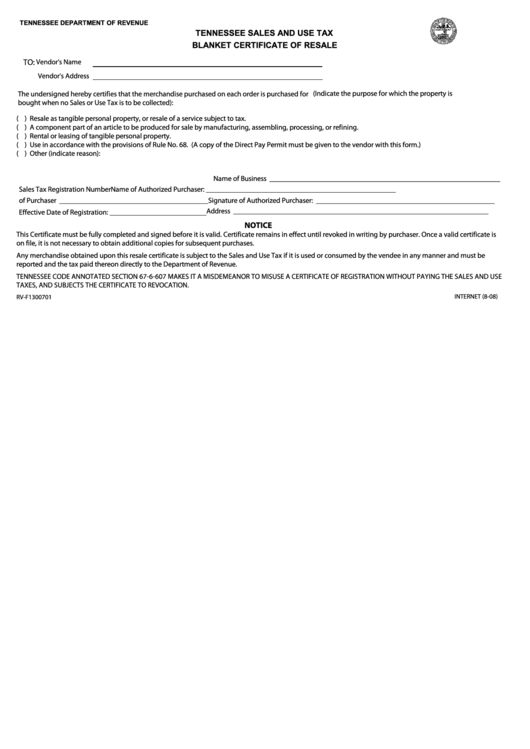

Tn Sales Tax Exempt Form - Application for broadband infrastructure sales and use tax exemption; If an organization qualifies as exempt from sales and use tax under tenn. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for research and development. Find out how to apply for.

This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax exemption; Application for research and development. Find out how to apply for. Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee.

Application for research and development. Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use. If an organization qualifies as exempt from sales and use tax under tenn. Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Find out how to apply for.

Tennessee Resale Certificate Trivantage

Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. Application for broadband infrastructure sales and use tax exemption; Purchasers must provide a new resale or exemption certificate if there are changes in.

Tn Sales Tax Exemption Form

Find out how to apply for. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Application for broadband infrastructure sales and use tax exemption; Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Application for research and development.

Printable Tennessee Sales Tax Exemption Certificates

Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Application for broadband infrastructure sales and use tax exemption; Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. This application for registration is to be used to register your organization for exemption.

Tennessee State Tax Withholding Form

Application for research and development. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax exemption; Purchasers must provide a new resale or exemption certificate if there are changes.

Printable Tennessee Sales Tax Exemption Certificates Tax exemption

Application for broadband infrastructure sales and use tax exemption; Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. If an organization qualifies as exempt from sales and use tax under tenn. Sellers may.

New TaxExempt Forms in Tennessee? 21st Century Christian, Inc.

Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. If an organization qualifies as exempt from sales and use tax under tenn. Application for research and development. Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Find out how to apply.

20222024 Form TN RVF1301301 Fill Online, Printable, Fillable, Blank

If an organization qualifies as exempt from sales and use tax under tenn. Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Application for research and development. Application for broadband infrastructure.

Tennessee Tax Clearance Certificate prntbl.concejomunicipaldechinu.gov.co

Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Application for research and development. Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to.

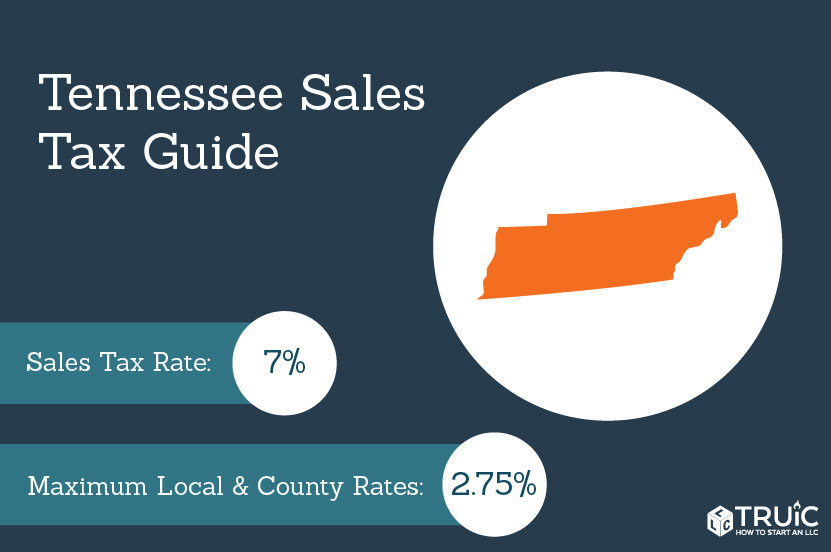

Tennessee Sales Tax Small Business Guide TRUiC

Learn about the different types of exemptions, certificates, and credits available for sales and use tax in tennessee. If an organization qualifies as exempt from sales and use tax under tenn. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Application for research and development. Application for broadband infrastructure.

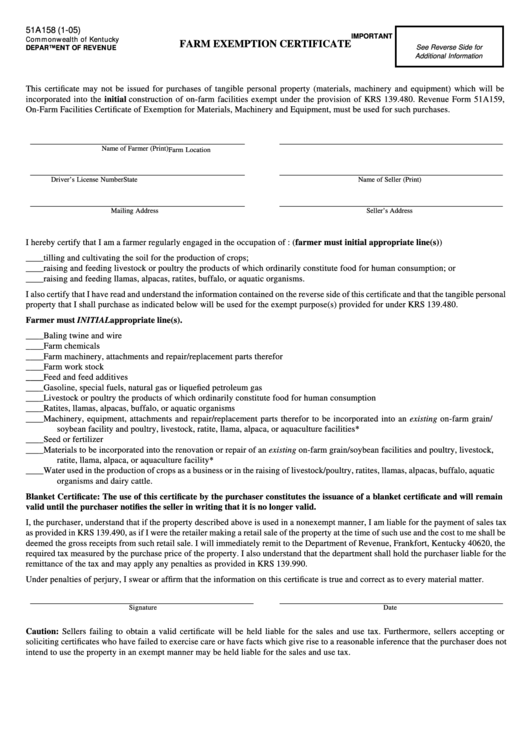

Farm Tax Exempt Form Tn

Find out how to apply for. If an organization qualifies as exempt from sales and use tax under tenn. Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for.

Learn About The Different Types Of Exemptions, Certificates, And Credits Available For Sales And Use Tax In Tennessee.

Application for broadband infrastructure sales and use tax exemption; If an organization qualifies as exempt from sales and use tax under tenn. Sellers may continue to accept this paper form to document exempt sales to the federal and tennessee government entities. Find out how to apply for.

Application For Research And Development.

Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. This application for registration is to be used to register your organization for exemption from the tennessee sales or use.