Tip Reporting Form

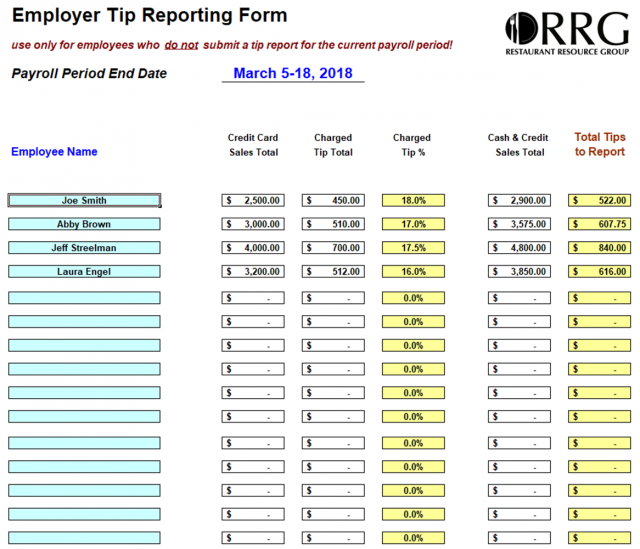

Tip Reporting Form - Keep a daily tip record. Otherwise, here is the information required; Use this form to track and report your employee's tips. Employees must keep a daily record of tips received. Employers use form 8027 to: You may use irs form 4070 to report tips to your employer. Annually report to the irs receipts and tips from their large food or beverage establishments. Determine allocated tips for tipped employees. Generally, you must report all tips you received in the tax year on your tax return. This includes both server cash tips as well as credit card tips recorded by your pos system for each server.

Otherwise, here is the information required; Use this form to track and report your employee's tips. Provide it in any format, but put it in writing: Determine allocated tips for tipped employees. Annually report to the irs receipts and tips from their large food or beverage establishments. Keep a daily tip record. Employers use form 8027 to: Employees must keep a daily record of tips received. Generally, you must report all tips you received in the tax year on your tax return. This includes both server cash tips as well as credit card tips recorded by your pos system for each server.

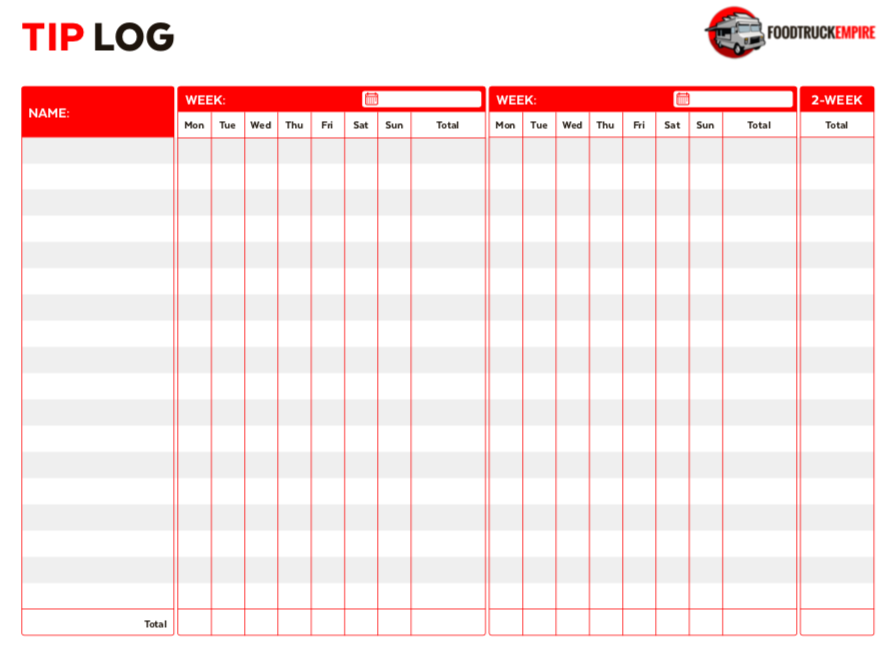

Keep a daily tip record. Provide it in any format, but put it in writing: This includes both server cash tips as well as credit card tips recorded by your pos system for each server. Employees must keep a daily record of tips received. Annually report to the irs receipts and tips from their large food or beverage establishments. Use this form to track and report your employee's tips. You can use form 4070a, employee's daily record of tips,. You may use irs form 4070 to report tips to your employer. Determine allocated tips for tipped employees. Generally, you must report all tips you received in the tax year on your tax return.

Restaurant Resource Group What Employers Need to Know About Tip Reporting

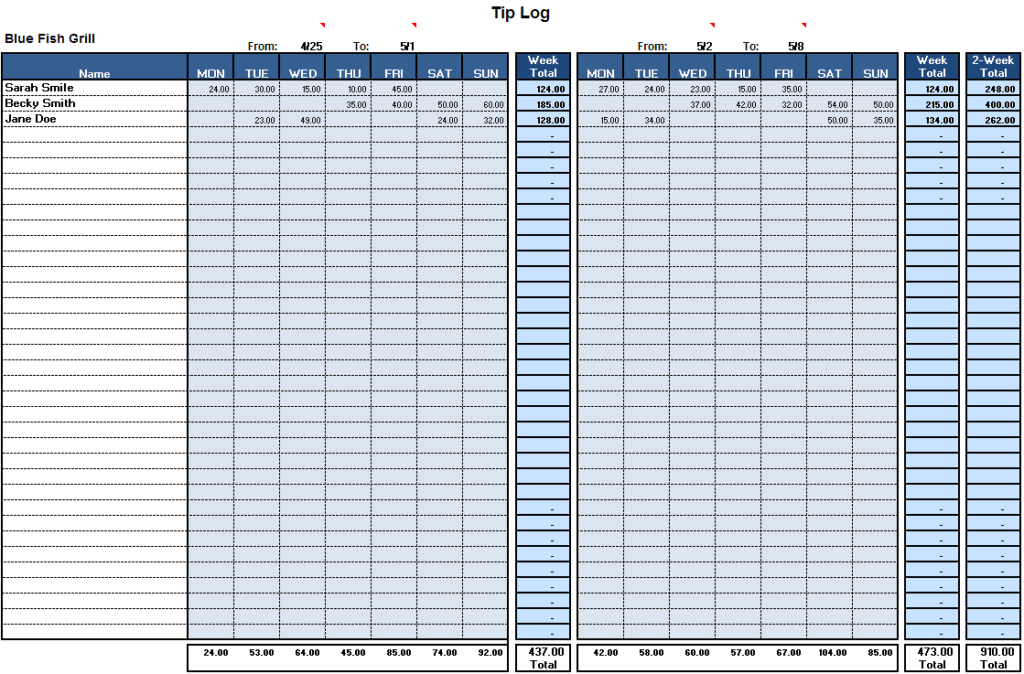

Employers use form 8027 to: Report all tips on an individual income tax return. You can use form 4070a, employee's daily record of tips,. Keep a daily tip record. Annually report to the irs receipts and tips from their large food or beverage establishments.

Download Templates Printable Restaurant Tip Reporting Forms

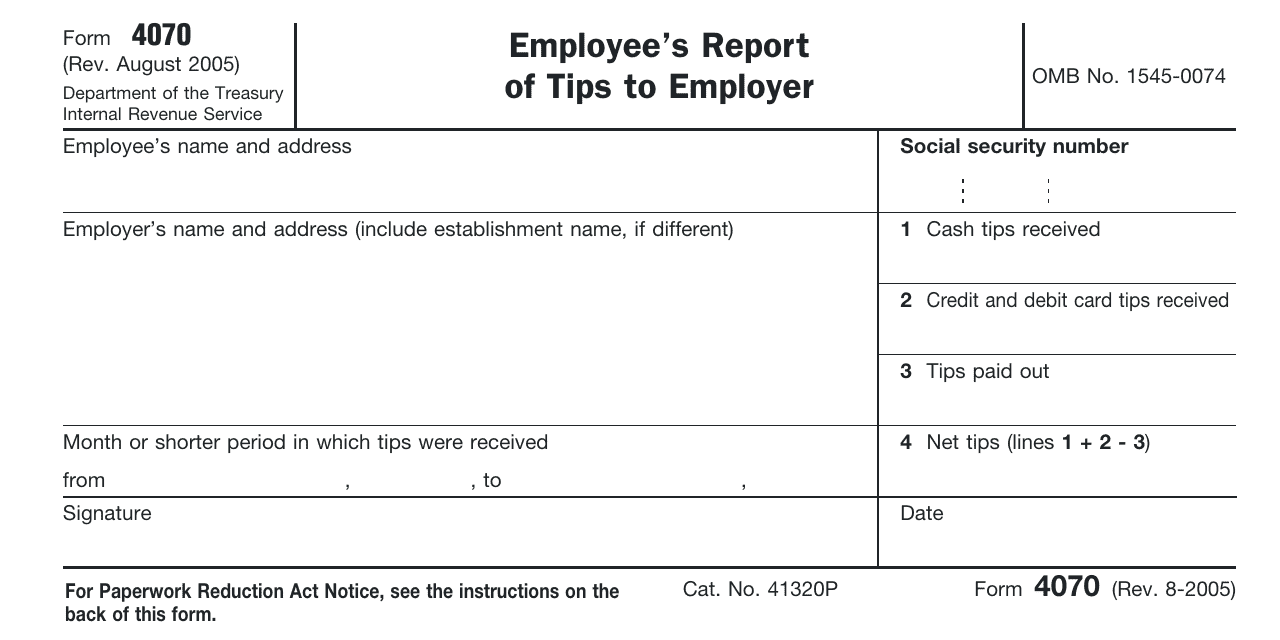

Employers use form 8027 to: Provide it in any format, but put it in writing: Otherwise, here is the information required; You can use form 4070a, employee's daily record of tips,. You may use irs form 4070 to report tips to your employer.

Tip Tracker Spreadsheet —

You can use form 4070a, employee's daily record of tips,. Otherwise, here is the information required; Employees must keep a daily record of tips received. Provide it in any format, but put it in writing: Employers use form 8027 to:

Employee Tip Reporting Form Printable Form 2024

Otherwise, here is the information required; You may use irs form 4070 to report tips to your employer. Employees must keep a daily record of tips received. This includes both server cash tips as well as credit card tips recorded by your pos system for each server. You can use form 4070a, employee's daily record of tips,.

Tip Reporting Form Gratuity Irs Tax Forms

Provide it in any format, but put it in writing: Employees must keep a daily record of tips received. Annually report to the irs receipts and tips from their large food or beverage establishments. Otherwise, here is the information required; Generally, you must report all tips you received in the tax year on your tax return.

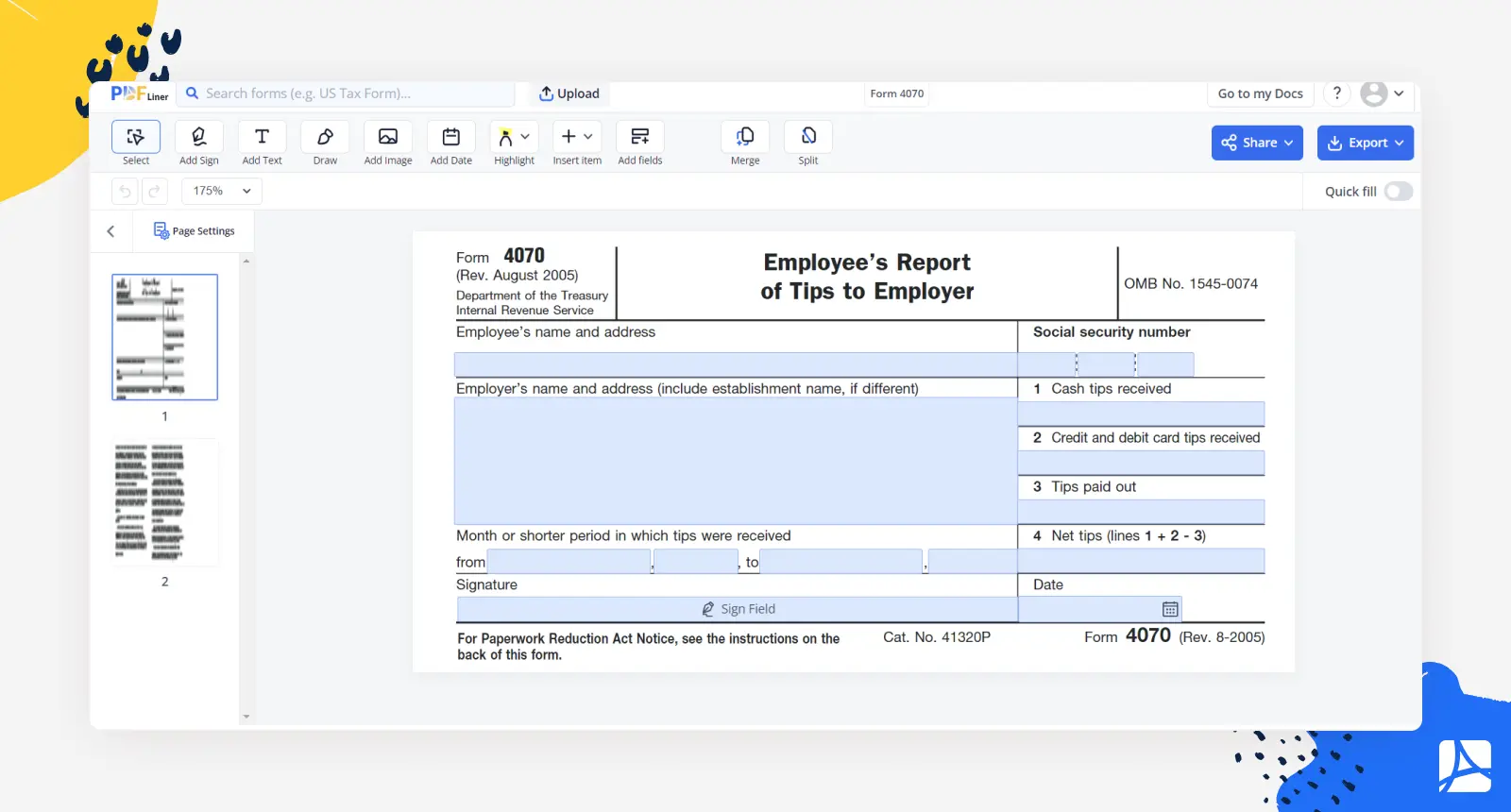

Irs tip reporting form 4070 Fill online, Printable, Fillable Blank

Determine allocated tips for tipped employees. You may use irs form 4070 to report tips to your employer. Employees must keep a daily record of tips received. Otherwise, here is the information required; This includes both server cash tips as well as credit card tips recorded by your pos system for each server.

Printable Tip Reporting Sheet

Determine allocated tips for tipped employees. Use this form to track and report your employee's tips. Generally, you must report all tips you received in the tax year on your tax return. Keep a daily tip record. Employees must keep a daily record of tips received.

Printable Tip Reporting Sheet Printable Word Searches

You may use irs form 4070 to report tips to your employer. You can use form 4070a, employee's daily record of tips,. Annually report to the irs receipts and tips from their large food or beverage establishments. Employers use form 8027 to: This includes both server cash tips as well as credit card tips recorded by your pos system for.

Irs Form 4070a Printable Printable Forms Free Online

Otherwise, here is the information required; Determine allocated tips for tipped employees. Use this form to track and report your employee's tips. Employers use form 8027 to: You may use irs form 4070 to report tips to your employer.

Irs Form 4070 Fillable Printable Forms Free Online

Employees must keep a daily record of tips received. You can use form 4070a, employee's daily record of tips,. Report all tips on an individual income tax return. Keep a daily tip record. This includes both server cash tips as well as credit card tips recorded by your pos system for each server.

This Includes Both Server Cash Tips As Well As Credit Card Tips Recorded By Your Pos System For Each Server.

You may use irs form 4070 to report tips to your employer. Otherwise, here is the information required; Keep a daily tip record. Provide it in any format, but put it in writing:

Determine Allocated Tips For Tipped Employees.

Employees must keep a daily record of tips received. You can use form 4070a, employee's daily record of tips,. Use this form to track and report your employee's tips. Report all tips on an individual income tax return.

Annually Report To The Irs Receipts And Tips From Their Large Food Or Beverage Establishments.

Employers use form 8027 to: Generally, you must report all tips you received in the tax year on your tax return.