Texas Articles Of Incorporation Form

Texas Articles Of Incorporation Form - These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Learn how to diy or hire us to incorporate for you. In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary.

In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary. These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. Learn how to diy or hire us to incorporate for you. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state.

Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Learn how to diy or hire us to incorporate for you. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary.

Free Articles Of Incorporation charlotte clergy coalition

Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary. Learn how.

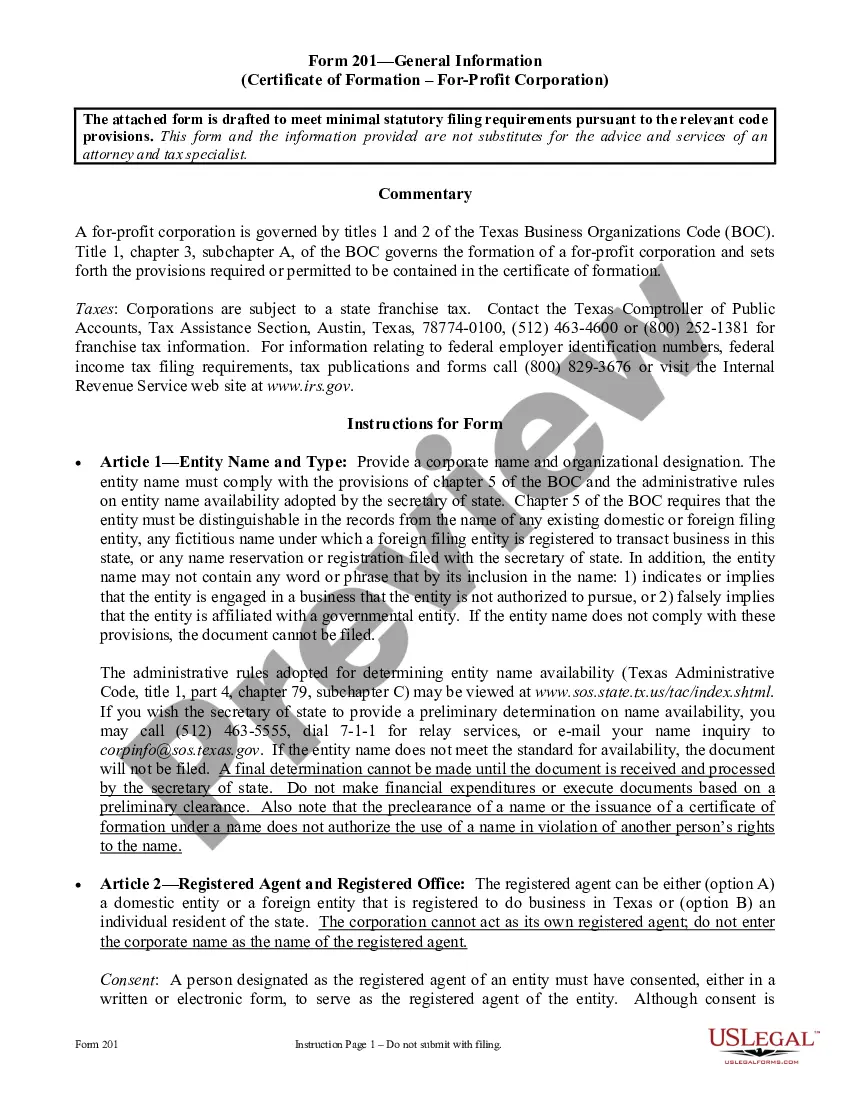

Texas Articles of Incorporation for Domestic For Articles Of

In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary. Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. These forms.

Free Printable Articles Of Incorporation Templates [PDF, Word] Non Profit

In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary. Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Learn how.

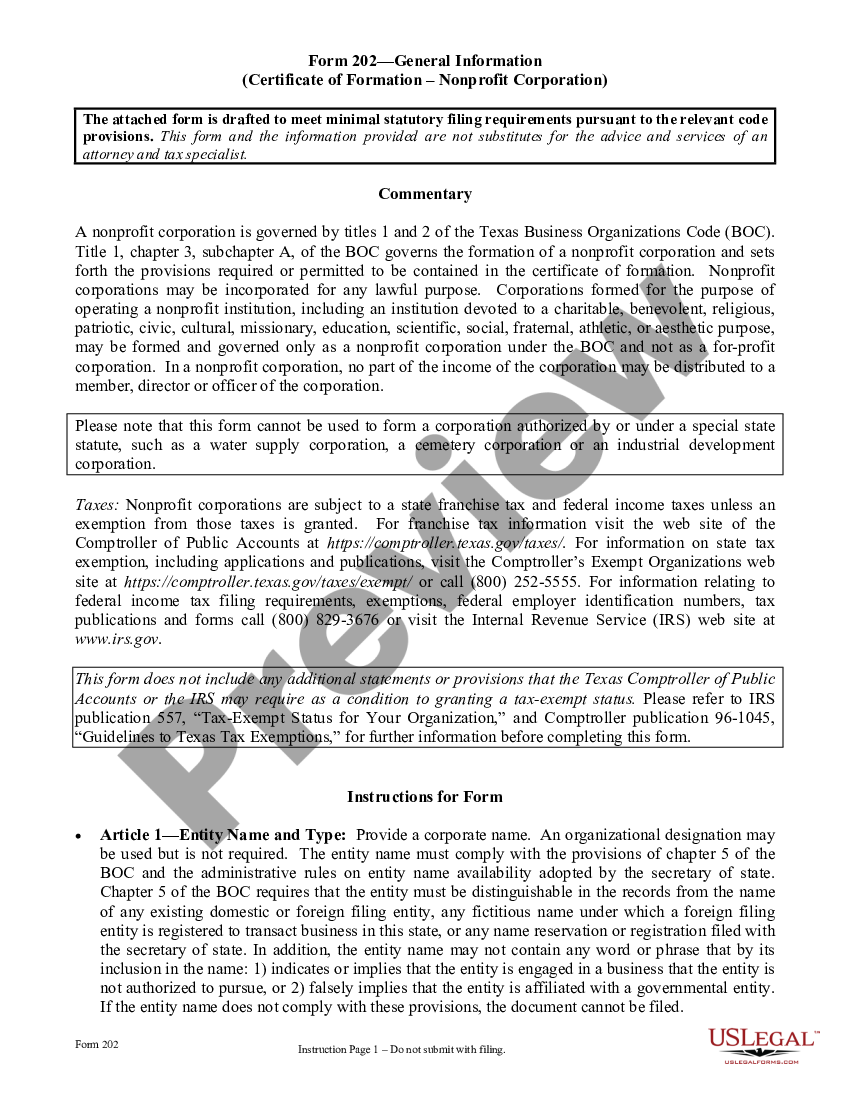

Articles Of Incorporation Texas Template Fill Online, Printable

These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Learn how to diy or hire us.

Articles Of Incorporation Fill Online, Printable, Fillable, Blank

Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. Learn how to diy or hire us.

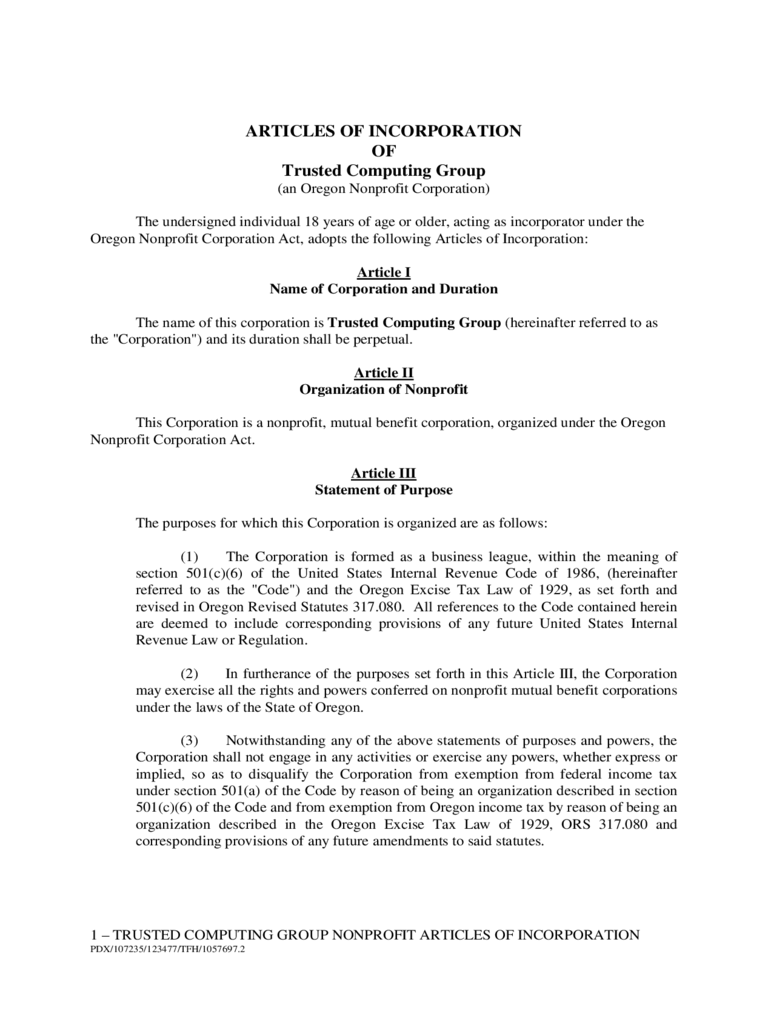

Texas Articles of Incorporation for Domestic Nonprofit Corporation

Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Learn how.

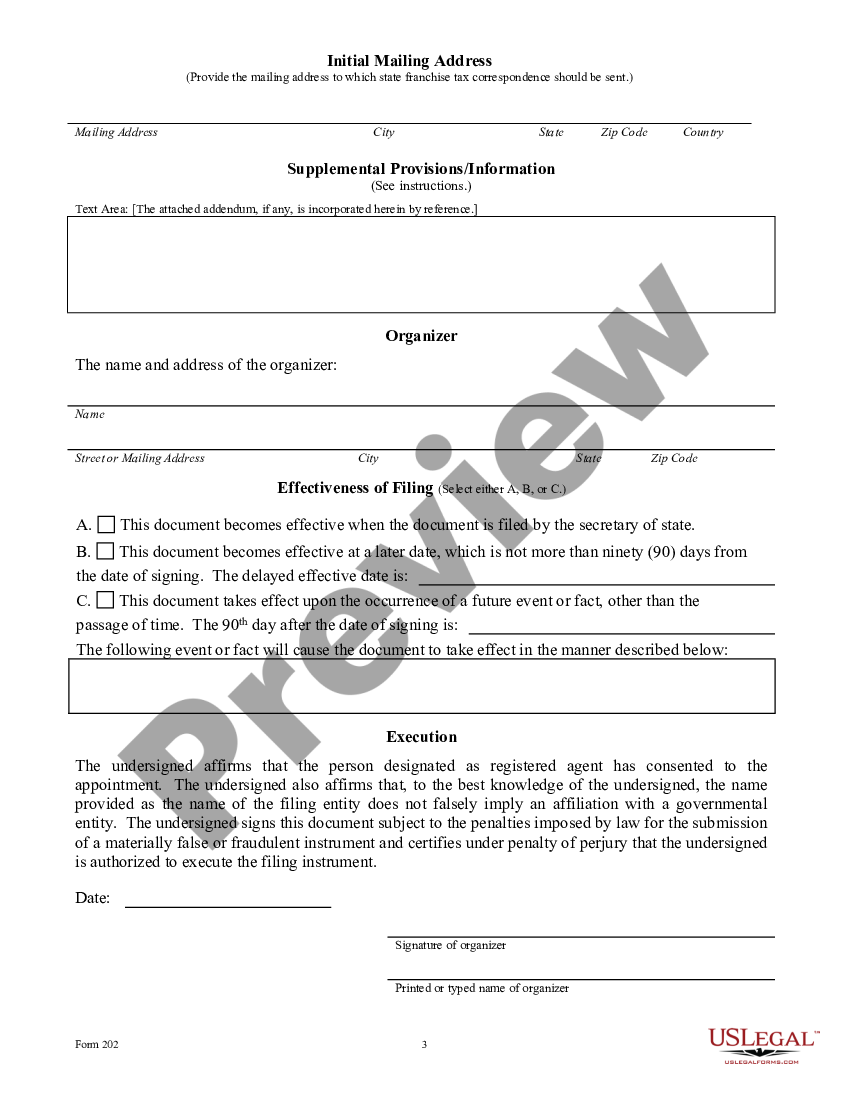

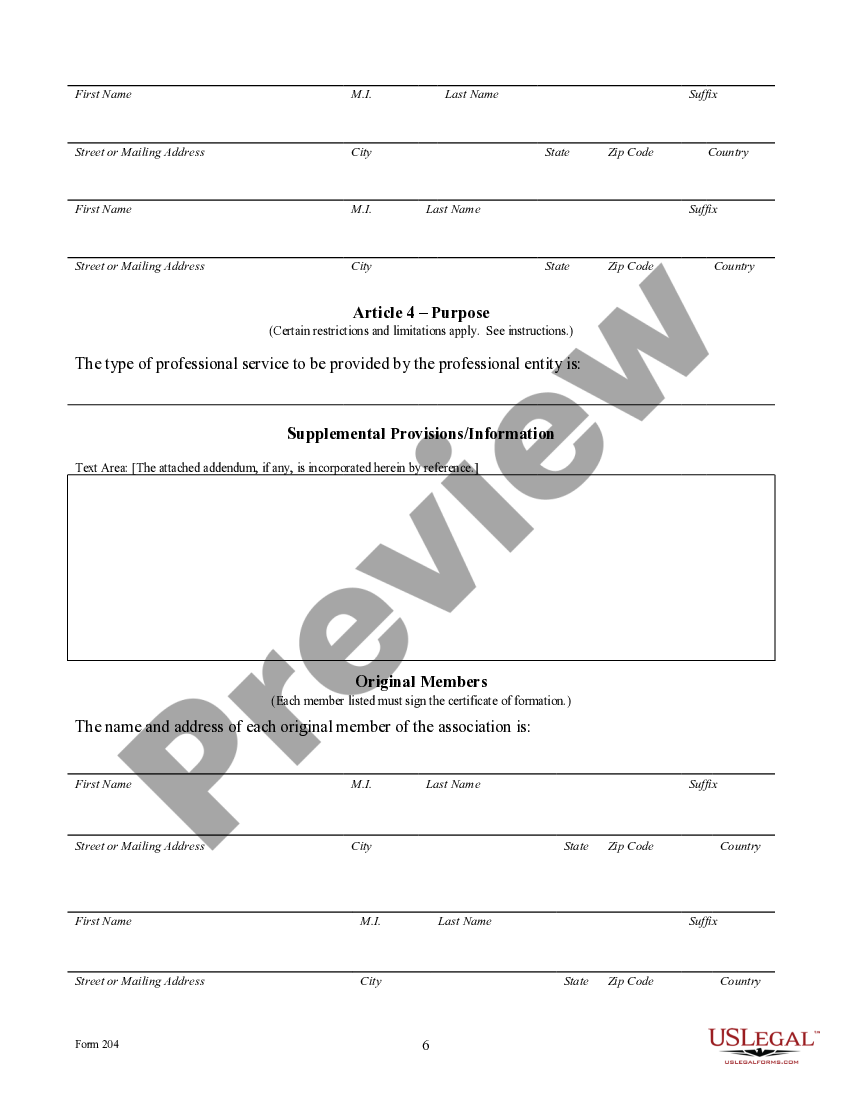

Texas Articles of Incorporation for Professional Association US Legal

Learn how to diy or hire us to incorporate for you. These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Form a corporation in texas by filing a certificate of formation w/ the.

Free Printable Articles Of Incorporation Templates [PDF, Word] Non Profit

These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. In texas, forms 201 through 208 are.

Odessa Texas Articles of Incorporation for Domestic Nonprofit

Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state. Learn how to diy or hire us to incorporate for you. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. In texas, forms 201 through 208 are used, depending on the type of.

Alabama Articles of Incorporation Certified copy, Articles, Alabama

In texas, forms 201 through 208 are used, depending on the type of business you are forming, for incorporation through the secretary. Learn how to diy or hire us to incorporate for you. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. These forms are for filing domestic business and.

In Texas, Forms 201 Through 208 Are Used, Depending On The Type Of Business You Are Forming, For Incorporation Through The Secretary.

Learn how to diy or hire us to incorporate for you. These forms are for filing domestic business and nonprofit entity formations, foreign entity registrations, amendments, terminations, and. Before granting a tax exemption, the internal revenue service (irs) requires that the articles of incorporation contain certain provisions. Form a corporation in texas by filing a certificate of formation w/ the texas secretary of state.

![Free Printable Articles Of Incorporation Templates [PDF, Word] Non Profit](https://www.typecalendar.com/wp-content/uploads/2023/05/articles-of-incorporation-texas.jpg?gid=429)

![Free Printable Articles Of Incorporation Templates [PDF, Word] Non Profit](https://www.typecalendar.com/wp-content/uploads/2023/05/texas-articles-of-incorporation.jpg?gid=429)