States With The Highest Income Tax

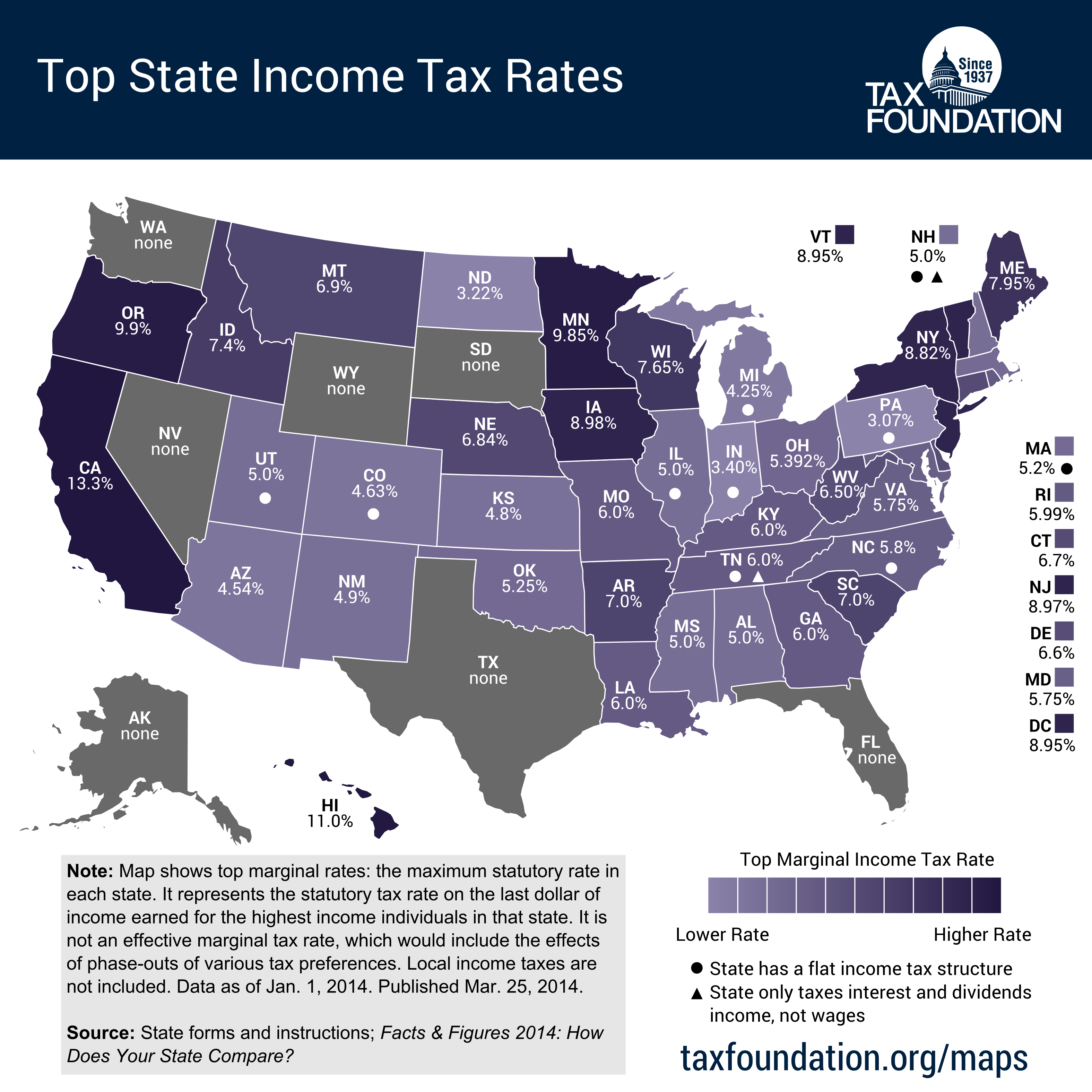

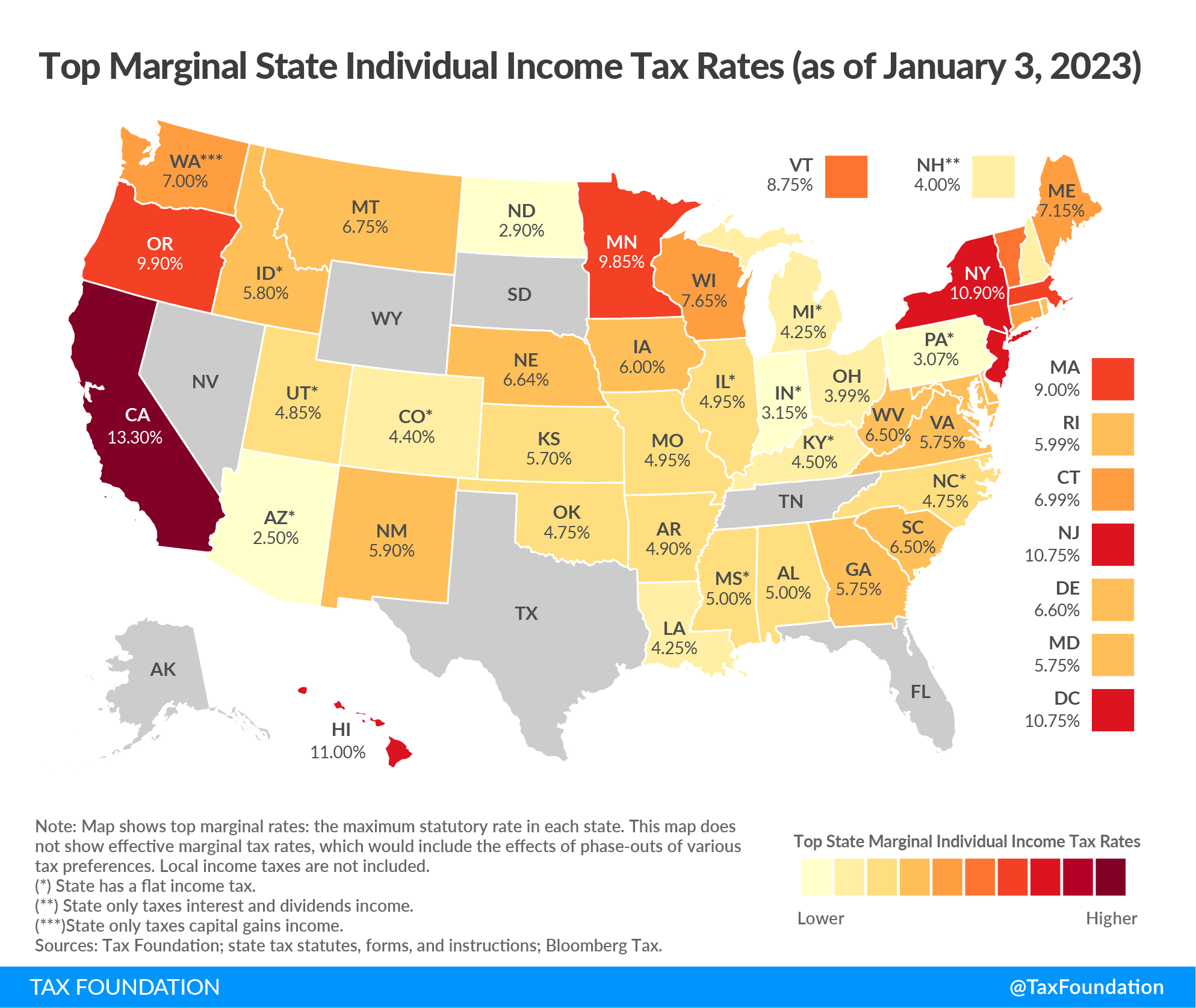

States With The Highest Income Tax - Tax credits and deductions, filing status and residency status can influence what you pay. The map below shows the highest and lowest tax rates in states with progressive tax structures; California has nine state income tax rates, ranging from 1% to 12.3%. The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Rates for states with flat tax rate structures; Your bracket depends on your taxable income and filing status. The state has four tax rates: And it also lists states that do not. Ohio state income tax brackets depend on taxable income and residency status. Your tax rate and bracket depend on your income and filing status.

And it also lists states that do not. The state has four tax rates: Your tax rate and bracket depend on your income and filing status. Rates for states with flat tax rate structures; Ohio state income tax brackets depend on taxable income and residency status. Your bracket depends on your taxable income and filing status. New york state has nine income tax rates, ranging from 4% to 10.9%. The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Tax credits and deductions, filing status and residency status can influence what you pay. California has nine state income tax rates, ranging from 1% to 12.3%.

The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status. New york state has nine income tax rates, ranging from 4% to 10.9%. The map below shows the highest and lowest tax rates in states with progressive tax structures; Ohio state income tax brackets depend on taxable income and residency status. Your tax rate and bracket depend on your income and filing status. The state has four tax rates: California has nine state income tax rates, ranging from 1% to 12.3%. Tax credits and deductions, filing status and residency status can influence what you pay. And it also lists states that do not.

States With Highest Tax 2024 Lelia Karola

The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. New york state has nine income tax rates, ranging from 4% to 10.9%. Tax credits and deductions, filing status and residency status can influence what you pay. Your bracket depends on your taxable income and filing status. The state has four.

South Carolina's 2021 Agenda Why Tax Cuts Matter

Your tax rate and bracket depend on your income and filing status. Your bracket depends on your taxable income and filing status. Ohio state income tax brackets depend on taxable income and residency status. The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The state has four tax rates:

A List of Tax Rates for Each State

California has nine state income tax rates, ranging from 1% to 12.3%. The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Ohio state income tax brackets depend on taxable income and residency status. And it also lists states that do not. Tax credits and deductions, filing status and residency status.

California Tops List of 10 States With Highest Taxes

California has nine state income tax rates, ranging from 1% to 12.3%. Your tax rate and bracket depend on your income and filing status. And it also lists states that do not. The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing.

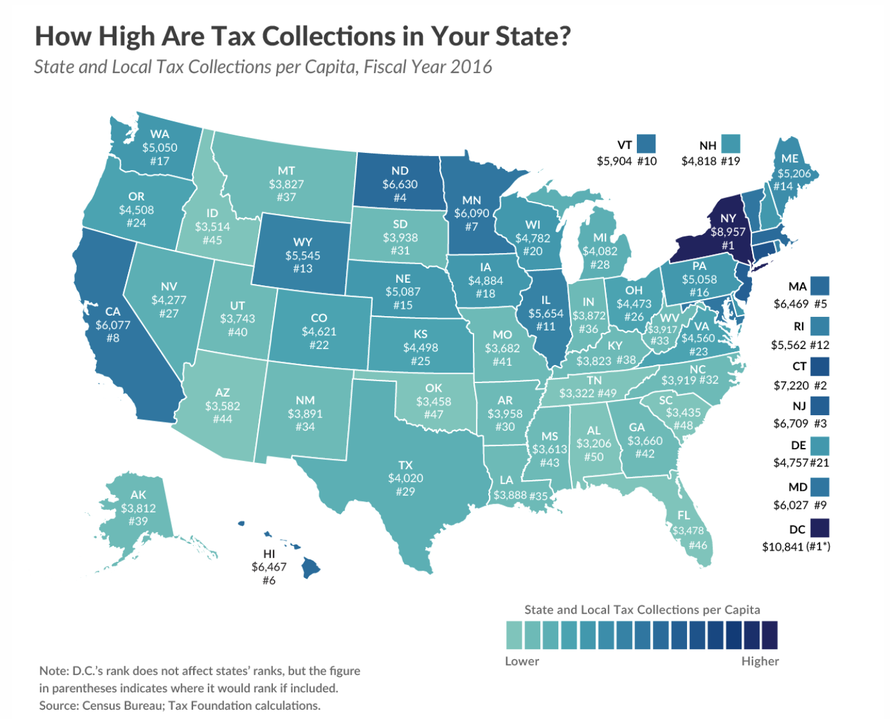

These States Have The Highest Tax Burden In The US Zero Hedge

California has nine state income tax rates, ranging from 1% to 12.3%. Your tax rate and bracket depend on your income and filing status. And it also lists states that do not. Tax credits and deductions, filing status and residency status can influence what you pay. New york state has nine income tax rates, ranging from 4% to 10.9%.

Monday Map Top State Tax Rates

Your bracket depends on your taxable income and filing status. Your tax rate and bracket depend on your income and filing status. And it also lists states that do not. Tax credits and deductions, filing status and residency status can influence what you pay. Rates for states with flat tax rate structures;

Top State Tax Rates for All 50 States Chris Banescu

Tax credits and deductions, filing status and residency status can influence what you pay. And it also lists states that do not. New york state has nine income tax rates, ranging from 4% to 10.9%. Your bracket depends on your taxable income and filing status. The state has four tax rates:

The 10 States With The Highest Tax Burden (And The Lowest) Zippia

New york state has nine income tax rates, ranging from 4% to 10.9%. The map below shows the highest and lowest tax rates in states with progressive tax structures; Ohio state income tax brackets depend on taxable income and residency status. The state has four tax rates: And it also lists states that do not.

Individual States

New york state has nine income tax rates, ranging from 4% to 10.9%. The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Rates for states with flat tax rate structures; Your tax rate and bracket depend on your income and filing status. The state has four tax rates:

Which states have the highest and lowest tax? USAFacts

California has nine state income tax rates, ranging from 1% to 12.3%. Rates for states with flat tax rate structures; Tax credits and deductions, filing status and residency status can influence what you pay. Ohio state income tax brackets depend on taxable income and residency status. The map below shows the highest and lowest tax rates in states with progressive.

Ohio State Income Tax Brackets Depend On Taxable Income And Residency Status.

The map below shows the highest and lowest tax rates in states with progressive tax structures; Your bracket depends on your taxable income and filing status. California has nine state income tax rates, ranging from 1% to 12.3%. Rates for states with flat tax rate structures;

New York State Has Nine Income Tax Rates, Ranging From 4% To 10.9%.

The state has four tax rates: Tax credits and deductions, filing status and residency status can influence what you pay. Your tax rate and bracket depend on your income and filing status. And it also lists states that do not.

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)