State Of Ohio Sales Tax Exemption Form

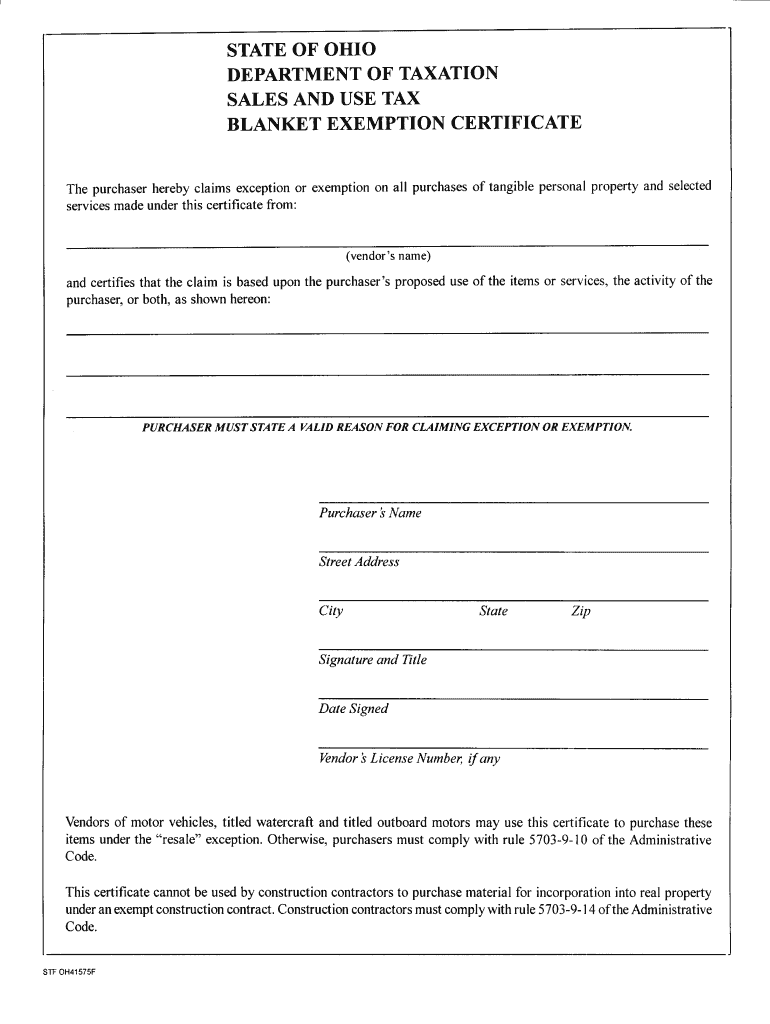

State Of Ohio Sales Tax Exemption Form - Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Blanket exemption certificate [revised march 2022] the. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Check with that state to determine your. Learn how to use the forms for different situations, such. Provide the id number to claim exemption from sales tax that is required by the taxing state. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Find the forms to claim exemption or exception on sales tax for various purchases in ohio. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.

Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Find the forms to claim exemption or exception on sales tax for various purchases in ohio. Provide the id number to claim exemption from sales tax that is required by the taxing state. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Blanket exemption certificate [revised march 2022] the. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Check with that state to determine your. Learn how to use the forms for different situations, such.

Blanket exemption certificate [revised march 2022] the. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Learn how to use the forms for different situations, such. Find the forms to claim exemption or exception on sales tax for various purchases in ohio. Check with that state to determine your. Provide the id number to claim exemption from sales tax that is required by the taxing state. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.

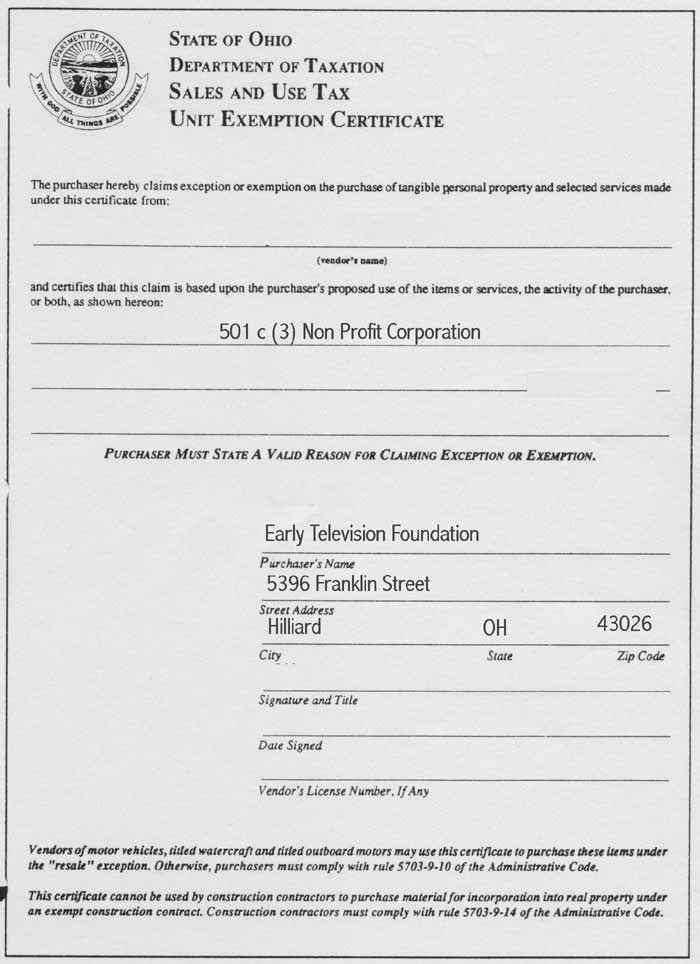

The Early Television Foundation

Check with that state to determine your. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Provide the id number to claim exemption from sales tax that is required by the taxing state. Find the forms to claim exemption or exception on sales tax for various purchases.

State Of Ohio Sales Tax Exempt Form 2024 Lina Shelby

Blanket exemption certificate [revised march 2022] the. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Check with that state to determine your. Find the forms to claim exemption.

blanket certificate of exemption ohio Fill Online, Printable, Fillable

Find the forms to claim exemption or exception on sales tax for various purchases in ohio. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Provide the id number to claim exemption from sales tax that is required by the taxing state. Download and fill out this form to claim exception.

Save time and money on Sales tax exemption certificate and Workbooks

Provide the id number to claim exemption from sales tax that is required by the taxing state. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Check with that.

Application for real property tax exemption and remission (Ohio) in

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Find the forms to claim exemption or exception on sales tax for various purchases in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio..

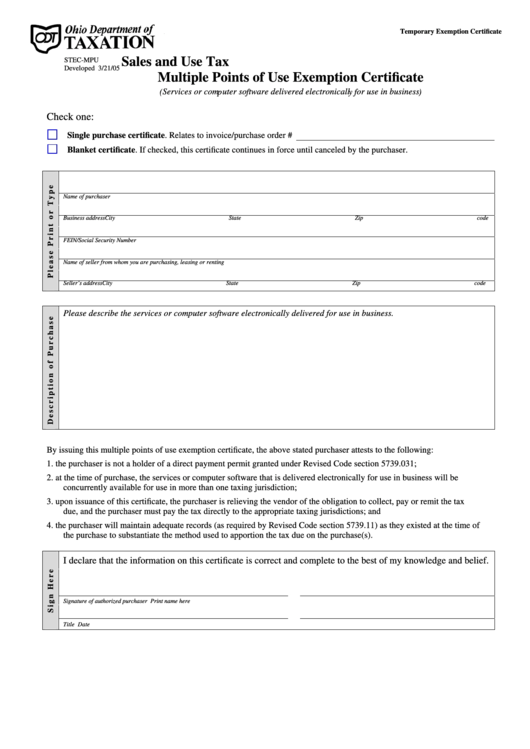

Form StecMpu 2005 Sales And Use Tax Multiple Points Of Use

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Learn how to use the forms for different situations, such. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Find the forms to claim exemption or exception on sales.

State Of Ohio Unit Tax Exempt Form

Provide the id number to claim exemption from sales tax that is required by the taxing state. Check with that state to determine your. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Learn how to use the forms for different situations, such. The purchaser hereby claims.

ohio sales tax exemption form example Fighting Column Photo Galleries

Provide the id number to claim exemption from sales tax that is required by the taxing state. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Blanket exemption certificate [revised march.

Texas Sales And Use Tax Resale Certificate Example / 01 315 Form Fill

Check with that state to determine your. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Find the forms to claim exemption or exception on sales tax for various purchases in.

Sd Certificate Of Exemption For Sales Tax

Check with that state to determine your. Find the forms to claim exemption or exception on sales tax for various purchases in ohio. Provide the id number to claim exemption from sales tax that is required by the taxing state. Learn how to use the forms for different situations, such. Blanket exemption certificate the purchaser hereby claims exception or exemption.

Learn How To Use The Forms For Different Situations, Such.

Provide the id number to claim exemption from sales tax that is required by the taxing state. Check with that state to determine your. Find the forms to claim exemption or exception on sales tax for various purchases in ohio. Blanket exemption certificate [revised march 2022] the.

Download And Fill Out This Form To Claim Exception Or Exemption On Purchases Of Tangible Personal Property And Selected Services In Ohio.

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.