Ss Withholding Form

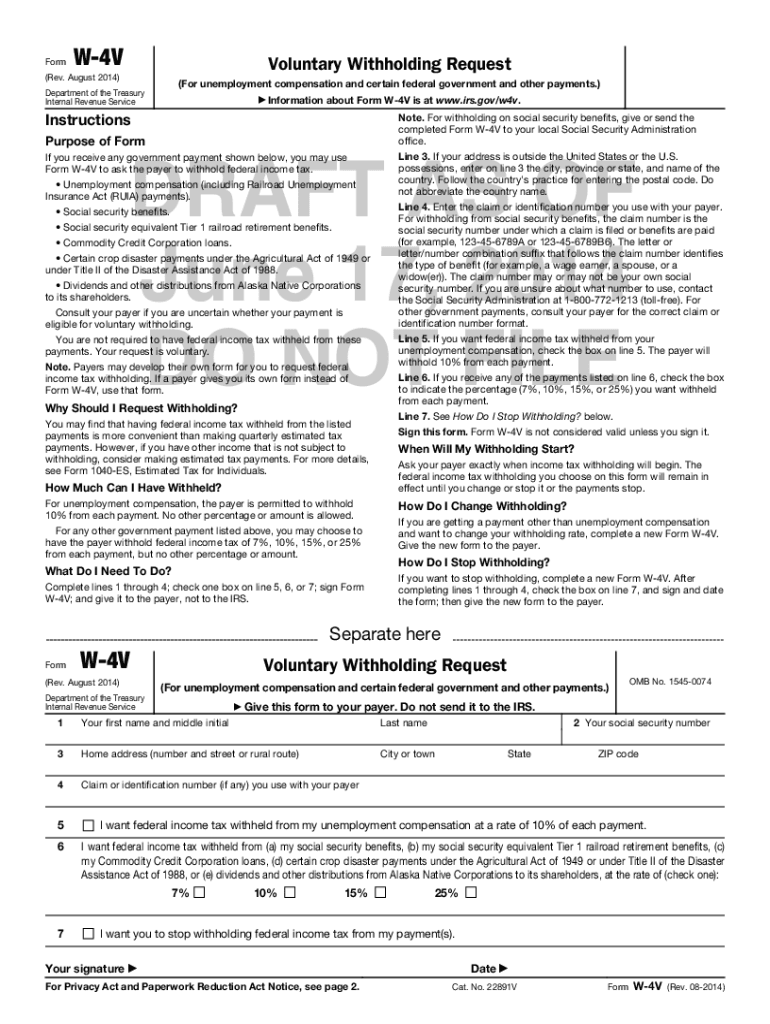

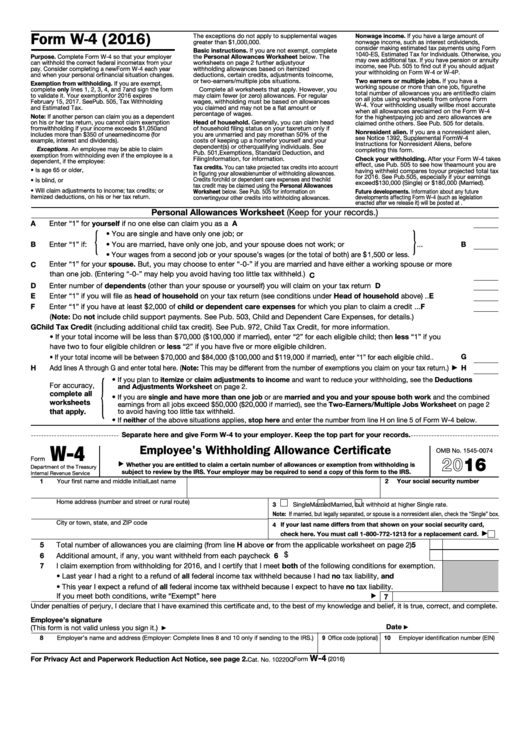

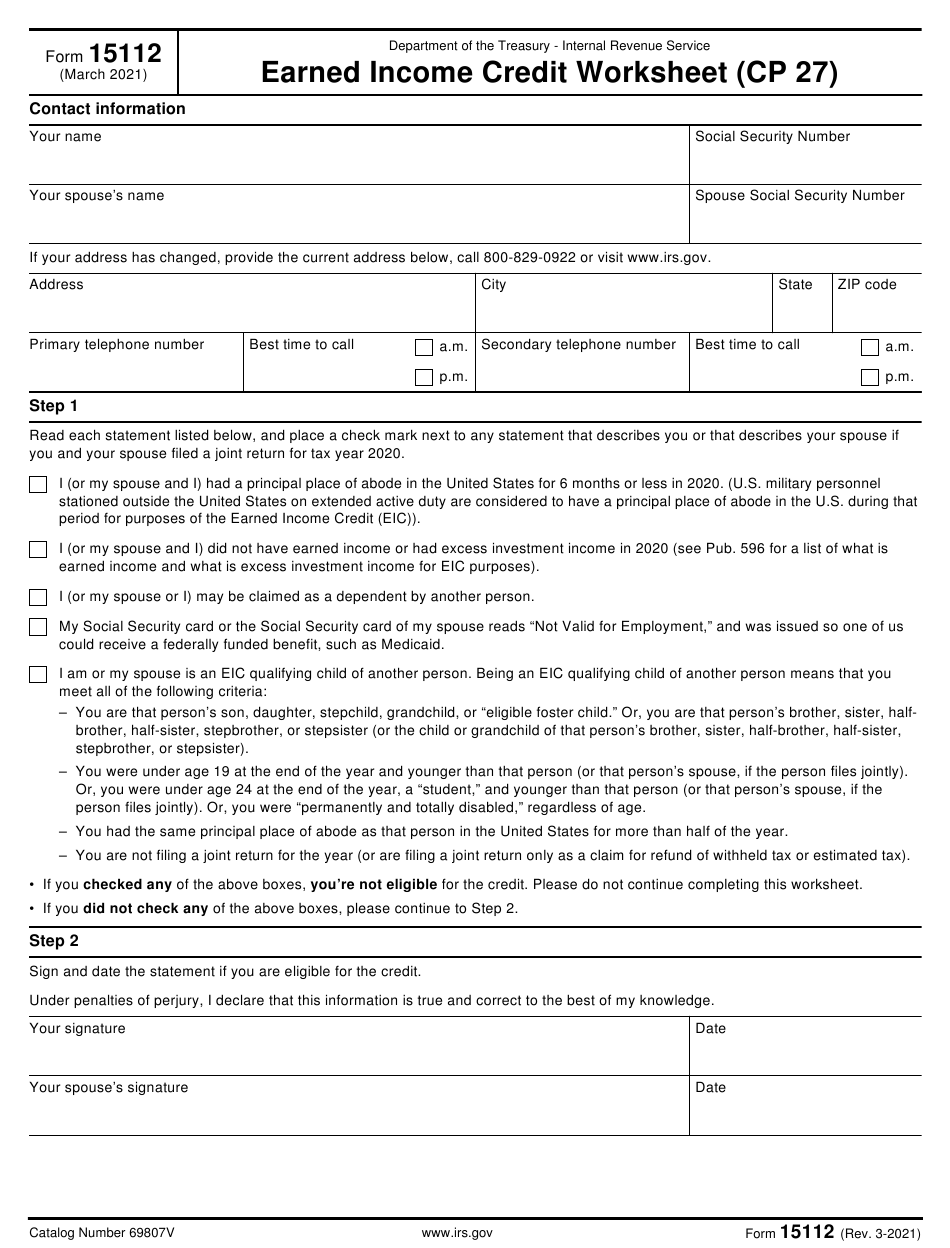

Ss Withholding Form - You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Not all forms are listed. Tell the representative you want to withhold taxes from your social security benefit. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you are already receiving benefits. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. 203 rows all forms are free. If you can't find the form you need, or you need help completing a form, please call us at 1.

Not all forms are listed. If you can't find the form you need, or you need help completing a form, please call us at 1. Tell the representative you want to withhold taxes from your social security benefit. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. 203 rows all forms are free. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. If you are already receiving benefits. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,.

If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Not all forms are listed. If you are already receiving benefits. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Tell the representative you want to withhold taxes from your social security benefit. 203 rows all forms are free. If you can't find the form you need, or you need help completing a form, please call us at 1.

Form SS8 Determination of Worker Status of Federal Employment Taxes

If you can't find the form you need, or you need help completing a form, please call us at 1. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. You can ask us to withhold federal taxes from your social security benefit payment when you.

Form SS8 Determination of Worker Status of Federal Employment Taxes

Tell the representative you want to withhold taxes from your social security benefit. Not all forms are listed. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you are.

North Carolina State Withholding Form Nc4 Ez

Tell the representative you want to withhold taxes from your social security benefit. 203 rows all forms are free. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out.

Social Security Tax Withholding Form 2022

If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. 203 rows all forms are free. Not all forms are listed. Tell the representative you want to withhold.

Foreign Tax Withholding Form

You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Not all forms are listed. If you are already receiving benefits. Tell the representative you want to withhold taxes from your social security benefit. 203 rows all forms are free.

W4V Voluntary Tax Withholding form Social Security YouTube

If you are already receiving benefits. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Tell the representative you want to withhold taxes from your social security benefit. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out.

Massachusetts Tax Withholding Forms

203 rows all forms are free. If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you can't find the form you need, or.

WorldWarCollectibles Postcard with Signature of WaffenSS KC

Not all forms are listed. If you can't find the form you need, or you need help completing a form, please call us at 1. Tell the representative you want to withhold taxes from your social security benefit. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. 203 rows all forms.

Social Security Tax Withholding Forms

If you can't find the form you need, or you need help completing a form, please call us at 1. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. If you get social security, you can ask us to withhold funds from your benefit and we will credit.

Akron Ohio Withholding Tax Forms

You can ask us to withhold federal taxes from your social security benefit payment when you first apply. If you are already receiving benefits. If you can't find the form you need, or you need help completing a form, please call us at 1. 203 rows all forms are free. If you’re already getting benefits and then later decide to.

If You Can't Find The Form You Need, Or You Need Help Completing A Form, Please Call Us At 1.

If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. If you’re already getting benefits and then later decide to start withholding, you’ll need to fill out a voluntary withholding request,. 203 rows all forms are free. You can ask us to withhold federal taxes from your social security benefit payment when you first apply.

Not All Forms Are Listed.

Tell the representative you want to withhold taxes from your social security benefit. If you are already receiving benefits.