Puerto Rico Tax Return Form 482

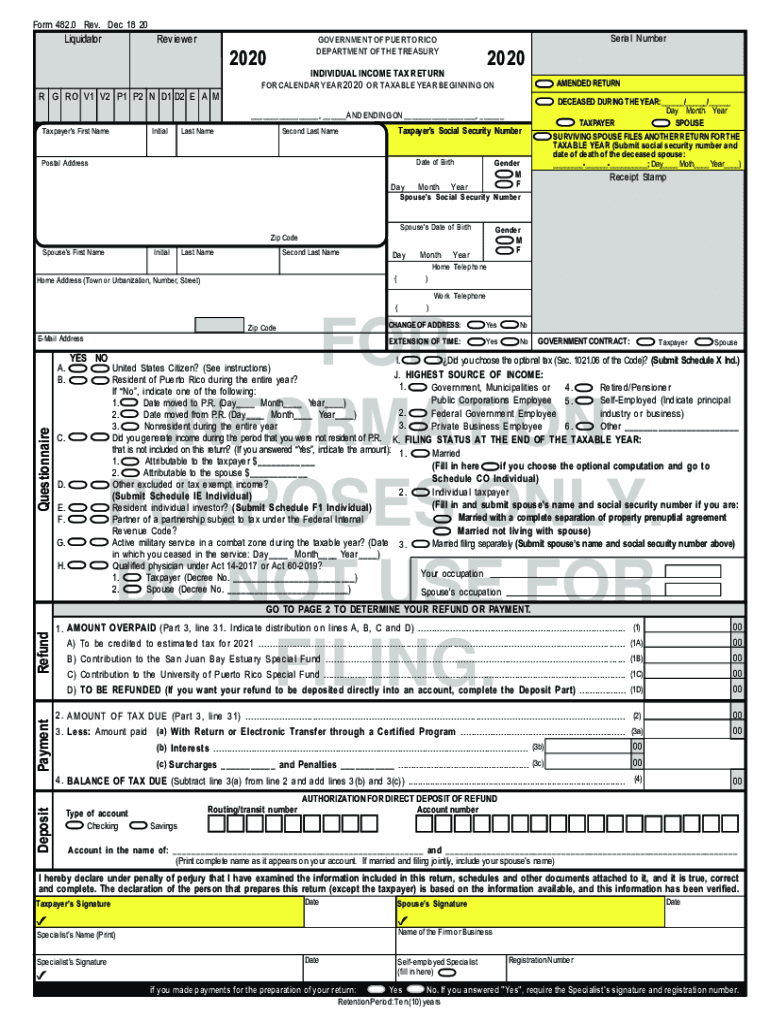

Puerto Rico Tax Return Form 482 - You can still file your federal tax return however, you would need to file. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. For additional details, please refer. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. For more details on this. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means. Turbotax does not support state tax returns from puerto rico.

Turbotax does not support state tax returns from puerto rico. For more details on this. For additional details, please refer. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. You can still file your federal tax return however, you would need to file. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means.

Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. Turbotax does not support state tax returns from puerto rico. For more details on this. You can still file your federal tax return however, you would need to file. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means. For additional details, please refer. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income.

puerto rico tax return form 482 Fill Online, Printable, Fillable

Turbotax does not support state tax returns from puerto rico. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. For additional details, please refer. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. You can still file.

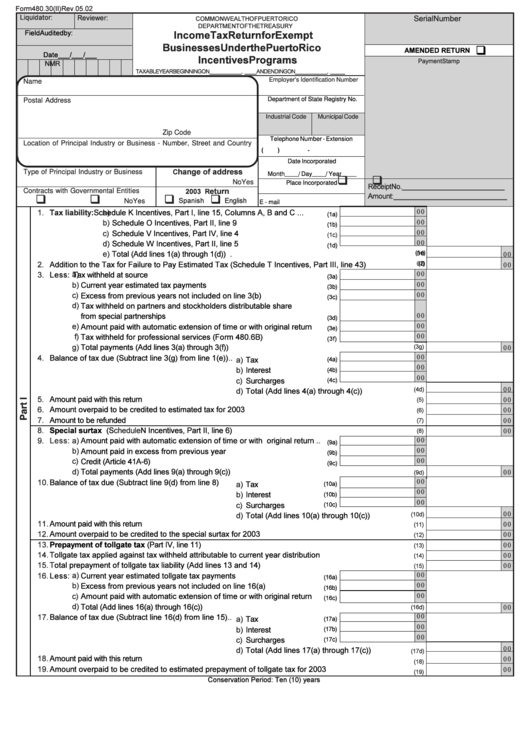

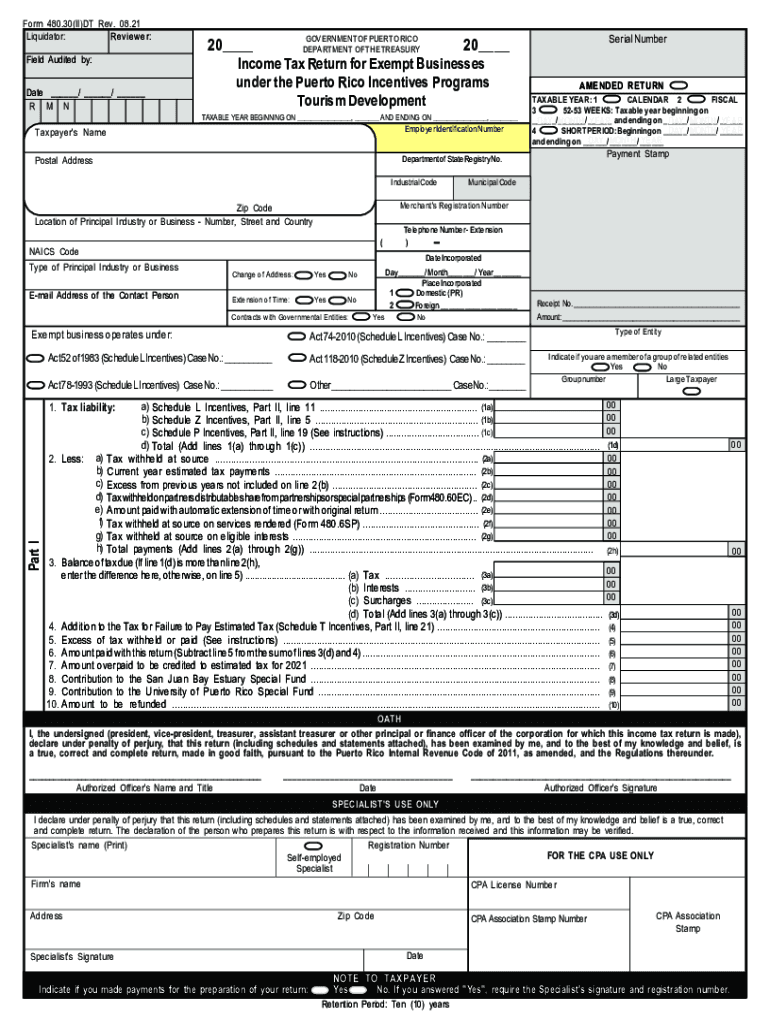

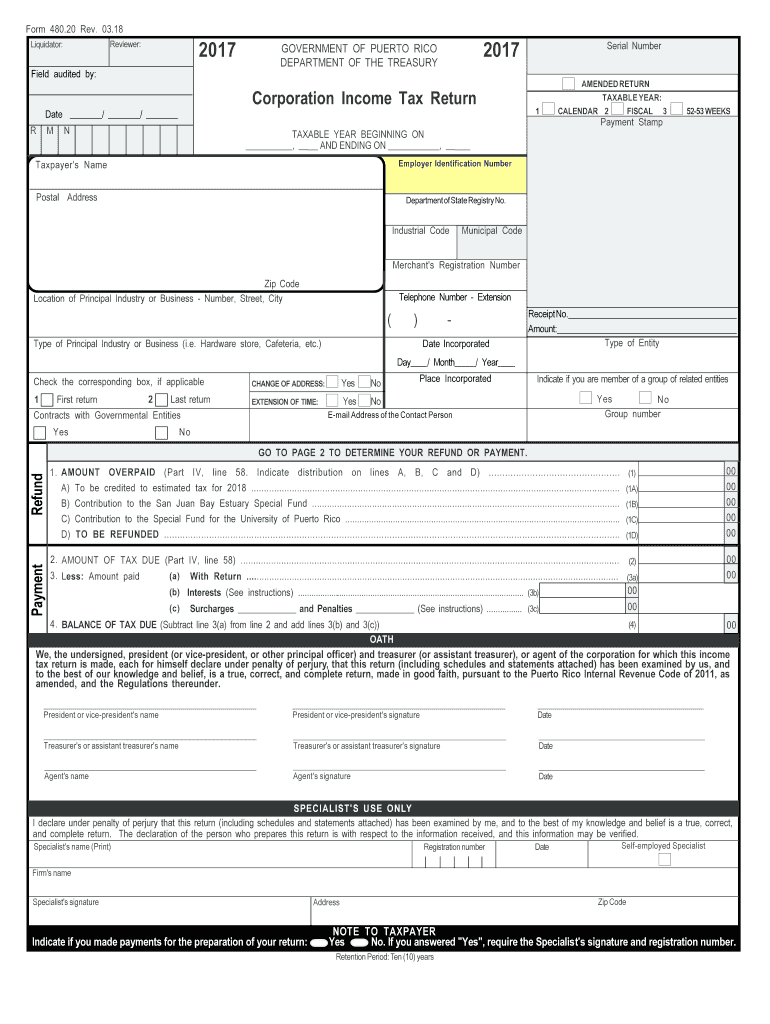

Form 480.30(Ii) Tax Return For Exempt Business Under The

The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. For more details on this. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic.

Puerto Rico 480 Tax Complete with ease airSlate SignNow

La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. For additional details, please refer. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than.

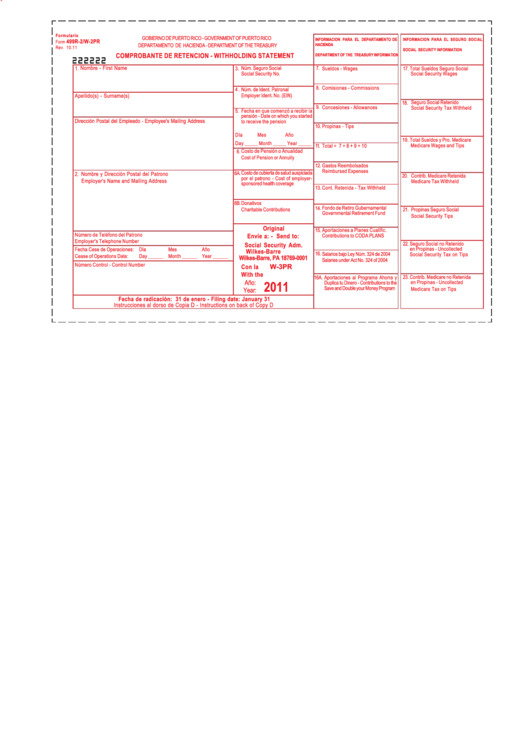

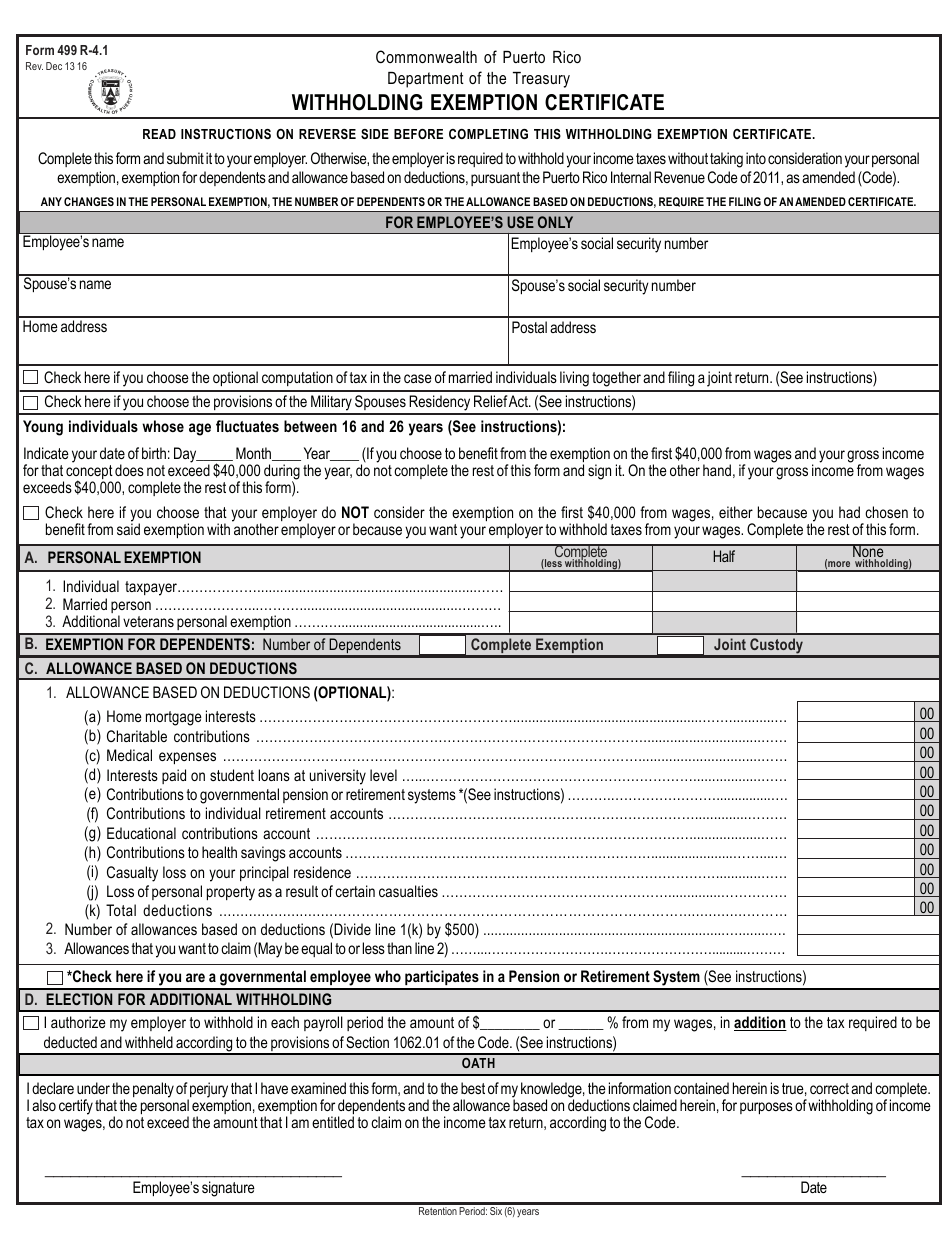

Form 499r2/w2pr Comprobante De Retencion Withholding Statement

Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. Turbotax does not support state tax returns from puerto rico. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means. The individual income tax return (form 482.0) for tax.

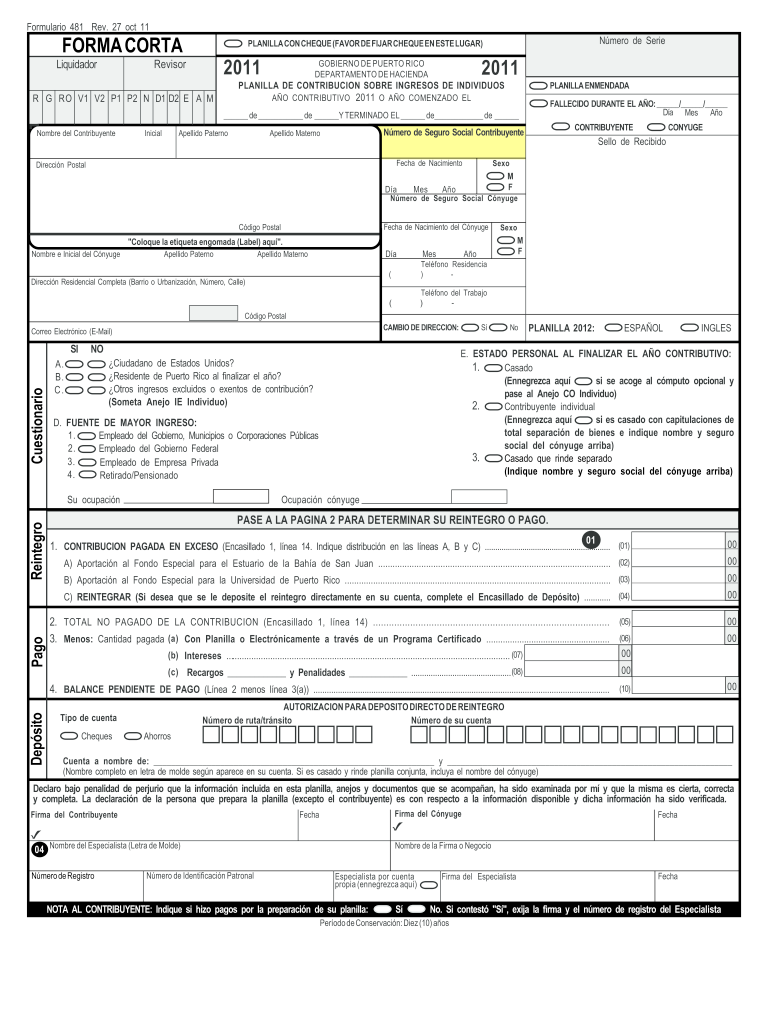

Puerto rico 481 2011 form Rellena, firma y envía para firmar DocHub

Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. You can still file your federal tax return however, you would need to file. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. For more details on this. La individual income tax form (form 482),.

2006 Form PR AS 2916.1 Fill Online, Printable, Fillable, Blank pdfFiller

For more details on this. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. You can still file your federal tax return however, you would need to file. For additional details, please refer. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by.

Puerto Rico Hotel Tax Exempt Form

Turbotax does not support state tax returns from puerto rico. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. You can still file your federal tax return however, you would need to file. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than.

Fillable Online puerto rico tax return form 482 Fill Online

The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. For additional details, please.

Form 482 Fill out & sign online DocHub

Turbotax does not support state tax returns from puerto rico. For more details on this. For additional details, please refer. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the.

PDF Filler 480 20 20182024 Form Fill Out and Sign Printable PDF

For additional details, please refer. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means. For more details on this. You can still file your federal tax return however, you would need.

Government Of Puerto Rico Department Of The Treasury Individual Income Tax Return For Calendar Year 2021 Or Taxable Year.

Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. La individual income tax form (form 482), corresponding to taxable year 2022, must be filed only by electronic means. Turbotax does not support state tax returns from puerto rico.

For More Details On This.

For additional details, please refer. You can still file your federal tax return however, you would need to file.