Planning For Retirement

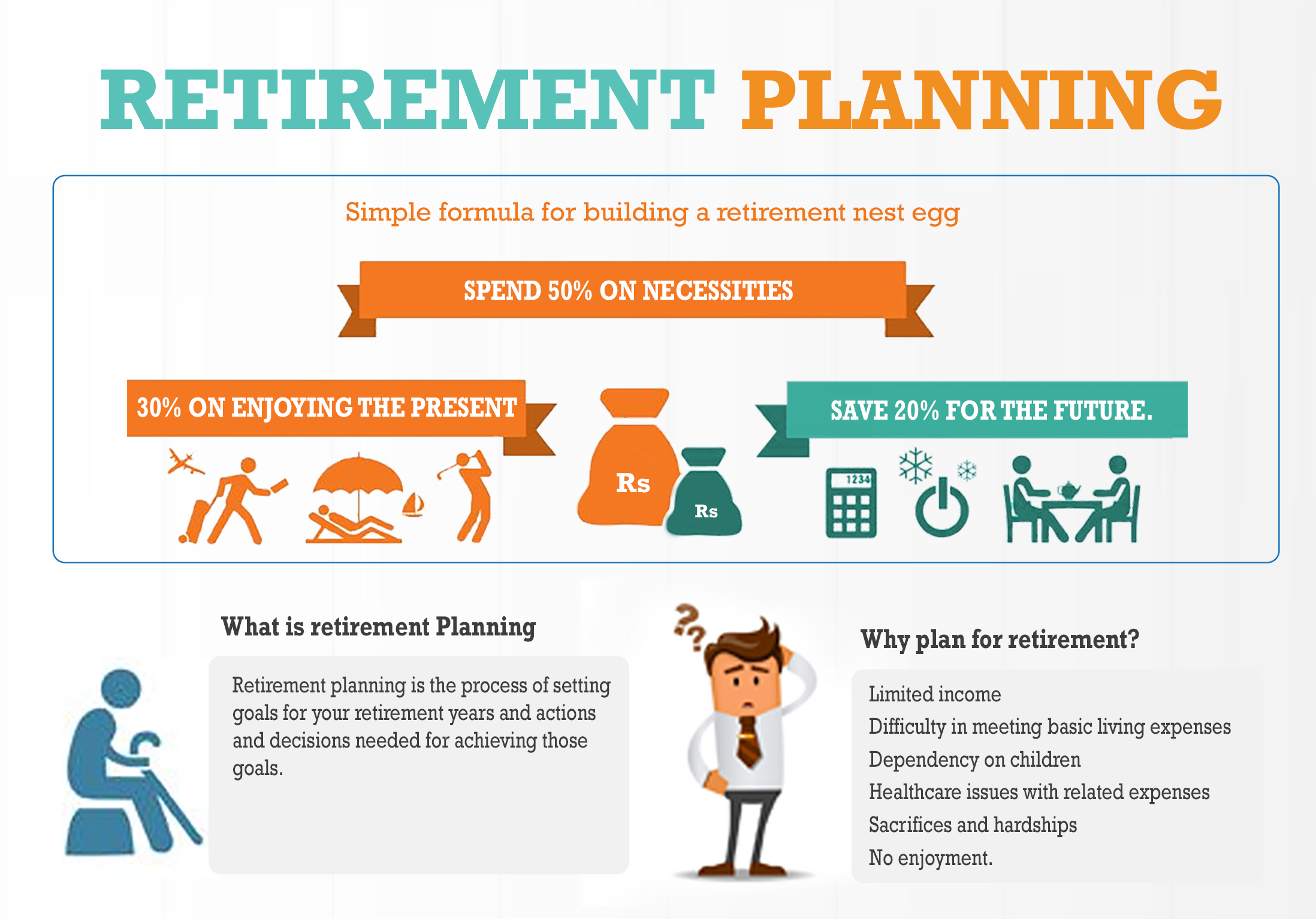

Planning For Retirement - Retirement planning is the process of preparing for financial independence during one's golden years. Planning for retirement helps you determine retirement income goals and prepare for the unexpected. It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. No matter your age, retirement planning includes five steps: There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to.

Planning for retirement helps you determine retirement income goals and prepare for the unexpected. It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to. Retirement planning is the process of preparing for financial independence during one's golden years. No matter your age, retirement planning includes five steps:

Planning for retirement helps you determine retirement income goals and prepare for the unexpected. No matter your age, retirement planning includes five steps: It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. Retirement planning is the process of preparing for financial independence during one's golden years. There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to.

5 Important Steps in Retirement Planning Tull Financial Group

It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to. Planning for retirement helps.

10 Helpful Tips For Retirement Planning

It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. No matter your age, retirement planning includes five steps: Retirement planning is the process of preparing for financial independence during one's golden years. There are a few steps to making a financial plan for retirement, starting with how much.

Myth busting three common retirement planning beliefs Prenger and Profitt

No matter your age, retirement planning includes five steps: It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. Planning for retirement helps you determine retirement income goals and prepare for the unexpected. Retirement planning is the process of preparing for financial independence during one's golden years. There are.

Retirement Planning JamaPunji

Planning for retirement helps you determine retirement income goals and prepare for the unexpected. No matter your age, retirement planning includes five steps: Retirement planning is the process of preparing for financial independence during one's golden years. There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities,.

How to Adjust Your Retirement Planning as You Age

No matter your age, retirement planning includes five steps: It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. Retirement planning is the process of preparing for financial independence during one's golden years. There are a few steps to making a financial plan for retirement, starting with how much.

SPECIAL EVENT Are You Ready for Retirement? Financial Planner Long

No matter your age, retirement planning includes five steps: There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to. Retirement planning is the process of preparing for financial independence during one's golden years. It involves.

5 Reasons Why You Should Start Retirement Planning Early Tweak Your Biz

It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. Retirement planning is the process of preparing for financial independence during one's golden years. Planning for retirement helps you determine retirement income goals and prepare for the unexpected. There are a few steps to making a financial plan for.

Important & Decisions for Each Phase of Retirement Planning

There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to. It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. Retirement planning is the.

Does Your Retirement Plan Overlook This Crucial Decision? myLifeSite

No matter your age, retirement planning includes five steps: Retirement planning is the process of preparing for financial independence during one's golden years. Planning for retirement helps you determine retirement income goals and prepare for the unexpected. It involves creating a savings and investment plan that aims to provide sufficient income to cover living expenses after one stops. There are.

Your Guide to Choosing the Best Retirement Plan for Your Employees

Retirement planning is the process of preparing for financial independence during one's golden years. No matter your age, retirement planning includes five steps: There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to. Planning for.

It Involves Creating A Savings And Investment Plan That Aims To Provide Sufficient Income To Cover Living Expenses After One Stops.

Planning for retirement helps you determine retirement income goals and prepare for the unexpected. No matter your age, retirement planning includes five steps: There are a few steps to making a financial plan for retirement, starting with how much money you'll need and your own priorities, then moving on to what kind of account you want, where to. Retirement planning is the process of preparing for financial independence during one's golden years.