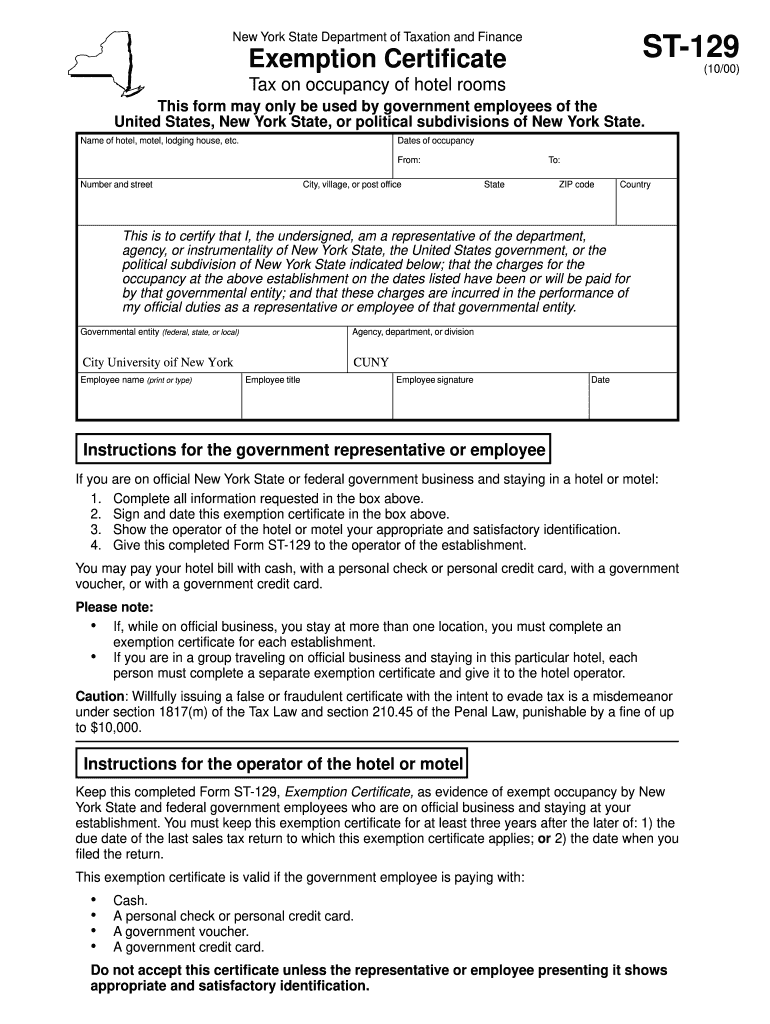

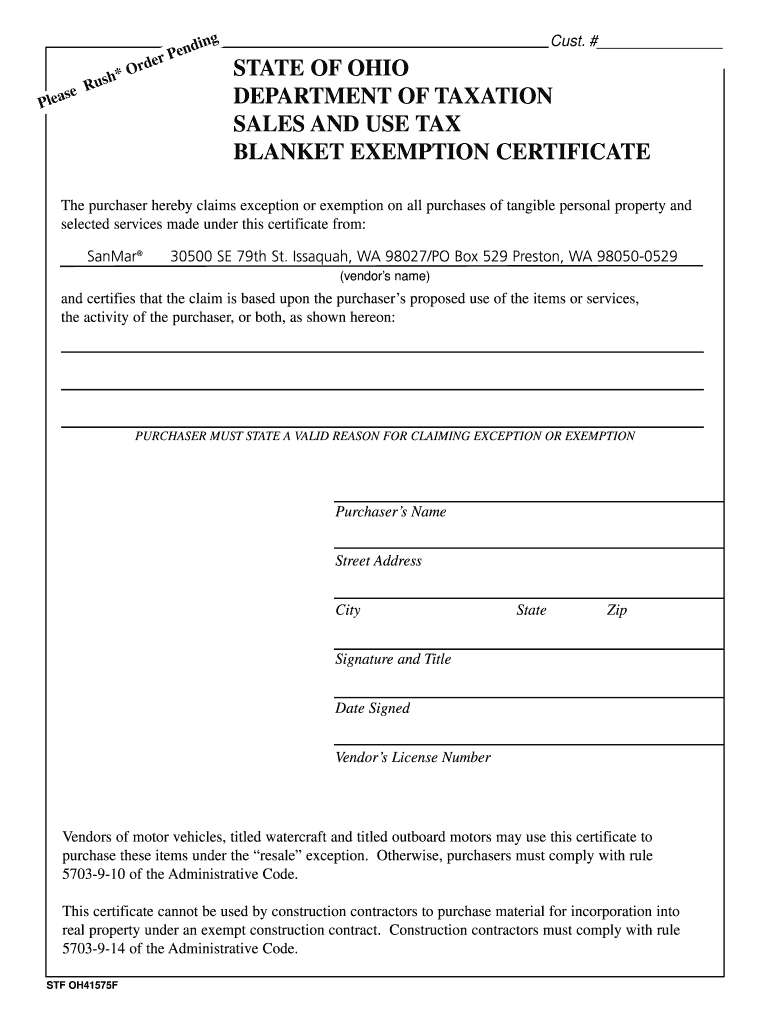

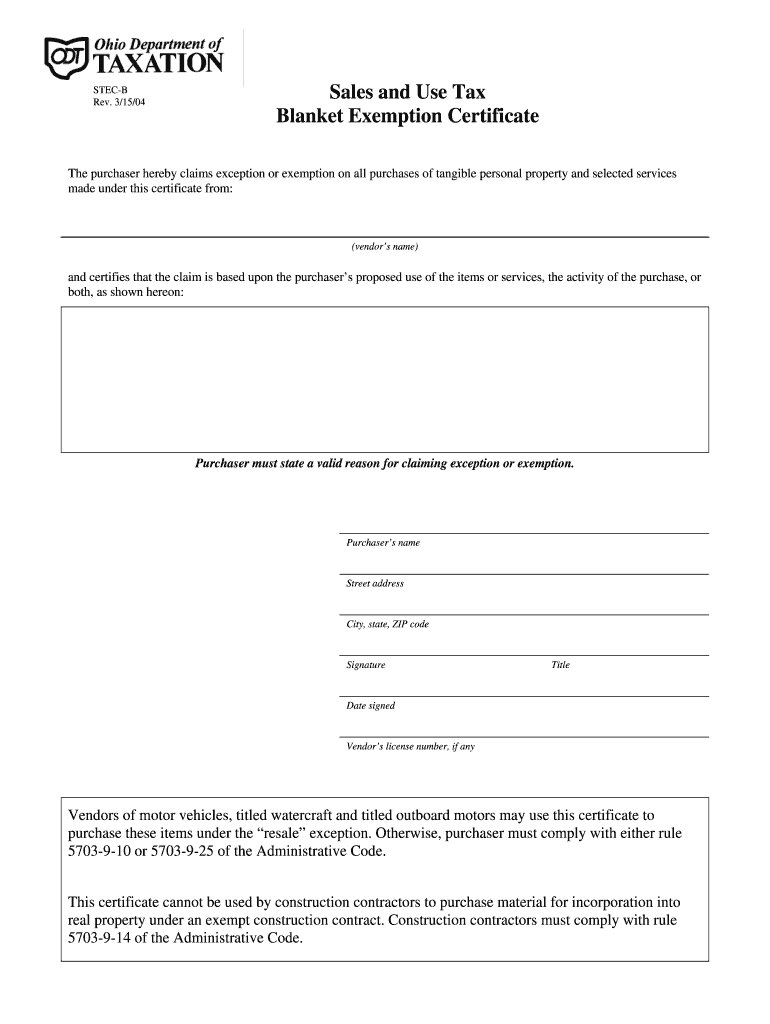

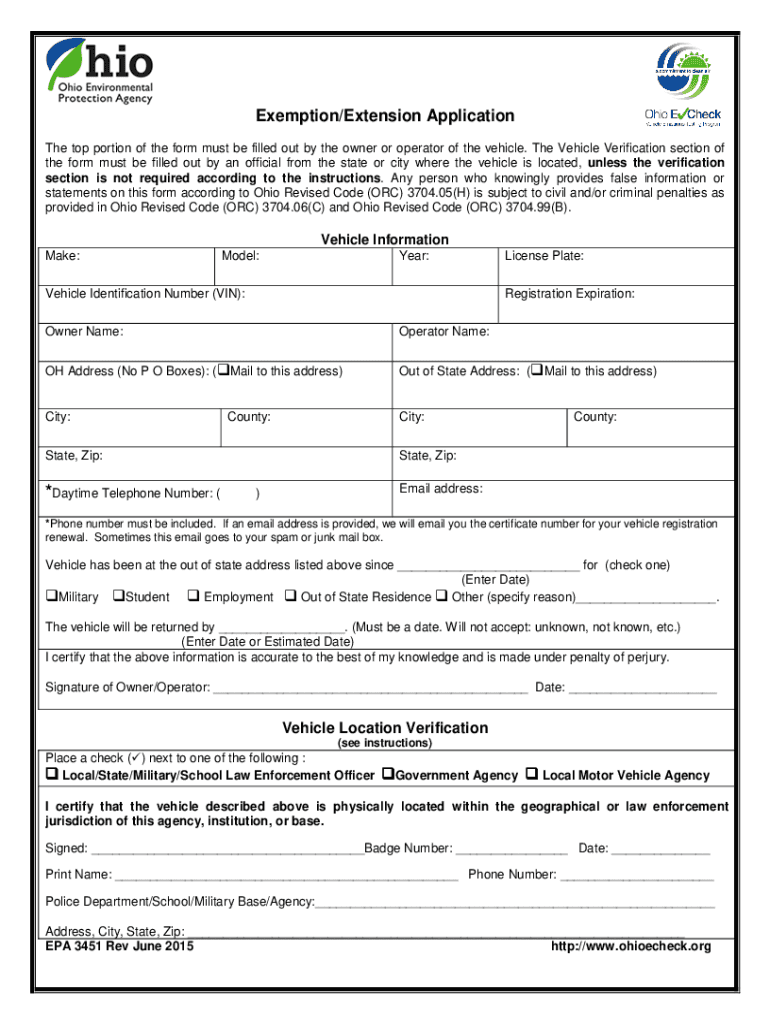

Ohio Tax Exempt Form Example

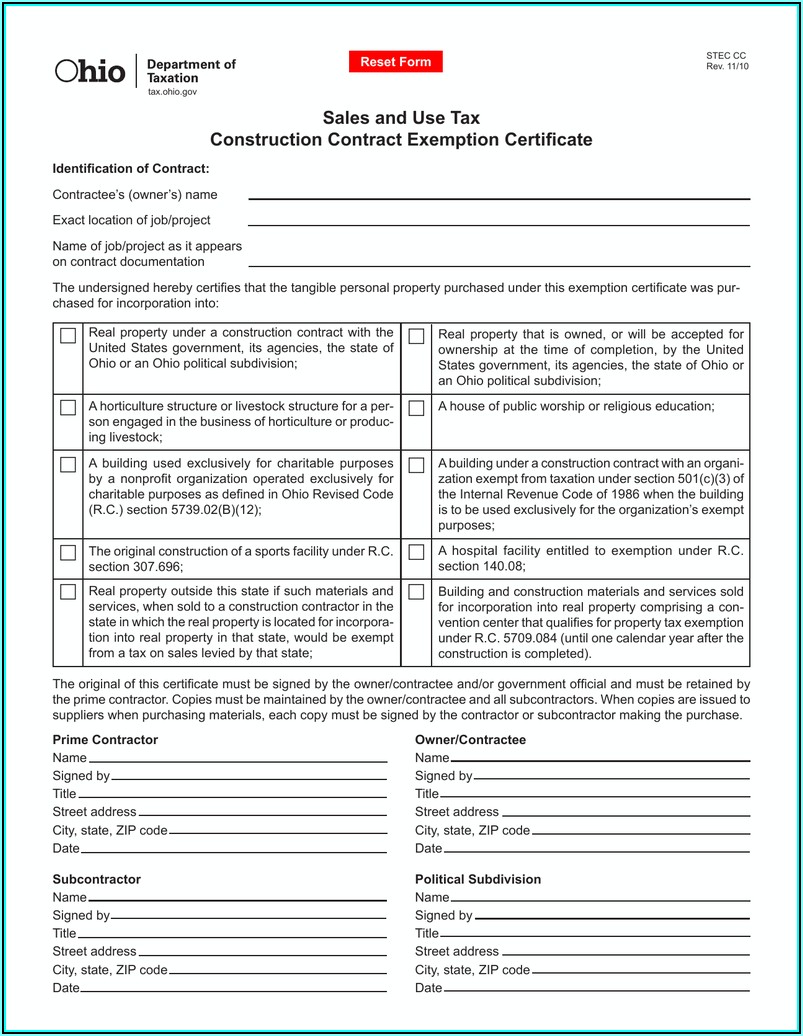

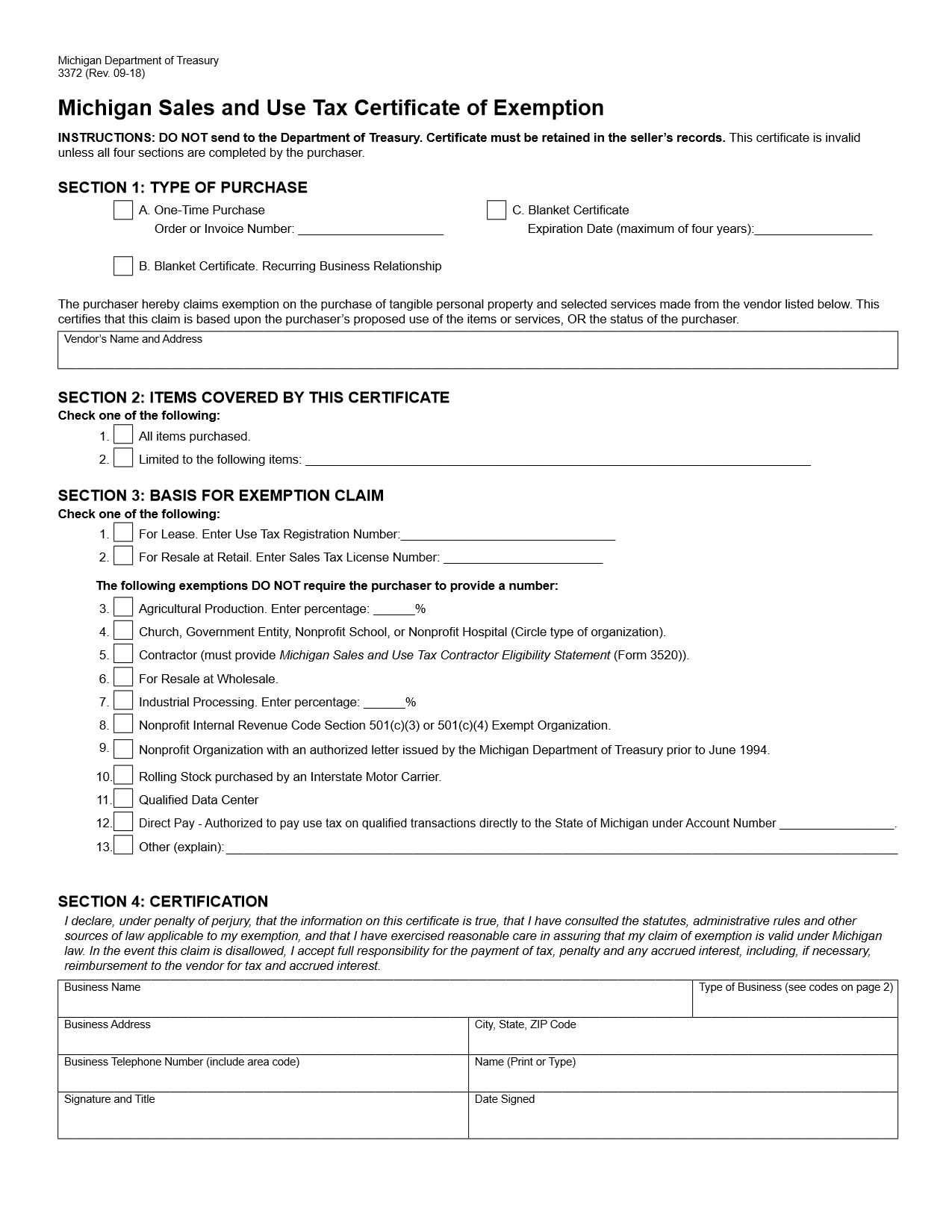

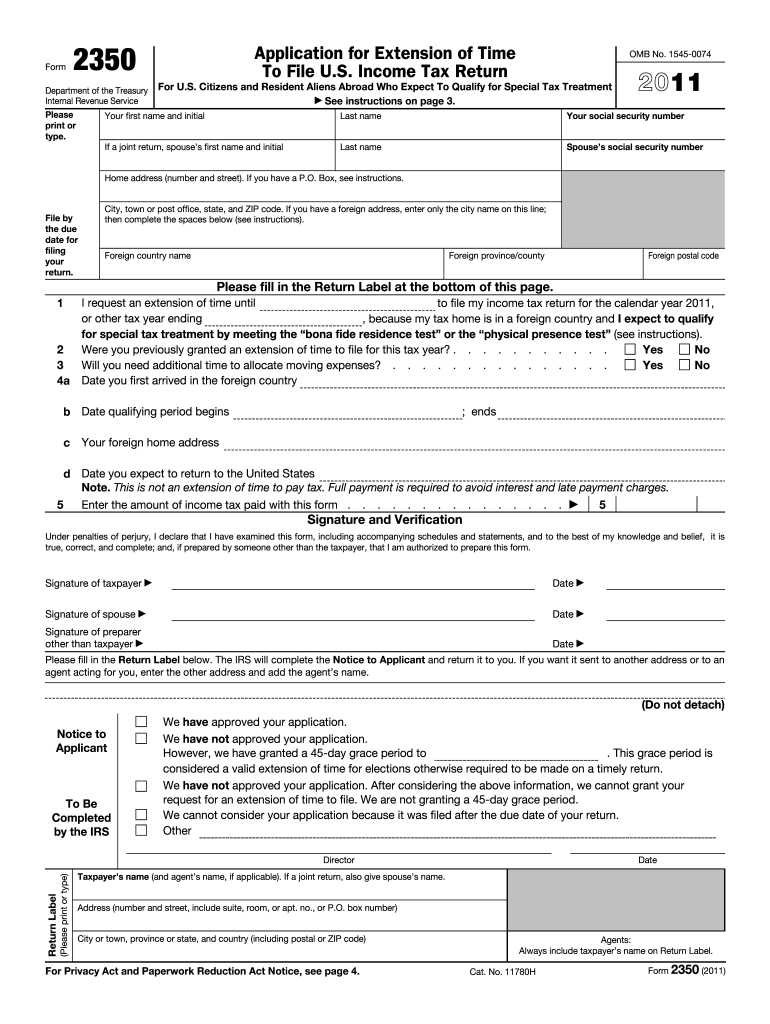

Ohio Tax Exempt Form Example - The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Vendors of motor vehicles, titled watercraft and titled outboard. Purchaser must state a valid reason for claiming exception or exemption. Download or print the 2023 ohio form stec b (sales and use tax blanket exemption certificate) for free from the ohio department of taxation. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.

The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. Purchaser must state a valid reason for claiming exception or exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Download or print the 2023 ohio form stec b (sales and use tax blanket exemption certificate) for free from the ohio department of taxation. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Vendors of motor vehicles, titled watercraft and titled outboard. Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property.

Download or print the 2023 ohio form stec b (sales and use tax blanket exemption certificate) for free from the ohio department of taxation. Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property. Vendors of motor vehicles, titled watercraft and titled outboard. The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. Purchaser must state a valid reason for claiming exception or exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.

Blank Fillable Ohio Tax Exempt Form Printable Forms Free Online

Vendors of motor vehicles, titled watercraft and titled outboard. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Download or print the 2023 ohio form stec b (sales and use tax blanket exemption certificate) for free from the ohio department of taxation. The following forms are authorized by the.

Farm Bag Supply Supplier of Agricultural Film

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Vendors of motor vehicles, titled watercraft and titled outboard. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Building and construction materials and services sold for incorporation into real.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Purchaser must state a valid reason for claiming exception or exemption. Download or print the 2023 ohio form stec b (sales and use tax blanket exemption certificate) for free from the ohio department of taxation. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. The following forms are authorized.

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Vendors of motor vehicles, titled watercraft and titled outboard. The following forms are authorized by the ohio department of taxation.

Sales Tax Exempt Form 2024 Ohio Jeanie Zsazsa

Purchaser must state a valid reason for claiming exception or exemption. Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property. The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. Vendors of motor vehicles, titled watercraft and titled outboard..

Tax Exempt Form Ohio Fill and Sign Printable Template Online US

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property. Purchaser must state a valid reason for claiming exception or exemption. The following forms are authorized by the ohio department.

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

Vendors of motor vehicles, titled watercraft and titled outboard. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Purchaser must state a valid reason for claiming exception or exemption. Download or print the 2023 ohio form stec b (sales and use tax blanket exemption certificate) for free from the.

Ohio tax exempt form Fill out & sign online DocHub

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Purchaser must state a valid reason for claiming exception or exemption. The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. The purchaser hereby claims exception or exemption on all.

Oh Sales Tax Blanket Exemption Form

Purchaser must state a valid reason for claiming exception or exemption. The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Vendors of motor vehicles, titled watercraft and titled outboard..

For the Tax Exempt in Ohio 20152024 Form Fill Out and Sign Printable

The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this..

The Purchaser Hereby Claims Exception Or Exemption On All Purchases Of Tangible Personal Property And Selected Services Made Under This.

Building and construction materials and services sold for incorporation into real property comprising a convention center that qualifies for property. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Download or print the 2023 ohio form stec b (sales and use tax blanket exemption certificate) for free from the ohio department of taxation. The following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases.

Vendors Of Motor Vehicles, Titled Watercraft And Titled Outboard.

Purchaser must state a valid reason for claiming exception or exemption.