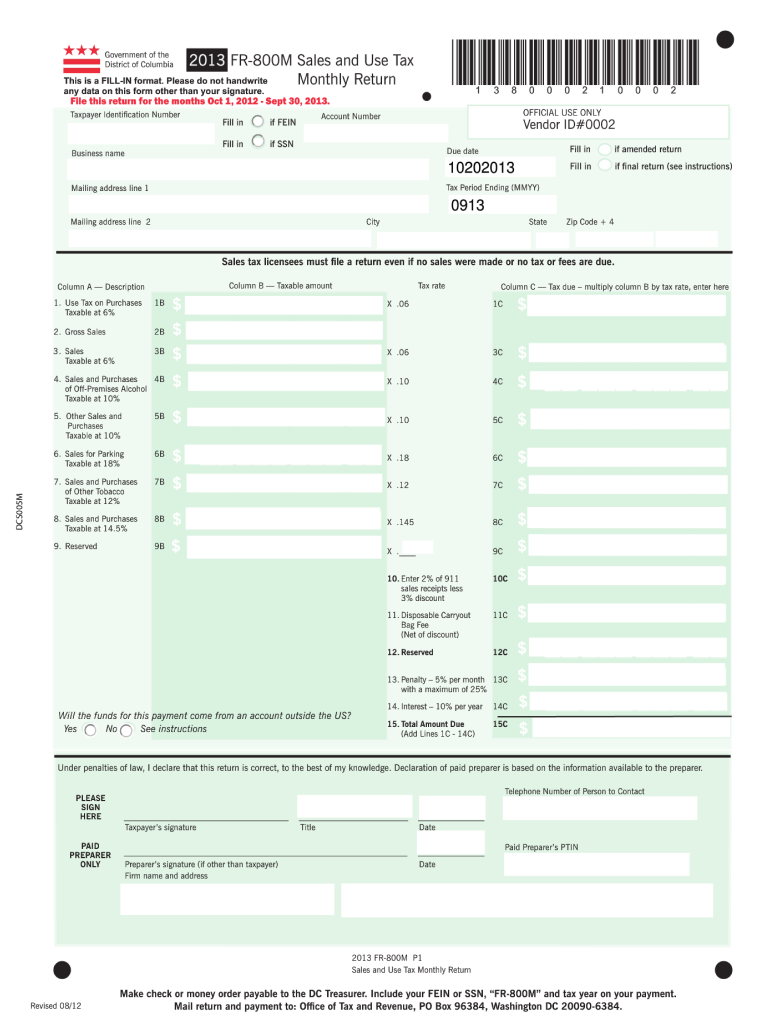

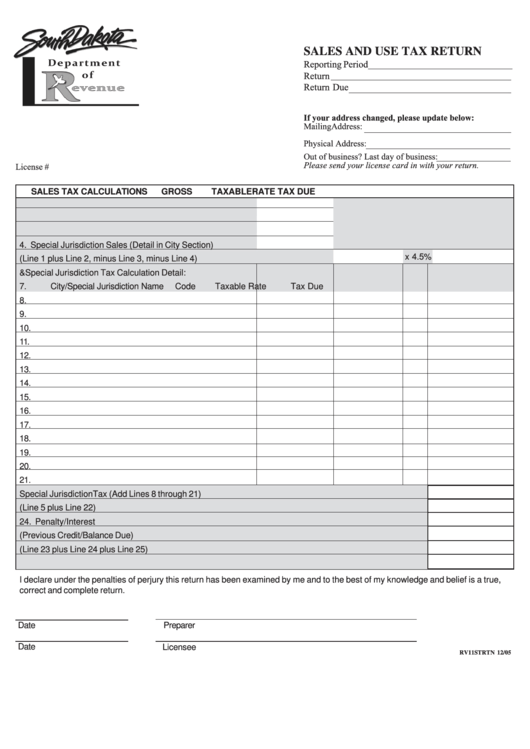

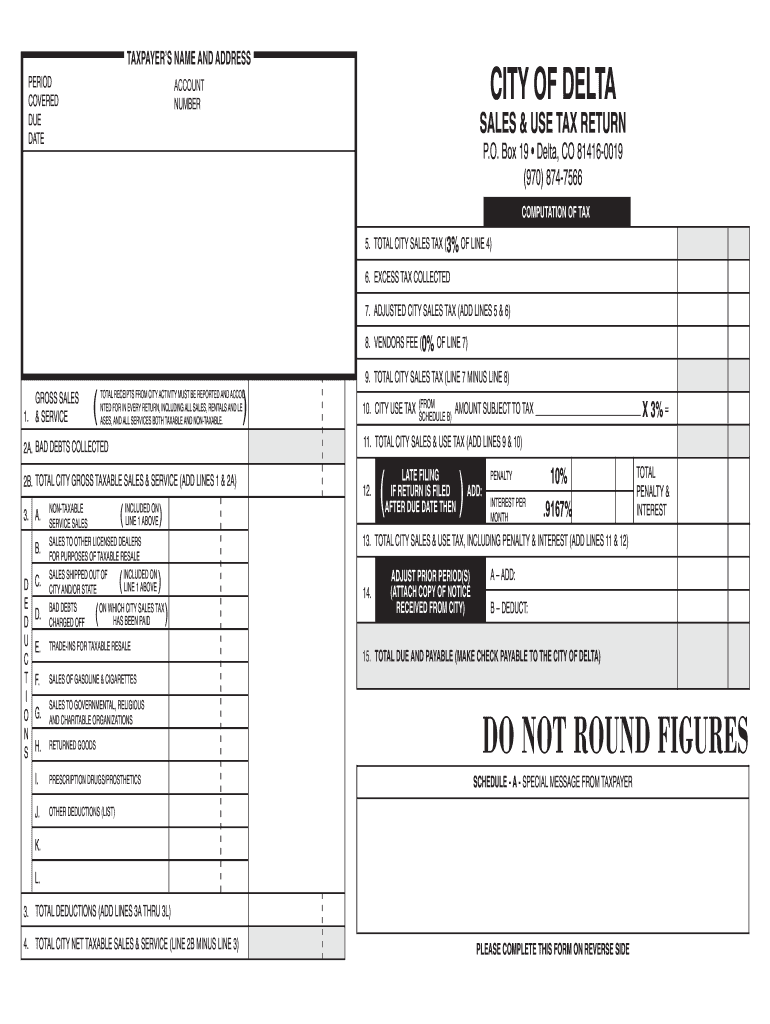

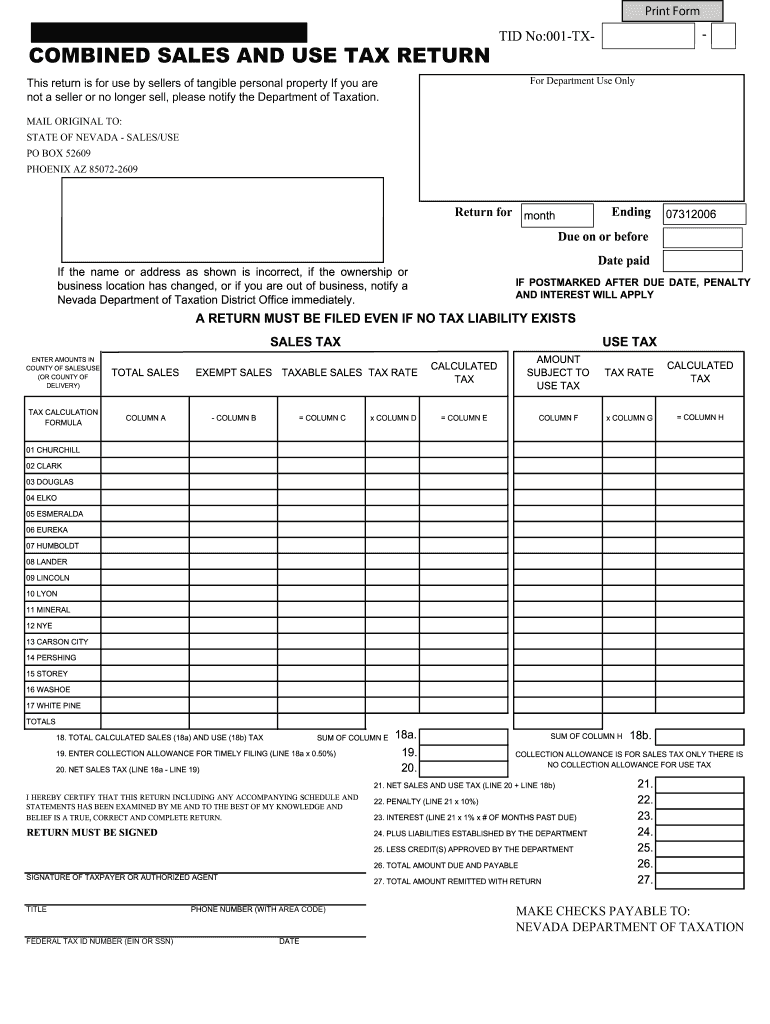

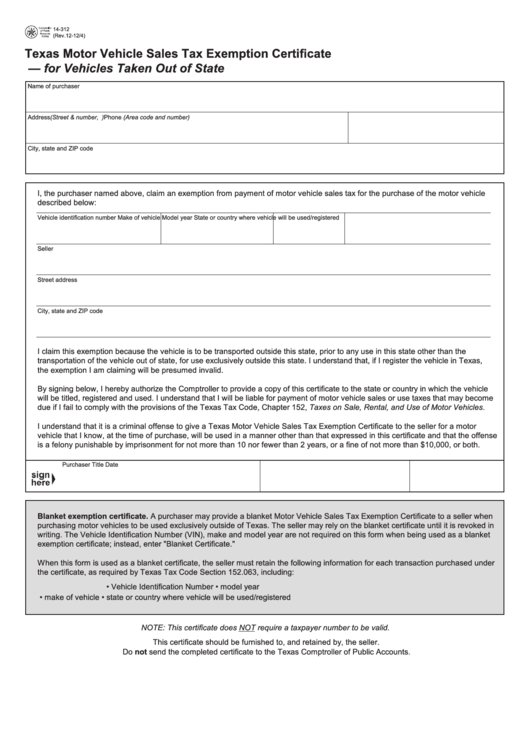

Nv Sales Use Tax Form

Nv Sales Use Tax Form - Sales & use tax forms. If you are not a. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales and use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax return.

Sales and use tax return. If you are not a. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax forms. Sales & use tax return.

If you are not a. Sales and use tax return. Sales & use tax forms. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax return.

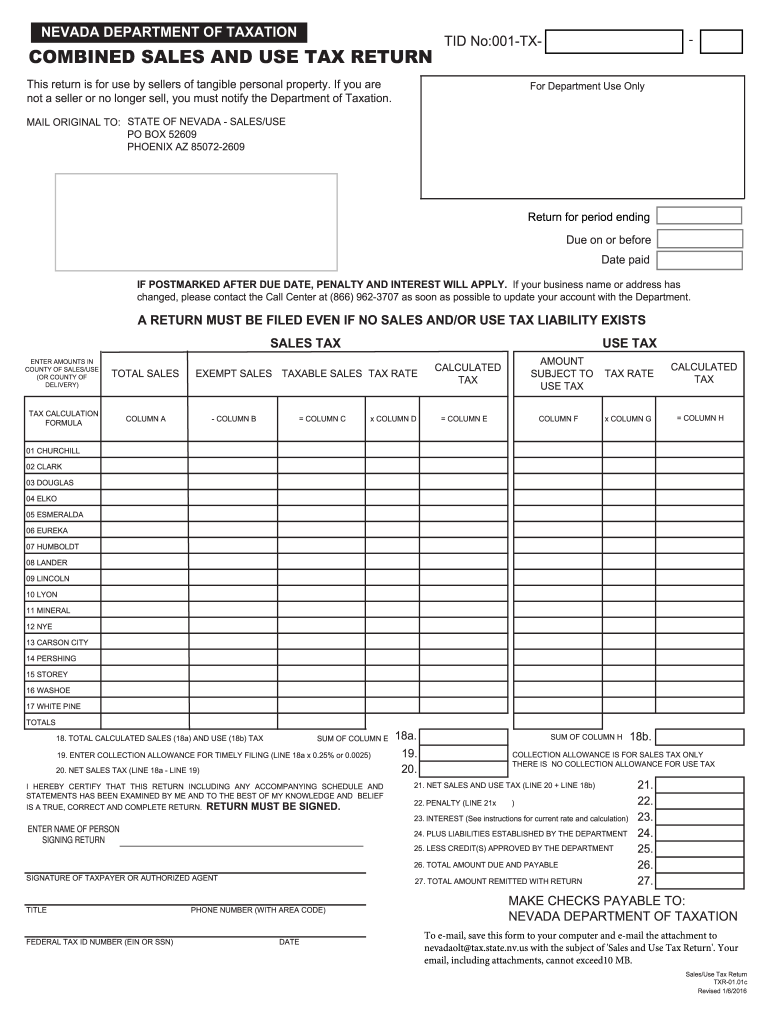

Blank Nv Sales And Use Tax Form / Form MBTFI Fillable Modified

Sales & use tax return. Sales and use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms.

2010 Form NV APP01.00 Fill Online, Printable, Fillable, Blank pdfFiller

Sales and use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax return. Sales & use tax forms. Total calculated sales (18a) and use (18b) tax 16 washoe 19.

Blank Nv Sales And Use Tax Form Blank Nv Sales And Use Tax Form

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. If you are not a. Sales and use tax return. Sales & use tax return. Sales & use tax forms.

Blank Nv Sales And Use Tax Form Blank Nv Sales And Use Tax Form

Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms. Sales and use tax return. Sales & use tax return.

Blank Nv Sales And Use Tax Form / Kentucky Sales Tax Farm Exemption

Sales & use tax forms. Sales and use tax return. Sales & use tax return. If you are not a. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.

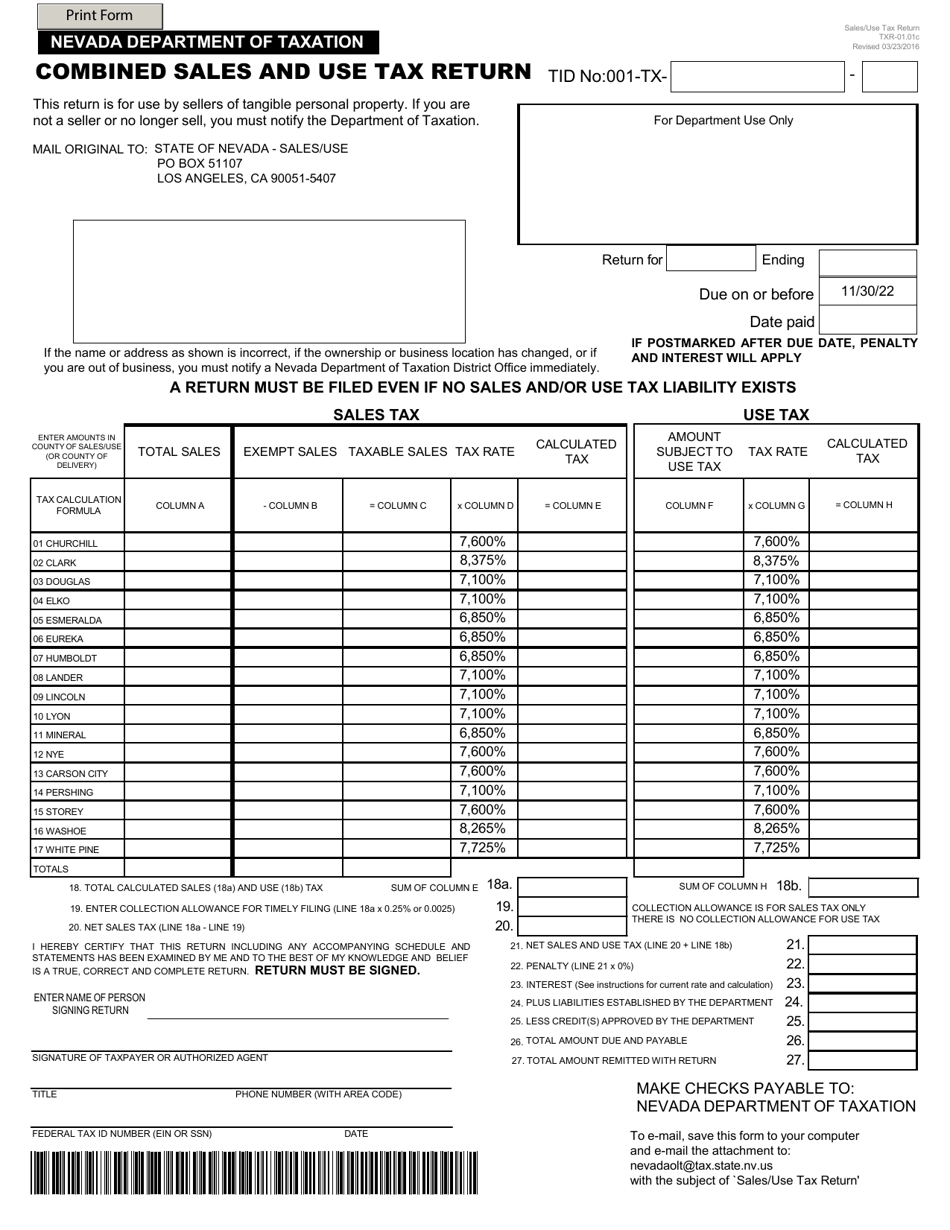

Nevada Sales and Use Tax 20062024 Form Fill Out and Sign Printable

Sales and use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. If you are not a. Sales & use tax return.

Blank Nv Sales And Use Tax Form / Kentucky Sales Tax Farm Exemption

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms. Sales and use tax return. If you are not a. Total calculated sales (18a) and use (18b) tax 16 washoe 19.

Nevada State Withholding Tax Form

Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms. If you are not a. Sales and use tax return.

Form TXR01.01C Download Fillable PDF or Fill Online Combined Sales and

Sales and use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax forms. Sales & use tax return.

Sales & Use Tax Forms.

Sales & use tax return. If you are not a. Sales and use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.