Nebraska Dept Of Revenue Forms

Nebraska Dept Of Revenue Forms - Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Business taxes can be a pain, but we're here to help you get to the resources you need to help alleviate that pain. Paper filers should mail this return with. Sales and use tax applications and. Forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. A form 941n is required even if there have been no payments subject. Parents and legal guardians can visit dor’s webpage for information related to qualifying for the tax credit and the. Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue.

Business taxes can be a pain, but we're here to help you get to the resources you need to help alleviate that pain. Paper filers should mail this return with. A form 941n is required even if there have been no payments subject. Parents and legal guardians can visit dor’s webpage for information related to qualifying for the tax credit and the. Forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue. Sales and use tax applications and.

Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue. Parents and legal guardians can visit dor’s webpage for information related to qualifying for the tax credit and the. Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Paper filers should mail this return with. Sales and use tax applications and. Forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. Business taxes can be a pain, but we're here to help you get to the resources you need to help alleviate that pain. A form 941n is required even if there have been no payments subject.

22 Nebraska Change Request Nebraska Department Of Revenue Fill and

Sales and use tax applications and. Forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. A form 941n is required even if there have been no payments subject. Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue. Parents and legal guardians can.

Ne dept of rev Fill out & sign online DocHub

Business taxes can be a pain, but we're here to help you get to the resources you need to help alleviate that pain. Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Paper filers should mail this return with. A form 941n is required even if.

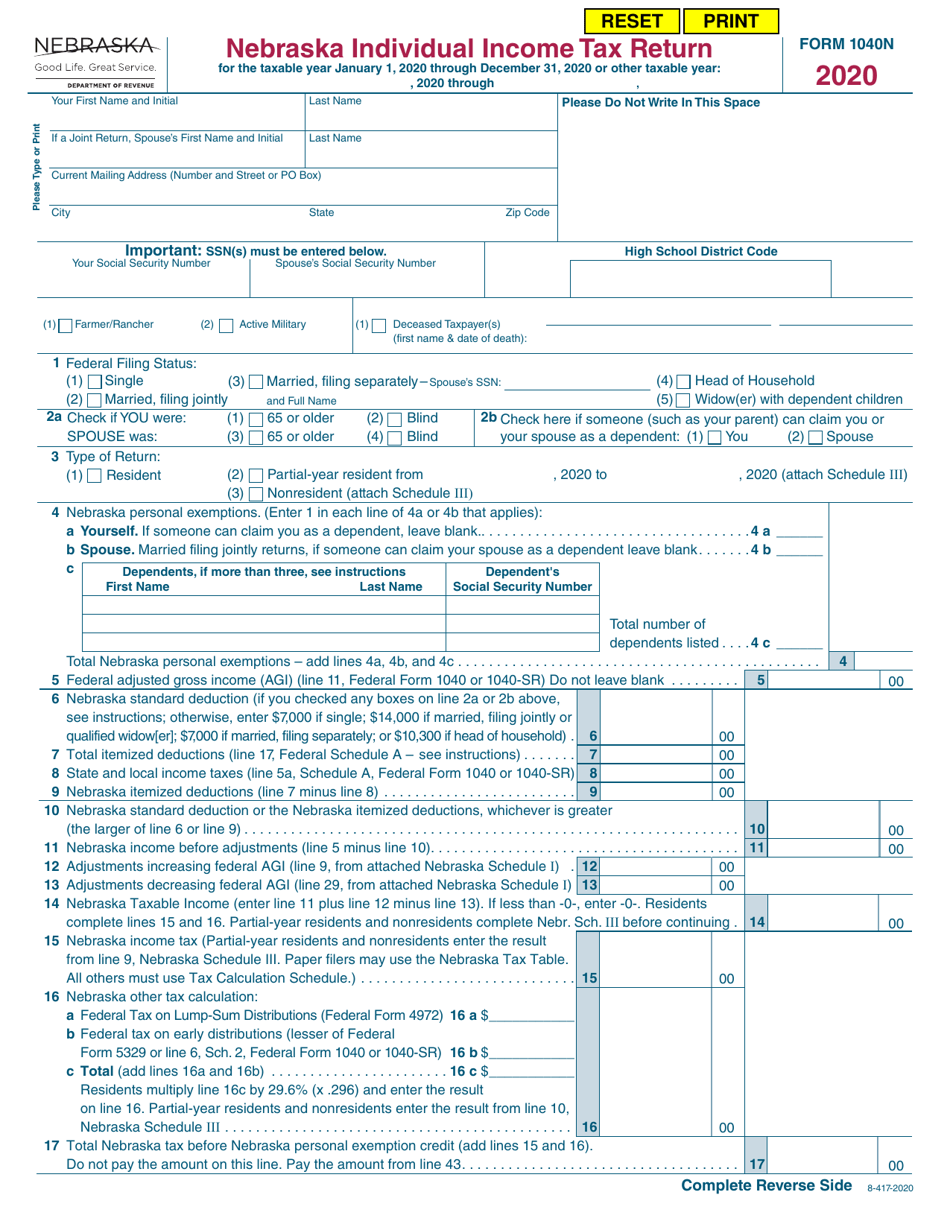

Fillable Nebraska State Tax Forms Printable Forms Free Online

Sales and use tax applications and. Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue. Business taxes can be a pain, but we're here to.

Nebraska taxpayers have millions in unclaimed property tax credit YouTube

Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Paper filers should mail this return with. Sales and use tax applications and. Parents and legal guardians can visit dor’s webpage for information related to qualifying for the tax credit and the. A form 941n is required.

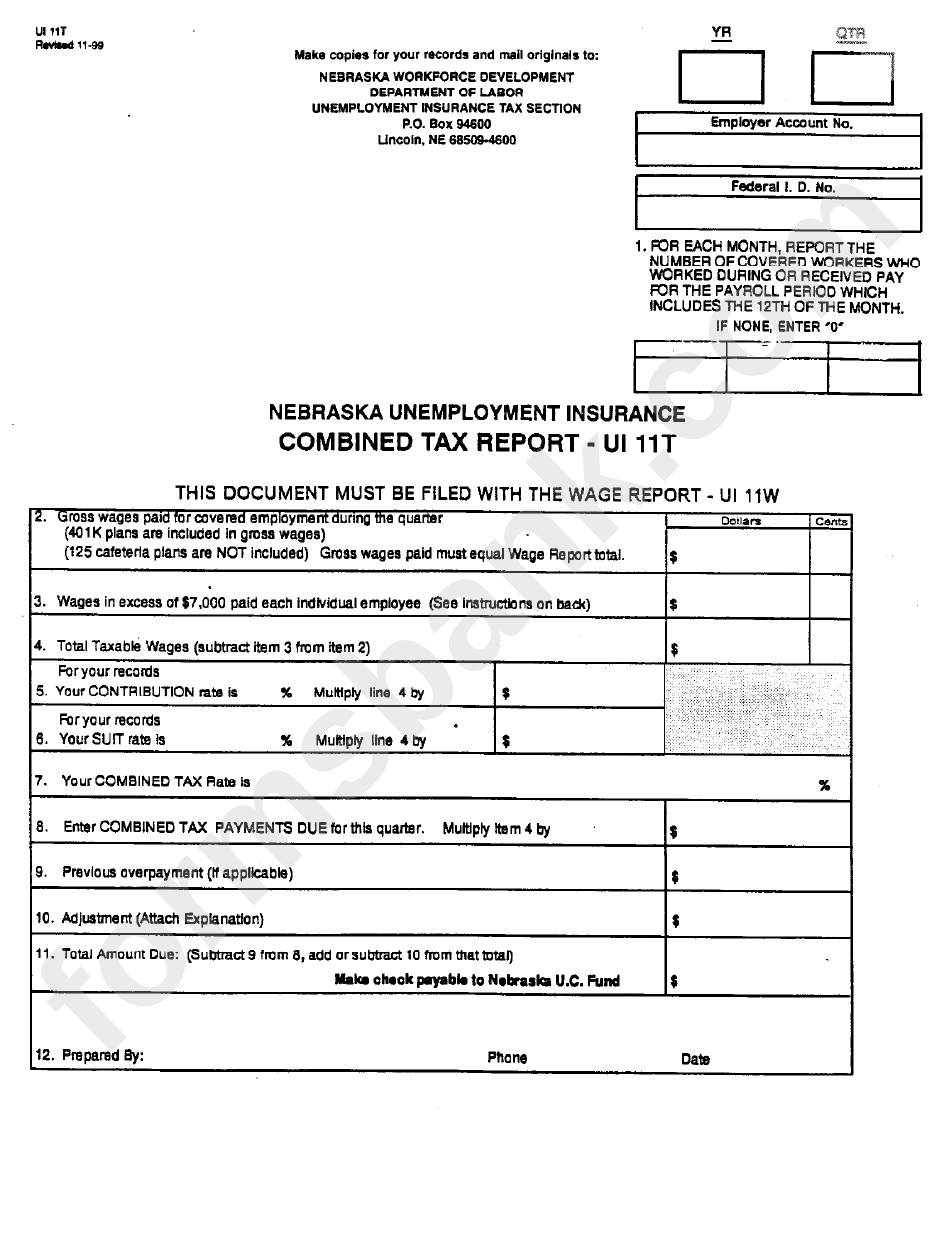

Form Ui11t Nebaska Unemployment Insurance Combined Tax Report

Business taxes can be a pain, but we're here to help you get to the resources you need to help alleviate that pain. Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Parents and legal guardians can visit dor’s webpage for information related to qualifying for.

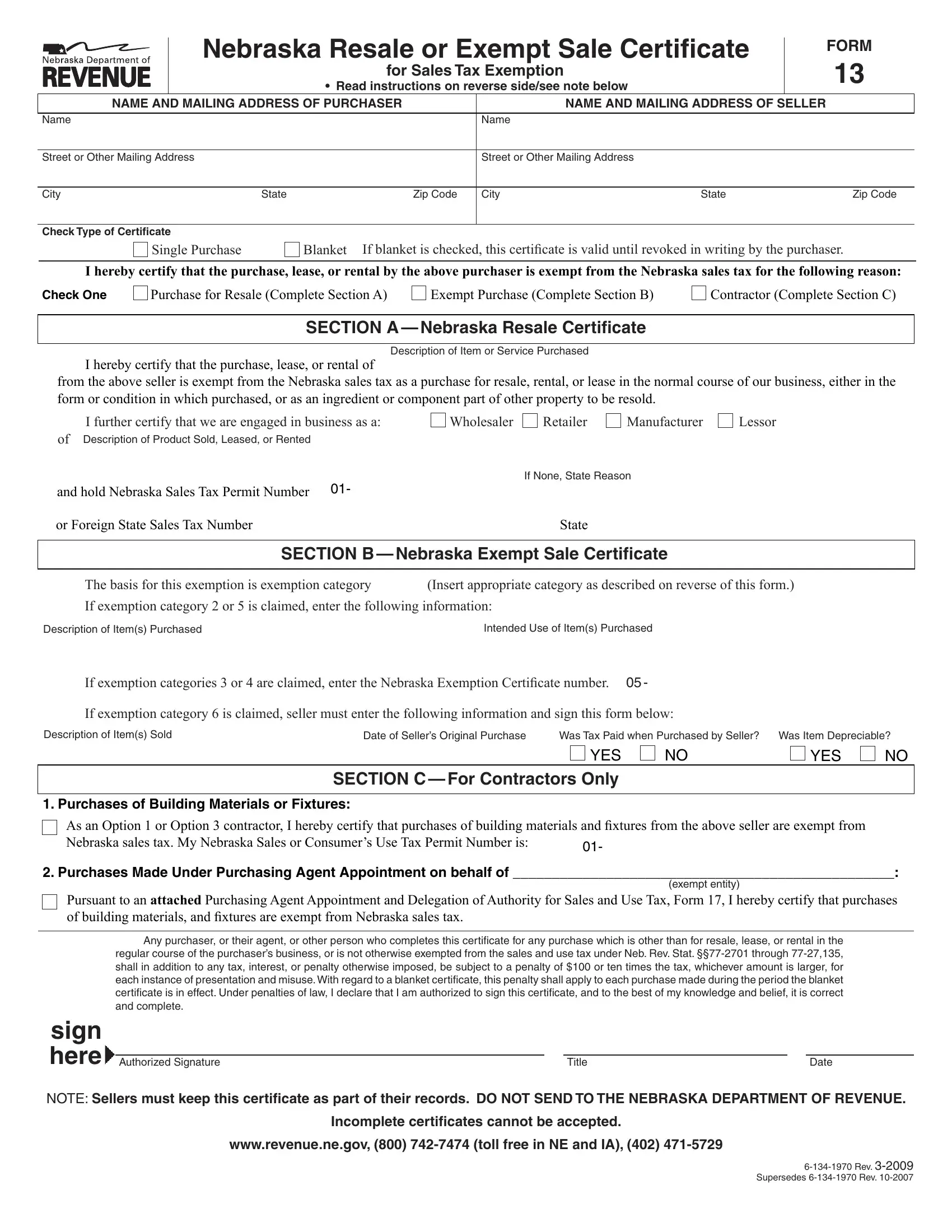

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online

Paper filers should mail this return with. Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Sales and use tax applications and. A form 941n is required even if there have been no payments subject. Forms for county officials, homestead exemption, car lines, air carriers, public.

Fillable Online forms in Chapter 24 Apportionment Nebraska

Sales and use tax applications and. Forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. A form 941n is required even if there have been no payments subject. Parents and legal guardians can visit dor’s webpage for information related to qualifying for the tax credit and the. Sign up for our subscription service to.

Form 2 Download Fillable PDF or Fill Online Nebraska and Local Business

Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Sales and use tax applications and. Paper filers should mail this return with. A form 941n is required even if there have been no payments subject. Business taxes can be a pain, but we're here to help.

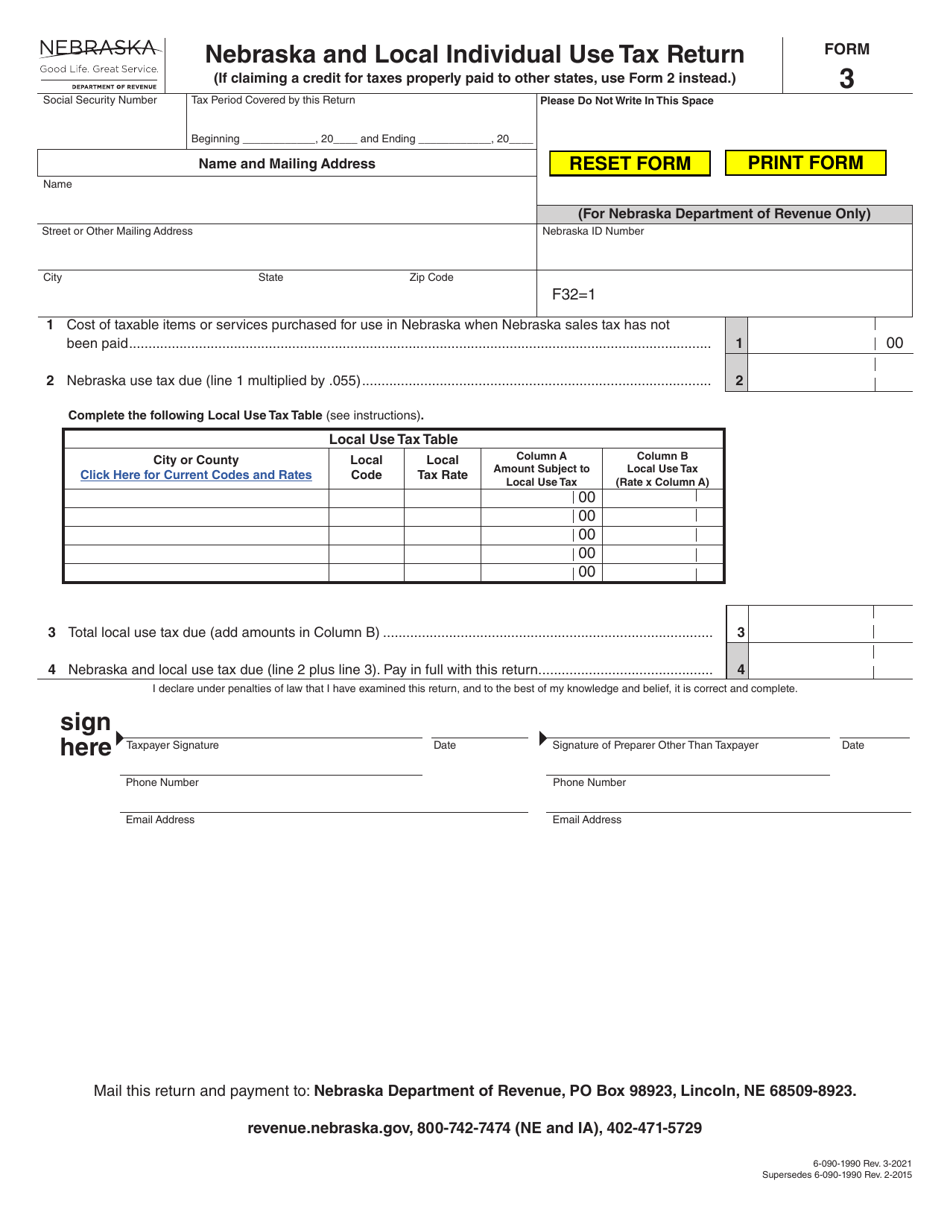

Form 3 Download Fillable PDF or Fill Online Nebraska and Local

Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue. Forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. Business.

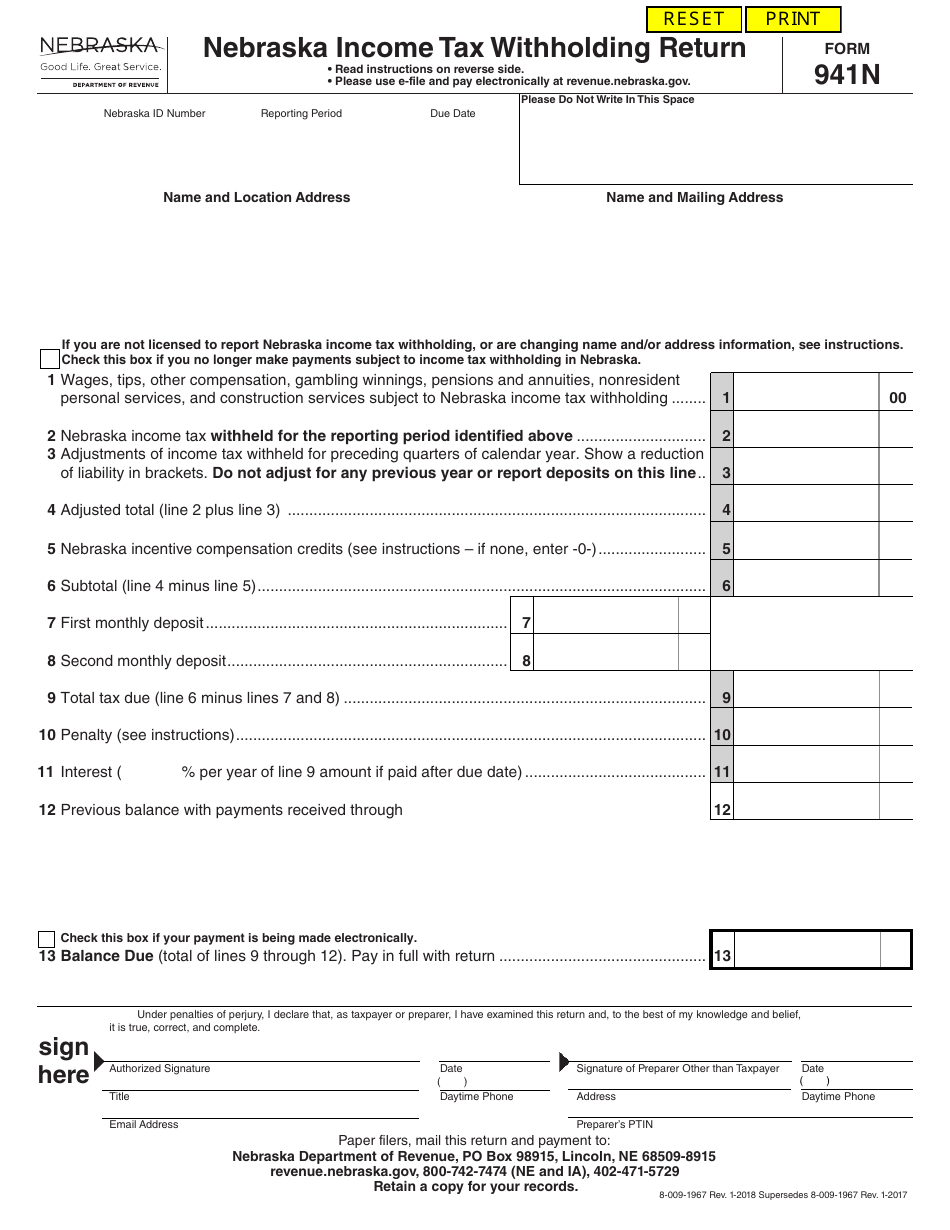

Form 941N Fill Out, Sign Online and Download Fillable PDF, Nebraska

Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue. Business taxes can be a pain, but we're here to help you get to the resources you need to help alleviate that pain. Sign up for our subscription service to be notified when nebfile for individuals will be available.

Forms For County Officials, Homestead Exemption, Car Lines, Air Carriers, Public Service Entities, And Railroads.

Paper filers should mail this return with. Parents and legal guardians can visit dor’s webpage for information related to qualifying for the tax credit and the. Nebraska has a state income tax that ranges between 2.46% and 5.84%, which is administered by the nebraska department of revenue. Business taxes can be a pain, but we're here to help you get to the resources you need to help alleviate that pain.

Sales And Use Tax Applications And.

Sign up for our subscription service to be notified when nebfile for individuals will be available for filing 2024 nebraska individual income tax. A form 941n is required even if there have been no payments subject.