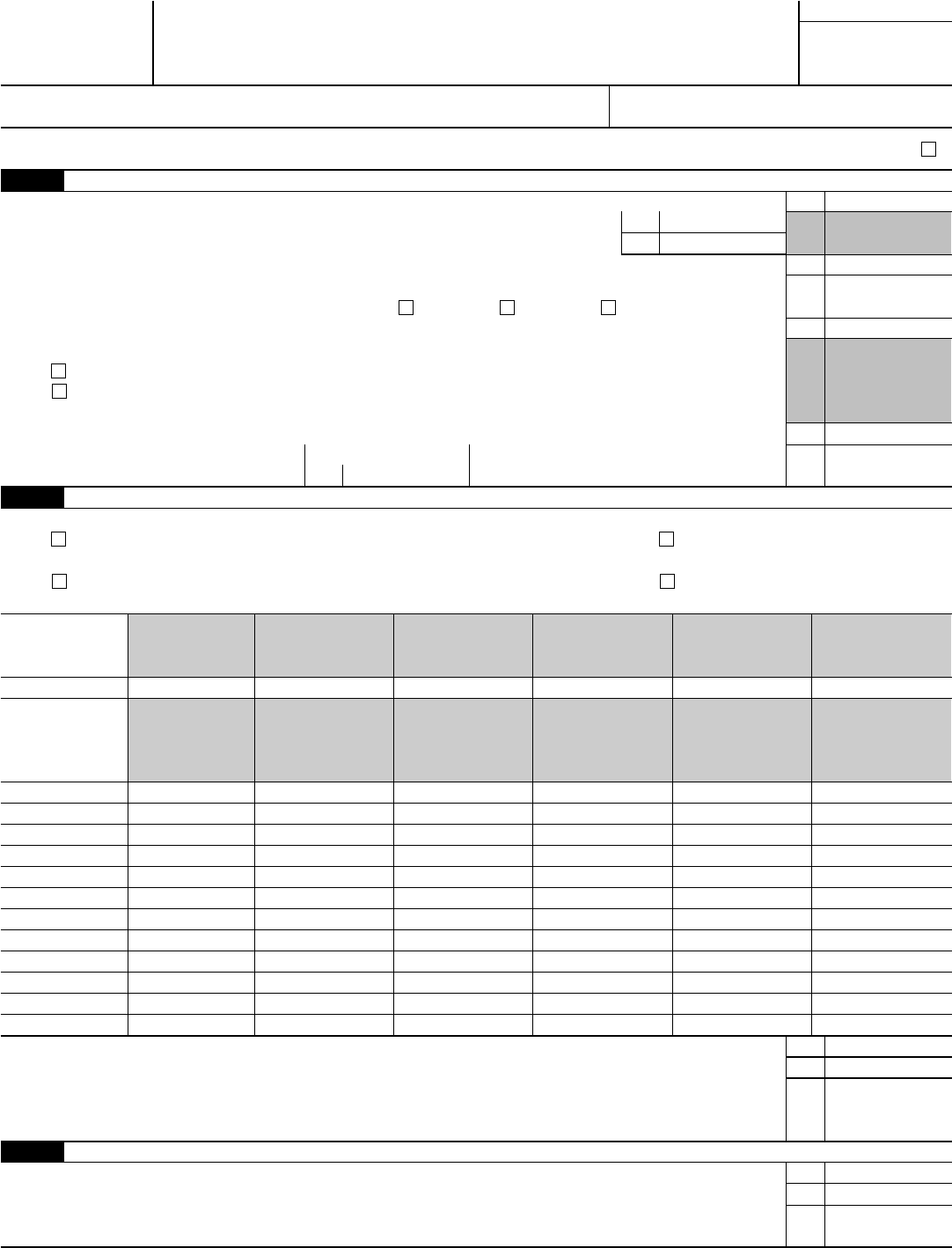

Modified Agi Form 8962

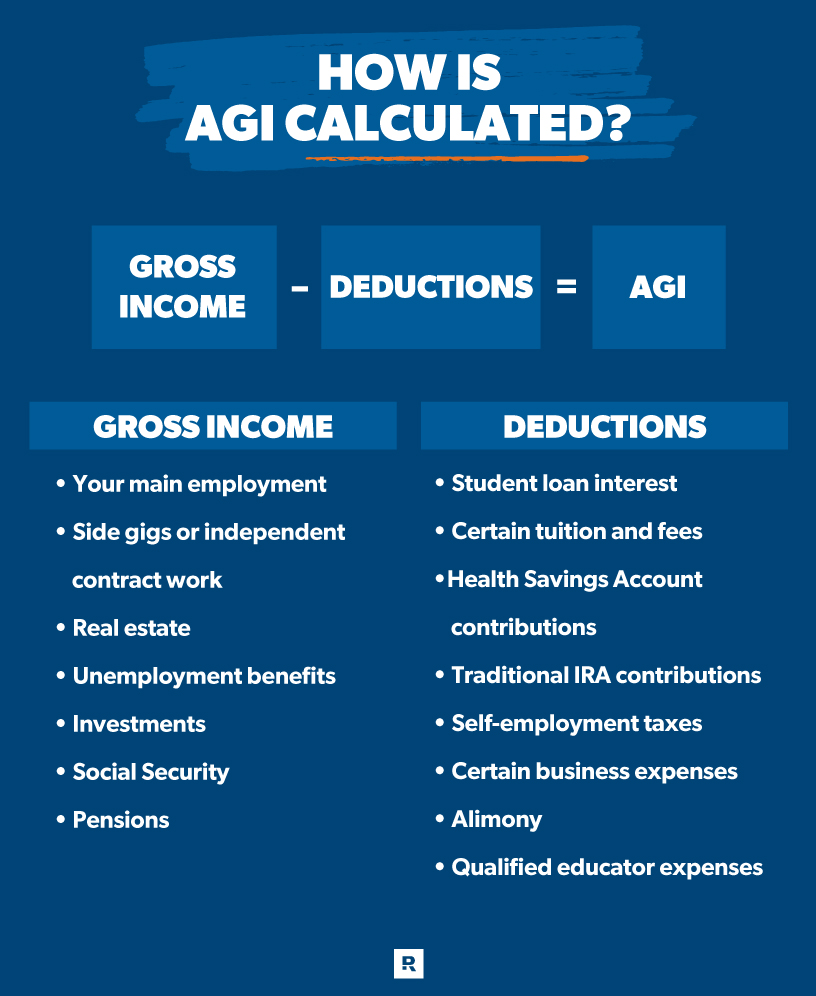

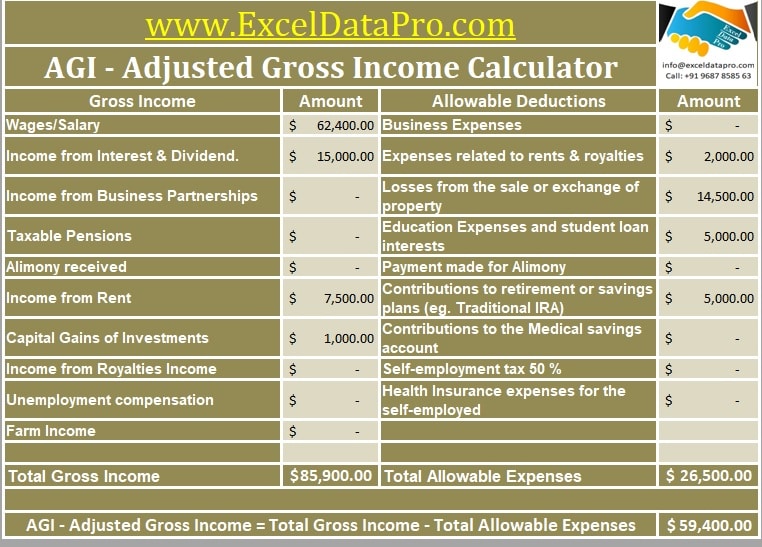

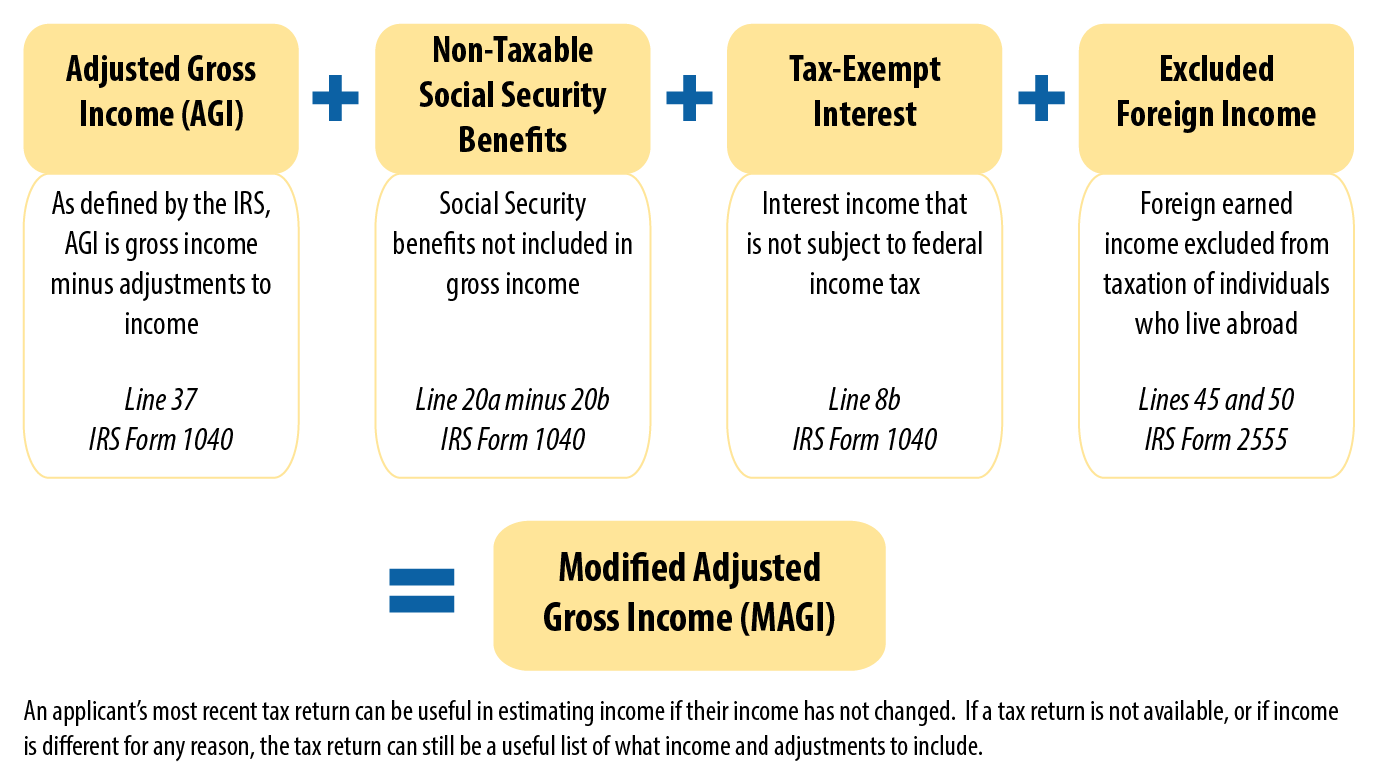

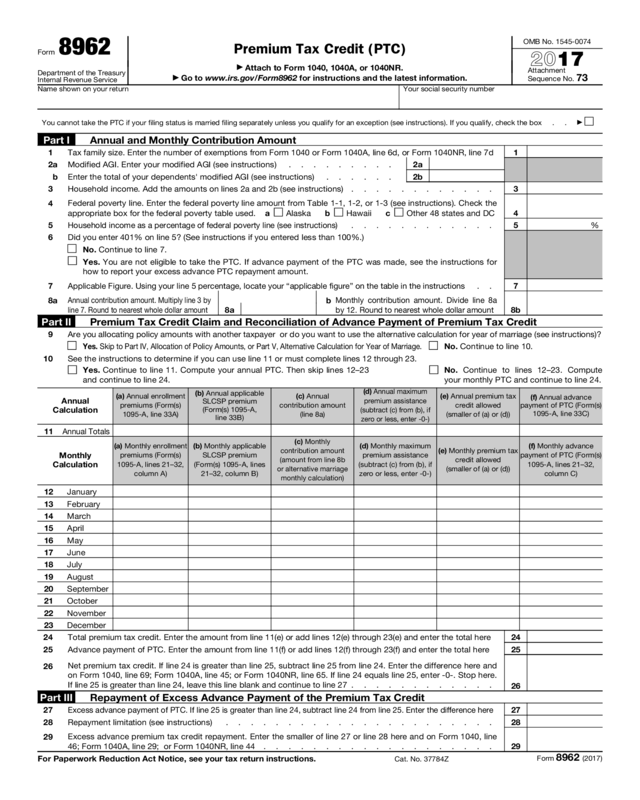

Modified Agi Form 8962 - If you have received a notice from the irs to send them form 8962, please see below. Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile. For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable. Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,. The magi calculation is your adjusted.

The magi calculation is your adjusted. Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,. Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile. Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable. For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. If you have received a notice from the irs to send them form 8962, please see below.

For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,. If you have received a notice from the irs to send them form 8962, please see below. The magi calculation is your adjusted. Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable. Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile.

Printable Irs Form 8962 Printable Forms Free Online

The magi calculation is your adjusted. If you have received a notice from the irs to send them form 8962, please see below. For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Turbotax asks you in the interview questions for the modified adjusted.

Form 8962 2024

For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,. Household income on line 3 must equal the total of line 2a, modified.

Fillable Online Worksheet 3 Modified AGI if you are filing federal

Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable. For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. If you have received a notice from the irs to send them form.

What Is Adjusted Gross AGI Does My Snapshot On Tax Act Have The

The magi calculation is your adjusted. If you have received a notice from the irs to send them form 8962, please see below. For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Household income on line 3 must equal the total of line.

Modified Adjusted Gross Calculator 2024 Ellyn Hillary

Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile. Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,. If you have received a notice from the irs to send them form 8962, please see below. The.

Premium Tax Credit Form Free Download

For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable. The magi calculation is your adjusted. If you have received a notice from.

3 Easy Ways to Fill Out Form 8962 wikiHow

Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable. Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile. The magi calculation is your adjusted. If you have received a notice from the irs to send them.

Modified Adjusted Gross (MAGI)

Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,. Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile. The magi calculation is your adjusted. If you have received a notice from the irs to send them.

2016 Form 8962 Edit, Fill, Sign Online Handypdf

Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,. The magi calculation is your adjusted. If you have received a notice from the irs to send them form 8962, please see below. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,.

2016 Form 8962 Edit, Fill, Sign Online Handypdf

Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile. For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Modified adjusted gross income is the adjusted gross income on your federal income.

The Magi Calculation Is Your Adjusted.

Household income on line 3 must equal the total of line 2a, modified agi, and 2b, dependents' modified agi, for efile. For purposes of the ptc, household income is the modified adjusted gross income (modified agi) of you and your spouse (if filing a joint return) (see. Modified adjusted gross income is the adjusted gross income on your federal income tax return plus any excluded foreign income, nontaxable. Turbotax asks you in the interview questions for the modified adjusted gross income (agi) for your dependents (form 8962, part i,.

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)