Missouri Tax Exempt Form Hotel

Missouri Tax Exempt Form Hotel - Show — utility bar hide — utility bar. Hotels & motels tax matrix effective date: To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Excellent customer service, every time. There are two ways a guest can qualify for exemption from the tax. Guests must have stayed at the motel/hotel for more than 31 days (in the.

Hotels & motels tax matrix effective date: Excellent customer service, every time. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Show — utility bar hide — utility bar. Guests must have stayed at the motel/hotel for more than 31 days (in the. There are two ways a guest can qualify for exemption from the tax.

Excellent customer service, every time. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Show — utility bar hide — utility bar. There are two ways a guest can qualify for exemption from the tax. Hotels & motels tax matrix effective date: Guests must have stayed at the motel/hotel for more than 31 days (in the.

Sales Tax Exempt Form 2024 Va

Show — utility bar hide — utility bar. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Hotels & motels tax matrix effective date: There are two ways a guest can qualify for exemption from the tax. Excellent customer service, every time.

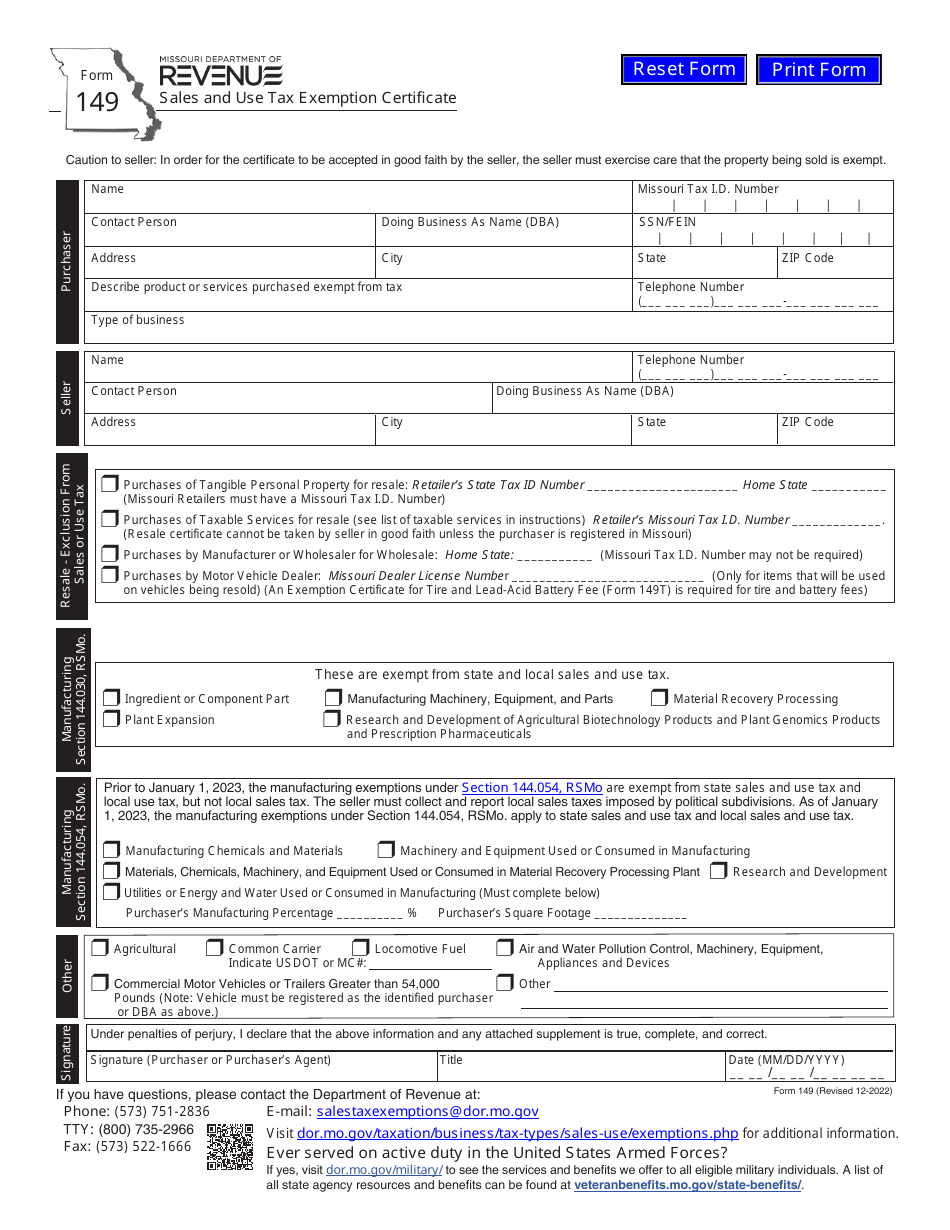

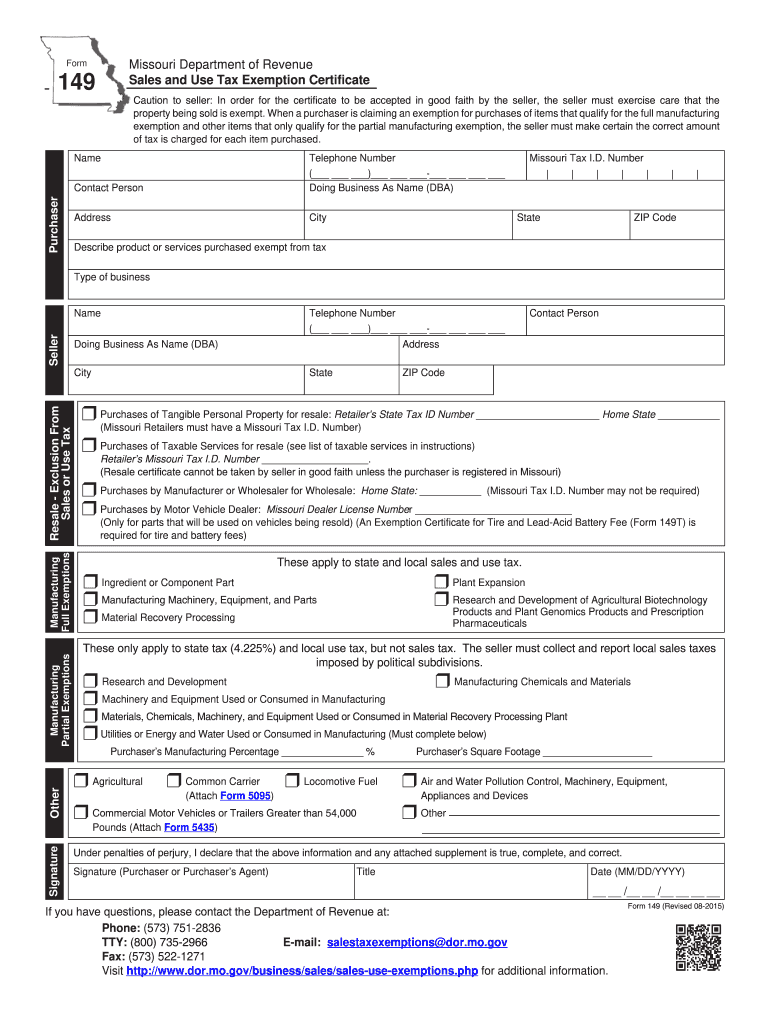

Fillable Missouri Tax Exempt Form 149 Printable Forms Free Online

Excellent customer service, every time. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Show — utility bar hide — utility bar. There are two ways a guest can qualify for exemption from the tax. Guests must have stayed at the motel/hotel for more than 31 days (in.

Missouri Hotel Tax Exempt 20142024 Form Fill Out and Sign Printable

There are two ways a guest can qualify for exemption from the tax. Excellent customer service, every time. Guests must have stayed at the motel/hotel for more than 31 days (in the. Show — utility bar hide — utility bar. Hotels & motels tax matrix effective date:

Missouri Sales Tax Exemption Form Agriculture

Hotels & motels tax matrix effective date: Show — utility bar hide — utility bar. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Guests must have stayed at the motel/hotel for more than 31 days (in the. There are two ways a guest can qualify for exemption.

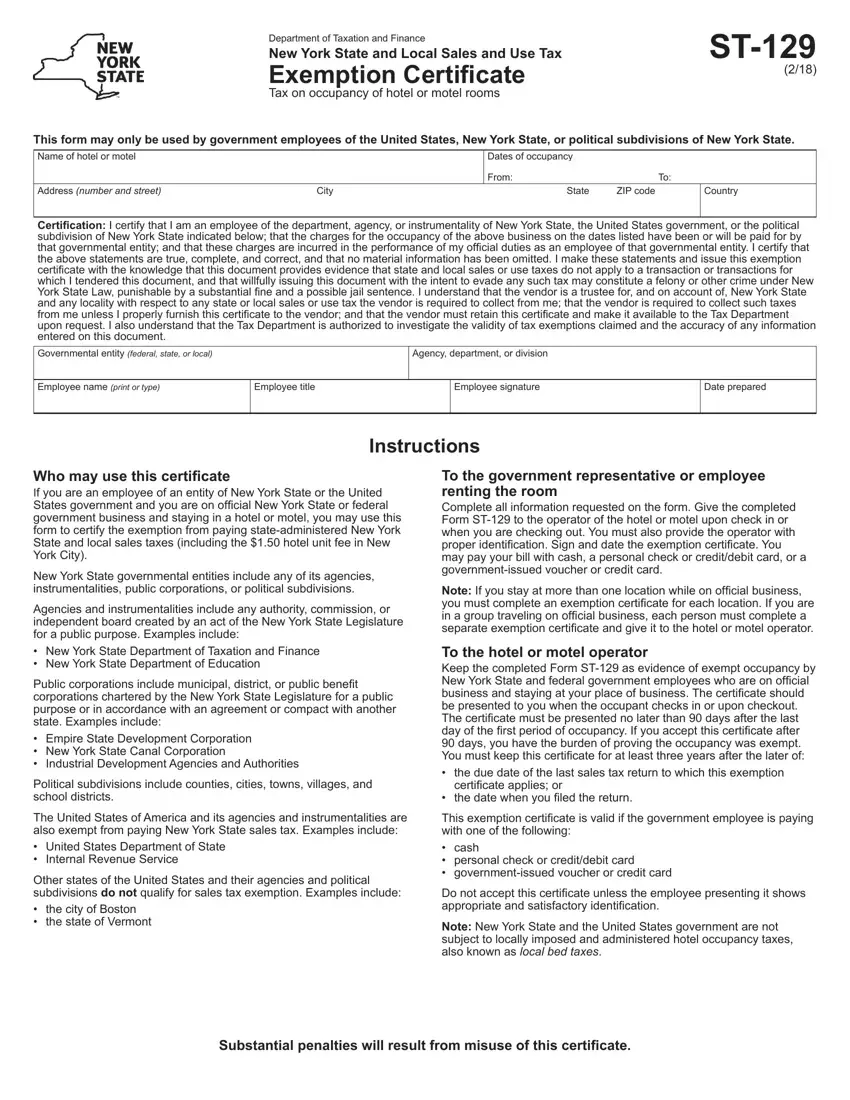

New York Hotel Tax Exempt Form ≡ Fill Out Printable PDF Forms Online

There are two ways a guest can qualify for exemption from the tax. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Hotels & motels tax matrix effective date: Show — utility bar hide — utility bar. Guests must have stayed at the motel/hotel for more than 31.

State Of Utah Tax Exempt Form Form example download

There are two ways a guest can qualify for exemption from the tax. Hotels & motels tax matrix effective date: Excellent customer service, every time. Show — utility bar hide — utility bar. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states.

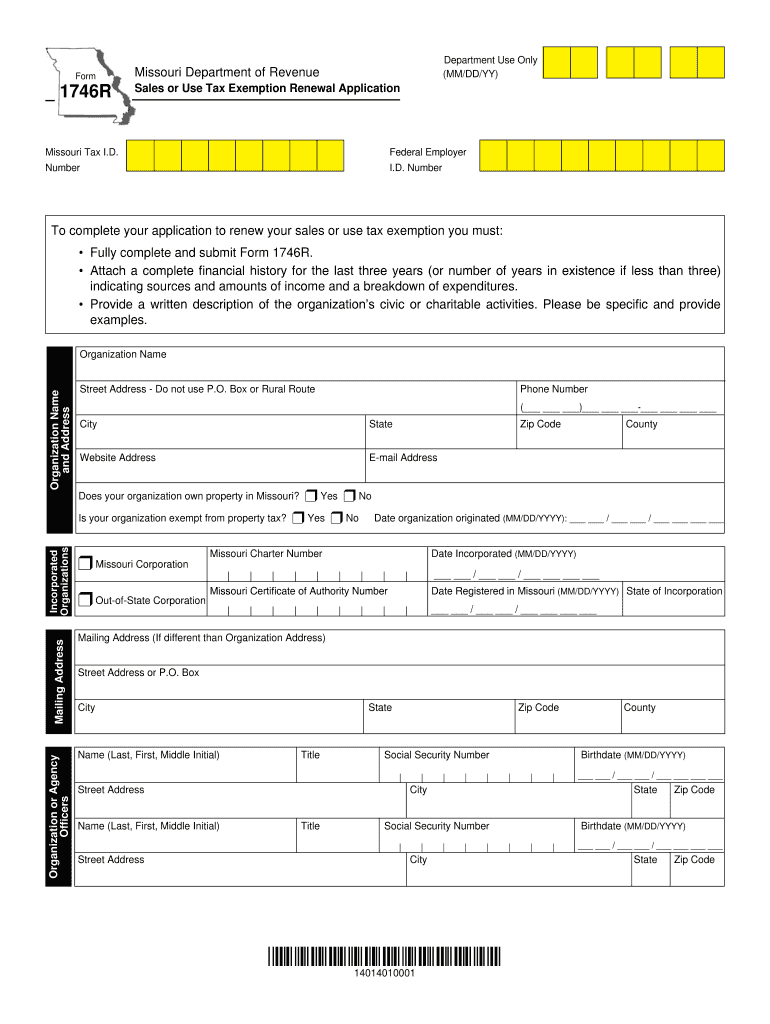

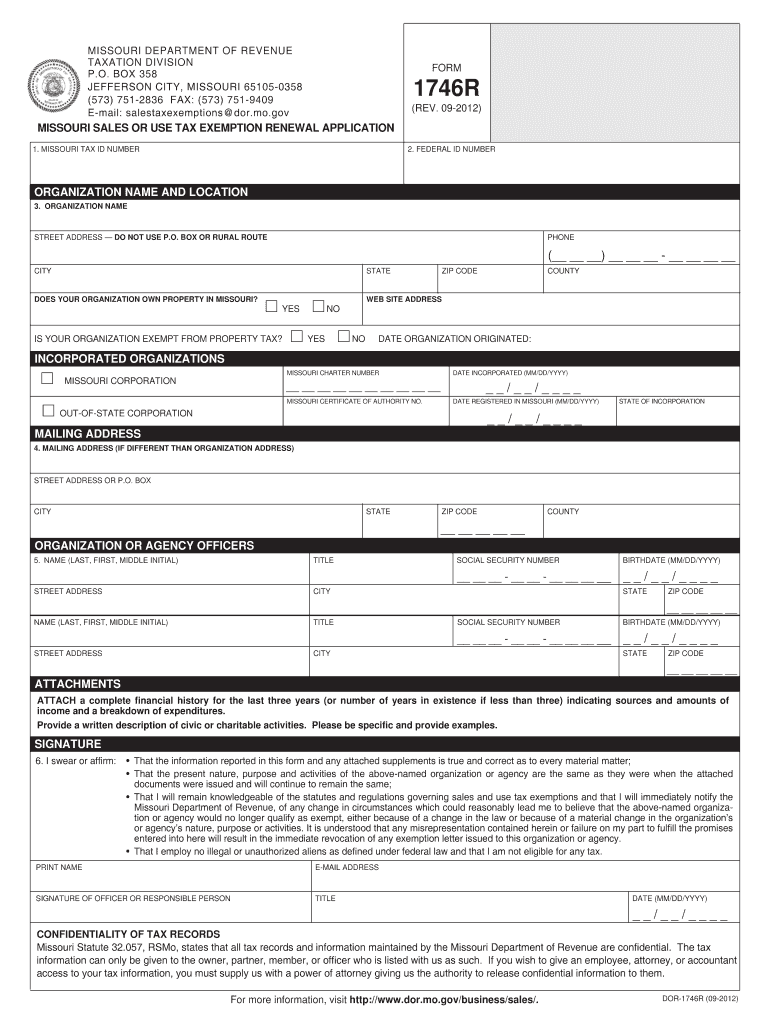

Missouri Tax Exemption Renewal Form Fill Out and Sign Printable PDF

Hotels & motels tax matrix effective date: To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. There are two ways a guest can qualify for exemption from the tax. Excellent customer service, every time. Guests must have stayed at the motel/hotel for more than 31 days (in the.

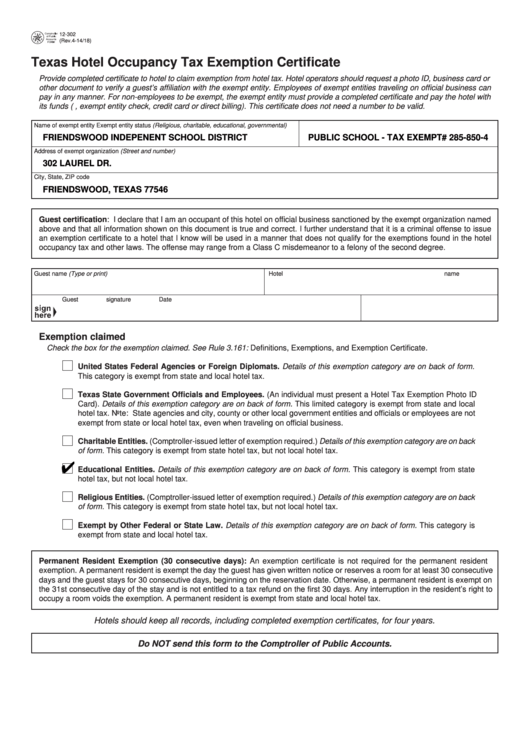

South Carolina Hotel Tax Exempt Form

Show — utility bar hide — utility bar. Excellent customer service, every time. There are two ways a guest can qualify for exemption from the tax. Guests must have stayed at the motel/hotel for more than 31 days (in the. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other.

Missouri hotel tax exempt form Fill out & sign online DocHub

To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Show — utility bar hide — utility bar. Hotels & motels tax matrix effective date: Guests must have stayed at the motel/hotel for more than 31 days (in the. Excellent customer service, every time.

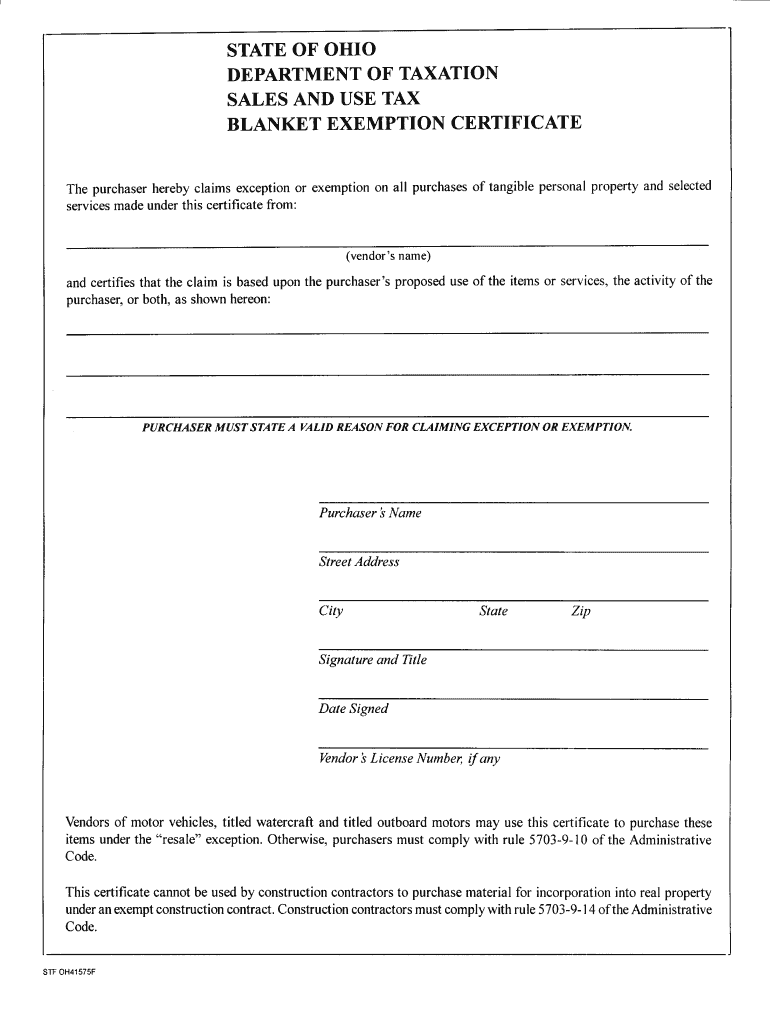

Ohio Tax Exempt Form Fast and secure airSlate SignNow

There are two ways a guest can qualify for exemption from the tax. Guests must have stayed at the motel/hotel for more than 31 days (in the. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Hotels & motels tax matrix effective date: Show — utility bar hide.

Hotels & Motels Tax Matrix Effective Date:

To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri or other states. Guests must have stayed at the motel/hotel for more than 31 days (in the. Excellent customer service, every time. There are two ways a guest can qualify for exemption from the tax.