Medicare Irmaa Life Changing Event Form

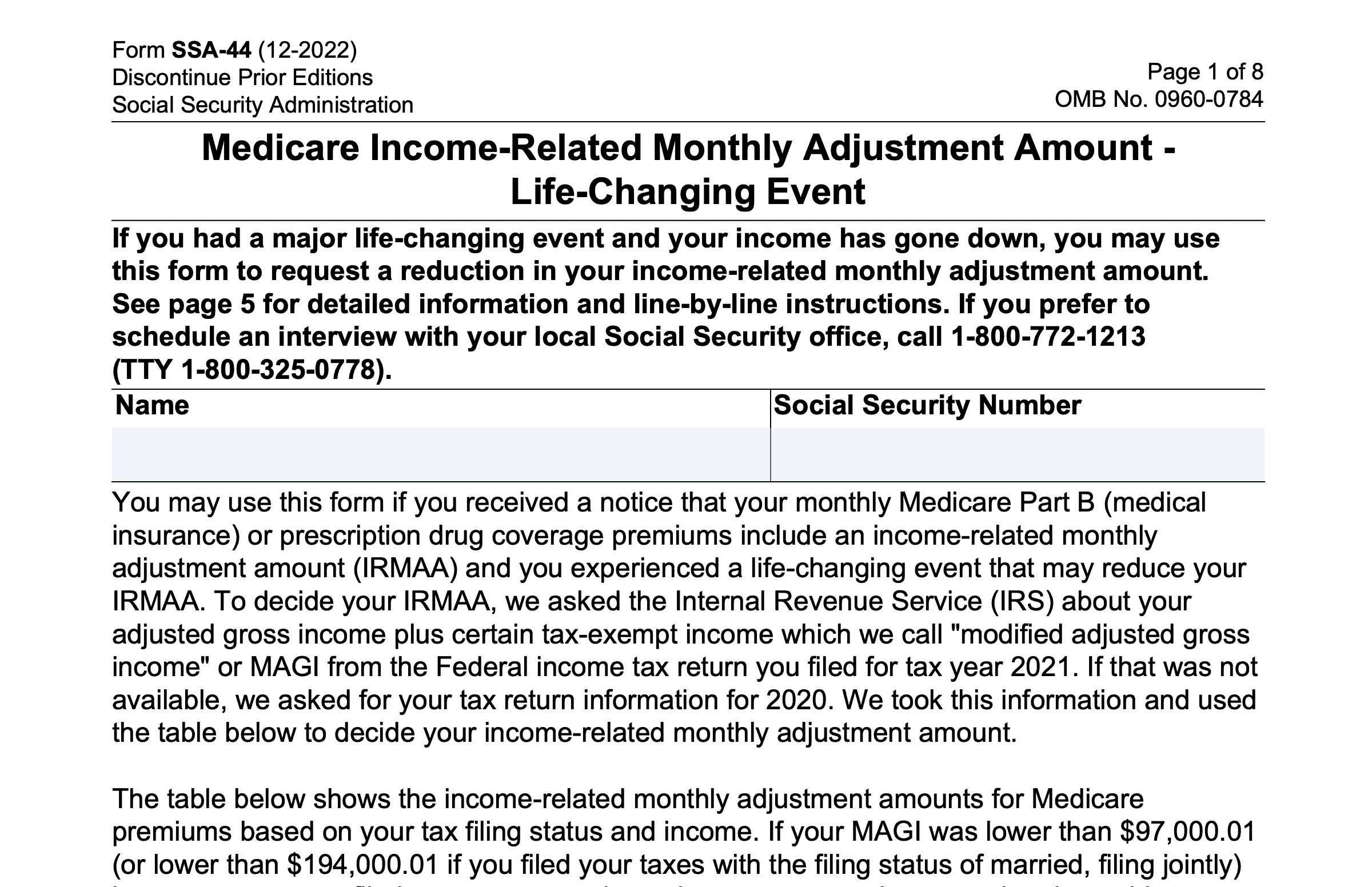

Medicare Irmaa Life Changing Event Form - Listed below are pages we encourage you to review to learn more about 2024 changes. The social security administration (ssa) determines if you owe an irmaa based on the income you reported on your irs tax return two years prior. We also encourage you to register for an mi. If you are expected to pay irmaa,. Each year, there are several important medicare changes. You will need to provide documentation of either.

Listed below are pages we encourage you to review to learn more about 2024 changes. The social security administration (ssa) determines if you owe an irmaa based on the income you reported on your irs tax return two years prior. Each year, there are several important medicare changes. If you are expected to pay irmaa,. You will need to provide documentation of either. We also encourage you to register for an mi.

Each year, there are several important medicare changes. We also encourage you to register for an mi. If you are expected to pay irmaa,. You will need to provide documentation of either. The social security administration (ssa) determines if you owe an irmaa based on the income you reported on your irs tax return two years prior. Listed below are pages we encourage you to review to learn more about 2024 changes.

Ssa44 Form 2024 Irmaa Appeal Form 2024 Pdf Micki Stormie

You will need to provide documentation of either. Each year, there are several important medicare changes. Listed below are pages we encourage you to review to learn more about 2024 changes. We also encourage you to register for an mi. If you are expected to pay irmaa,.

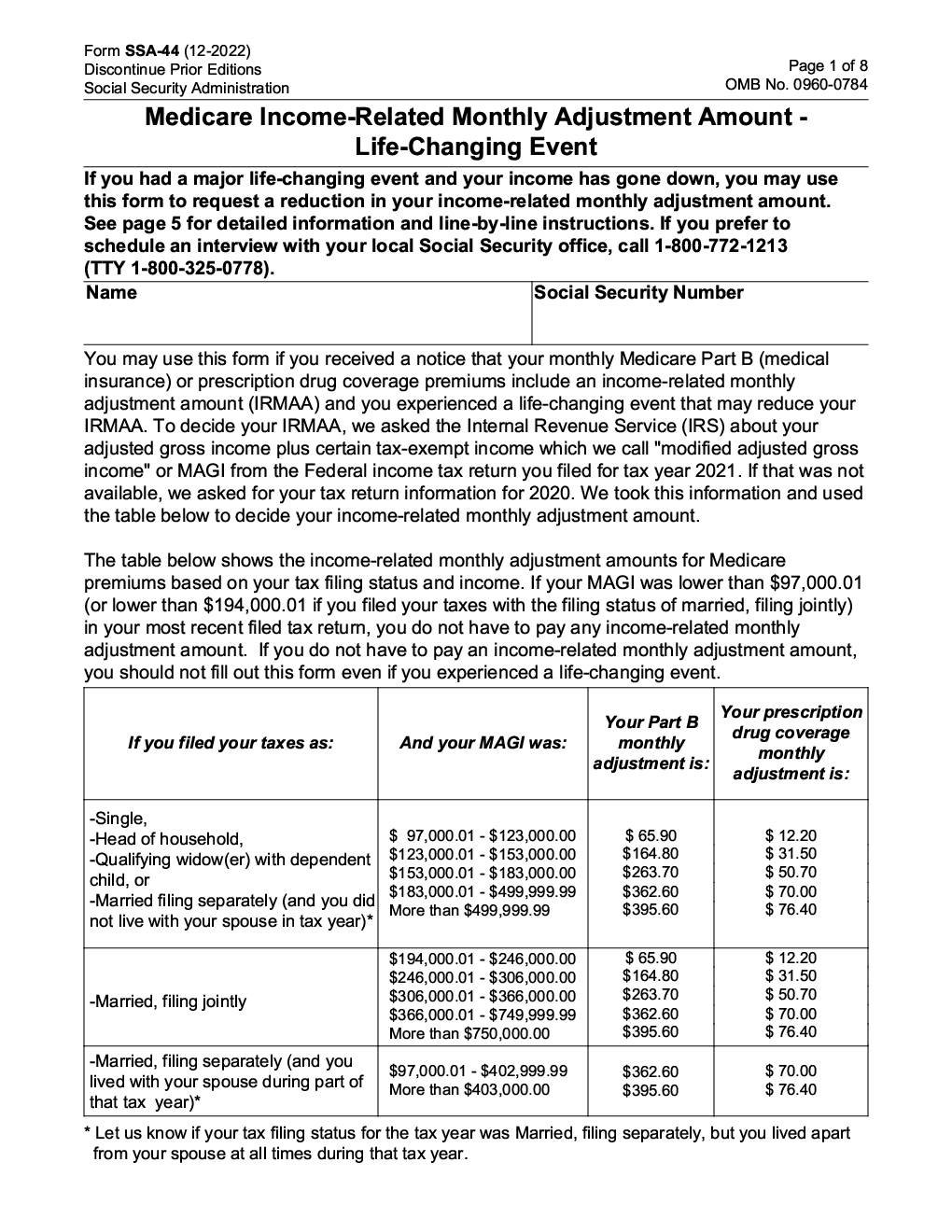

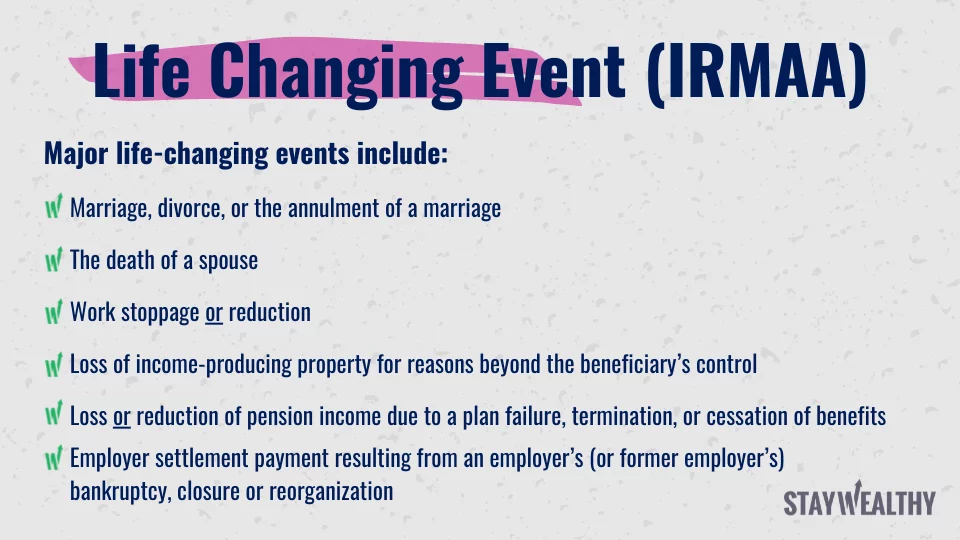

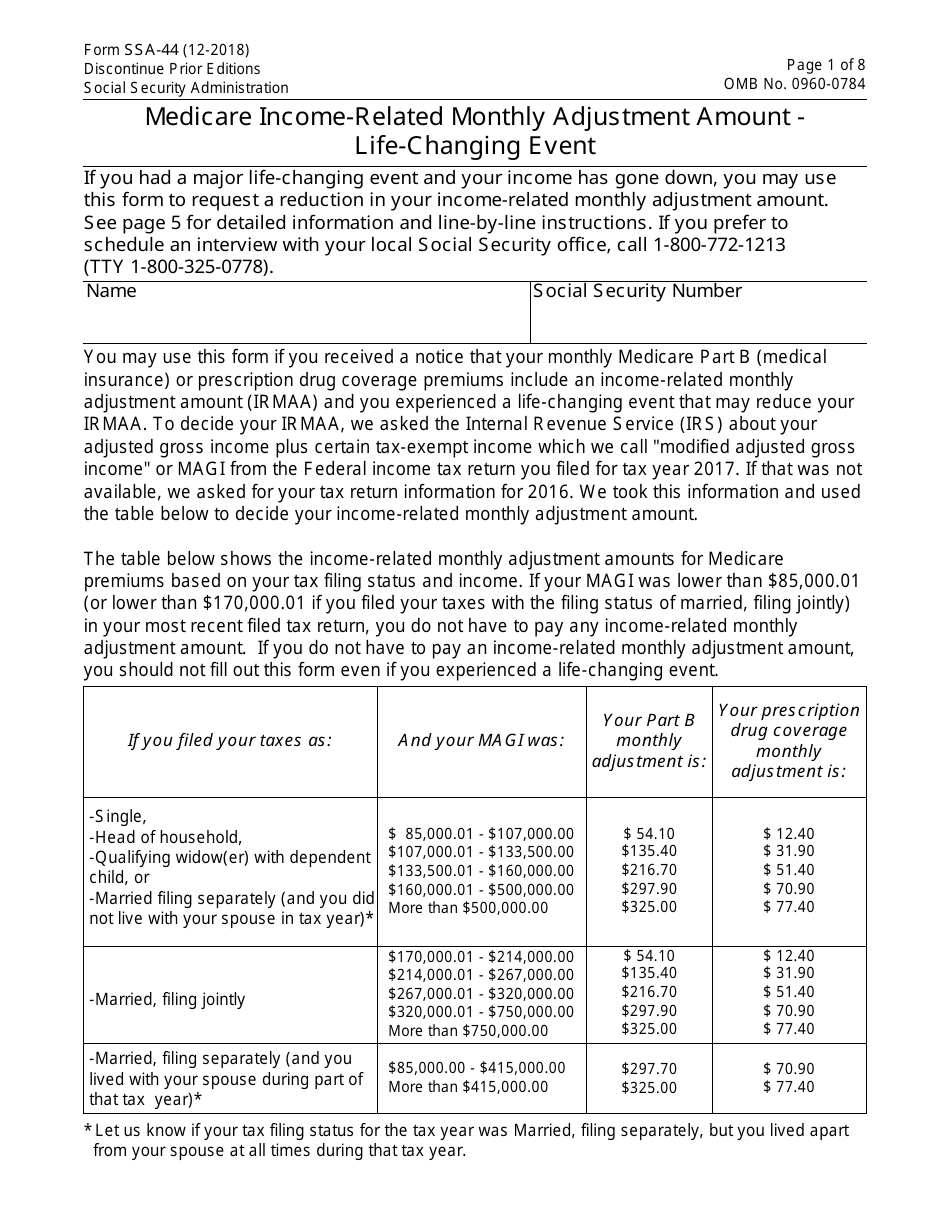

Form SSA44. Medicare Monthly Adjustment Amount (IRMAA

The social security administration (ssa) determines if you owe an irmaa based on the income you reported on your irs tax return two years prior. You will need to provide documentation of either. Listed below are pages we encourage you to review to learn more about 2024 changes. Each year, there are several important medicare changes. We also encourage you.

Medicare Irmaa 2024 Appeal Form Dael Junina

Listed below are pages we encourage you to review to learn more about 2024 changes. If you are expected to pay irmaa,. The social security administration (ssa) determines if you owe an irmaa based on the income you reported on your irs tax return two years prior. You will need to provide documentation of either. We also encourage you to.

Irmaa Limits 2024 Hedi Raeann

We also encourage you to register for an mi. Each year, there are several important medicare changes. Listed below are pages we encourage you to review to learn more about 2024 changes. You will need to provide documentation of either. If you are expected to pay irmaa,.

Irmaa Appeal 2024 Form Shara BetteAnn

Each year, there are several important medicare changes. The social security administration (ssa) determines if you owe an irmaa based on the income you reported on your irs tax return two years prior. You will need to provide documentation of either. If you are expected to pay irmaa,. Listed below are pages we encourage you to review to learn more.

Form SSA44 Fill Out, Sign Online and Download Fillable PDF

Listed below are pages we encourage you to review to learn more about 2024 changes. Each year, there are several important medicare changes. You will need to provide documentation of either. If you are expected to pay irmaa,. We also encourage you to register for an mi.

Irmaa Appeal Form 2023 Printable Forms Free Online

Listed below are pages we encourage you to review to learn more about 2024 changes. Each year, there are several important medicare changes. You will need to provide documentation of either. We also encourage you to register for an mi. If you are expected to pay irmaa,.

Each Year, There Are Several Important Medicare Changes.

Listed below are pages we encourage you to review to learn more about 2024 changes. You will need to provide documentation of either. If you are expected to pay irmaa,. The social security administration (ssa) determines if you owe an irmaa based on the income you reported on your irs tax return two years prior.