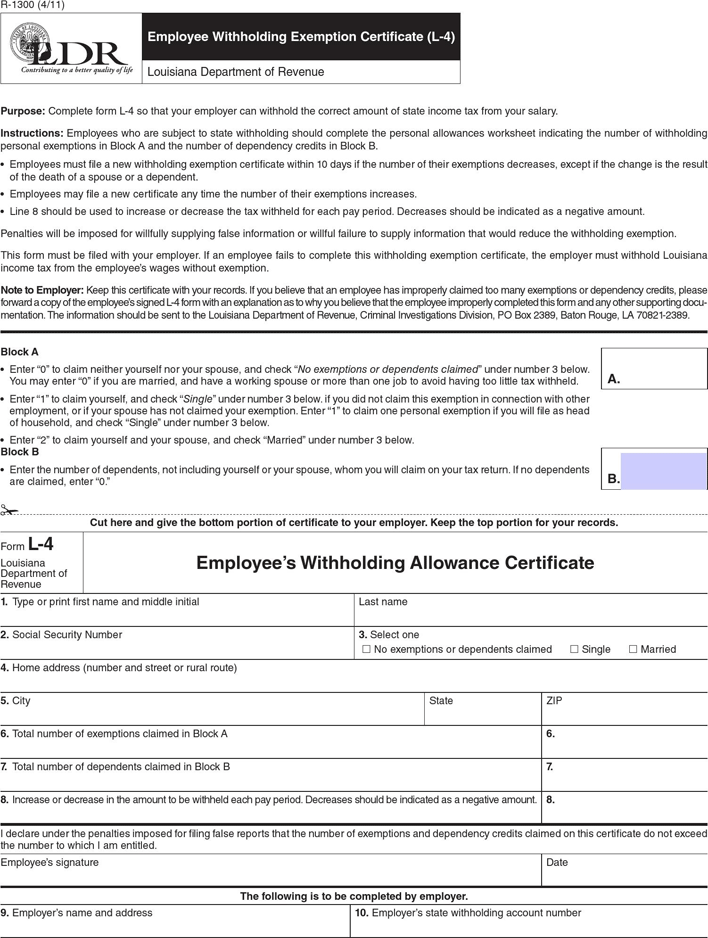

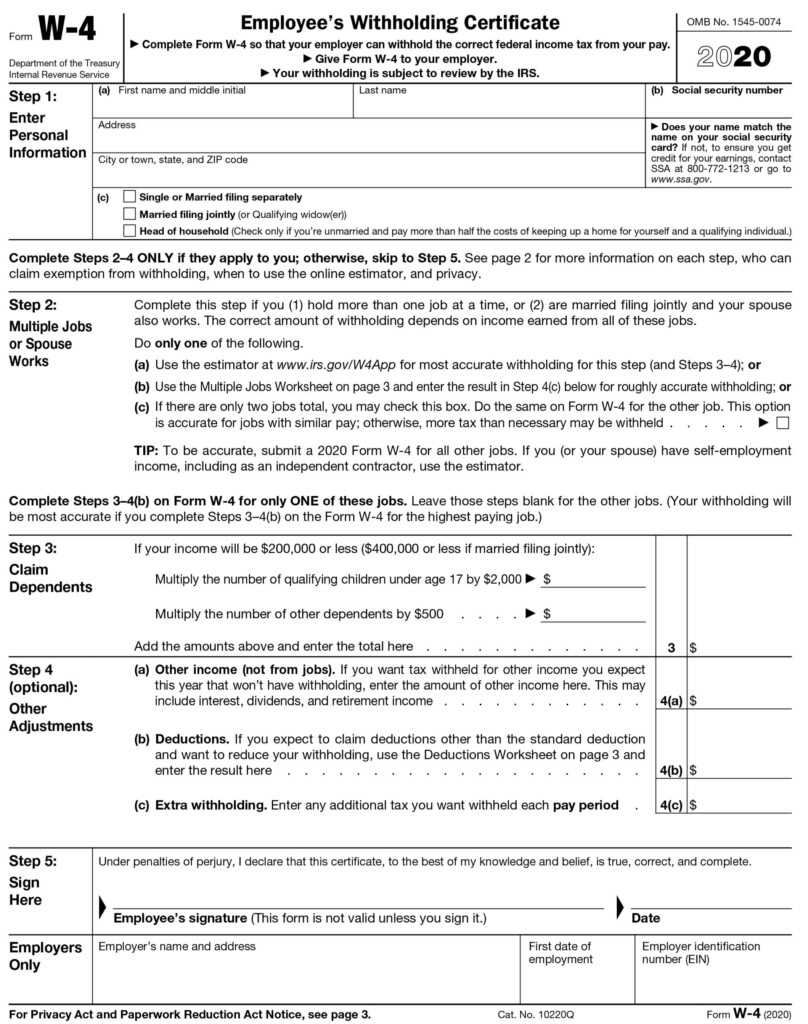

Louisiana State Withholding Form

Louisiana State Withholding Form - Louisiana department of revenue purpose: Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Otherwise he must withhold louisiana income tax from your wages.

Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Louisiana department of revenue purpose: Otherwise he must withhold louisiana income tax from your wages.

Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Louisiana department of revenue purpose: Otherwise he must withhold louisiana income tax from your wages.

Louisiana Employee Withholding Form 2023 Printable Forms Free Online

Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Louisiana department of revenue purpose: Otherwise he must withhold louisiana income tax from your wages.

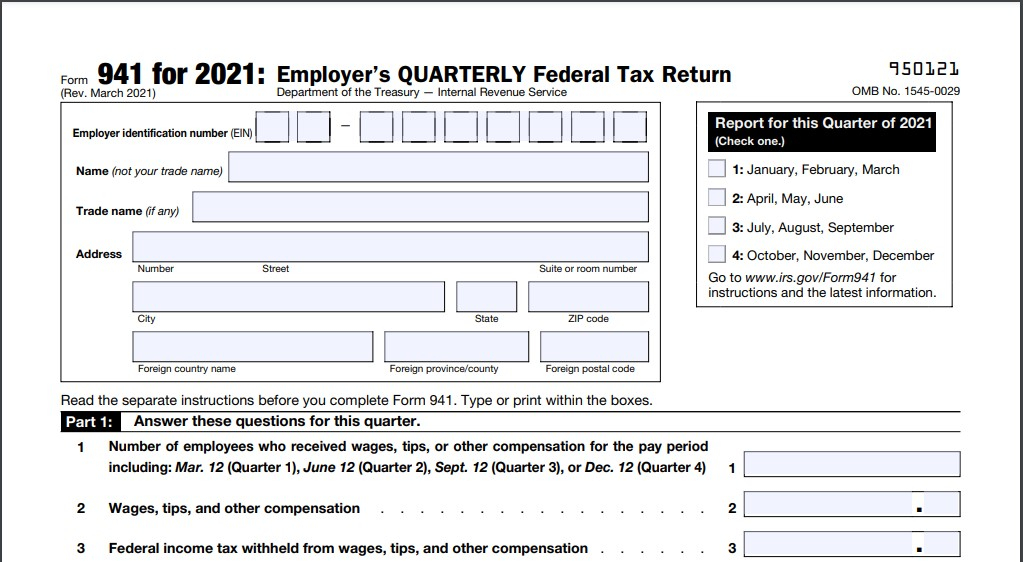

2022 Louisiana Tax Withholding Form

Otherwise he must withhold louisiana income tax from your wages. Louisiana department of revenue purpose: Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana.

State Of Ohio Employee Withholding Form

Louisiana department of revenue purpose: Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Otherwise he must withhold louisiana income tax from your wages.

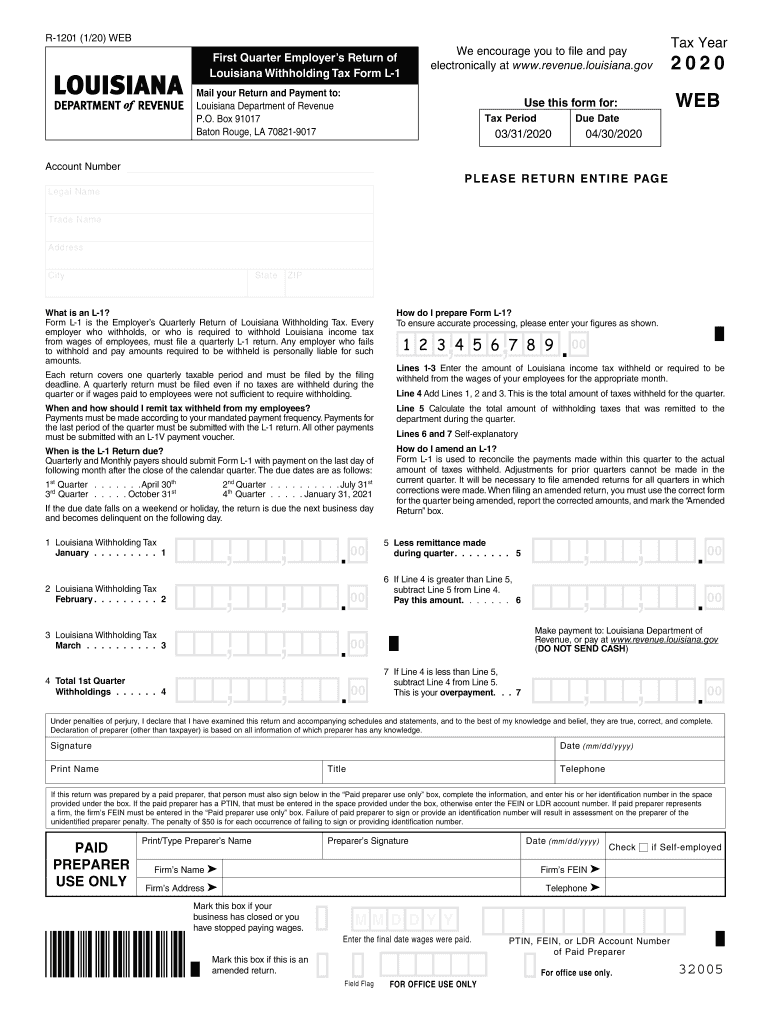

Louisiana L 1 4th Quarter 20202024 Form Fill Out and Sign Printable

Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Otherwise he must withhold louisiana income tax from your wages. Louisiana department of revenue purpose:

Besiktas 2023 Forma Printable Forms Free Online

Louisiana department of revenue purpose: Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Otherwise he must withhold louisiana income tax from your wages.

State Of Alabama Employee Tax Withholding Form 2024

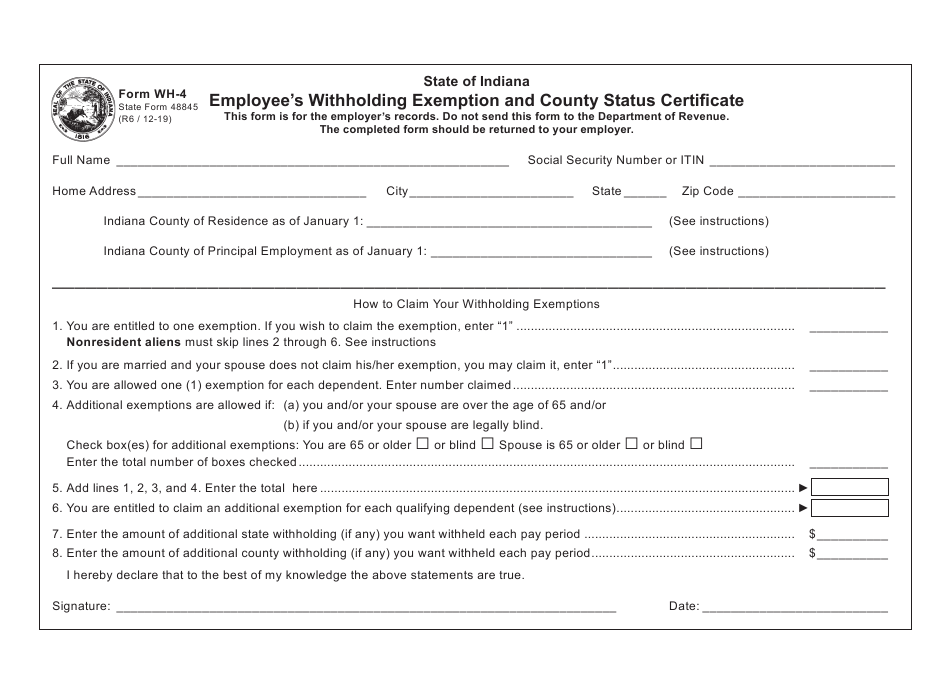

Louisiana department of revenue purpose: Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Otherwise he must withhold louisiana income tax from your wages.

Louisiana State Tax Deadline 2024 Veda Allegra

Louisiana department of revenue purpose: Otherwise he must withhold louisiana income tax from your wages. Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana.

Oregon W4 Number Of Allowances

Otherwise he must withhold louisiana income tax from your wages. Louisiana department of revenue purpose: Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana.

W9 Form Louisiana 9 Easy Rules Of W9 Form Louisiana AH STUDIO Blog

Louisiana department of revenue purpose: Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Otherwise he must withhold louisiana income tax from your wages.

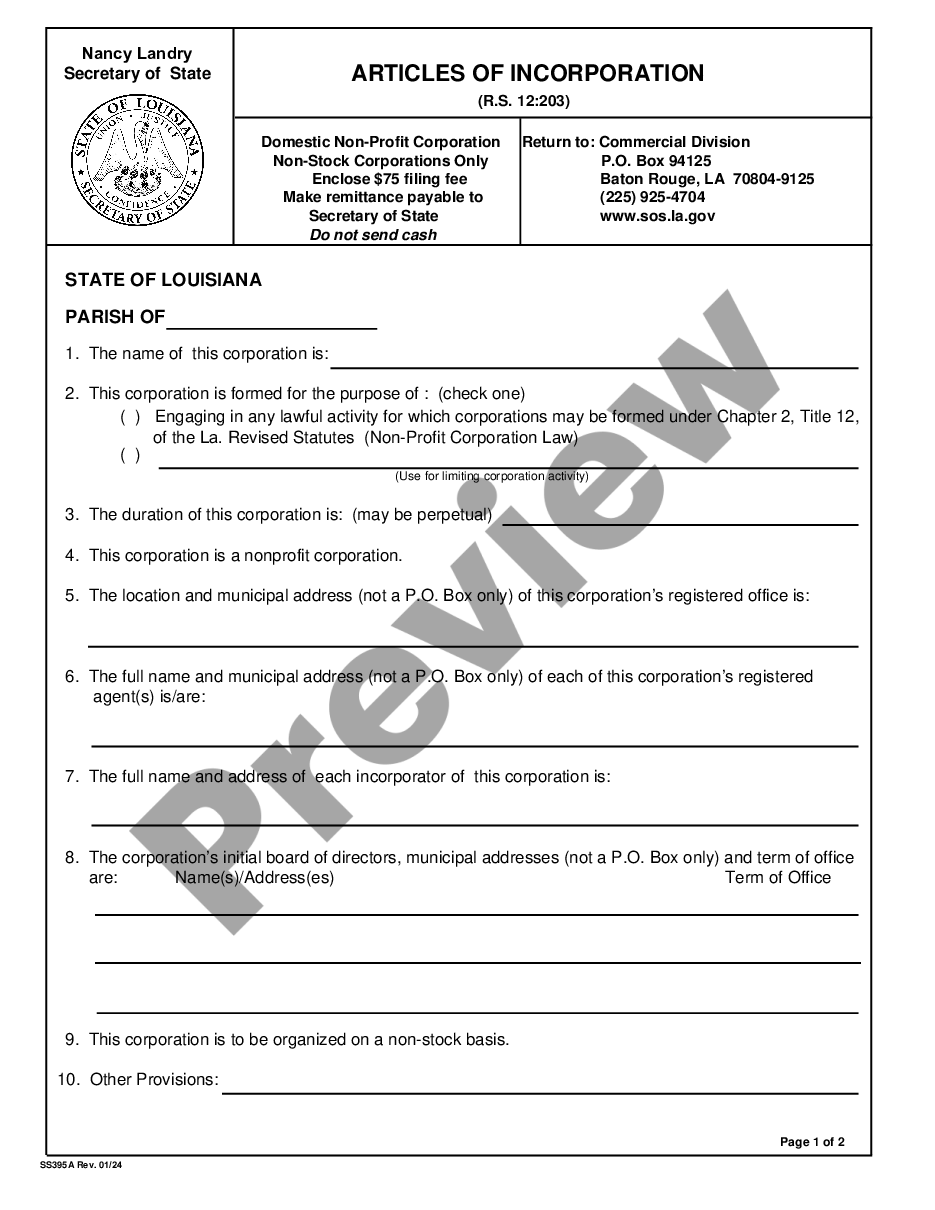

Articles Of Incorporation Louisiana Withholding US Legal Forms

Otherwise he must withhold louisiana income tax from your wages. Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana. Louisiana department of revenue purpose:

Louisiana Department Of Revenue Purpose:

Otherwise he must withhold louisiana income tax from your wages. Every employer who withheld or was required to withhold income tax from wages must file the employer’s quarterly return of louisiana.