Loans From Shareholders On Balance Sheet

Loans From Shareholders On Balance Sheet - These loans to shareholders appear on a company’s balance sheet as a receivable. A financial advisor or cpa should use caution when. Shareholder loans should appear in the liability section of the balance sheet. For loans of more than $10,000, the irs requires taxpayers to treat. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans from shareholders s corp must follow all rules and regulations to be legal. It’s essential that this loan be either positive or zero.

These loans to shareholders appear on a company’s balance sheet as a receivable. For loans of more than $10,000, the irs requires taxpayers to treat. Loans from shareholders s corp must follow all rules and regulations to be legal. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. A financial advisor or cpa should use caution when. Shareholder loans should appear in the liability section of the balance sheet. It’s essential that this loan be either positive or zero.

A financial advisor or cpa should use caution when. Loans from shareholders s corp must follow all rules and regulations to be legal. Shareholder loans should appear in the liability section of the balance sheet. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. These loans to shareholders appear on a company’s balance sheet as a receivable. For loans of more than $10,000, the irs requires taxpayers to treat. It’s essential that this loan be either positive or zero.

amount owing to director in balance sheet Kevin Dyer

For loans of more than $10,000, the irs requires taxpayers to treat. Shareholder loans should appear in the liability section of the balance sheet. Loans from shareholders s corp must follow all rules and regulations to be legal. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. A.

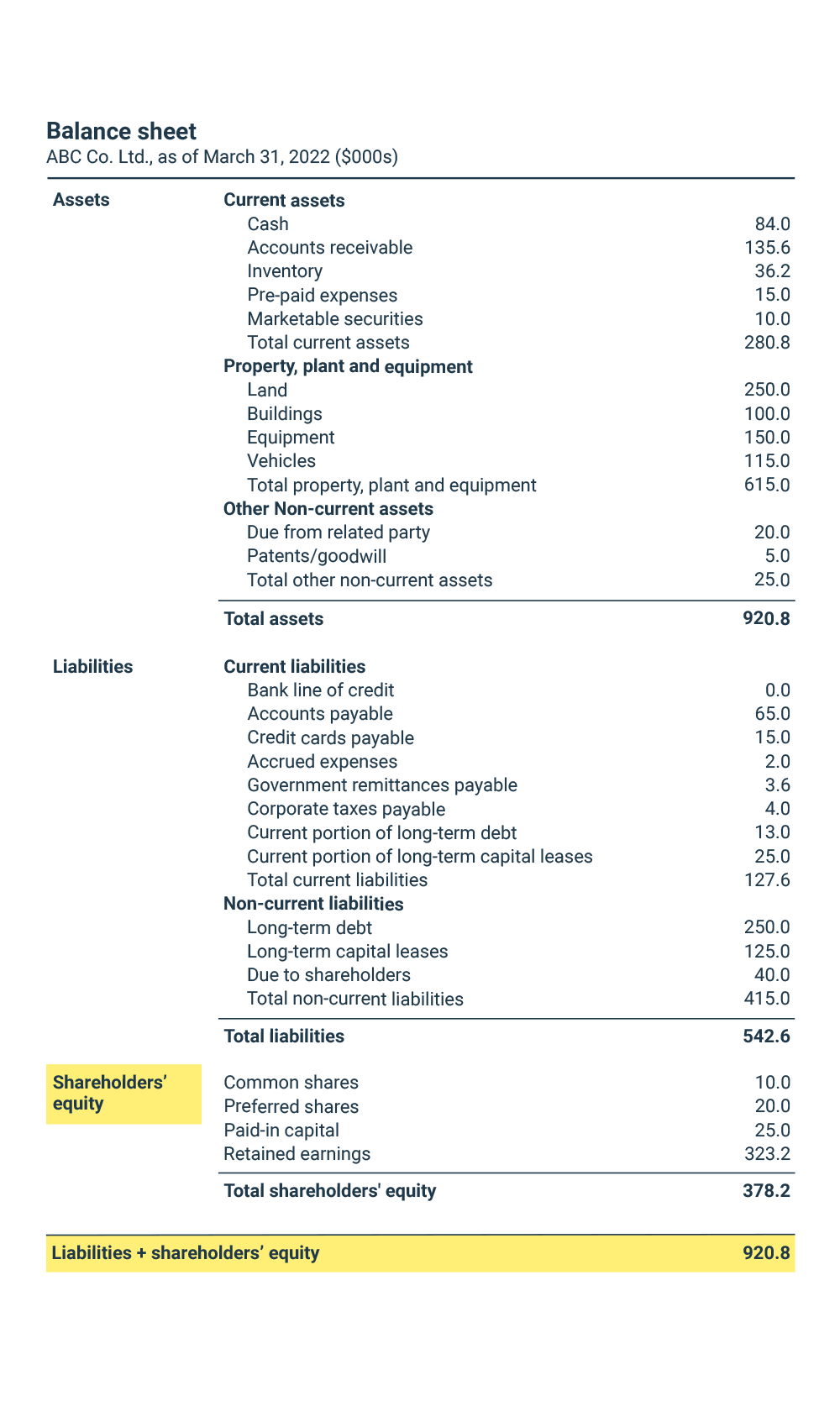

Liabilities Side of Balance Sheet Finance Train

These loans to shareholders appear on a company’s balance sheet as a receivable. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. A financial advisor or cpa should.

What Is a Balance Sheet? Complete Guide Pareto Labs

A financial advisor or cpa should use caution when. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. It’s essential that this loan be either positive or zero. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have..

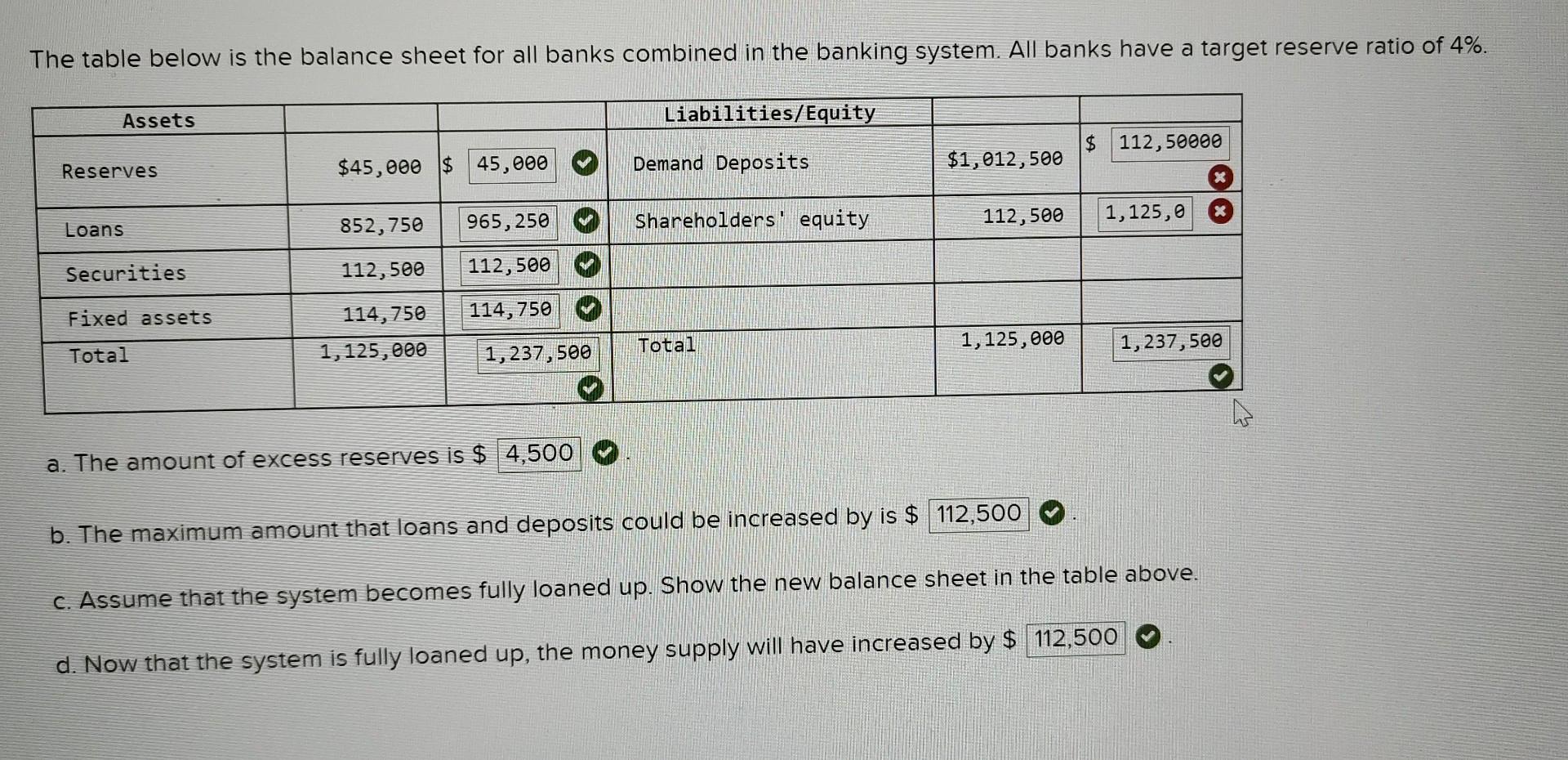

Solved The table below is the balance sheet for all banks

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Shareholder loans should appear in the liability section of the balance sheet. These loans to shareholders appear on a company’s balance sheet as a receivable. Loans to shareholders are not deductible for the corporation and, in fact, the corporation.

Shareholder Loan The Benefits, Risks, and What You Need to Know

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. These loans to shareholders appear on a company’s balance sheet as a receivable. Shareholder loans should appear in the liability section of the balance sheet. A financial advisor or cpa should use caution when. Loans to shareholders are not.

How To Show A Loan On A Balance Sheet Info Loans

Shareholder loans should appear in the liability section of the balance sheet. Loans from shareholders s corp must follow all rules and regulations to be legal. It’s essential that this loan be either positive or zero. A financial advisor or cpa should use caution when. In general, the balance of your shareholder loan represents the total owner cash draws from.

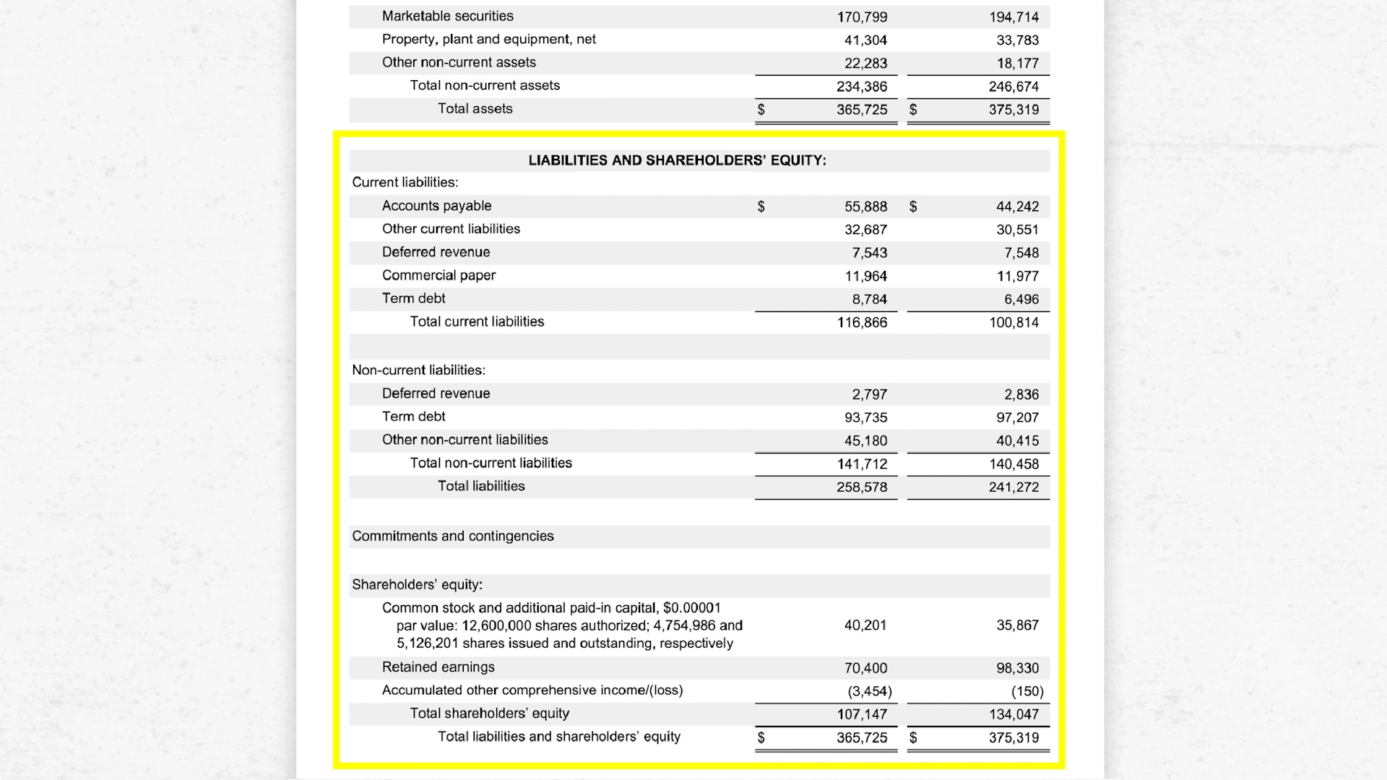

Shareholder Loan Understand it and Avoid Trouble with the CRA Blog

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. These loans to shareholders appear on a company’s balance sheet as a receivable. It’s essential that this loan be either positive or zero. For loans of more than $10,000, the irs requires taxpayers to treat. Shareholder loans should appear.

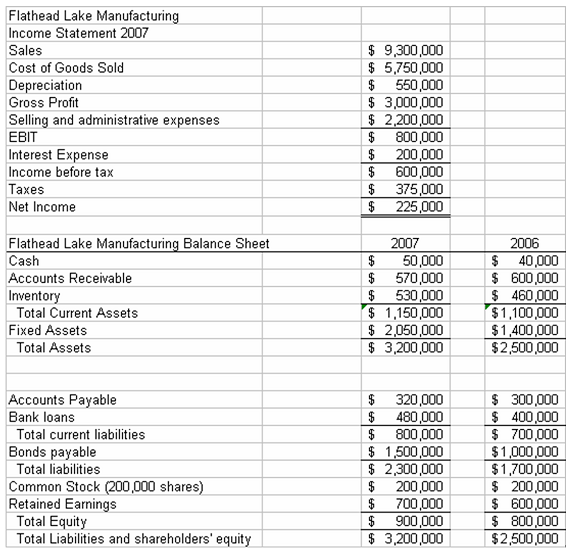

Solved For The Balance Sheet, Treat Bank Loans As Short T...

For loans of more than $10,000, the irs requires taxpayers to treat. These loans to shareholders appear on a company’s balance sheet as a receivable. It’s essential that this loan be either positive or zero. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. Shareholder loans should appear in.

Shareholder Loan Understand it and Avoid Trouble with the CRA JPDO

It’s essential that this loan be either positive or zero. Shareholder loans should appear in the liability section of the balance sheet. A financial advisor or cpa should use caution when. Loans from shareholders s corp must follow all rules and regulations to be legal. In general, the balance of your shareholder loan represents the total owner cash draws from.

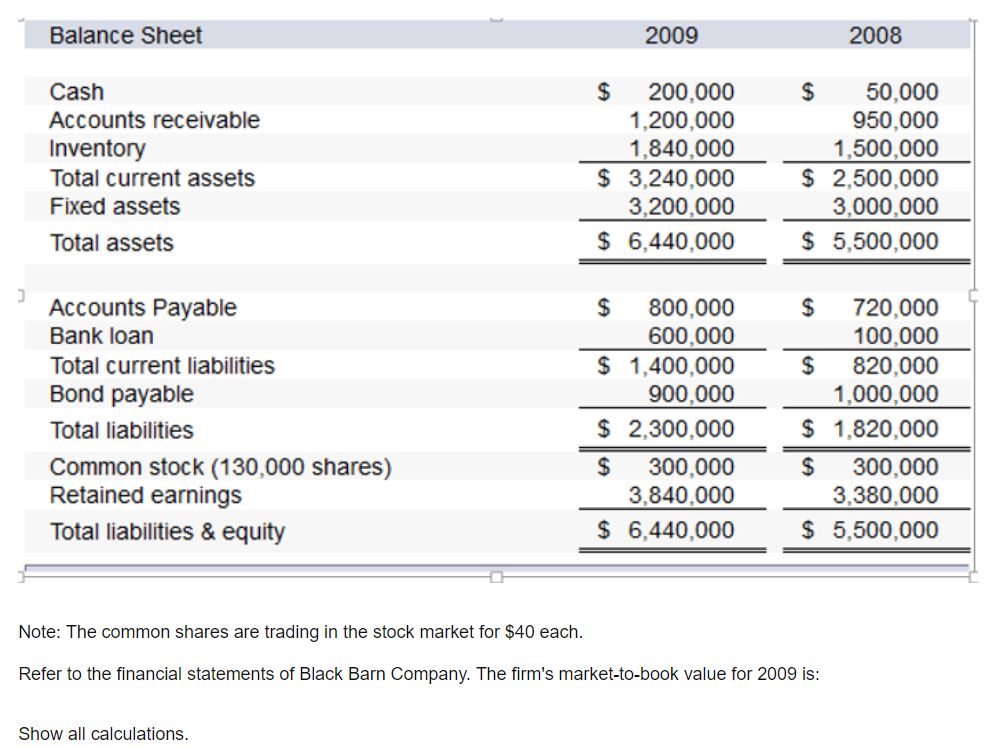

Financial Analysis Balance Sheet Seeking Wisdom

Loans from shareholders s corp must follow all rules and regulations to be legal. For loans of more than $10,000, the irs requires taxpayers to treat. A financial advisor or cpa should use caution when. These loans to shareholders appear on a company’s balance sheet as a receivable. Shareholder loans should appear in the liability section of the balance sheet.

These Loans To Shareholders Appear On A Company’s Balance Sheet As A Receivable.

For loans of more than $10,000, the irs requires taxpayers to treat. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans from shareholders s corp must follow all rules and regulations to be legal. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.

A Financial Advisor Or Cpa Should Use Caution When.

Shareholder loans should appear in the liability section of the balance sheet. It’s essential that this loan be either positive or zero.