Kiddie Tax Form 8814

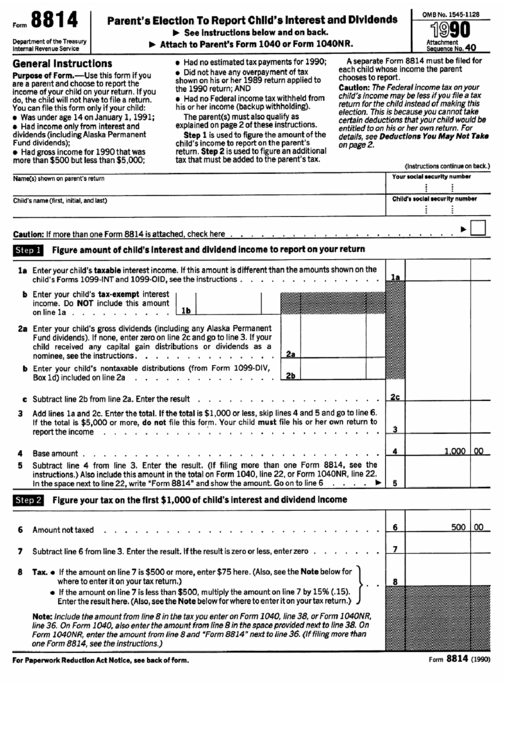

Kiddie Tax Form 8814 - What is irs form 8814? Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things:

The form will help you. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: What is irs form 8814? Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax.

What is irs form 8814? The form will help you. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use.

Kiddie Tax How It Works, Examples, and TaxSaving Strategies SuperMoney

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If your child receives passive income from investments,.

Form 8814 A Parent's Guide to Navigating the Kiddie Tax in 2024 XOA

The form will help you. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify.

IRS Form 8814 ≡ Fill Out Printable PDF Forms Online

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. The form will help you. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. What is irs form 8814? Information about form 8814, parent's election to report child's interest and dividends,.

Does the Kiddie Tax Affect Your Family? Roger Rossmeisl, CPA

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. The form will help you. If your child receives passive income from investments, like dividends or interest, the irs has a way.

Kiddie Tax Explained A Comprehensive Guide for Parents IncSight

If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: The form will help you. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate.

What is the Kiddie Tax?

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. The form will help you. What is irs form 8814? If your child receives passive income from investments, like dividends or interest, the irs has a.

IRS Form 8814 Instructions Your Child's Interest & Dividends

The form will help you. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If.

Understanding Kiddie Tax Wendy Barlin

If your child receives passive income from investments, like dividends or interest, the irs has a way to simplify things: If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may.

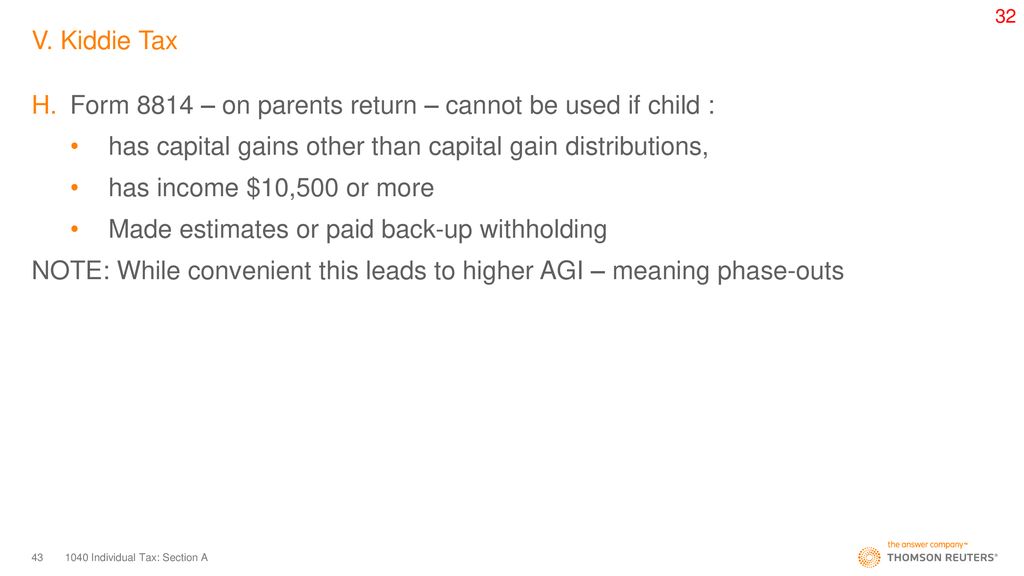

1040 Individual Tax Section A ppt download

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use. If the child doesn't qualify for.

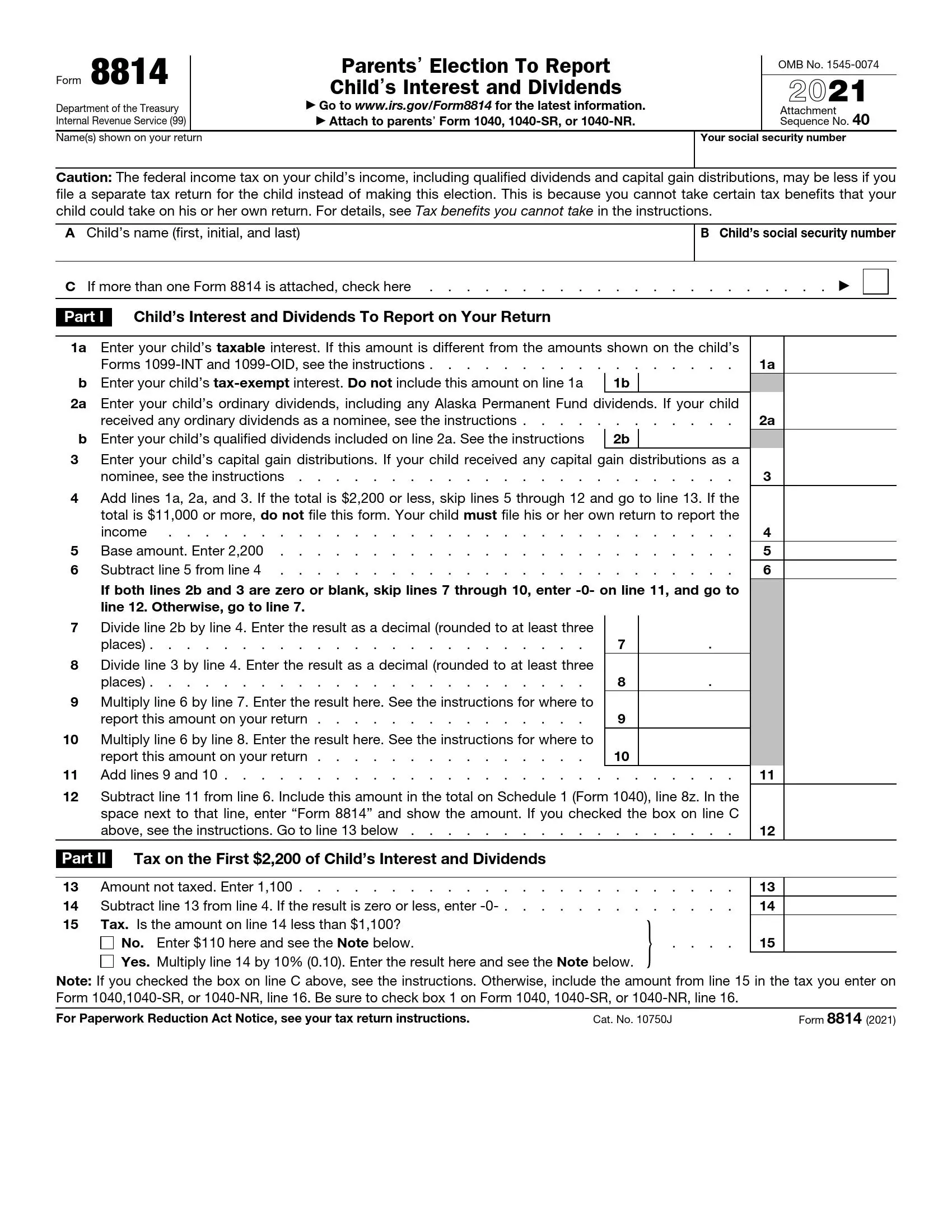

Form 8814 Parents' Election To Report Child'S Interest And Dividends

What is irs form 8814? Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax. The form will help you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If your child receives passive income from investments, like dividends or interest,.

Irs Form 8814, Parents’ Election To Report Child’s Interest And Dividends, Is The Tax Form Parents May Use.

The form will help you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. What is irs form 8814?

If Your Child Receives Passive Income From Investments, Like Dividends Or Interest, The Irs Has A Way To Simplify Things:

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax.