Irs Form 3531 Missing Signature

Irs Form 3531 Missing Signature - If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. You have to mail the form with the ink signature directly to the irs. I filed electronically for 2019 and no. Note that form 3531 says a photocopied signature is not a. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). My wife received the 3531 form saying that no signature in the original 1040 form. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. Together with the 3531 form, all the original. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing.

The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Note that form 3531 says a photocopied signature is not a. Together with the 3531 form, all the original. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. You have to mail the form with the ink signature directly to the irs. My wife received the 3531 form saying that no signature in the original 1040 form. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. I filed electronically for 2019 and no.

Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. I filed electronically for 2019 and no. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. My wife received the 3531 form saying that no signature in the original 1040 form. You have to mail the form with the ink signature directly to the irs. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. Together with the 3531 form, all the original. Note that form 3531 says a photocopied signature is not a.

3.11.3 Individual Tax Returns Internal Revenue Service

The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. I filed electronically for 2019 and no. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. Together with.

Fillable Online Solved I received form 3531 from the IRS. ( top right

I filed electronically for 2019 and no. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. You have to mail the form with the ink signature.

Irs Revenue Ruling 202414 Phaedra

Note that form 3531 says a photocopied signature is not a. You have to mail the form with the ink signature directly to the irs. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. It sounds like your signature is missing or improperly.

Printable Irs Form 3531 Printable Forms Free Online

I filed electronically for 2019 and no. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. Together with the 3531 form, all the original. If the required valid legal signature is missing or not below the jurat statement, send the return back to the.

Missing signature? r/FAFSA

My wife received the 3531 form saying that no signature in the original 1040 form. You have to mail the form with the ink signature directly to the irs. Note that form 3531 says a photocopied signature is not a. If the required valid legal signature is missing or not below the jurat statement, send the return back to the.

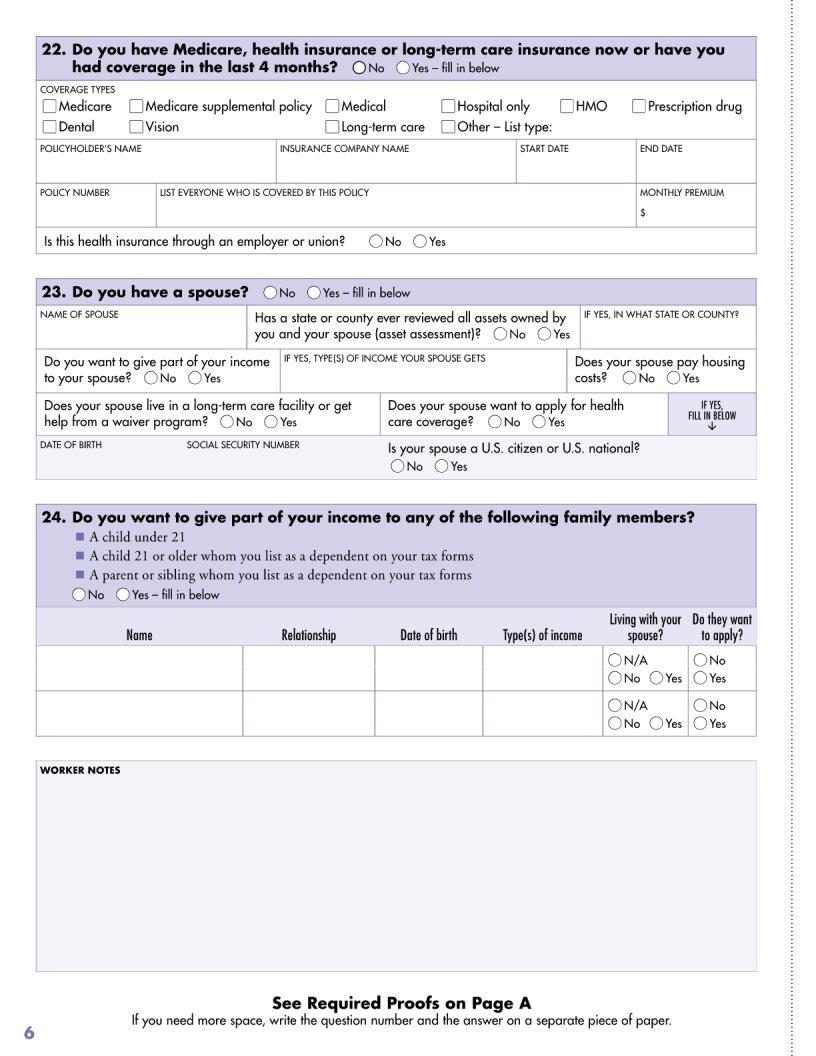

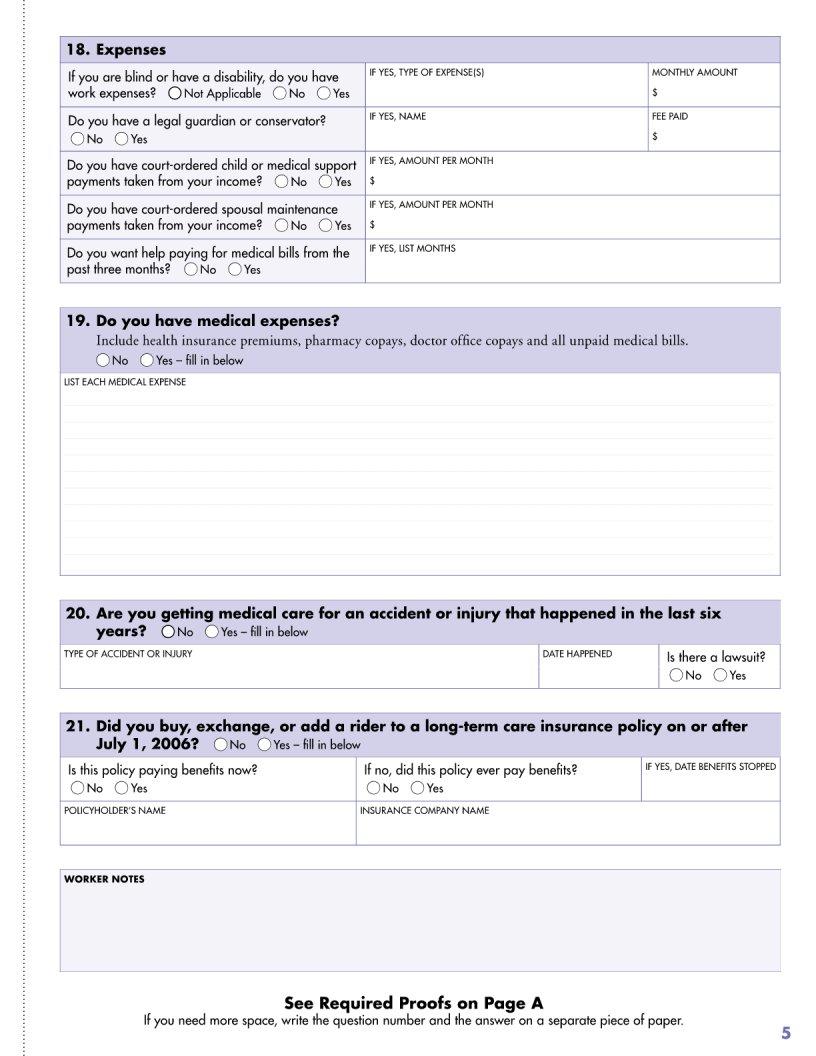

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

My wife received the 3531 form saying that no signature in the original 1040 form. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Note that form 3531 says a photocopied signature is not a. I filed electronically for 2019 and no. Together with the 3531 form, all the.

Printable Irs Form 3531 Printable Forms Free Online

My wife received the 3531 form saying that no signature in the original 1040 form. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box.

Irs Form 3531 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. Note that form 3531 says a photocopied signature is not a. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Form 3531, page 2this represents page 2.

Printable Irs Form 3531 Printable Forms Free Online

My wife received the 3531 form saying that no signature in the original 1040 form. I filed electronically for 2019 and no. Note that form 3531 says a photocopied signature is not a. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. It sounds like.

IRS Audit Letter 3531 Sample 1

You have to mail the form with the ink signature directly to the irs. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. I filed.

Note That Form 3531 Says A Photocopied Signature Is Not A.

Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. My wife received the 3531 form saying that no signature in the original 1040 form. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Together with the 3531 form, all the original.

It Sounds Like Your Signature Is Missing Or Improperly Signed (Box 1) But That Your Return Is Missing (Box 7).

You have to mail the form with the ink signature directly to the irs. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. I filed electronically for 2019 and no.