Irs Form 2290 Due Date

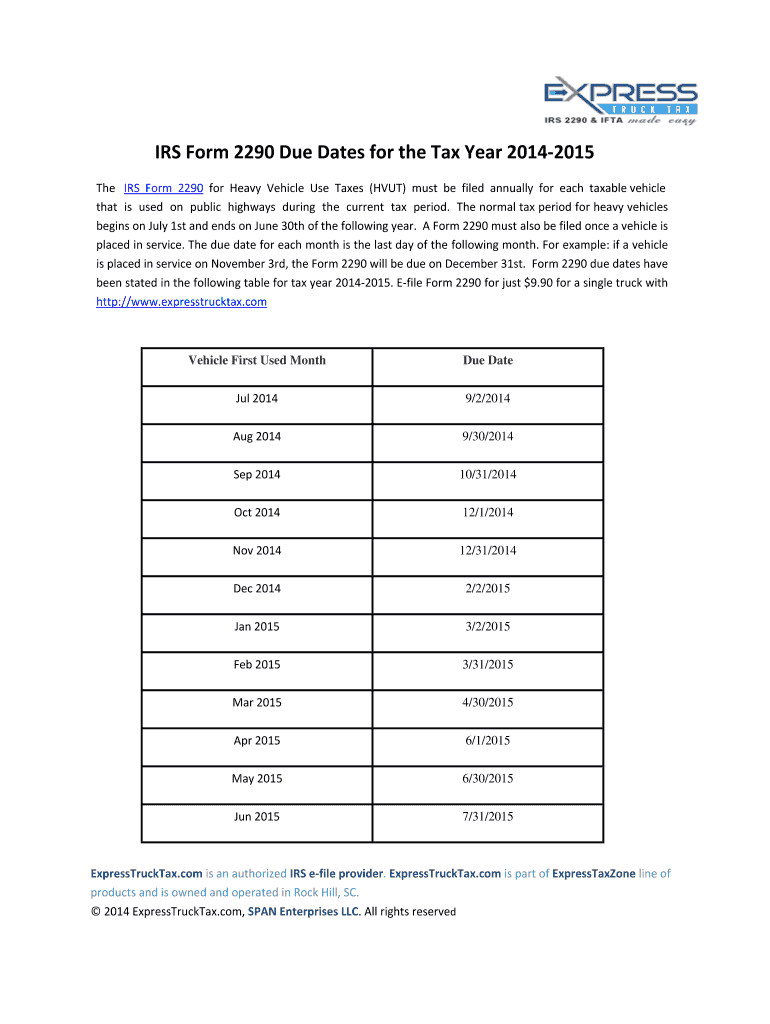

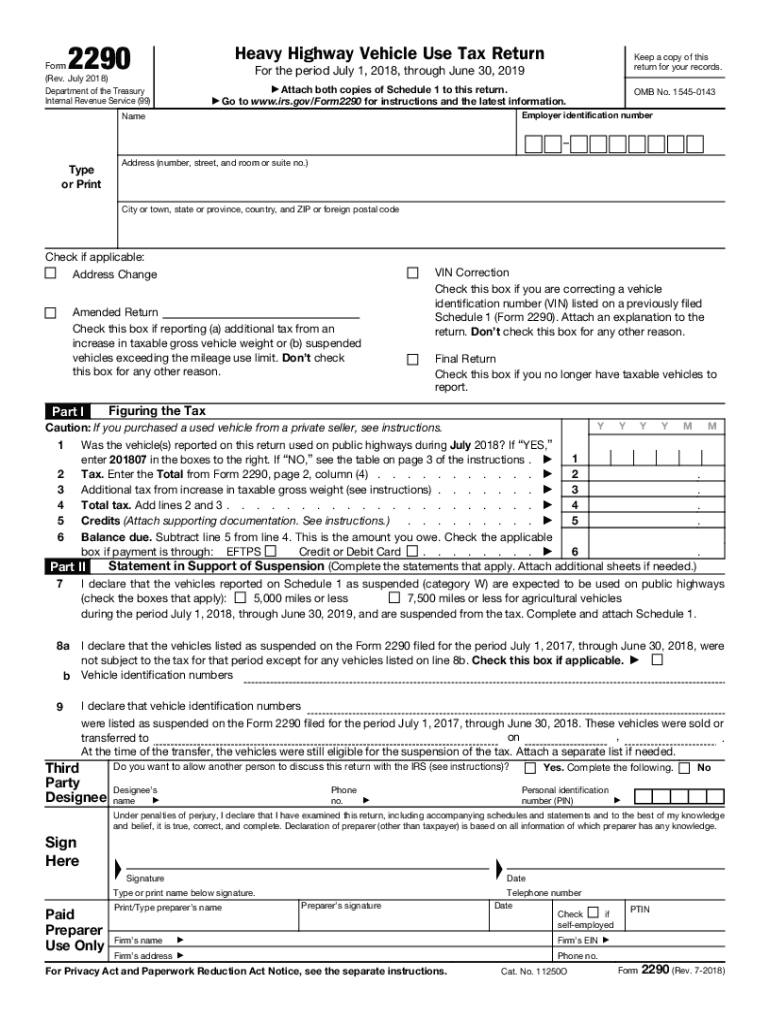

Irs Form 2290 Due Date - If the due date falls on a saturday, sunday, or legal holiday, file by the next. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest. The buyer should enter the month after the sale on form 2290, line 1 (example: If you have vehicles with a combined gross weight of 55,000 pounds or. November 2024 is entered as “202411”). The due date of form 2290 doesn’t change. Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. Use the table below to determine your filing deadline. What is the irs form 2290 due date? You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways.

You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. If you have vehicles with a combined gross weight of 55,000 pounds or. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest. The due date of form 2290 doesn’t change. Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. November 2024 is entered as “202411”). In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. What is the irs form 2290 due date? The buyer should enter the month after the sale on form 2290, line 1 (example: If the due date falls on a saturday, sunday, or legal holiday, file by the next.

Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. The due date of form 2290 doesn’t change. What is the irs form 2290 due date? In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. If the due date falls on a saturday, sunday, or legal holiday, file by the next. The buyer should enter the month after the sale on form 2290, line 1 (example: Use the table below to determine your filing deadline. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest. November 2024 is entered as “202411”). If you have vehicles with a combined gross weight of 55,000 pounds or.

IRS 2290 Due Dates 2014 Fill and Sign Printable Template Online US

November 2024 is entered as “202411”). What is the irs form 2290 due date? Use the table below to determine your filing deadline. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest.

IRS Form 2290 due date for the year 202223 by trucktax online Issuu

Use the table below to determine your filing deadline. The due date of form 2290 doesn’t change. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. What is the irs form 2290 due date? The buyer should enter the month after the sale.

Form 2290 Due Date Heavy Vehicle Use Tax (HVUT) Deadline IRS

You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. November 2024 is entered as “202411”). Use the table below to determine your filing deadline. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties.

Irs Form 2290 Due Date Form Resume Examples

What is the irs form 2290 due date? If you have vehicles with a combined gross weight of 55,000 pounds or. November 2024 is entered as “202411”). If the due date falls on a saturday, sunday, or legal holiday, file by the next. Note that as with all irs tax returns, if the due date happens to fall on a.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

The due date of form 2290 doesn’t change. The buyer should enter the month after the sale on form 2290, line 1 (example: You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. File form 2290 and submit your 2290 payment for your heavy.

Irs Form 2290 Due Date 2017 Form Resume Examples AjYdnDb2l0

The buyer should enter the month after the sale on form 2290, line 1 (example: You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. What is the irs form 2290 due date? The due date of form 2290 doesn’t change. If the due.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest. What is the irs form 2290 due date? If you have vehicles with a combined gross weight of 55,000 pounds or. You must file form 2290 for these trucks by the last day of the month following the month.

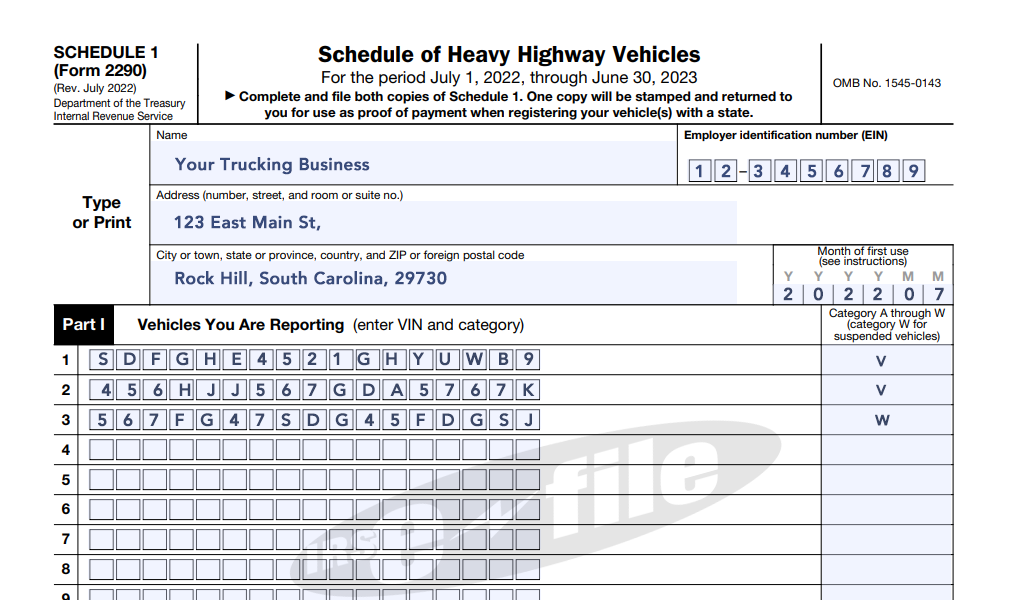

Get Form 2290 Schedule 1 in Minutes Efile Form 2290 Online

Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. The buyer should enter the month after the sale on form 2290, line 1 (example: What is the irs form 2290 due date? In this case, the answer to the question, ‘when is the 2290 due’ is august 31st..

File IRS 2290 Form Online for 20232024 Tax Period

In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. If you have vehicles with a combined gross weight of 55,000 pounds or. File form 2290 and submit your 2290 payment for your.

Irs Gov 2290 20182024 Form Fill Out and Sign Printable PDF Template

If the due date falls on a saturday, sunday, or legal holiday, file by the next. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. The buyer.

The Due Date Of Form 2290 Doesn’t Change.

If the due date falls on a saturday, sunday, or legal holiday, file by the next. Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. If you have vehicles with a combined gross weight of 55,000 pounds or. Use the table below to determine your filing deadline.

The Buyer Should Enter The Month After The Sale On Form 2290, Line 1 (Example:

In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. What is the irs form 2290 due date? November 2024 is entered as “202411”). File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest.