Income Tax Payable On Balance Sheet

Income Tax Payable On Balance Sheet - This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. See how income tax payable. However, there is a difference.

See how income tax payable. However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet.

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities.

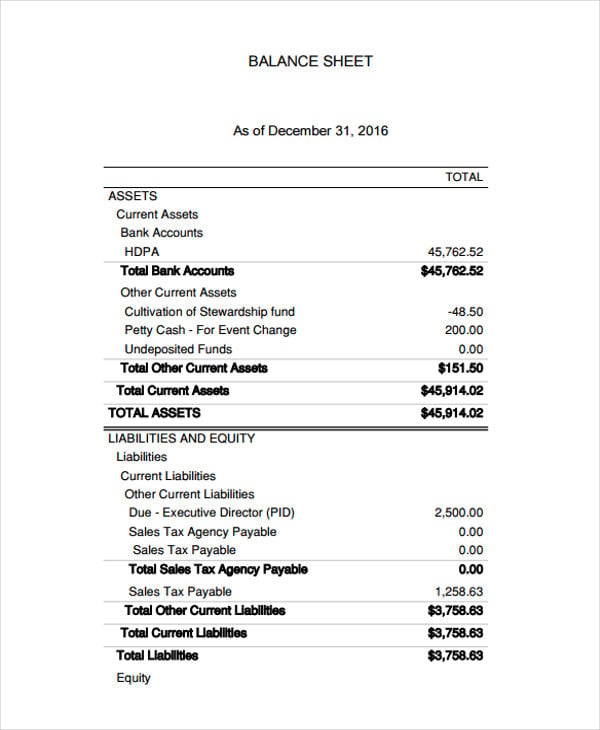

Tutorial Download Balance Sheet For Free Printable PDF DOC

See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability.

Tutorial Download Balance Sheet For Free Printable PDF DOC

See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets.

BALANCE SHEET Central Africa Tax Guide

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet..

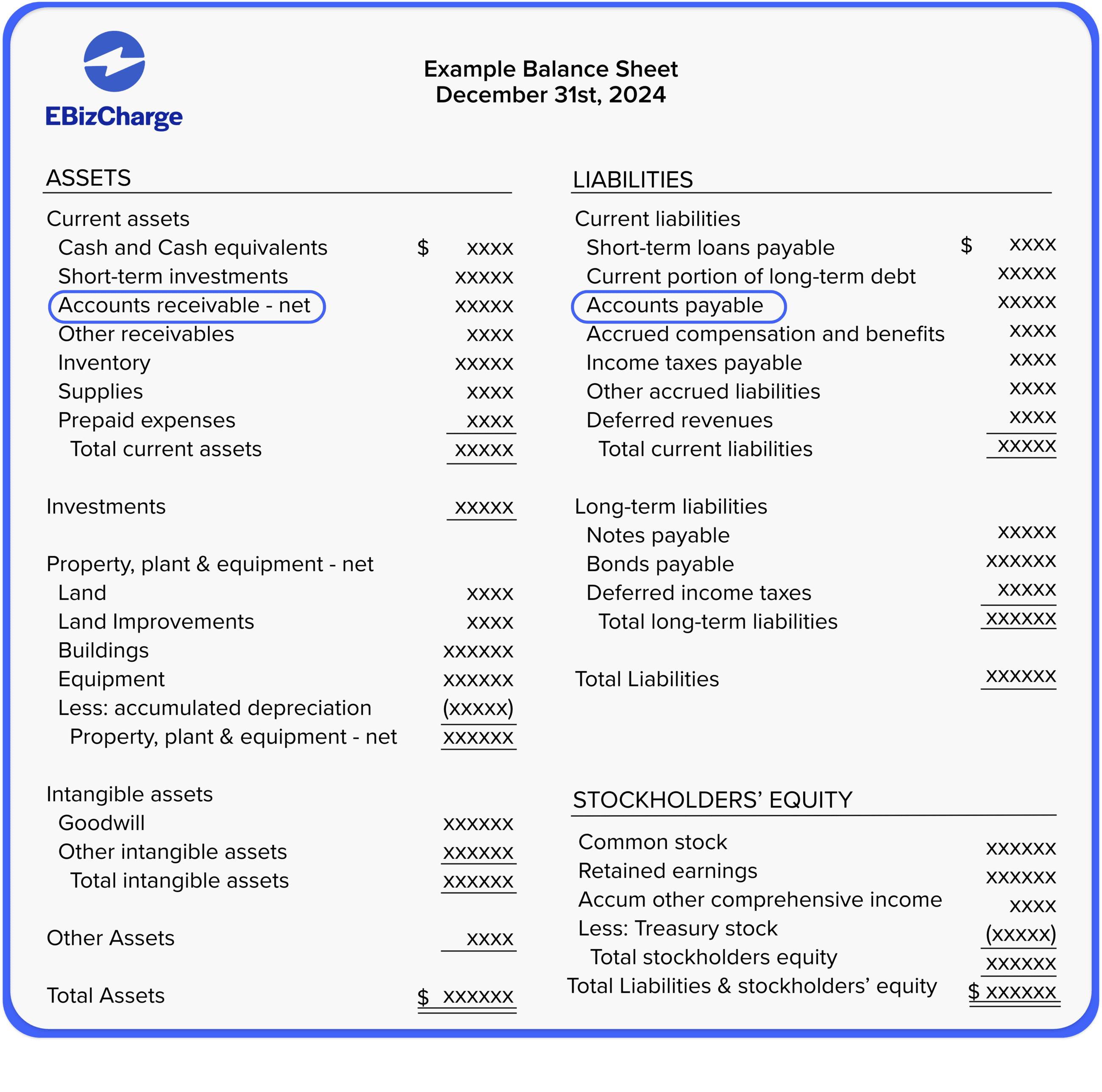

How Do Accounts Payable Show on the Balance Sheet?

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets.

A Guide to Balance Sheets and Statements

However, there is a difference. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability.

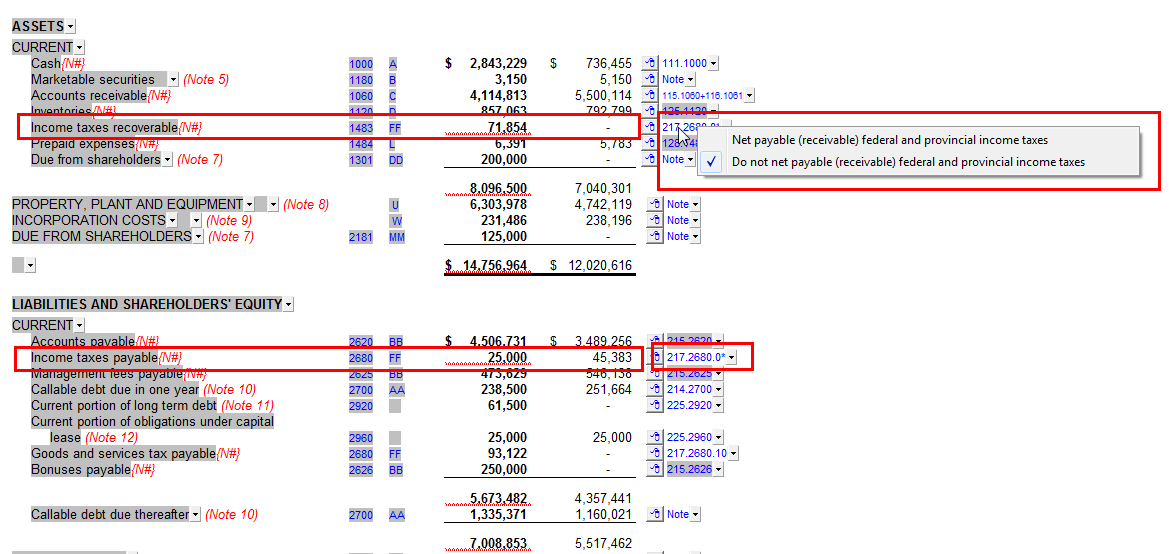

Option to net balances recoverable/payable on the balance sheet?

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability.

Tax Basis Balance Sheet Example

However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. See how income tax payable. Income taxes payable and deferred tax liabilities are both recorded on the liability.

Taxes Payable on Balance Sheet Owing Taxes — 1099 Cafe

However, there is a difference. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities..

What are Accounts Receivable and Accounts Payable?

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. However, there is a difference. See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is.

What is taxes payable BDC.ca

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. However, there is a difference. See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is.

Income Taxes Payable And Deferred Tax Liabilities Are Both Recorded On The Liability Side Of The Balance Sheet.

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities.