Good Will Donation Form

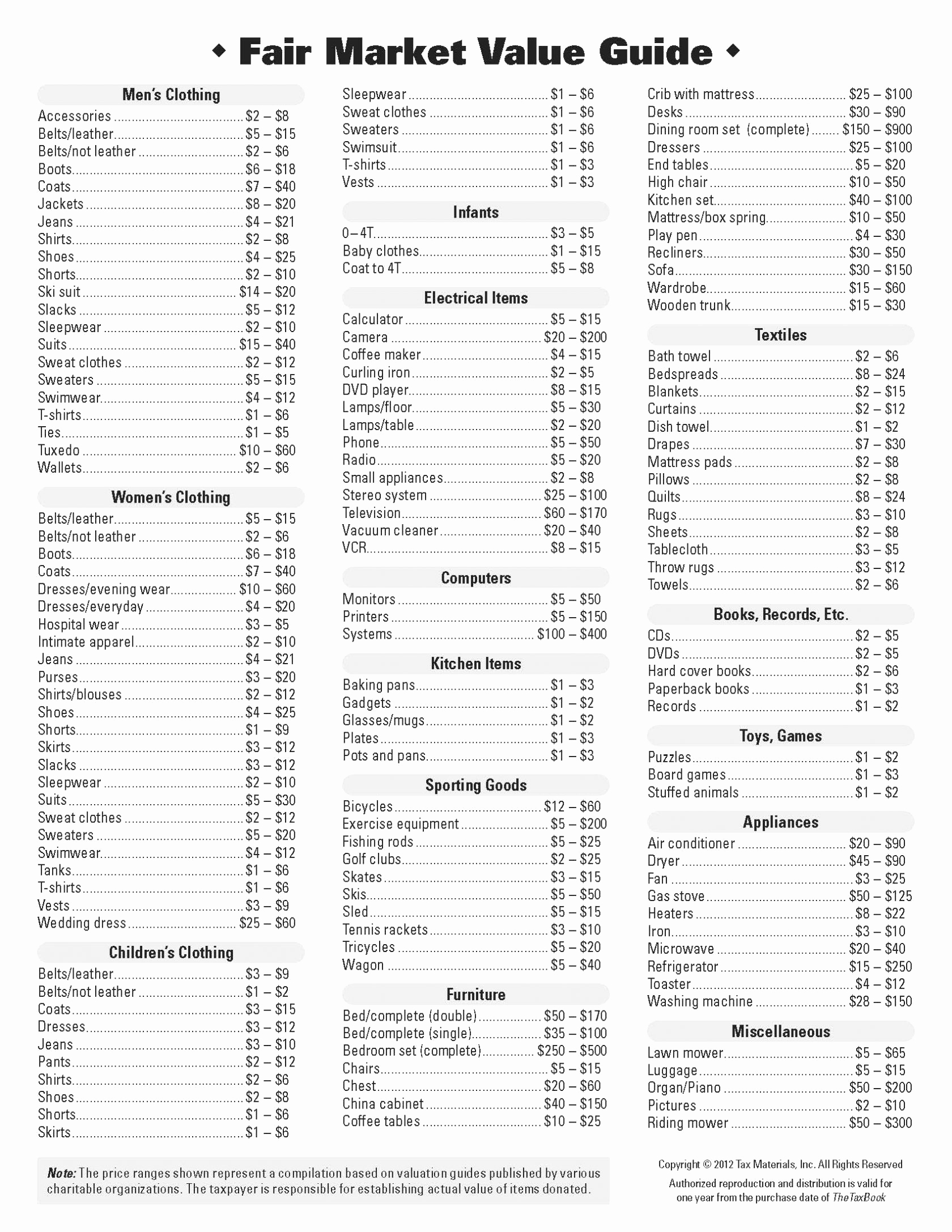

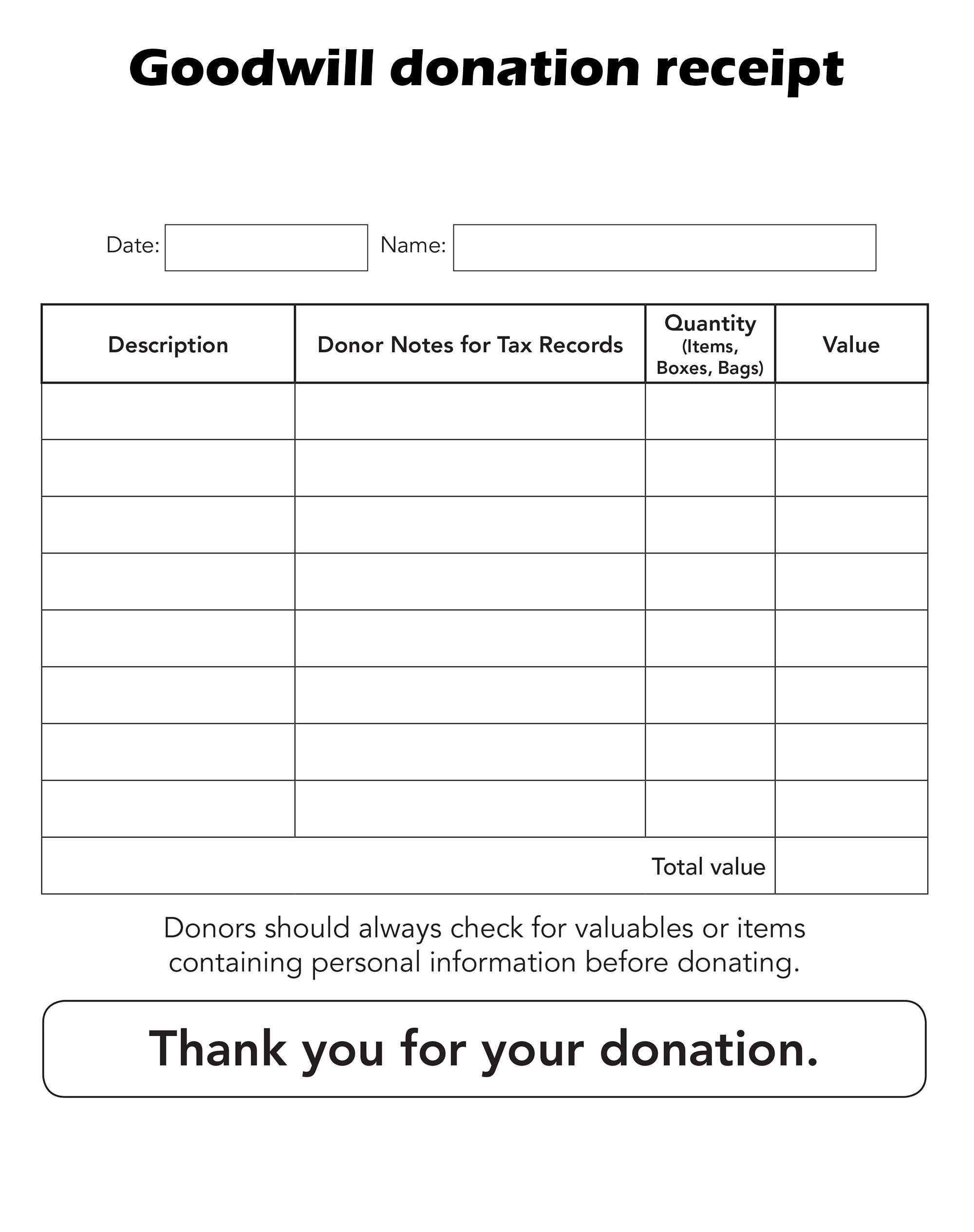

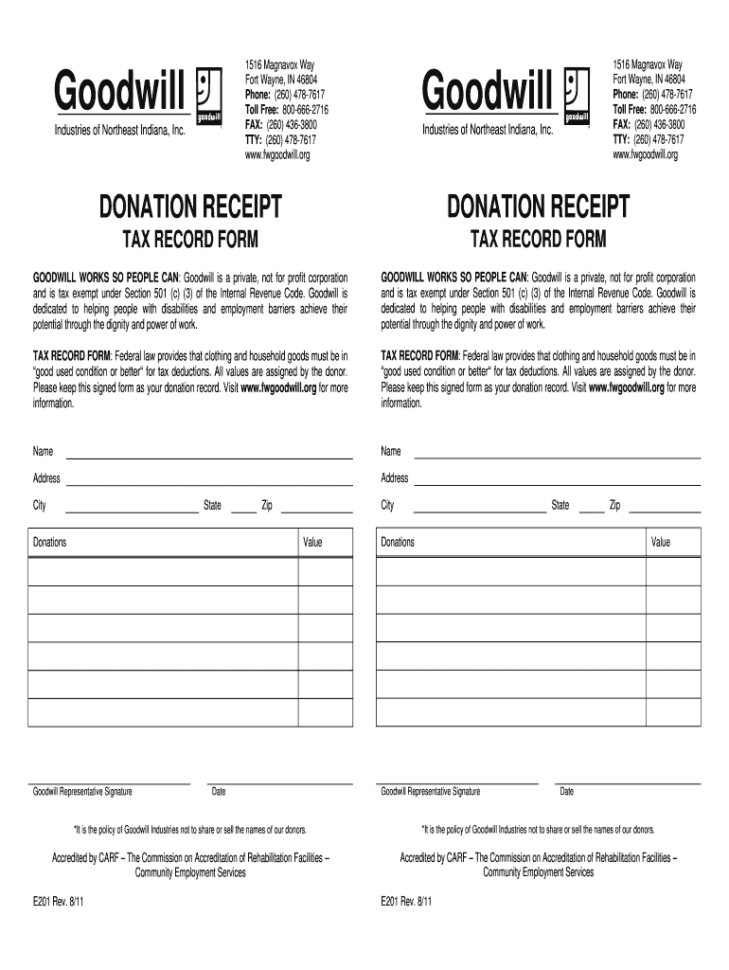

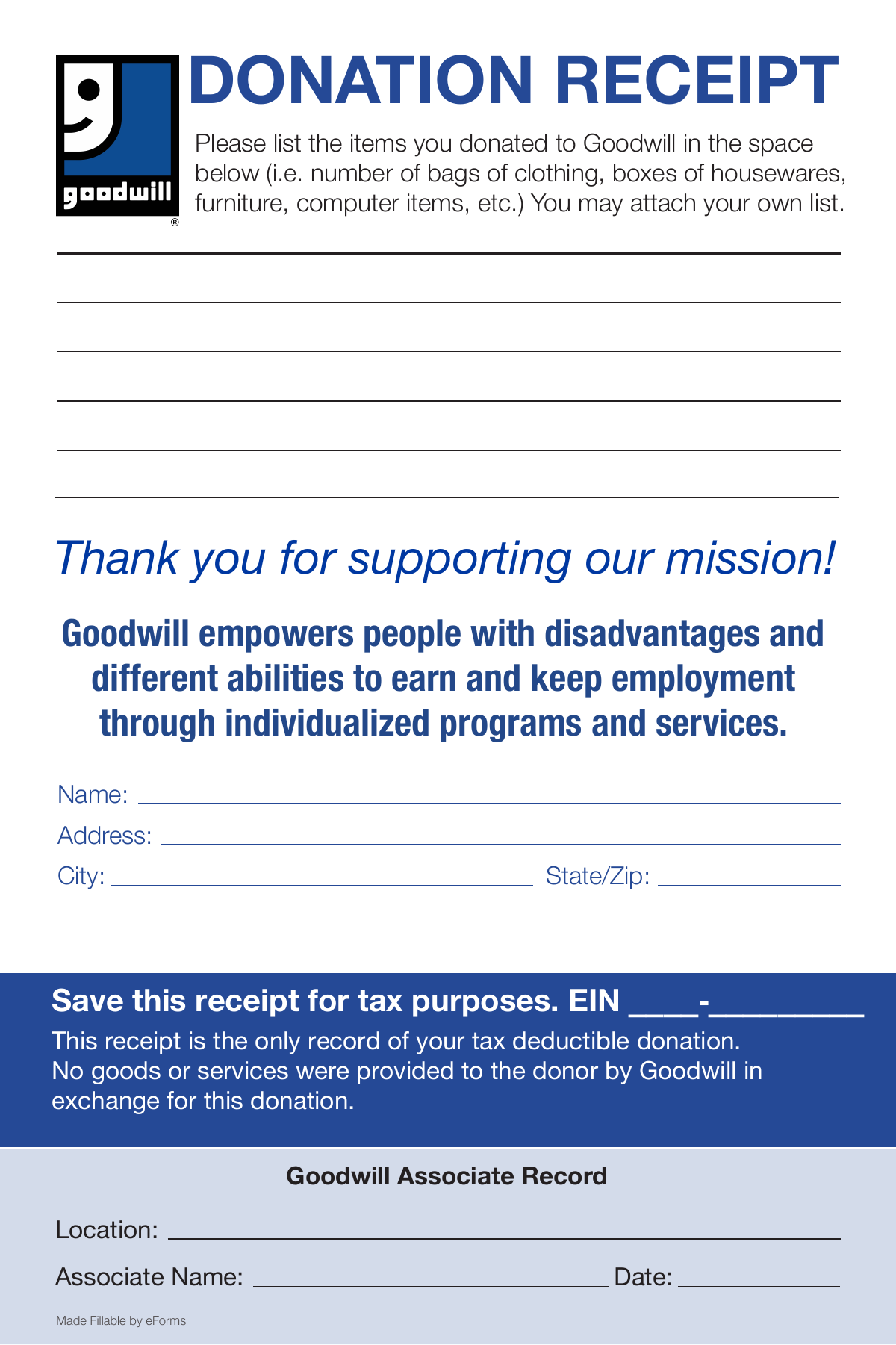

Good Will Donation Form - Use this receipt when filing your taxes. To meet everyone's needs, our template is. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. A donor is responsible for valuing the donated items, and it's. Please consult your personal tax advisor regarding the tax deductibility of your. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze.

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. To meet everyone's needs, our template is. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. Use this receipt when filing your taxes. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. Please consult your personal tax advisor regarding the tax deductibility of your. A donor is responsible for valuing the donated items, and it's. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor.

To meet everyone's needs, our template is. Please consult your personal tax advisor regarding the tax deductibility of your. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. A donor is responsible for valuing the donated items, and it's. Use this receipt when filing your taxes. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Use this receipt when filing your taxes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor.

Goodwill Donation Excel Spreadsheet Google Spreadshee goodwill donation

Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. To meet everyone's needs, our template is. Please consult your personal tax advisor regarding the tax deductibility of your. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. We've designed our goodwill donation form template.

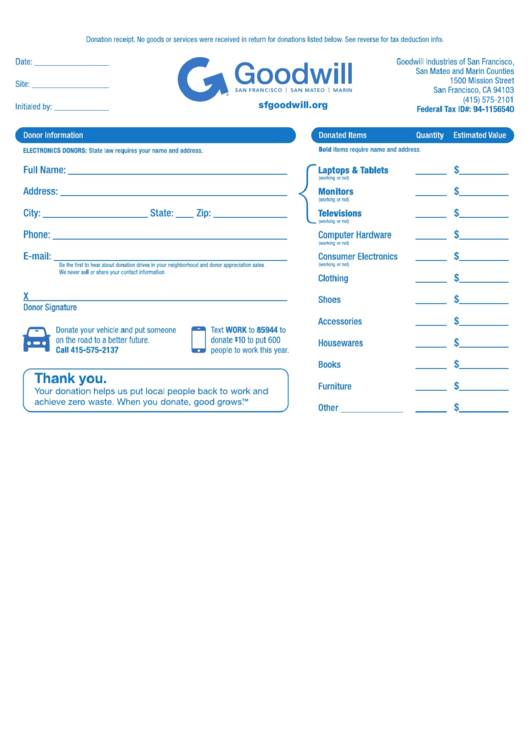

Professional Goodwill Tax Receipt Form Word Sample Receipt template

Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. Use this receipt when filing your taxes. Please consult your personal tax advisor regarding the tax deductibility of your. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Use this.

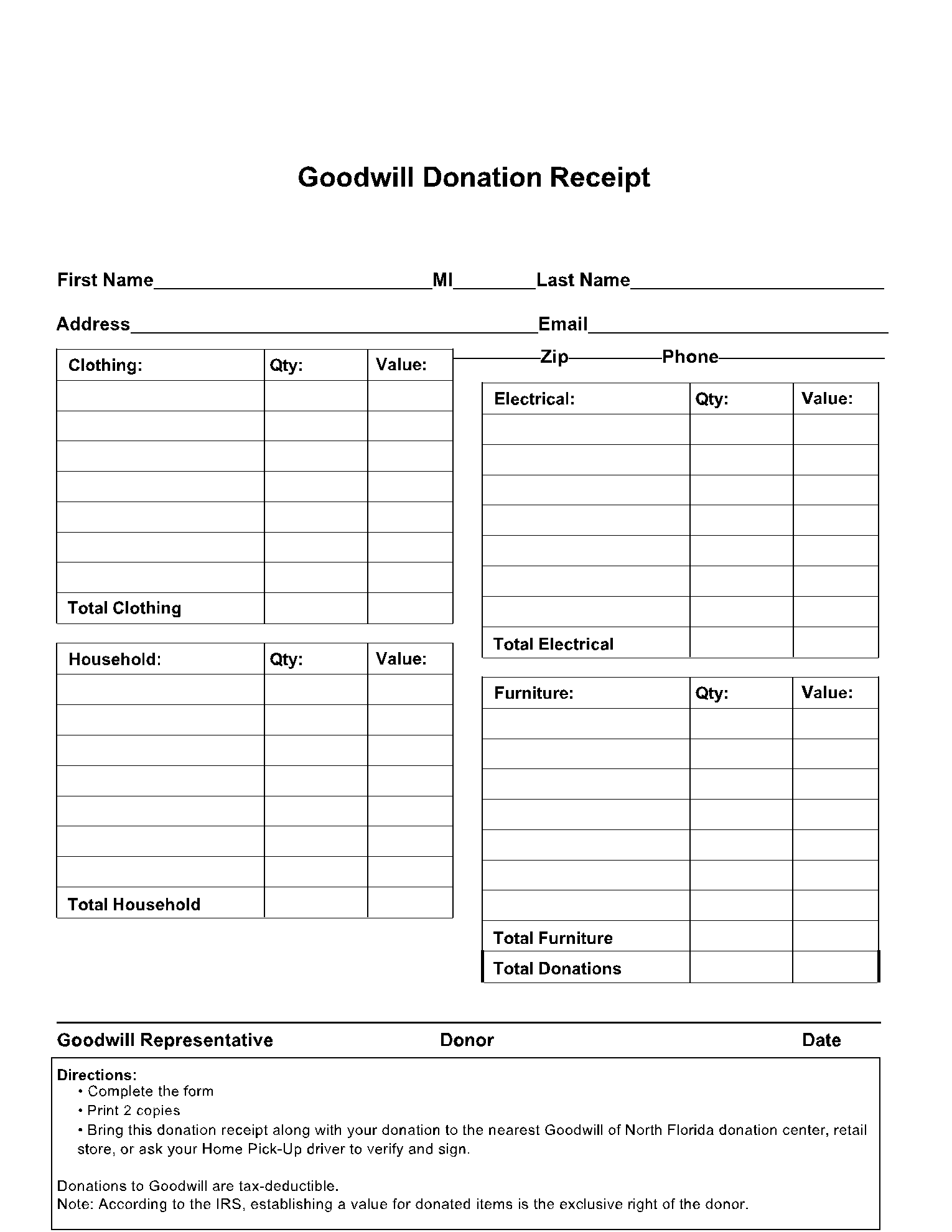

Donation Printable Form Printable Forms Free Online

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Use this receipt when filing your taxes. We've designed our goodwill donation.

Goodwill Donation Receipt Fill Online Printable Fillable —

Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze..

Explore Our Sample of Thrift Store Donation Receipt Template Business

Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Use this receipt when filing your taxes. A donor is responsible for valuing the donated items, and it's. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. To meet everyone's needs,.

Free Goodwill Donation Receipt Template PDF eForms

Use this receipt when filing your taxes. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. To meet everyone's needs, our template is. A donation receipt is used to claim.

Pdf Printable Goodwill Donation Receipt Printable Templates

A donor is responsible for valuing the donated items, and it's. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Use this receipt when filing your taxes. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze..

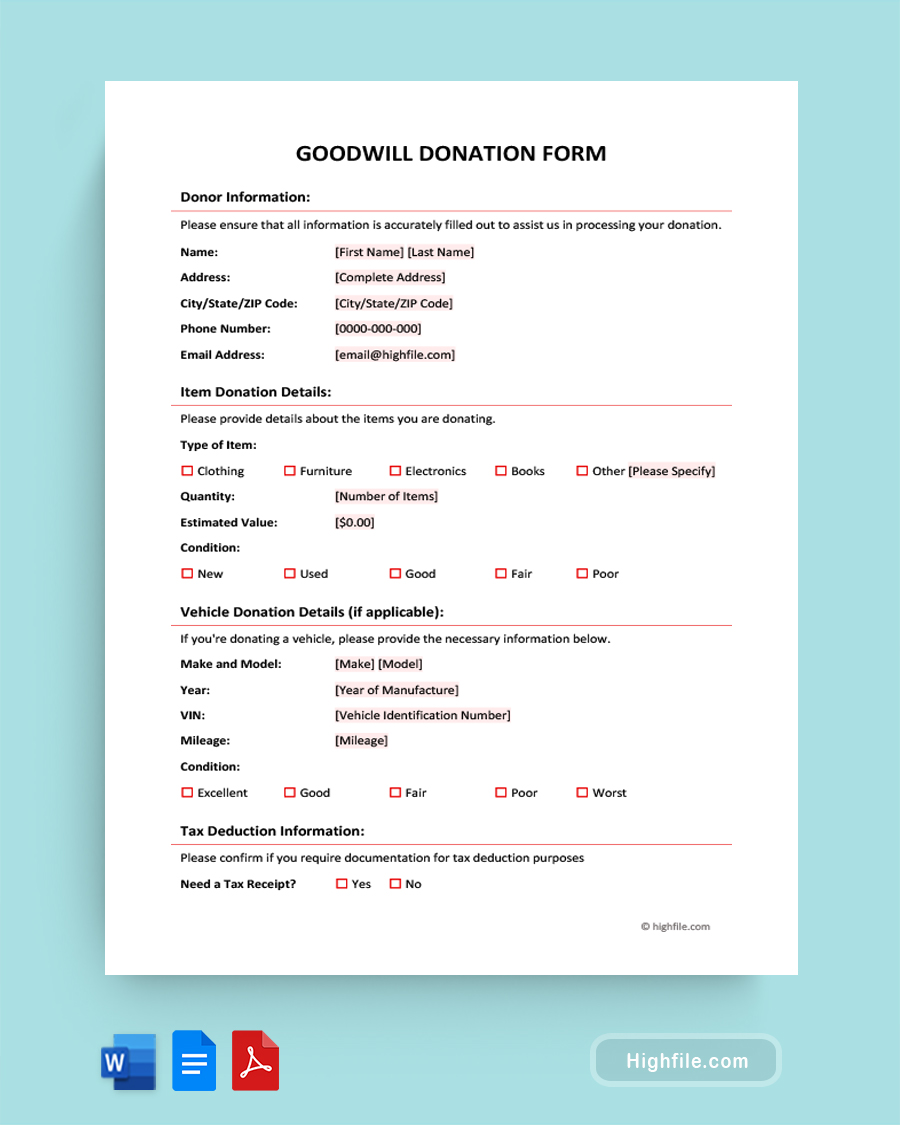

Goodwill Donation Form Word PDF Google Docs Highfile

A donor is responsible for valuing the donated items, and it's. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. To meet everyone's needs, our template is. A donation receipt is used to claim a.

American Red Cross Printable Donation Form Printable Forms Free Online

Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. Use this receipt when.

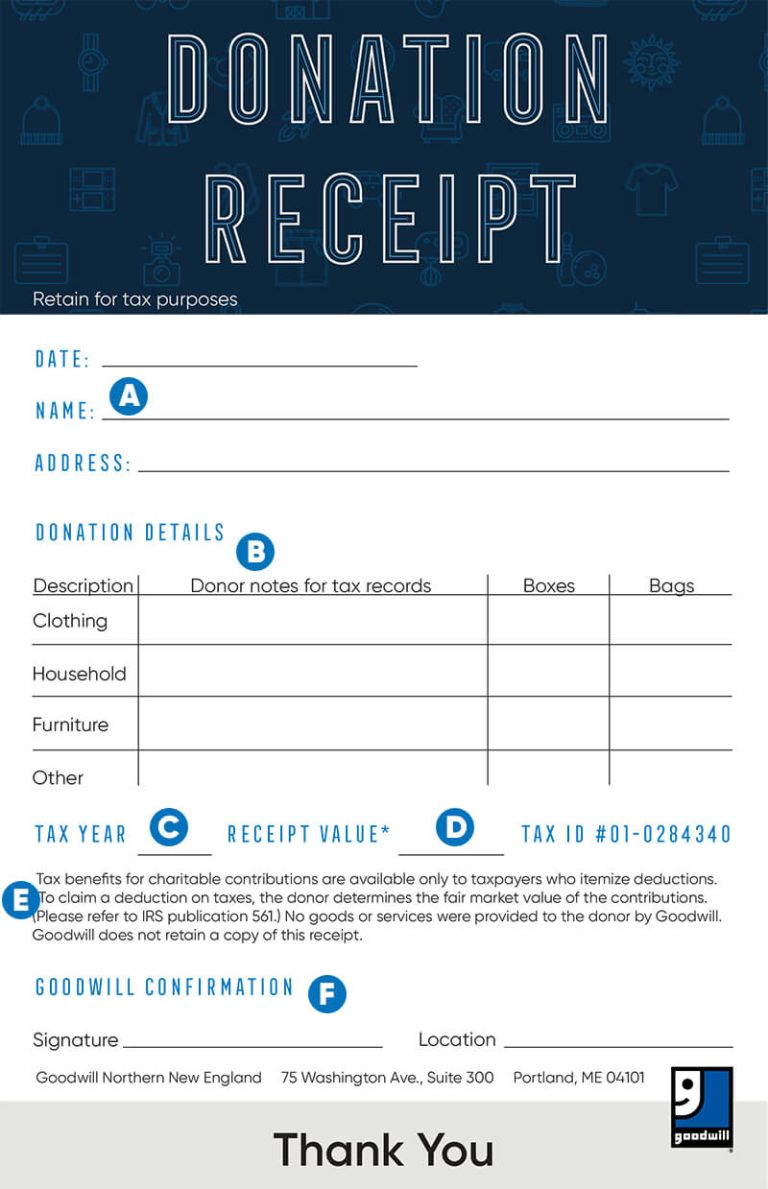

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Use this receipt when filing your taxes. To meet everyone's needs, our template is. Please consult your personal tax advisor regarding the tax deductibility of your. A donation receipt is used to claim a tax deduction for clothing and.

To Meet Everyone's Needs, Our Template Is.

Use this receipt when filing your taxes. A donor is responsible for valuing the donated items, and it's. Please consult your personal tax advisor regarding the tax deductibility of your. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes.

Use This Receipt When Filing Your Taxes.

We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more.