Franchise Tax Board Form 590

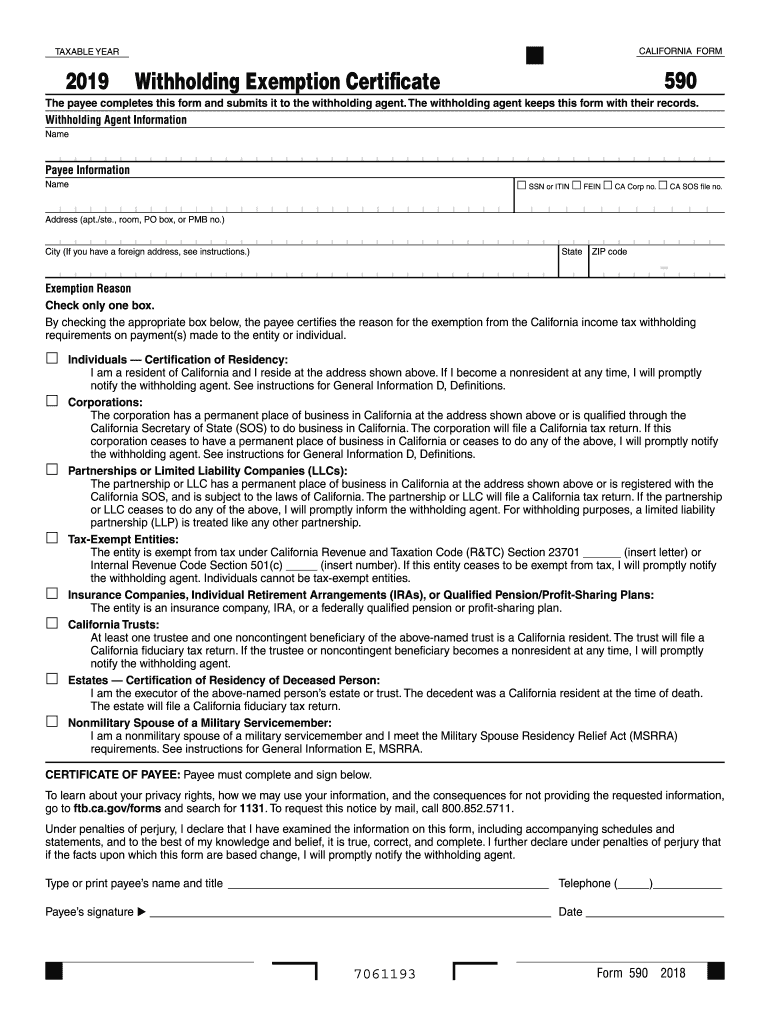

Franchise Tax Board Form 590 - Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup. Complete and present form 590 to the withholding agent. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Use form 590 to certify an exemption from nonresident withholding. The payee completes and signs.

Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Form 590 does not apply to payments of backup. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Complete and present form 590 to the withholding agent. The payee completes and signs. Use form 590 to certify an exemption from nonresident withholding.

Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Complete and present form 590 to the withholding agent. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Use form 590 to certify an exemption from nonresident withholding. The payee completes and signs. Form 590 does not apply to payments of backup.

2021 Form CA FTB 590P Fill Online, Printable, Fillable, Blank pdfFiller

The payee completes and signs. Form 590 does not apply to payments of backup. Complete and present form 590 to the withholding agent. Use form 590 to certify an exemption from nonresident withholding. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption.

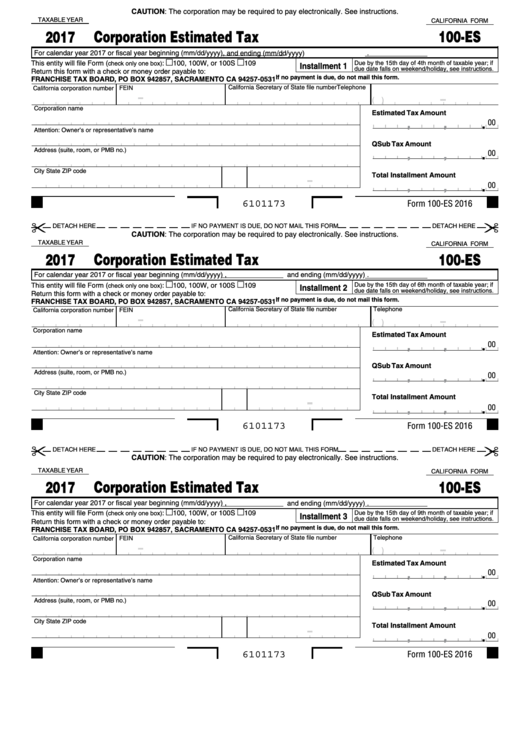

Fillable California Form 100 Es Corporate Esitimated Tax Franchise

Complete and present form 590 to the withholding agent. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The payee completes and signs. Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Form 590 does not apply to payments of backup.

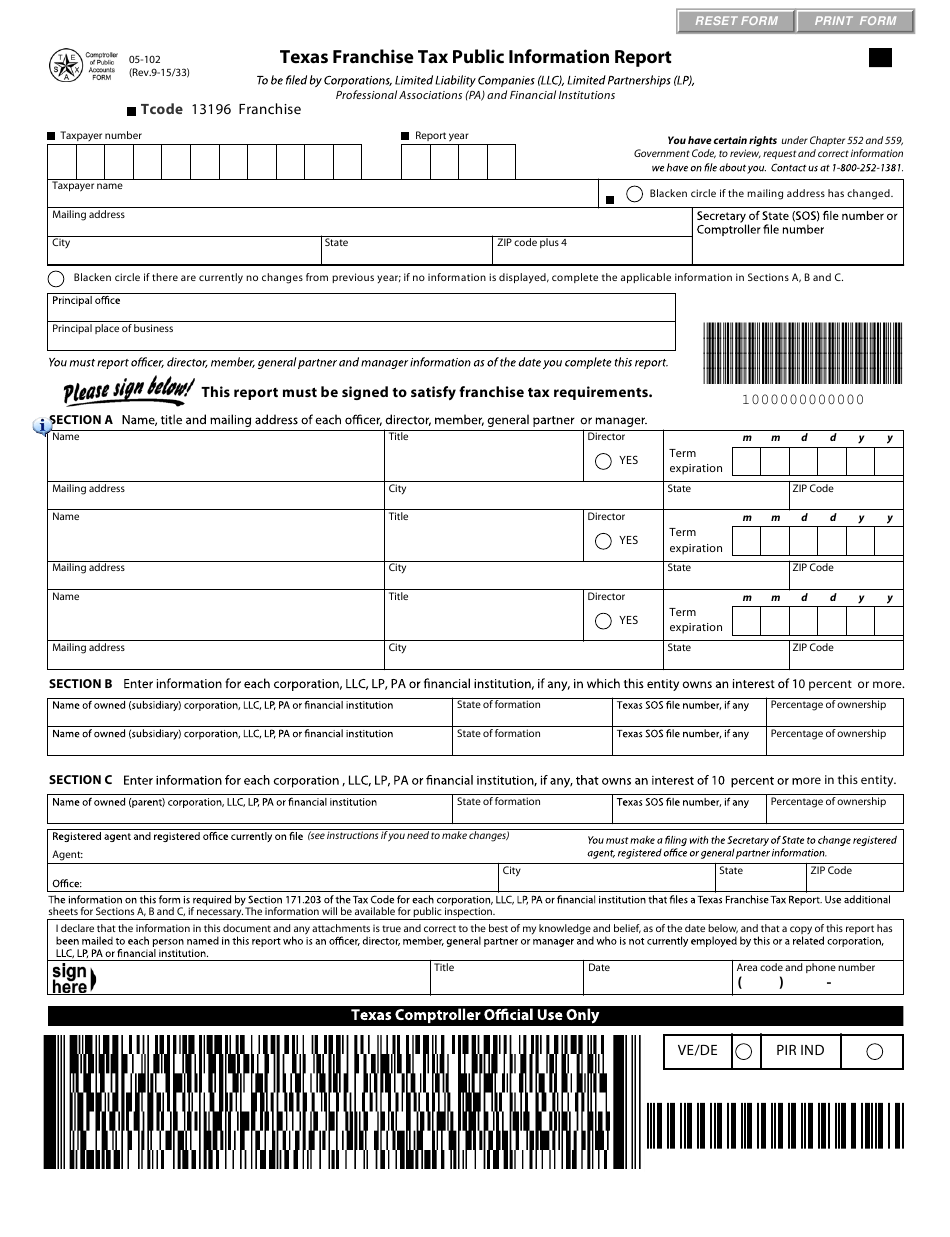

Texas Franchise Tax Rate 2024 Linea Petunia

Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Complete and present form 590 to the withholding agent. Form 590 does not apply to payments of backup. Use form 590 to certify an exemption from nonresident withholding. The payee completes and signs.

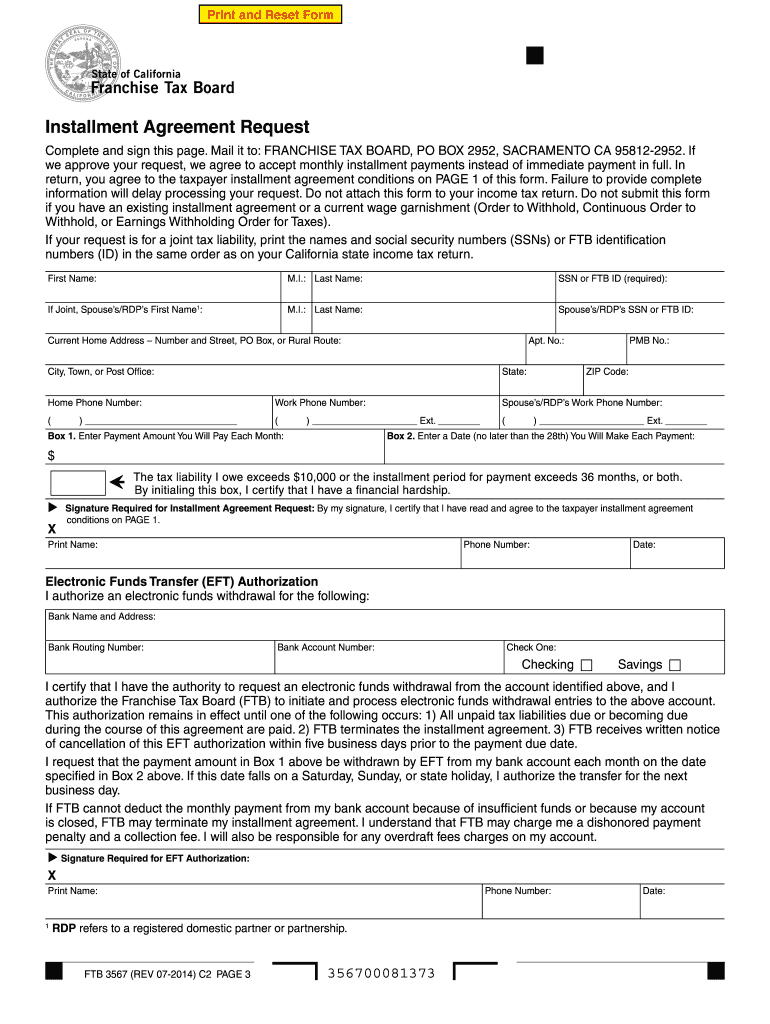

Form 3567 Fill out & sign online DocHub

Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Complete and present form 590 to the withholding agent. Form 590 does not apply to payments of backup. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 is used to claim an exemption from nonresident withholding on.

Form 593 California Franchise Tax Board

The payee completes and signs. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Form 590 does not apply to payments of backup. Complete and present form 590 to the withholding agent.

Instructions For Form FTB 5805 California Franchise Tax Board

Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The payee completes and signs. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Complete and present form 590 to the withholding.

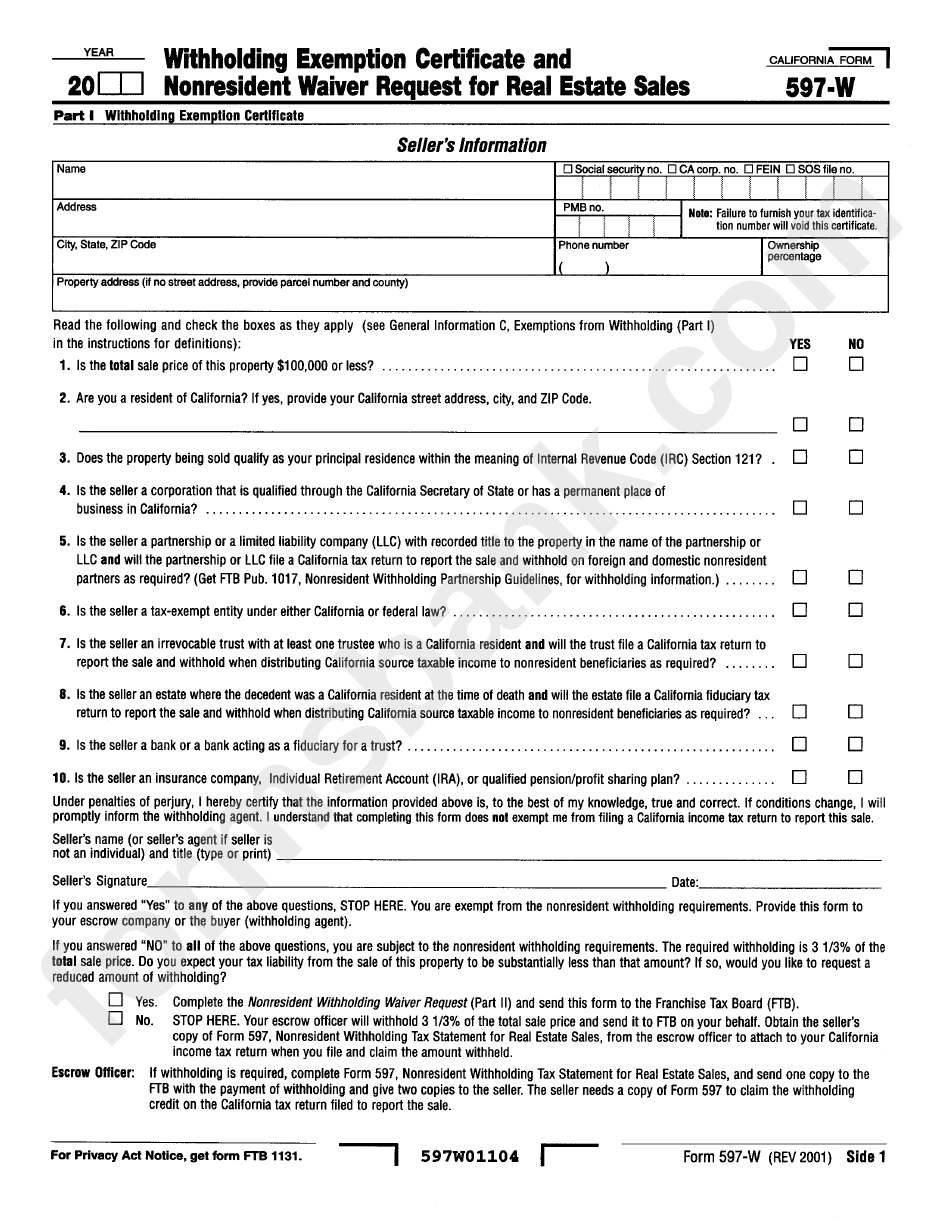

California Franchise Tax Board Form For Withholding Certificate For

Use form 590 to certify an exemption from nonresident withholding. The payee completes and signs. Complete and present form 590 to the withholding agent. Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Form 590 does not apply to payments of backup.

What You Need to Know About California Franchise Tax Board YouTube

Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. The payee completes and signs. Form 590 does not apply to payments of backup. Complete and present form 590 to the withholding agent.

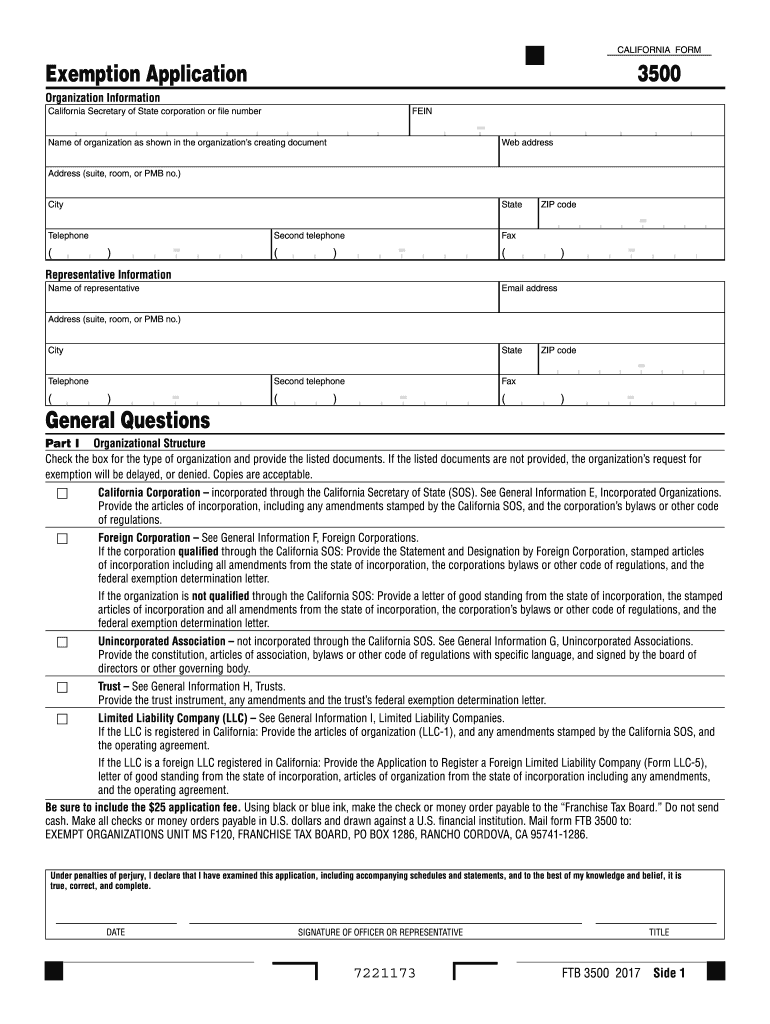

Franchise tax boardform3500 2011 Fill out & sign online DocHub

Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Form 590 does not apply to payments of backup. Complete and present form 590 to the withholding agent. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The payee completes and signs.

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Complete and present form 590 to the withholding agent. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Form 590 is used to claim an exemption from nonresident withholding on payments of california source income. Form 590 does not.

Use Form 590, Withholding Exemption Certificate, To Certify An Exemption From Nonresident Withholding.

Complete and present form 590 to the withholding agent. Form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. The payee completes and signs. Use form 590 to certify an exemption from nonresident withholding.

Form 590 Does Not Apply To Payments Of Backup.

Form 590 is used to claim an exemption from nonresident withholding on payments of california source income.