Form M1Pr Mn

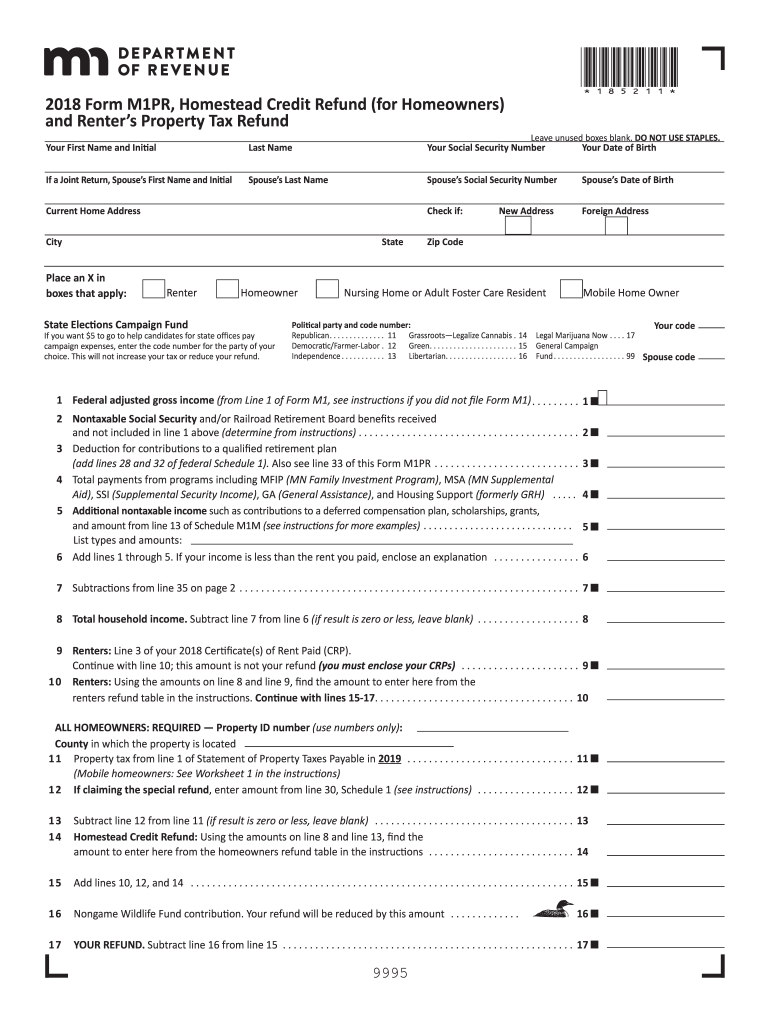

Form M1Pr Mn - Also, include nontaxable payments from the diver. I authorize the minnesota department of revenue to discuss this tax return with the preparer. • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. If you are filing as a. Minnesota property tax refund, mail station. We'll make sure you qualify, calculate your minnesota. Property taxes or rent paid on your primary residence in minnesota. Include nontaxable payments you received from programs listed on line 4 of form m1pr. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary.

If you are filing as a. Minnesota property tax refund, mail station. Include nontaxable payments you received from programs listed on line 4 of form m1pr. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. I authorize the minnesota department of revenue to discuss this tax return with the preparer. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. What do i need to claim the refund? • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. Property taxes or rent paid on your primary residence in minnesota. Also, include nontaxable payments from the diver.

We'll make sure you qualify, calculate your minnesota. If you are filing as a. I authorize the minnesota department of revenue to discuss this tax return with the preparer. What do i need to claim the refund? Also, include nontaxable payments from the diver. Property taxes or rent paid on your primary residence in minnesota. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Include nontaxable payments you received from programs listed on line 4 of form m1pr. • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax.

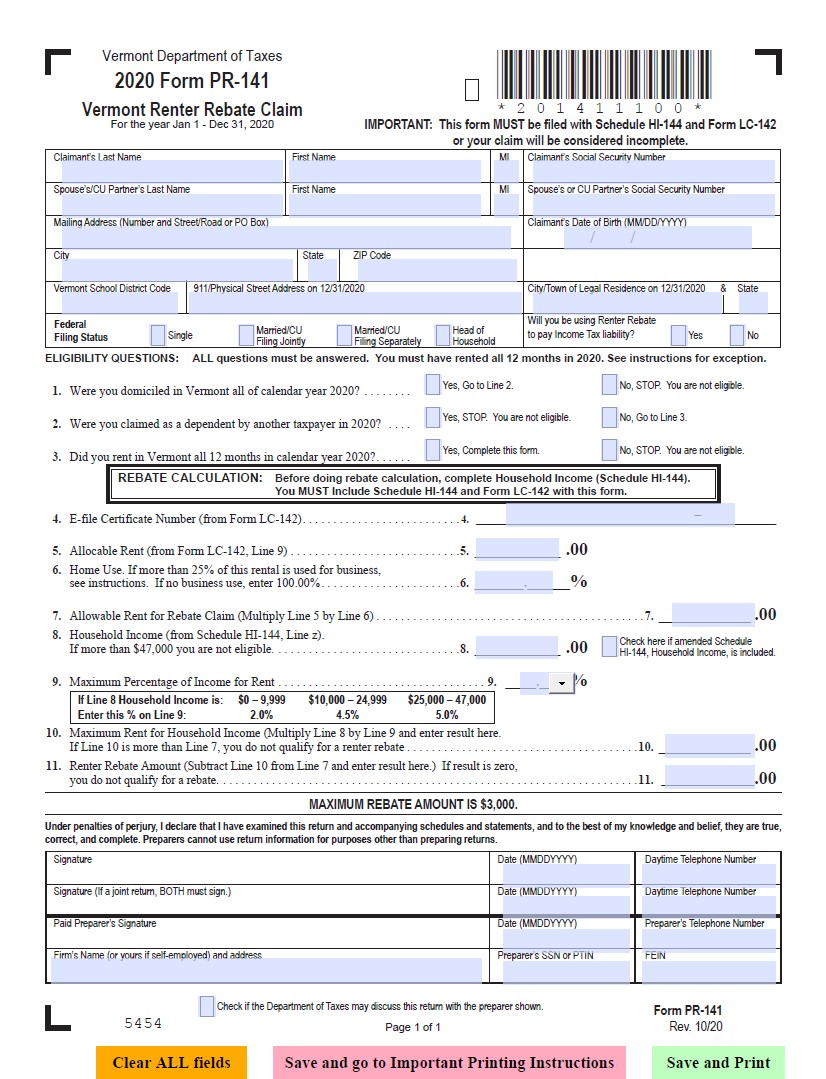

What Kind of MN Renters Rebate Form Can People Enjoy?

What do i need to claim the refund? We'll make sure you qualify, calculate your minnesota. Also, include nontaxable payments from the diver. If you are filing as a. I authorize the minnesota department of revenue to discuss this tax return with the preparer.

MN Schedule M15 20202022 Fill out Tax Template Online US Legal Forms

Also, include nontaxable payments from the diver. If you are filing as a. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. We'll make sure you qualify, calculate your minnesota. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax.

Fillable Form Arizona Dept Of Revenue Form 600a Printable Forms Free

If you are filing as a. Minnesota property tax refund, mail station. • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. I authorize the minnesota department of revenue to discuss this tax return with the preparer. We'll make sure you qualify, calculate your minnesota.

Mn M1Pr Form ≡ Fill Out Printable PDF Forms Online

Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Minnesota property tax refund, mail station. Property taxes or rent paid on your primary residence in minnesota. We'll make sure you qualify, calculate your minnesota. Also, include nontaxable payments from the diver.

How to Get TAX Refund from FBR Method to Get Refundable Tax

You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. What do i need to claim the refund? • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. Property taxes or rent paid on your primary residence in minnesota..

Mn Property Tax Refund 2024 Date Hatty Kordula

We'll make sure you qualify, calculate your minnesota. If you are filing as a. Minnesota property tax refund, mail station. What do i need to claim the refund? I authorize the minnesota department of revenue to discuss this tax return with the preparer.

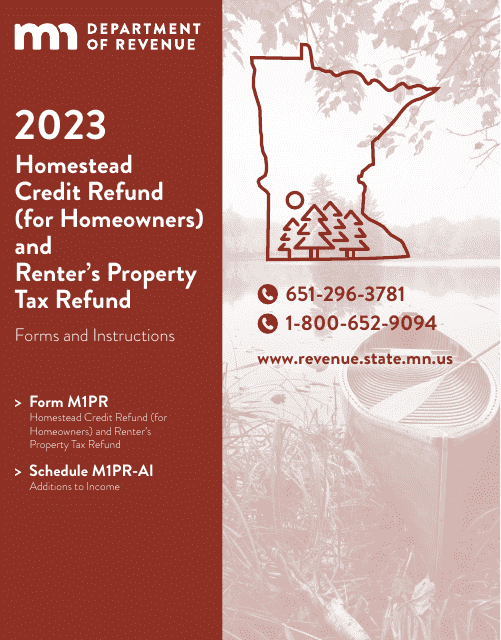

Download Instructions for Form M1PR Schedule M1PRAI PDF, 2023

• a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. I authorize the.

Mn Property Tax Refund 20182024 Form Fill Out and Sign Printable PDF

Property taxes or rent paid on your primary residence in minnesota. I authorize the minnesota department of revenue to discuss this tax return with the preparer. Include nontaxable payments you received from programs listed on line 4 of form m1pr. Minnesota property tax refund, mail station. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax.

2016 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank pdfFiller

Property taxes or rent paid on your primary residence in minnesota. Minnesota property tax refund, mail station. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund..

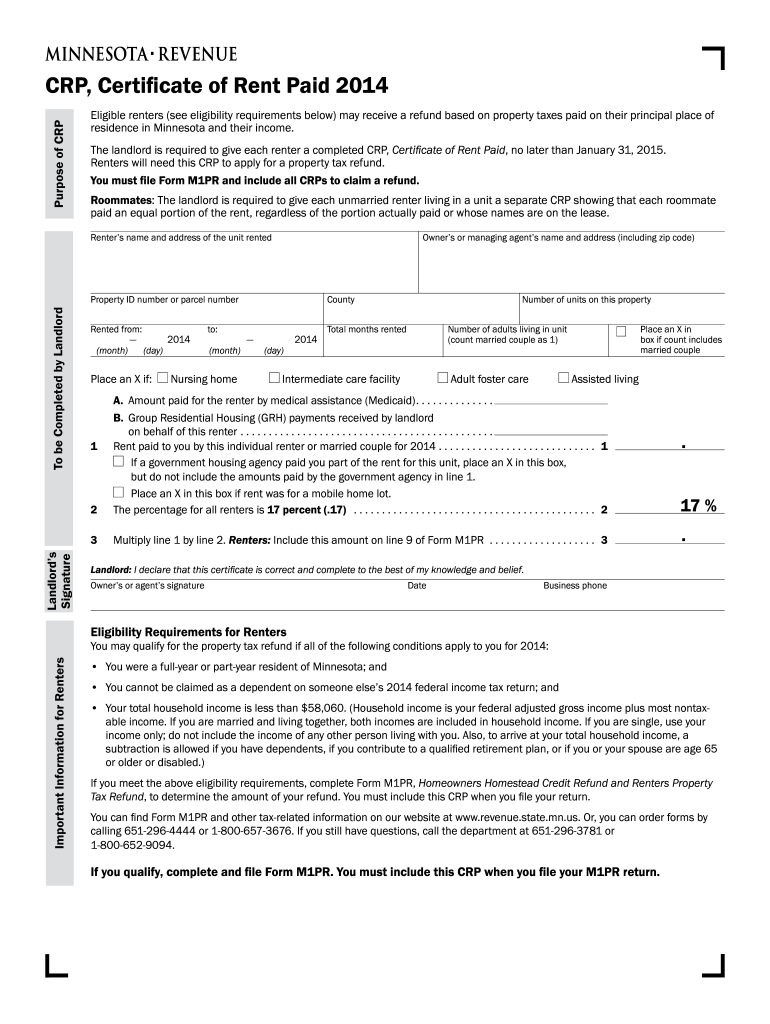

2014 Form MN DoR M1PR Fill Online Printable Fillable Blank PdfFiller

• a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. Include nontaxable payments you received from programs listed on line 4 of form m1pr. We'll make sure you qualify, calculate your minnesota. Minnesota property tax refund, mail station. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund.

Minnesota Property Tax Refund, Mail Station.

Property taxes or rent paid on your primary residence in minnesota. If you are filing as a. We'll make sure you qualify, calculate your minnesota. Include nontaxable payments you received from programs listed on line 4 of form m1pr.

• A Completed Form M1Pr, Homestead Credit Refund (For Homeowners) And Renter’s Property Tax.

Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. I authorize the minnesota department of revenue to discuss this tax return with the preparer. Also, include nontaxable payments from the diver. What do i need to claim the refund?

You May Be Eligible For A Refund Based On Your Household Income (See Pages 8 And 9) And The Property Taxes Or Rent Paid On Your Primary.

Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund.