Form 941 And 940

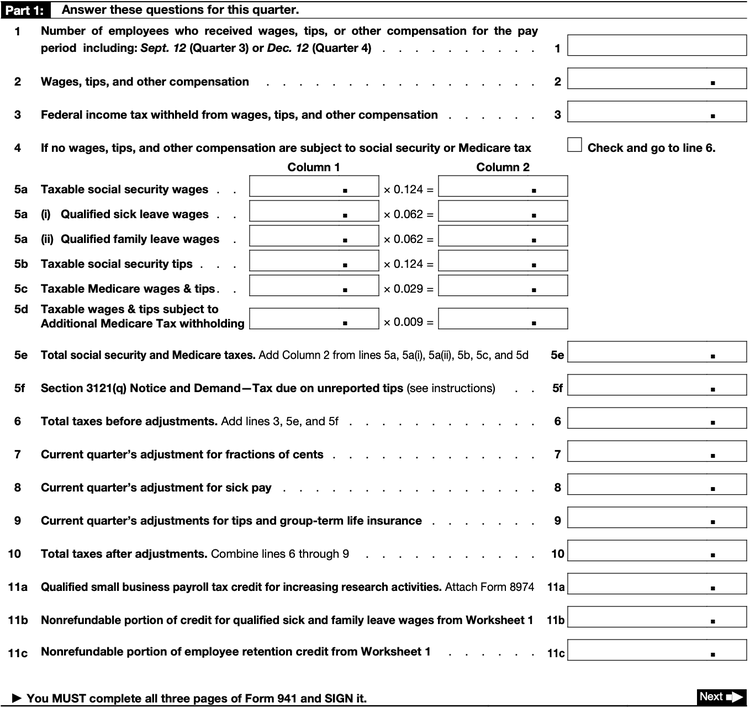

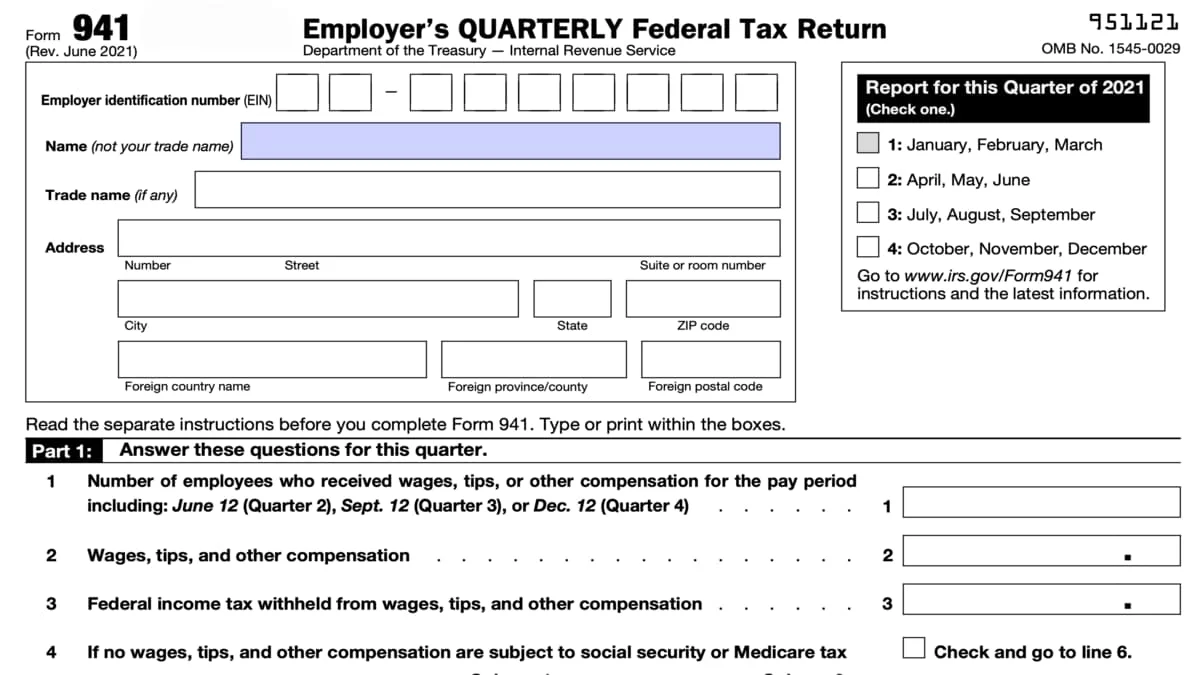

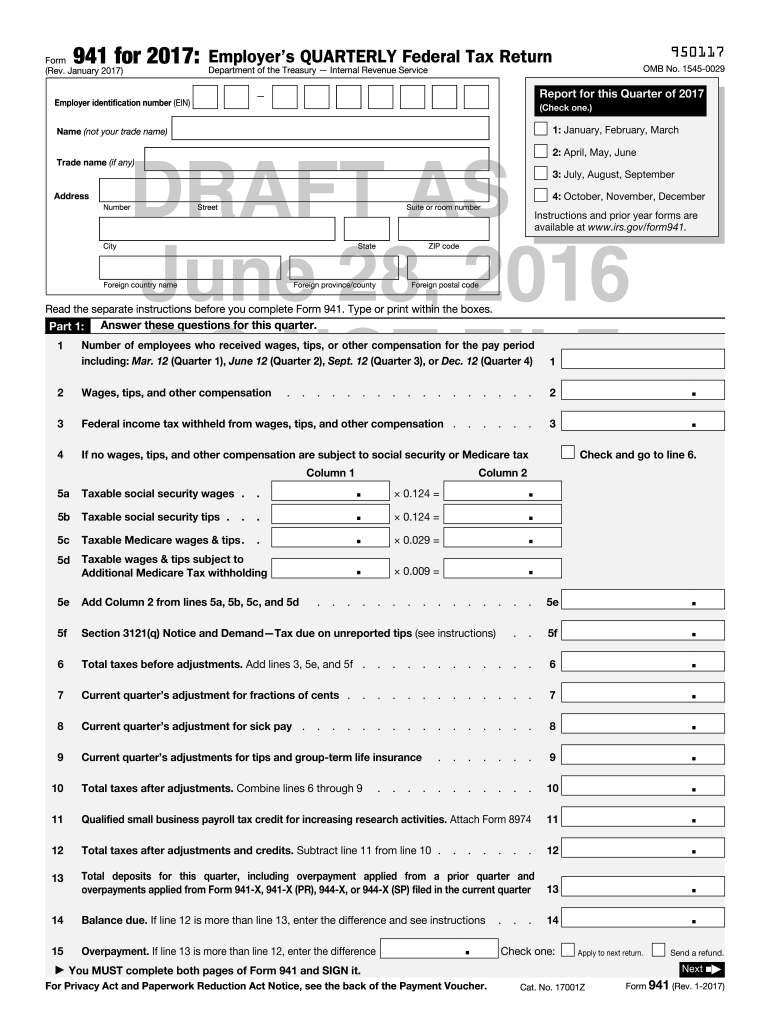

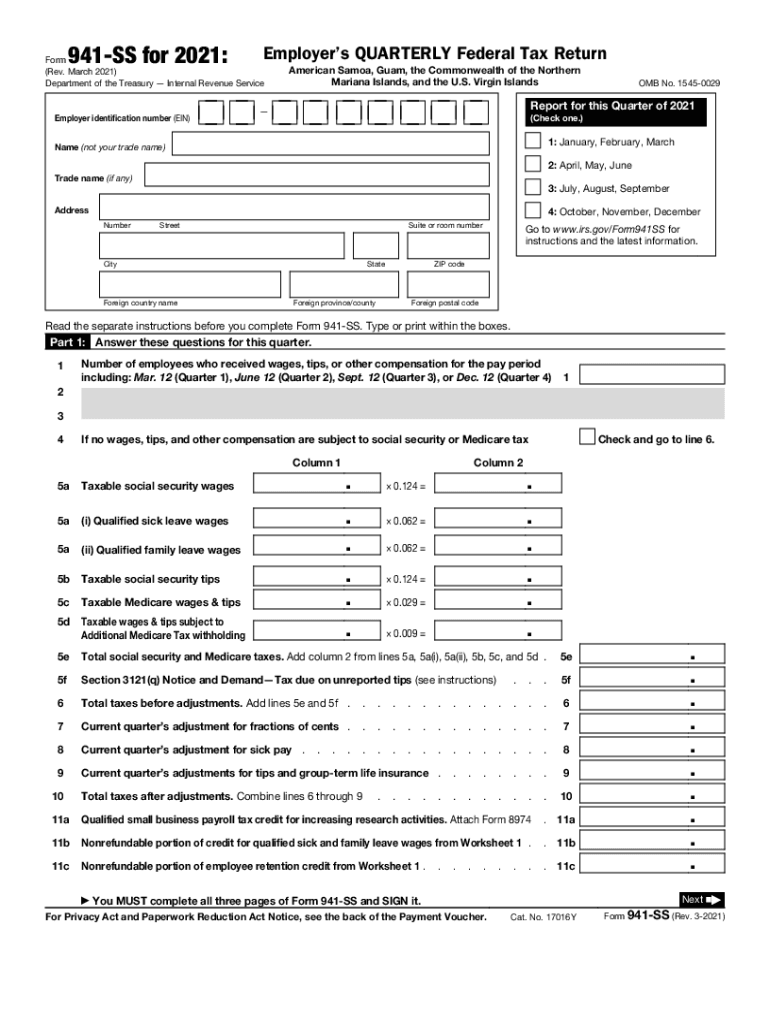

Form 941 And 940 - Generally, employers are required to file forms 941 quarterly. The irs determines which forms you file based on the amount of federal. However, some small employers (those whose annual liability for social. 941, 944, 943, and 940. There are 4 different federal payroll forms: Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

The irs determines which forms you file based on the amount of federal. However, some small employers (those whose annual liability for social. Generally, employers are required to file forms 941 quarterly. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. There are 4 different federal payroll forms: 941, 944, 943, and 940.

Generally, employers are required to file forms 941 quarterly. The irs determines which forms you file based on the amount of federal. However, some small employers (those whose annual liability for social. 941, 944, 943, and 940. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. There are 4 different federal payroll forms:

How to Prepare and File IRS Forms 940 and 941

Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. There are 4 different federal payroll forms: Generally, employers are required to file forms 941 quarterly. However, some small employers (those whose annual liability for social. The irs determines which forms you file based on the amount of federal.

Form 940 vs Form 941 Difference and Comparison

941, 944, 943, and 940. The irs determines which forms you file based on the amount of federal. Generally, employers are required to file forms 941 quarterly. There are 4 different federal payroll forms: Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Free Fillable Printable 940 Annual Form Printable Forms Free Online

Generally, employers are required to file forms 941 quarterly. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. 941, 944, 943, and 940. There are 4 different federal payroll forms: However, some small employers (those whose annual liability for social.

IRS Payroll Compliance Mastering Forms 941, 940, and more!

There are 4 different federal payroll forms: The irs determines which forms you file based on the amount of federal. 941, 944, 943, and 940. However, some small employers (those whose annual liability for social. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Printable Irs Form 940 Printable Forms Free Online

The irs determines which forms you file based on the amount of federal. There are 4 different federal payroll forms: Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. However, some small employers (those whose annual liability for social. Generally, employers are required to file forms 941 quarterly.

941 2016 Complete with ease airSlate SignNow

The irs determines which forms you file based on the amount of federal. 941, 944, 943, and 940. However, some small employers (those whose annual liability for social. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Generally, employers are required to file forms 941 quarterly.

What is IRS Form 940?

Generally, employers are required to file forms 941 quarterly. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. 941, 944, 943, and 940. The irs determines which forms you file based on the amount of federal. There are 4 different federal payroll forms:

941 Form 2024 Mailing Address Jodee Lynnell

Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Generally, employers are required to file forms 941 quarterly. There are 4 different federal payroll forms: The irs determines which forms you file based on the amount of federal. However, some small employers (those whose annual liability for social.

940 vs 941 What's The Difference Between Them & When to Use FUTA 940

There are 4 different federal payroll forms: Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. 941, 944, 943, and 940. Generally, employers are required to file forms 941 quarterly. However, some small employers (those whose annual liability for social.

Printable 941 Form 2021 Complete with ease airSlate SignNow

However, some small employers (those whose annual liability for social. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Generally, employers are required to file forms 941 quarterly. The irs determines which forms you file based on the amount of federal. There are 4 different federal payroll forms:

941, 944, 943, And 940.

However, some small employers (those whose annual liability for social. Generally, employers are required to file forms 941 quarterly. The irs determines which forms you file based on the amount of federal. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.