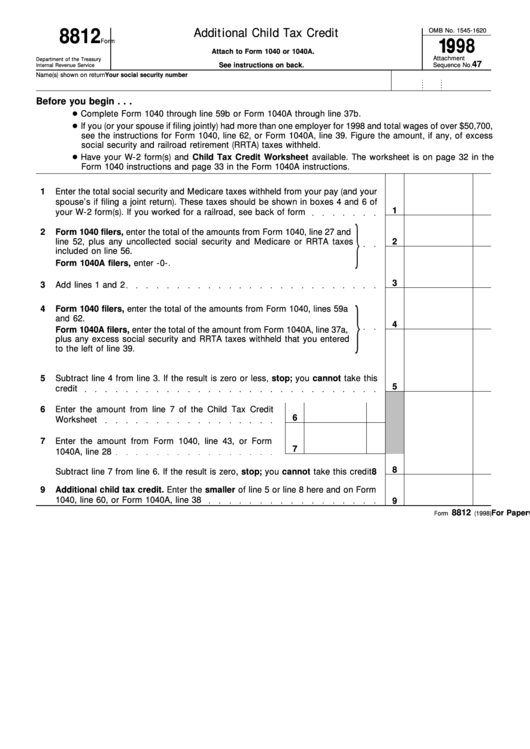

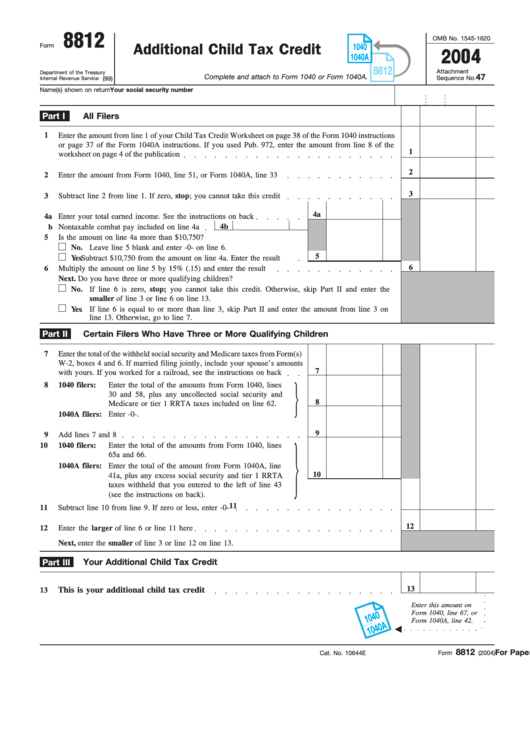

Form 8812 Line 5 Worksheet

Form 8812 Line 5 Worksheet - You can manually fill out the worksheet from. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Unfortunately, turbotax does not show the line 5 worksheet for their calculations.

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. You can manually fill out the worksheet from.

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. You can manually fill out the worksheet from. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the.

8812 Line 5 Worksheet Printable And Enjoyable Learning

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. You can manually fill out the worksheet from. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. Qualifying families with incomes less than $75,000 for single, $112,500 for head of.

Schedule 8812 Line 5 Worksheet

You can manually fill out the worksheet from. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on.

Form 8812 Worksheet Printable Word Searches

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. You can manually fill out the worksheet from. Unfortunately, turbotax does not show the.

2021 Irs Form 8812 Line 5 Worksheet Form example download

You can manually fill out the worksheet from. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Qualifying families with incomes less than $75,000 for single, $112,500 for head of.

Form 8812 Worksheet Printable Word Searches

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. In the.

Line 5 Worksheet Schedule 8812

You can manually fill out the worksheet from. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. If your employer withheld or you paid additional medicare tax or tier 1.

Fillable Online Schedule 8812 child tax credit worksheet. Schedule 8812

In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Unfortunately, turbotax does not show the line.

Fillable Online Child Tax Credit Form 8812 Line 5 worksheet Fax Email

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. You can manually fill out the worksheet.

Form 8812 Line 5 Worksheet 2021

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. In the.

Schedule 8812 Credit Limit Worksheet A

In the meantime, i decided to fill out the forms via paper as an educational exercise and i can't seem to get the credit correct on the. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1.

In The Meantime, I Decided To Fill Out The Forms Via Paper As An Educational Exercise And I Can't Seem To Get The Credit Correct On The.

You can manually fill out the worksheet from. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are.