Form 8027 Due Date

Form 8027 Due Date - Annually report to the irs receipts and tips from their large food or beverage establishments. File the completed form 8027 by the due date specified. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Who needs the instructions for form 8027 tip income reporting? You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. However, if you file electronically, the due date. Employers use form 8027 to:

File the completed form 8027 by the due date specified. Employers use form 8027 to: You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Who needs the instructions for form 8027 tip income reporting? However, if you file electronically, the due date. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Annually report to the irs receipts and tips from their large food or beverage establishments.

File the completed form 8027 by the due date specified. Annually report to the irs receipts and tips from their large food or beverage establishments. However, if you file electronically, the due date. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Employers use form 8027 to: Who needs the instructions for form 8027 tip income reporting?

A quick guide to IRS Form 8027 Outsource Accelerator

You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Employers use form 8027 to: Who needs the instructions for form 8027 tip income reporting? Annually report to the irs receipts and tips from their large food or beverage establishments. Form 8027 department of the treasury internal revenue service.

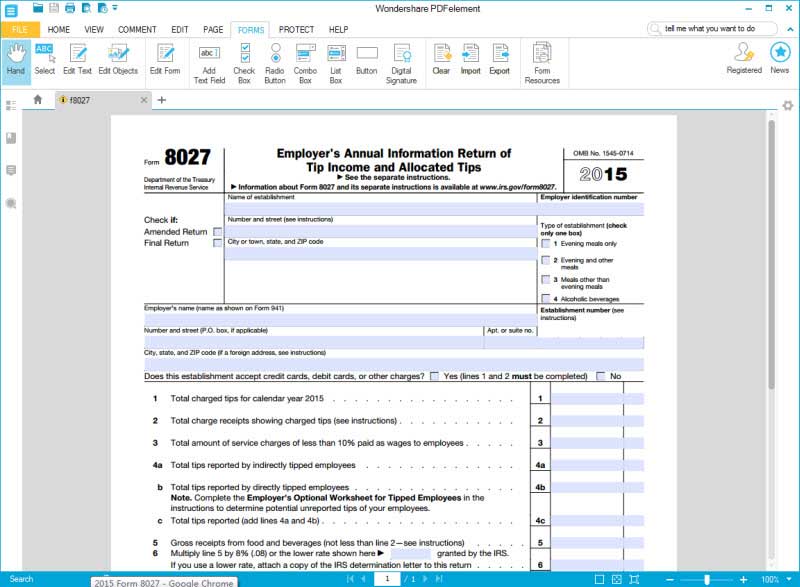

Federal Form 8027

Annually report to the irs receipts and tips from their large food or beverage establishments. File the completed form 8027 by the due date specified. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Who needs the instructions for form 8027 tip income reporting? However, if you file electronically,.

DA Form 8027r Fill Out, Sign Online and Download Fillable PDF

File the completed form 8027 by the due date specified. Annually report to the irs receipts and tips from their large food or beverage establishments. However, if you file electronically, the due date. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Form 8027 department of the treasury.

Workforce Reports Form 8027 Overview and Setup Support Center

You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Annually report to the irs receipts and tips from their large food or beverage establishments. Who needs the instructions for form 8027 tip income reporting? However, if you file electronically, the due date. File the completed form 8027 by.

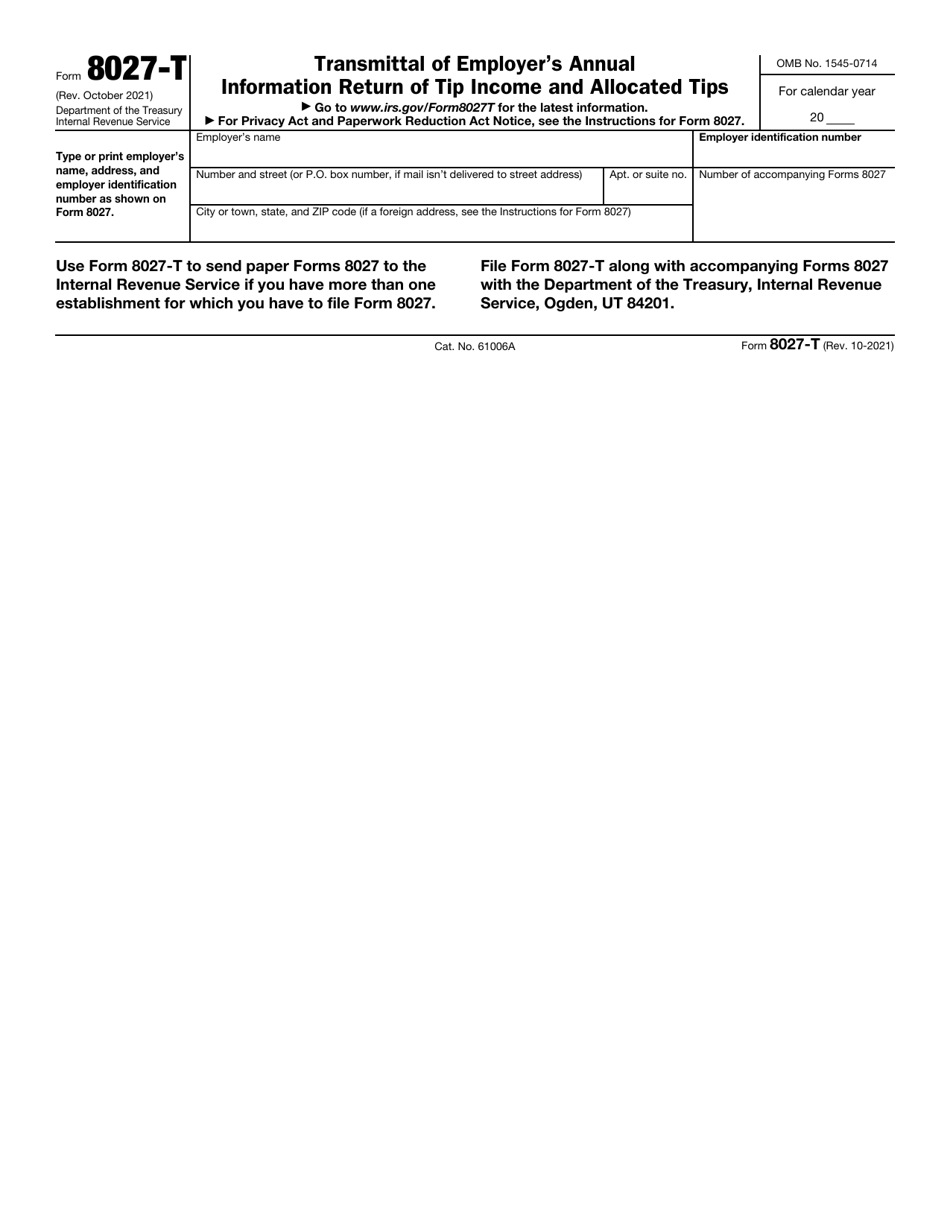

IRS Form 8027T Download Fillable PDF or Fill Online Transmittal of

Employers use form 8027 to: File the completed form 8027 by the due date specified. However, if you file electronically, the due date. Annually report to the irs receipts and tips from their large food or beverage establishments. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return.

Compliance Calendar for the month of August 2023 (FY 20222023

Employers use form 8027 to: Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Annually report to the irs receipts and tips from their large food or beverage.

Irs tip reporting form 4070 Fill online, Printable, Fillable Blank

File the completed form 8027 by the due date specified. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Annually report to the irs receipts and tips from their large food or beverage establishments. Who needs the instructions for form 8027 tip income reporting? Employers use form 8027 to:

Fillable Irs Form 8027 Printable Forms Free Online

File the completed form 8027 by the due date specified. Who needs the instructions for form 8027 tip income reporting? Annually report to the irs receipts and tips from their large food or beverage establishments. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Form 8027 department of.

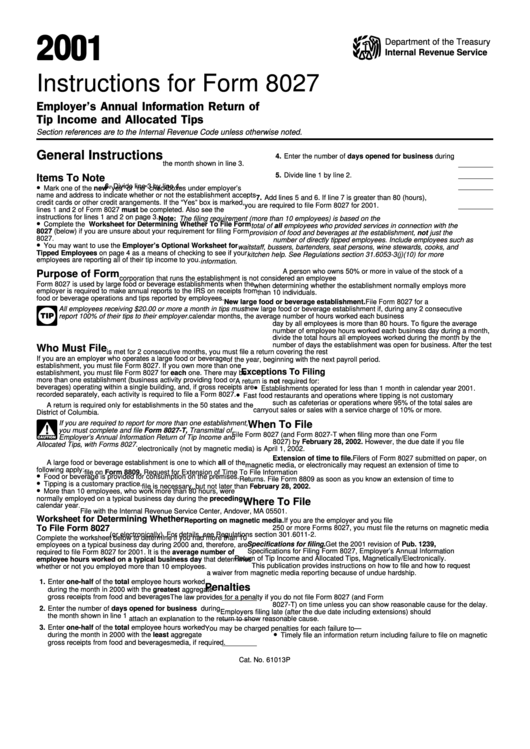

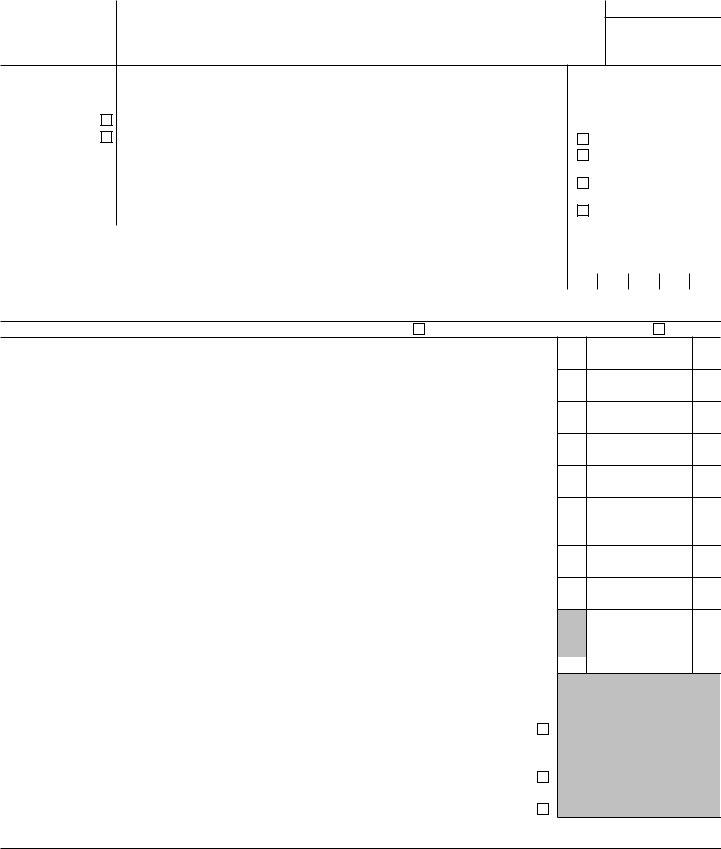

Instructions For Form 8027 printable pdf download

Employers use form 8027 to: Who needs the instructions for form 8027 tip income reporting? Annually report to the irs receipts and tips from their large food or beverage establishments. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. File the completed form 8027 by the due date specified.

Form 8027 ≡ Fill Out Printable PDF Forms Online

File the completed form 8027 by the due date specified. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. However, if you file electronically, the due date. Employers use form 8027 to: You must file form 8027 by february 28 of the year after the calendar year for which.

Employers Use Form 8027 To:

You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. However, if you file electronically, the due date. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Who needs the instructions for form 8027 tip income reporting?

Annually Report To The Irs Receipts And Tips From Their Large Food Or Beverage Establishments.

File the completed form 8027 by the due date specified.