Form 720 Filing

Form 720 Filing - Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. Pay the tax with form 720. File form 720 for the quarter in which you incur liability for the tax. See when to file, earlier. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s.

See when to file, earlier. Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. File form 720 for the quarter in which you incur liability for the tax. Pay the tax with form 720. Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s.

File form 720 for the quarter in which you incur liability for the tax. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Pay the tax with form 720. Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. See when to file, earlier.

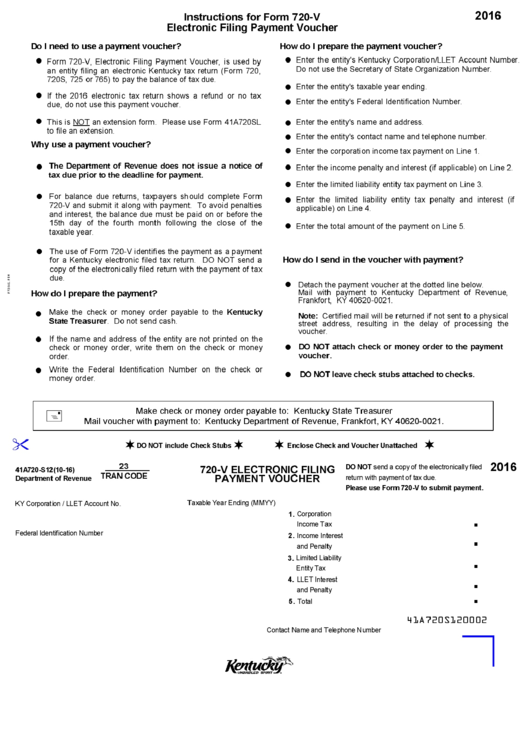

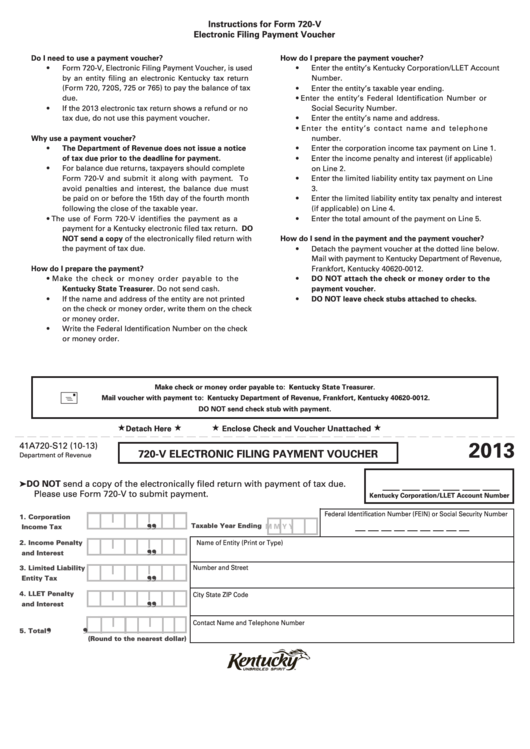

Form 720V Electronic Filing Payment Voucher 2016 printable pdf

File form 720 for the quarter in which you incur liability for the tax. Pay the tax with form 720. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. Businesses that sell goods or provide services subject to a federal excise tax need to file form 720.

“IRS Fully Automated EFiling Form 720” by Simple720 Medium

Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Pay the tax with form 720. See when to file, earlier. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. Businesses that sell goods or.

TAX FORM 720 ONLINE FILING. Are you looking for tax form 720 online

See when to file, earlier. File form 720 for the quarter in which you incur liability for the tax. Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on.

The deadline for filing Form 720 for the first quarter of 2021 is April

Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. See when to file, earlier. Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. File form 720 for the quarter in which you incur liability.

720 TAX FORM EFILING IN THE USA. 720 tax form EFiling in the USA is a

Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. Pay the tax with form 720. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. See when to file, earlier. File form 720 for the.

Form 720 EFiling How to File Accurately and On Time by Simple720

Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. File form 720 for the quarter in which you incur liability for the tax. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. Learn how.

FORM 720 EFILING USA. What is Form 720 Efiling USA? by Simple720

Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. File form 720 for the quarter in which you incur liability for the tax. Pay the.

Form 720 Fourth Quarter IRS Authorized Electronic

Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. See when to file, earlier. Pay the tax with form 720. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. File form 720 for the.

Us Form 720 Fillable Printable Forms Free Online

Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. File form 720 for the quarter in which you incur liability for the tax. Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Businesses that.

Form 720V Electronic Filing Payment Voucher 2013 printable pdf

See when to file, earlier. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s. Learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Businesses that sell goods or provide services subject to a federal.

See When To File, Earlier.

Businesses that sell goods or provide services subject to a federal excise tax need to file form 720 on a quarterly basis. File form 720 for the quarter in which you incur liability for the tax. Pay the tax with form 720. Depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s.