Form 15G Download Pdf

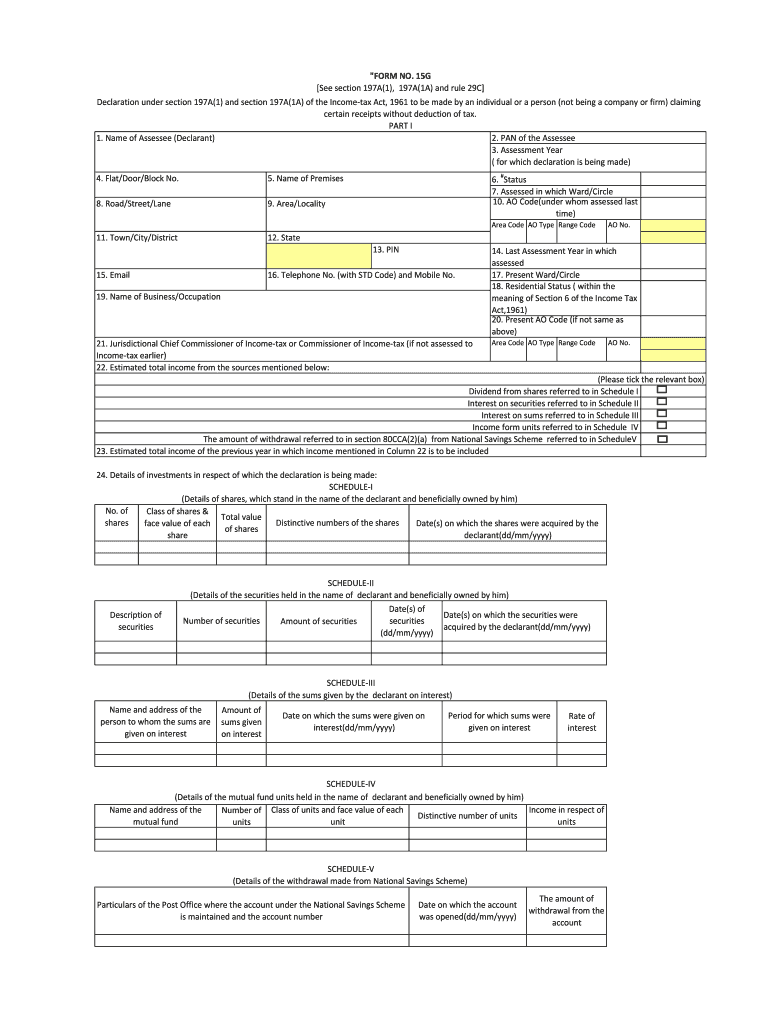

Form 15G Download Pdf - 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. 15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and section 197 a(ia) to be made by an individual or.

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and section 197 a(ia) to be made by an individual or. Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961.

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. 15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and section 197 a(ia) to be made by an individual or. Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

How to fill Form 15GForm 15G DownloadEPF Form 15G

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. Declaration under section 197a(1) and section 197a(1a) to be made by an individual.

Download Form 15g In Word Or Pdf Format For Pf Withdrawal 2022 NBKomputer

Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1).

Filled Form 15g For Pf Withdrawal

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. Declaration under section 197a(1) and section 197a(1a) to be made by an individual.

Form 15g download pdf

15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. 15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and.

Form 15G PDF Download Procedure to fill Form 15G

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. 15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and section 197 a(ia) to be.

Download Form 15g For Pf Withdrawal 2023 Printable Forms Free Online

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). Download the pdf of form 15g, a declaration to be made by an individual or a person.

Form 15g download pdf kumcrush

Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and.

Online Edit Form 15G PDF for PF Withdrawal (Hindi) 2022 23 Save TDS

15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and section 197 a(ia) to be made by an individual or. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person.

Form 15g for pf withdrawal Fill out & sign online DocHub

Download the pdf of form 15g, a declaration to be made by an individual or a person (not being a company or firm) claiming certain incomes. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1).

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and section 197 a(ia) to be made by an individual or. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Download the pdf of form 15g, a declaration to be made by an individual or a.

Download The Pdf Of Form 15G, A Declaration To Be Made By An Individual Or A Person (Not Being A Company Or Firm) Claiming Certain Incomes.

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961. 15g [see section 197a(1), 197a(1a) and 29c] declaration under section 197a (1) and section 197 a(ia) to be made by an individual or. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.