Fincen 105 Form

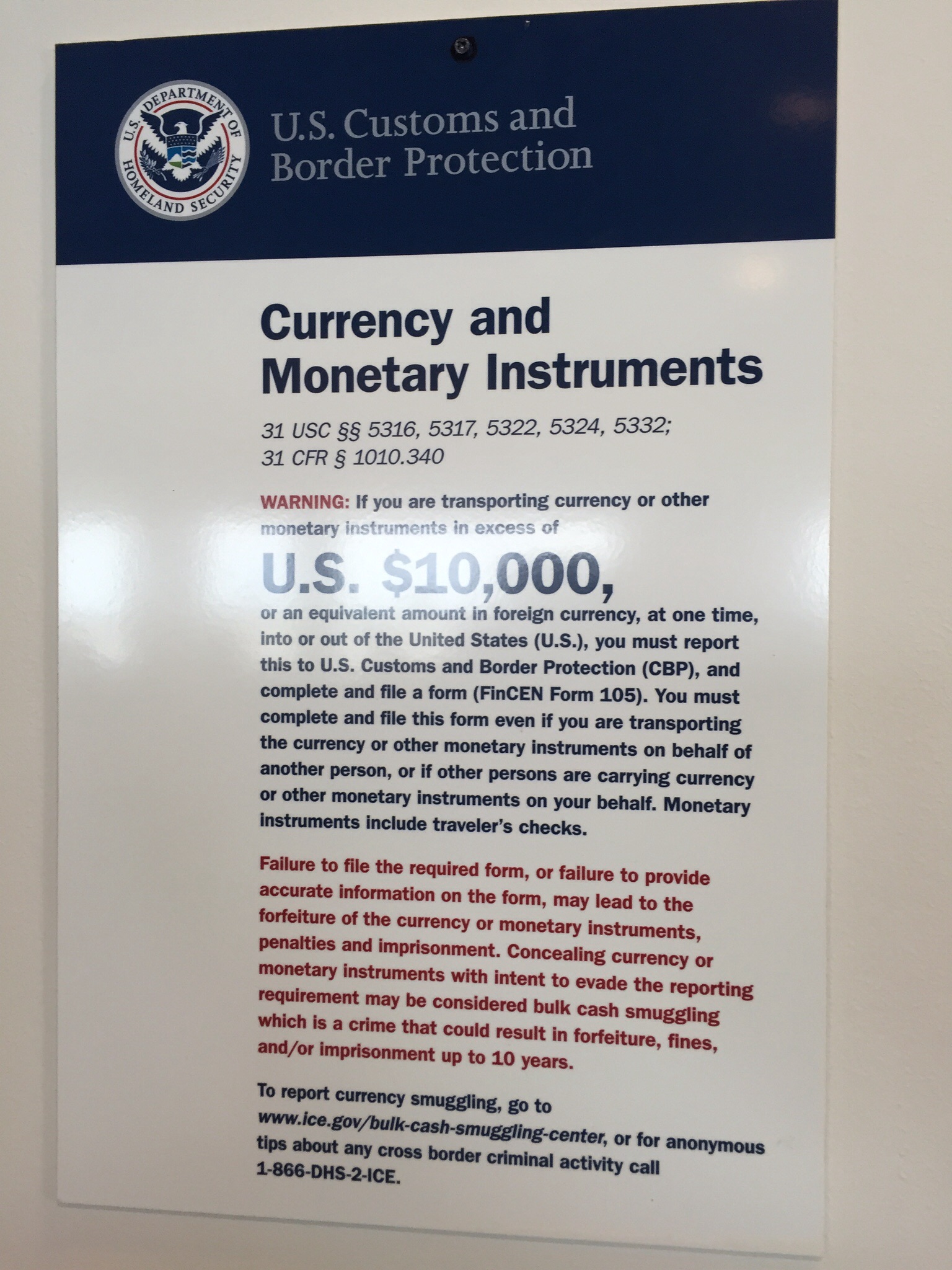

Fincen 105 Form - Or shipping or receiving from / to the united states. With an aggregate amount exceeding. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Currency transporters when entering or departing. Fill out and print form fincen 105 before you travel and present it to a cbp officer; This form is available for filing to travelers and. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. Fill out the currency reporting form (fincen 105) online; Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Ask a cbp officer for a paper copy and.

Ask a cbp officer for a paper copy and. Currency transporters when entering or departing. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Fill out and print form fincen 105 before you travel and present it to a cbp officer; Fill out the currency reporting form (fincen 105) online; This form is available for filing to travelers and. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Or shipping or receiving from / to the united states. With an aggregate amount exceeding. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by.

Fill out the currency reporting form (fincen 105) online; Fill out and print form fincen 105 before you travel and present it to a cbp officer; Currency transporters when entering or departing. This form is available for filing to travelers and. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. With an aggregate amount exceeding. Ask a cbp officer for a paper copy and. Or shipping or receiving from / to the united states. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one.

Federal RegisterN N Financial Crimes Enforcement Network

Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Currency transporters when entering or departing. Ask a cbp officer for a paper copy and. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in.

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding.

Fillable Online Fincen form 105 pdf. Fincen form 105 pdf. How to fill

Or shipping or receiving from / to the united states. Currency transporters when entering or departing. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments.

FINCEN FORM 109 PDF

This form is available for filing to travelers and. Fill out and print form fincen 105 before you travel and present it to a cbp officer; Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Fill out the currency reporting form (fincen 105) online; Ask.

Fincen 105 Fill out & sign online DocHub

Ask a cbp officer for a paper copy and. With an aggregate amount exceeding. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. Fill out the currency reporting form (fincen 105) online; This form.

Fincen Form 105 ≡ Fill Out Printable PDF Forms Online

Currency transporters when entering or departing. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Fill out the currency reporting form (fincen 105) online; In the united states shall file fincen form 105, within 15 days after receipt of the currency.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. With an aggregate amount exceeding. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at.

U.S. TREAS Form treasirsfincen1052003

Currency transporters when entering or departing. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Ask a cbp officer for a paper copy and. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in.

FinCEN 105 Reporting requirements of carrying cash overseas Nomad

Currency transporters when entering or departing. This form is available for filing to travelers and. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Ask a cbp officer for a paper copy and. Bsa regulations stipulate that a cmir must be used to report the.

Cash Reporting Requirement & FinCen 105 Great Lakes Customs Law

Currency transporters when entering or departing. Fill out and print form fincen 105 before you travel and present it to a cbp officer; This form is available for filing to travelers and. Or shipping or receiving from / to the united states. Ask a cbp officer for a paper copy and.

Fill Out The Currency Reporting Form (Fincen 105) Online;

Fill out and print form fincen 105 before you travel and present it to a cbp officer; Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Ask a cbp officer for a paper copy and.

In The United States Shall File Fincen Form 105, Within 15 Days After Receipt Of The Currency Or Monetary Instruments, With The Customs Officer In Charge At Any Port Of Entry Or Departure Or By.

Currency transporters when entering or departing. With an aggregate amount exceeding. Or shipping or receiving from / to the united states. This form is available for filing to travelers and.