Dividends Payable In Balance Sheet

Dividends Payable In Balance Sheet - Before dividends are paid, there is no impact on the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Paying the dividends reduces the amount. Dividends in the balance sheet.

Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Dividends in the balance sheet. Before dividends are paid, there is no impact on the balance sheet. Paying the dividends reduces the amount.

Paying the dividends reduces the amount. Before dividends are paid, there is no impact on the balance sheet. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Dividends in the balance sheet.

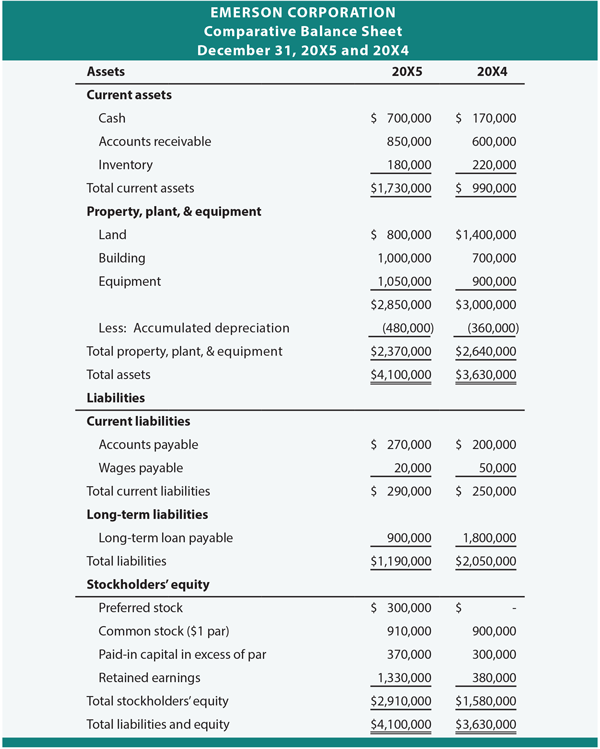

Solved Exercise 516 A comparative balance sheet for

Dividends in the balance sheet. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Before dividends are paid, there is no impact on the balance sheet. Paying the dividends reduces the amount. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are.

Balance Sheet Dividends

Dividends in the balance sheet. Paying the dividends reduces the amount. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Before dividends are paid, there is no impact on the balance sheet.

Balance Sheet Dividends

Recording dividends payable begins with the board of directors’ declaration, creating a legal. Dividends in the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Paying the dividends reduces the amount. Before dividends are paid, there is no impact on the balance sheet.

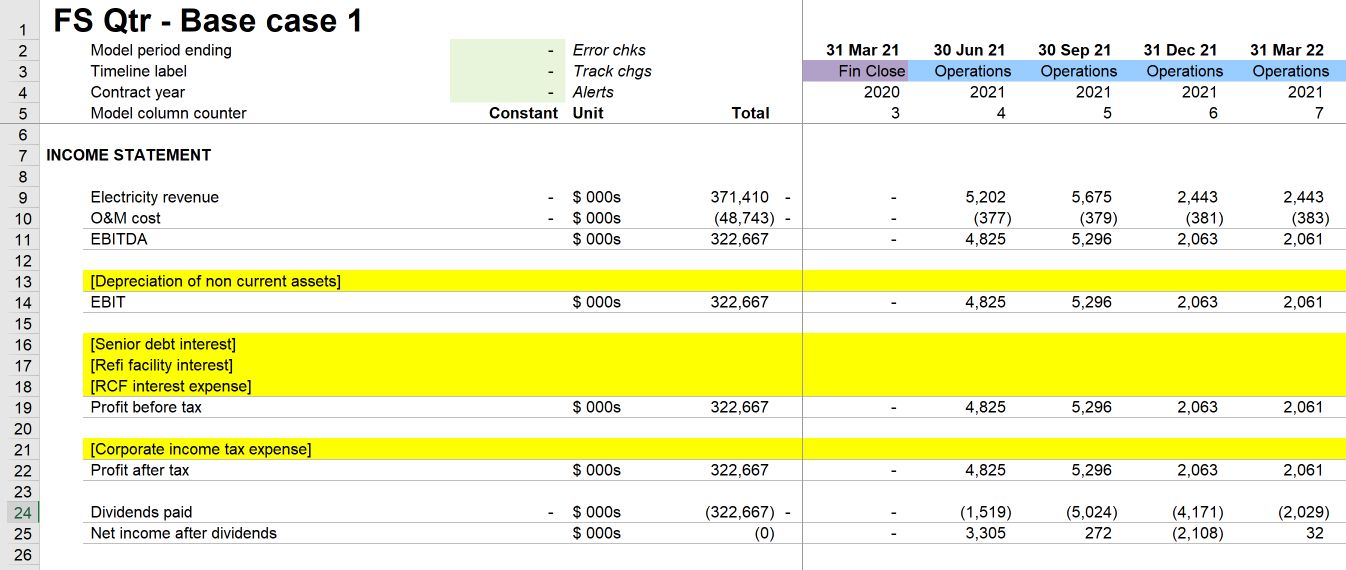

Modeling dividends solution

Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Before dividends are paid, there is no impact on the balance sheet. Paying the dividends reduces the amount. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Dividends in the balance sheet.

Dividend distribution negative retained earnings how to make a lot of

Recording dividends payable begins with the board of directors’ declaration, creating a legal. Paying the dividends reduces the amount. Before dividends are paid, there is no impact on the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Dividends in the balance sheet.

Dividend Paid Double Entry

Dividends in the balance sheet. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Before dividends are paid, there is no impact on the balance sheet. Paying the dividends reduces the amount. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are.

Balance Sheet Dividends

Dividends in the balance sheet. Before dividends are paid, there is no impact on the balance sheet. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Paying the dividends reduces the amount. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are.

How are dividends payable reported in the financial statements? Leia

Recording dividends payable begins with the board of directors’ declaration, creating a legal. Dividends in the balance sheet. Paying the dividends reduces the amount. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Before dividends are paid, there is no impact on the balance sheet.

Balance Sheet Dividends

Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Dividends in the balance sheet. Before dividends are paid, there is no impact on the balance sheet. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Paying the dividends reduces the amount.

Cool Net Balance Sheet Formula Profit And Loss Adjustment

Dividends in the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are. Before dividends are paid, there is no impact on the balance sheet. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Paying the dividends reduces the amount.

Dividends Payable Is Classified As A Current Liability On The Balance Sheet, Since The Expense Represents Declared Payments To Shareholders That Are.

Paying the dividends reduces the amount. Dividends in the balance sheet. Recording dividends payable begins with the board of directors’ declaration, creating a legal. Before dividends are paid, there is no impact on the balance sheet.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)