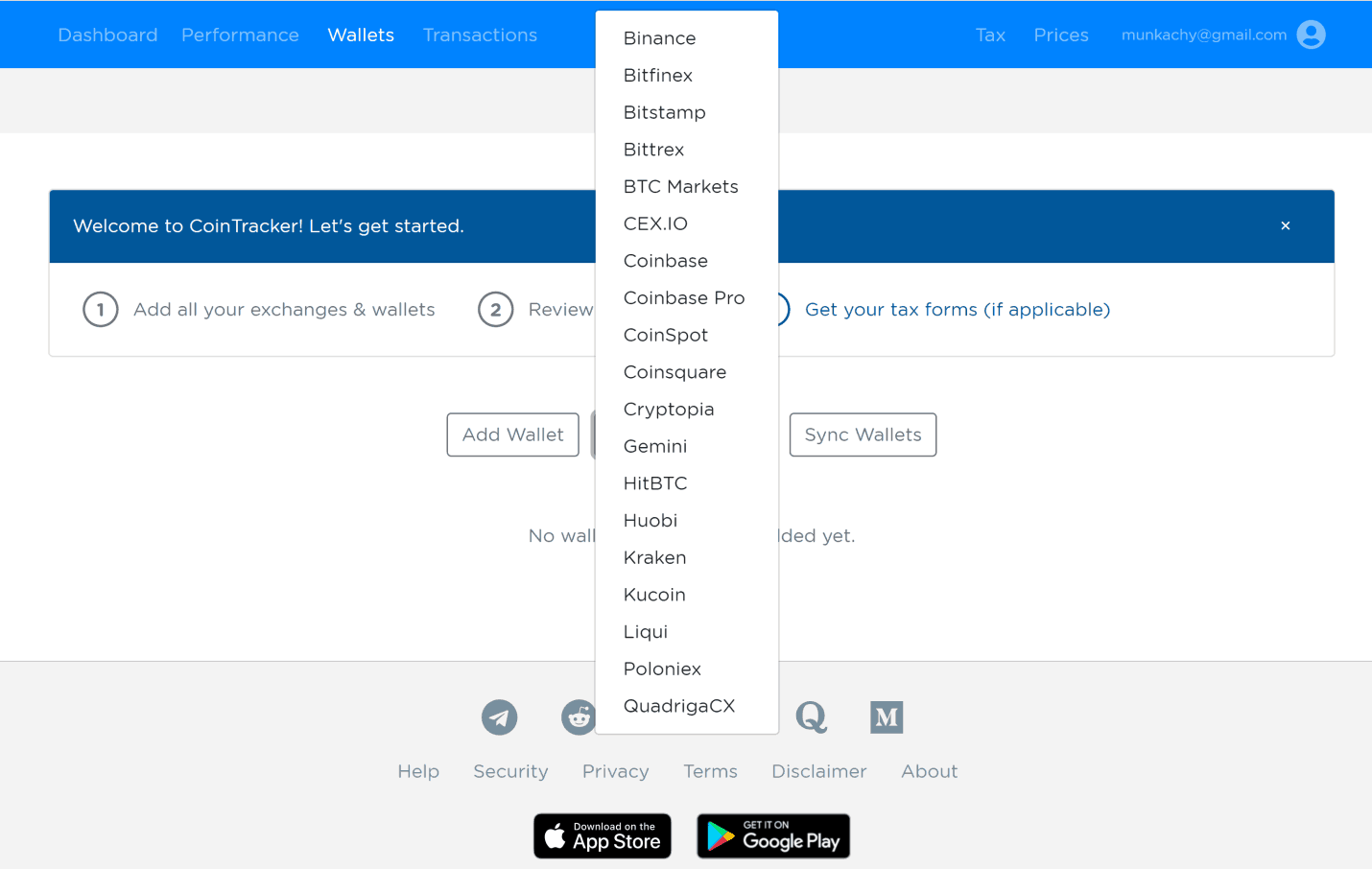

Cointracker Form 8949

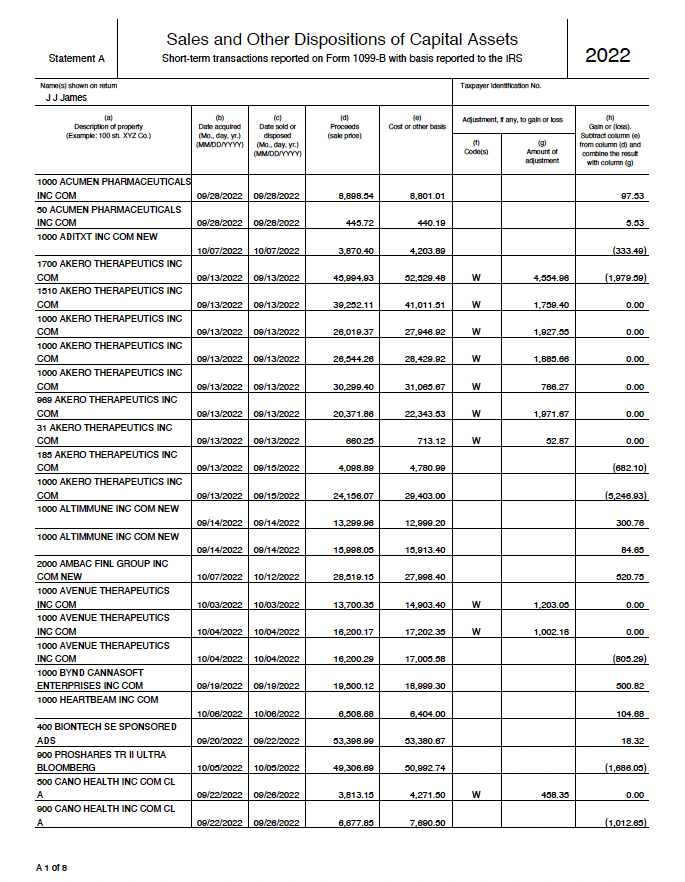

Cointracker Form 8949 - Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 sales of capital assets: This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 is used to report your cryptocurrency capital gains and losses. The irs uses information reported.

The irs uses information reported. Form 8949 is used to report your cryptocurrency capital gains and losses. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 sales of capital assets:

This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 sales of capital assets: Form 8949 is used to report your cryptocurrency capital gains and losses. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. The irs uses information reported. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto.

CoinTracker And H&R Block Integration H&R Block

Form 8949 is used to report your cryptocurrency capital gains and losses. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Cointracker, on the other hand, generates a.

Using TurboTax or CoinTracker to report on cryptocurrency Coinbase Help

The irs uses information reported. Form 8949 is used to report your cryptocurrency capital gains and losses. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 sales of capital assets: This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan.

What Crypto Tax Forms Should I File?

Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. The irs uses information reported. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. This guide covers the various ways you.

CoinTracker Benefits of a crypto tax form generator Cryptopolitan

Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 is used to report your cryptocurrency capital gains and losses. Cointracker, on the other hand, generates a.

Form 8949 Exception 2 When Electronically Filing Form 1040

The irs uses information reported. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 is used to report your cryptocurrency capital gains and losses. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949, schedule d, schedule 1, schedule a,.

Unable to generate 8949 tax form but able to generate other tax forms

Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Form.

Three Tax Forms Crypto Users Must File With the IRS

The irs uses information reported. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. This guide covers the various ways you.

What Crypto Tax Forms Should I File?

Form 8949 is used to report your cryptocurrency capital gains and losses. The irs uses information reported. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the.

2022 IRS Form 8949 Not Received Bugs CoinTracker

The irs uses information reported. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs.

Tax Center and form IRS 8949 have different values for capital gains

This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 is used to report your cryptocurrency capital gains and losses. The irs uses information reported.

The Irs Uses Information Reported.

Form 8949 is used to report your cryptocurrency capital gains and losses. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto.