Can Irs Debt Be Discharged In Chapter 11

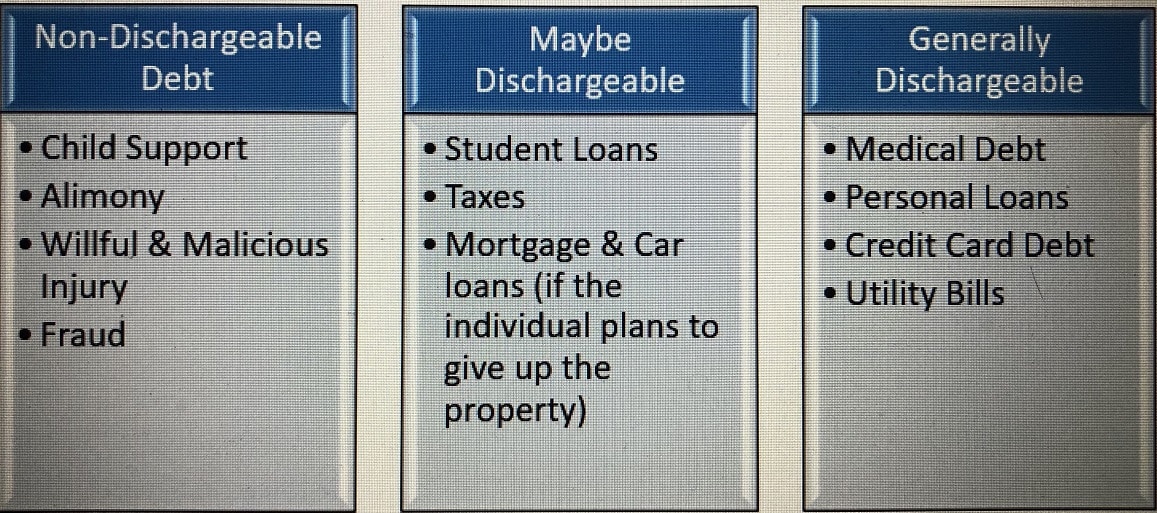

Can Irs Debt Be Discharged In Chapter 11 - What debts can be discharged in a chapter 11 bankruptcy? If you successfully complete your bankruptcy plan you will receive a discharge of debt. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. A discharge releases you (the debtor). In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). Certain taxes are not discharged, such as trust. In a business chapter 11, the debtor receives a discharge upon confirmation of the. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Sometimes penalties are discharged but not the taxes for the late filing of a tax return.

Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Sometimes penalties are discharged but not the taxes for the late filing of a tax return. If you successfully complete your bankruptcy plan you will receive a discharge of debt. What debts can be discharged in a chapter 11 bankruptcy? In a business chapter 11, the debtor receives a discharge upon confirmation of the. A discharge releases you (the debtor). In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). Certain taxes are not discharged, such as trust.

What debts can be discharged in a chapter 11 bankruptcy? In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. In a business chapter 11, the debtor receives a discharge upon confirmation of the. In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). Certain taxes are not discharged, such as trust. A discharge releases you (the debtor). Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. If you successfully complete your bankruptcy plan you will receive a discharge of debt.

Can You File Bankruptcy On IRS Debt?

Sometimes penalties are discharged but not the taxes for the late filing of a tax return. Certain taxes are not discharged, such as trust. What debts can be discharged in a chapter 11 bankruptcy? A discharge releases you (the debtor). In a business chapter 11, the debtor receives a discharge upon confirmation of the.

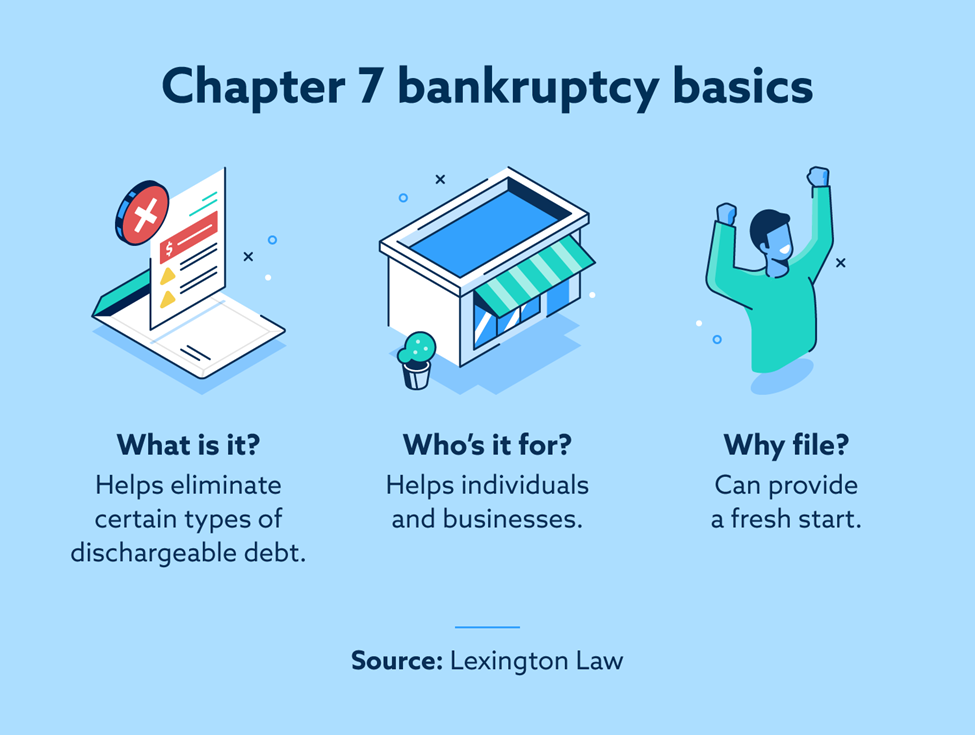

Does Chapter 7 wipe out all debt? Leia aqui What debts are not

In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). Sometimes penalties are discharged but not the taxes for the late filing of a tax return. What debts can be discharged in a chapter 11 bankruptcy? In a business chapter 11, the debtor receives a discharge upon confirmation of the..

Can I Qualify for IRS Debt in Bankruptcy? OakTree Law

What debts can be discharged in a chapter 11 bankruptcy? In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In a business chapter 11, the debtor receives a discharge upon confirmation of the. Sometimes penalties.

Chapter 7 Bankruptcy 24 Hour Legal Advice Ask A Lawyer Live Chat

Certain taxes are not discharged, such as trust. A discharge releases you (the debtor). Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In a business chapter 11, the debtor receives a discharge upon confirmation of the. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter.

Chapter 13 Bankruptcy Can IRS Debt be Discharged? Internal Revenue

A discharge releases you (the debtor). In a business chapter 11, the debtor receives a discharge upon confirmation of the. Certain taxes are not discharged, such as trust. What debts can be discharged in a chapter 11 bankruptcy? Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities.

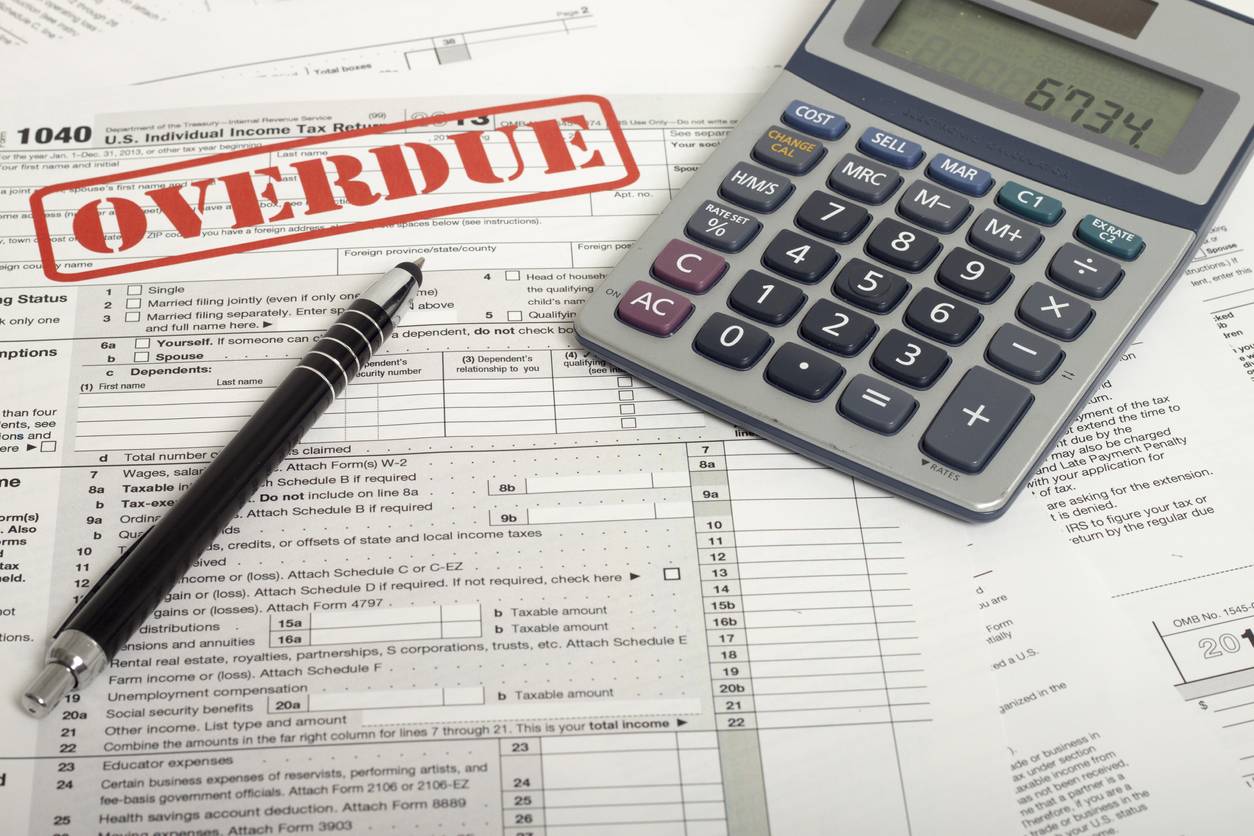

Can back taxes be discharged in chapter 7?

If you successfully complete your bankruptcy plan you will receive a discharge of debt. A discharge releases you (the debtor). In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). What.

Using Chapter 13 to Deal With Overdue Taxes

A discharge releases you (the debtor). In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. In a business chapter 11, the debtor receives a discharge upon confirmation of the. In order to be dischargeable, the.

Can your IRS debts expire?

In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). Certain taxes are not discharged, such as trust. What debts can be discharged in a chapter 11 bankruptcy? In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. In a business.

Understanding Debt Discharge in Chapter 7 Bankruptcy What Can and

Certain taxes are not discharged, such as trust. In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Sometimes penalties are discharged but not the taxes for the late filing of a tax return. In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc §.

Can IRS debt be discharged in Chapter 13?

In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). A discharge releases you (the debtor). What debts can be discharged in a chapter 11 bankruptcy? If you successfully complete your bankruptcy plan you will receive a discharge of debt. Certain taxes are not discharged, such as trust.

Certain Taxes Are Not Discharged, Such As Trust.

If you successfully complete your bankruptcy plan you will receive a discharge of debt. In order to be dischargeable, the tax debt must meet the rules outlined in 11 usc § 523(a)(1) and 507(a)(8). A discharge releases you (the debtor). Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities.

In A Business Chapter 11, The Debtor Receives A Discharge Upon Confirmation Of The.

What debts can be discharged in a chapter 11 bankruptcy? In some situations, the irs considers canceled debt taxable income, but not in the case of chapter 11 bankruptcy. Sometimes penalties are discharged but not the taxes for the late filing of a tax return.