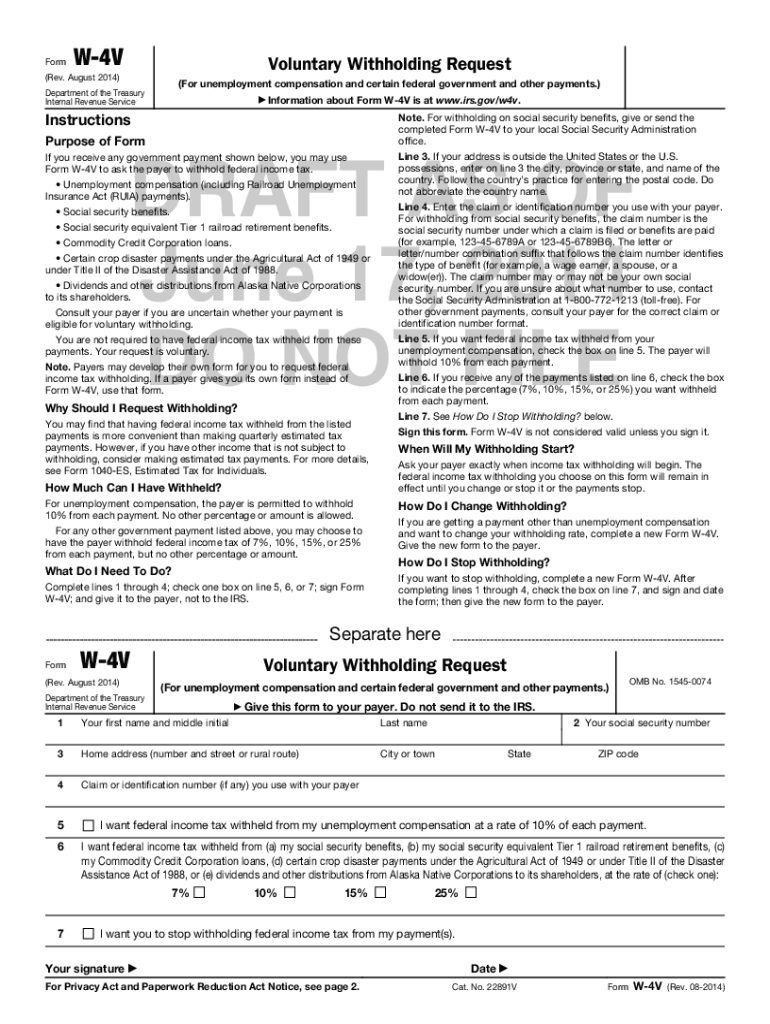

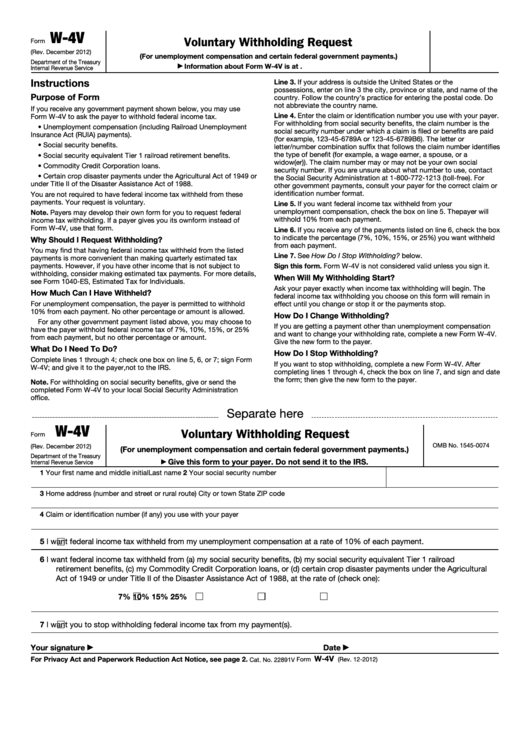

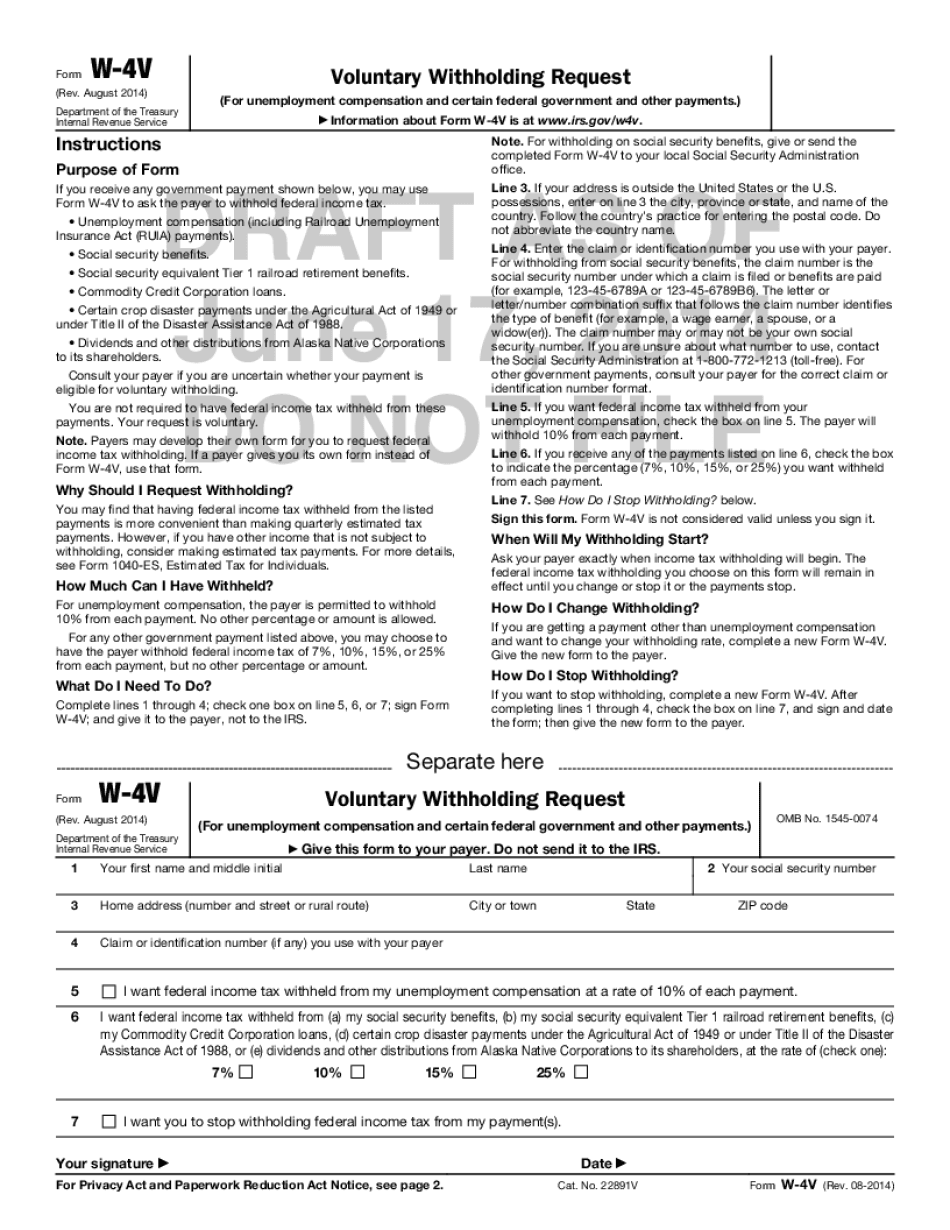

Can I File Form W 4V Online

Can I File Form W 4V Online - Voluntary withholding request from the irs' website. Use this form to ask payers to withhold federal income tax from certain government payments. You have to complete the form manually and return it to your local social. Then, find the social security office closest to your. Voluntary withholding request from the irs' website. Then, find the social security office closest to your home and.

Use this form to ask payers to withhold federal income tax from certain government payments. You have to complete the form manually and return it to your local social. Voluntary withholding request from the irs' website. Then, find the social security office closest to your. Voluntary withholding request from the irs' website. Then, find the social security office closest to your home and.

Then, find the social security office closest to your home and. Voluntary withholding request from the irs' website. Voluntary withholding request from the irs' website. You have to complete the form manually and return it to your local social. Then, find the social security office closest to your. Use this form to ask payers to withhold federal income tax from certain government payments.

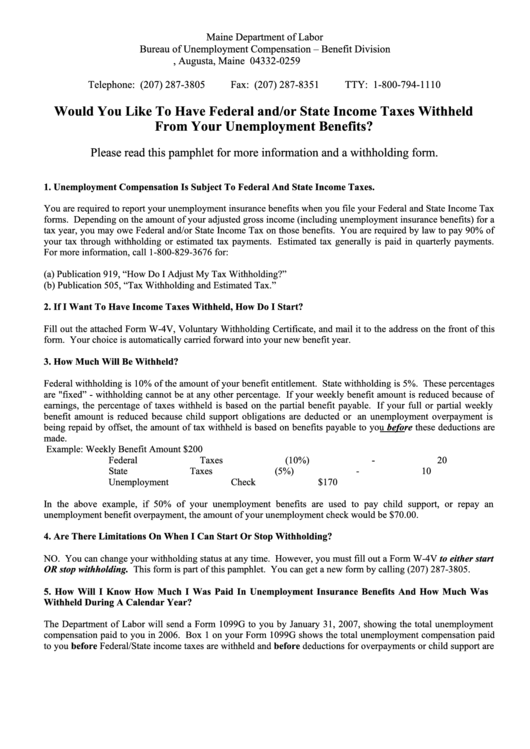

Fillable Online Form w 4v pdf. Form w 4v pdf. How to file form w4v

Then, find the social security office closest to your. Use this form to ask payers to withhold federal income tax from certain government payments. Voluntary withholding request from the irs' website. You have to complete the form manually and return it to your local social. Voluntary withholding request from the irs' website.

W4v Tax Form Complete with ease airSlate SignNow

Voluntary withholding request from the irs' website. You have to complete the form manually and return it to your local social. Then, find the social security office closest to your. Then, find the social security office closest to your home and. Voluntary withholding request from the irs' website.

Form W 4V Printable

Then, find the social security office closest to your home and. Then, find the social security office closest to your. Voluntary withholding request from the irs' website. Voluntary withholding request from the irs' website. Use this form to ask payers to withhold federal income tax from certain government payments.

Manage Documents Using Our Editable Form For Form W 4v

Then, find the social security office closest to your home and. Voluntary withholding request from the irs' website. Then, find the social security office closest to your. You have to complete the form manually and return it to your local social. Voluntary withholding request from the irs' website.

Form W4V template ONLYOFFICE

Use this form to ask payers to withhold federal income tax from certain government payments. Then, find the social security office closest to your. Voluntary withholding request from the irs' website. Voluntary withholding request from the irs' website. Then, find the social security office closest to your home and.

Printable W4V Form 2022 W4 Form

You have to complete the form manually and return it to your local social. Use this form to ask payers to withhold federal income tax from certain government payments. Then, find the social security office closest to your home and. Voluntary withholding request from the irs' website. Voluntary withholding request from the irs' website.

Form W 4V Printable

Use this form to ask payers to withhold federal income tax from certain government payments. Then, find the social security office closest to your. You have to complete the form manually and return it to your local social. Voluntary withholding request from the irs' website. Voluntary withholding request from the irs' website.

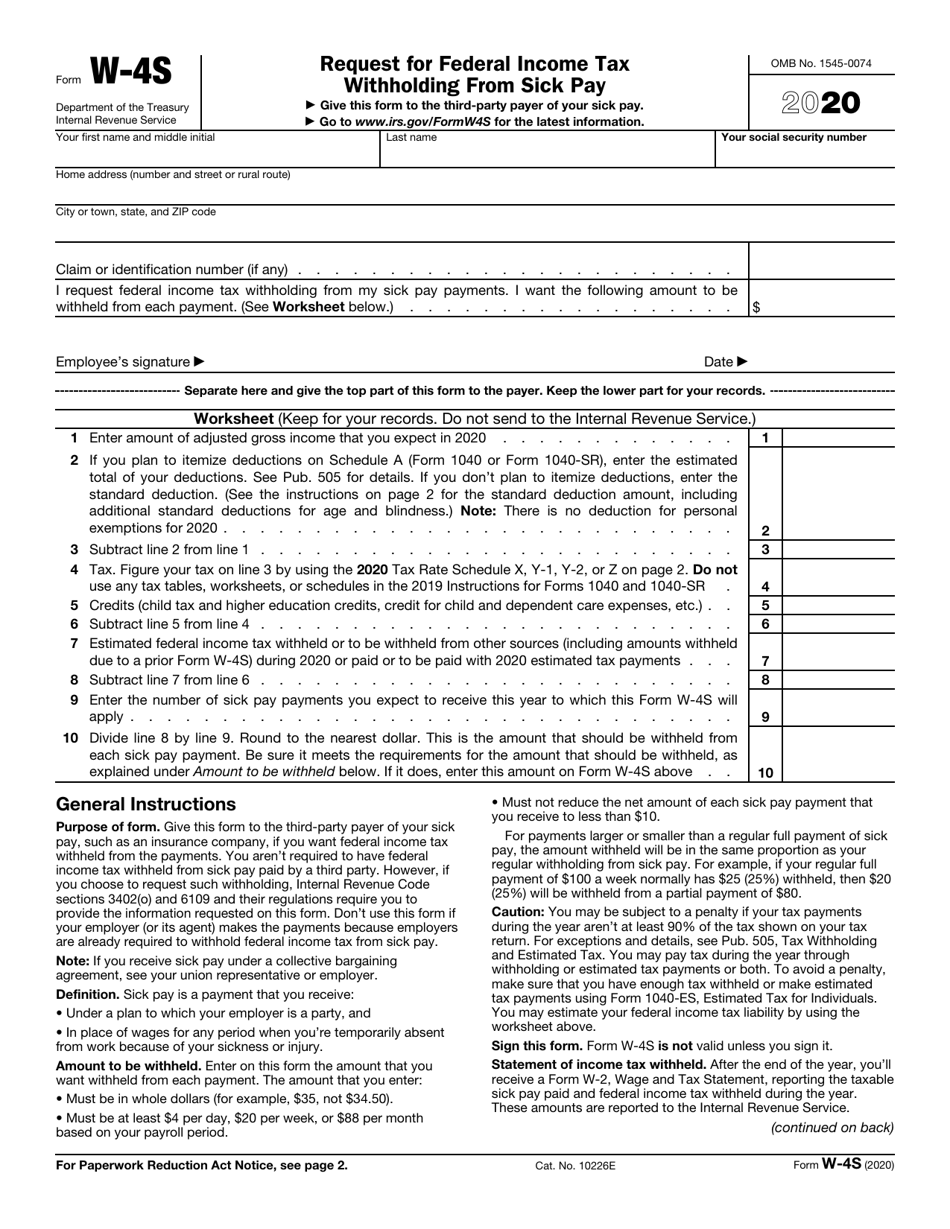

IRS Form W4S 2020 Fill Out, Sign Online and Download Fillable PDF

Then, find the social security office closest to your. Voluntary withholding request from the irs' website. Use this form to ask payers to withhold federal income tax from certain government payments. You have to complete the form manually and return it to your local social. Then, find the social security office closest to your home and.

W4V Printable Form

Voluntary withholding request from the irs' website. You have to complete the form manually and return it to your local social. Voluntary withholding request from the irs' website. Then, find the social security office closest to your. Use this form to ask payers to withhold federal income tax from certain government payments.

W4V Voluntary Tax Withholding form Social Security YouTube

Voluntary withholding request from the irs' website. Use this form to ask payers to withhold federal income tax from certain government payments. You have to complete the form manually and return it to your local social. Voluntary withholding request from the irs' website. Then, find the social security office closest to your.

You Have To Complete The Form Manually And Return It To Your Local Social.

Use this form to ask payers to withhold federal income tax from certain government payments. Voluntary withholding request from the irs' website. Then, find the social security office closest to your home and. Then, find the social security office closest to your.