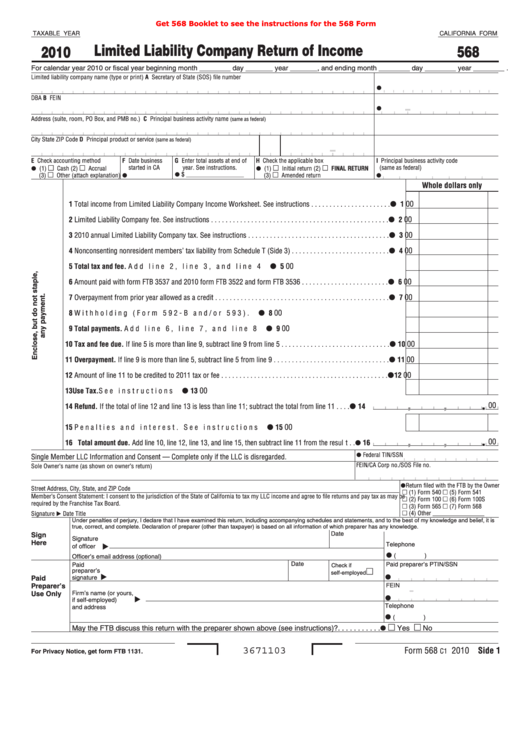

California Llc Tax Form 568

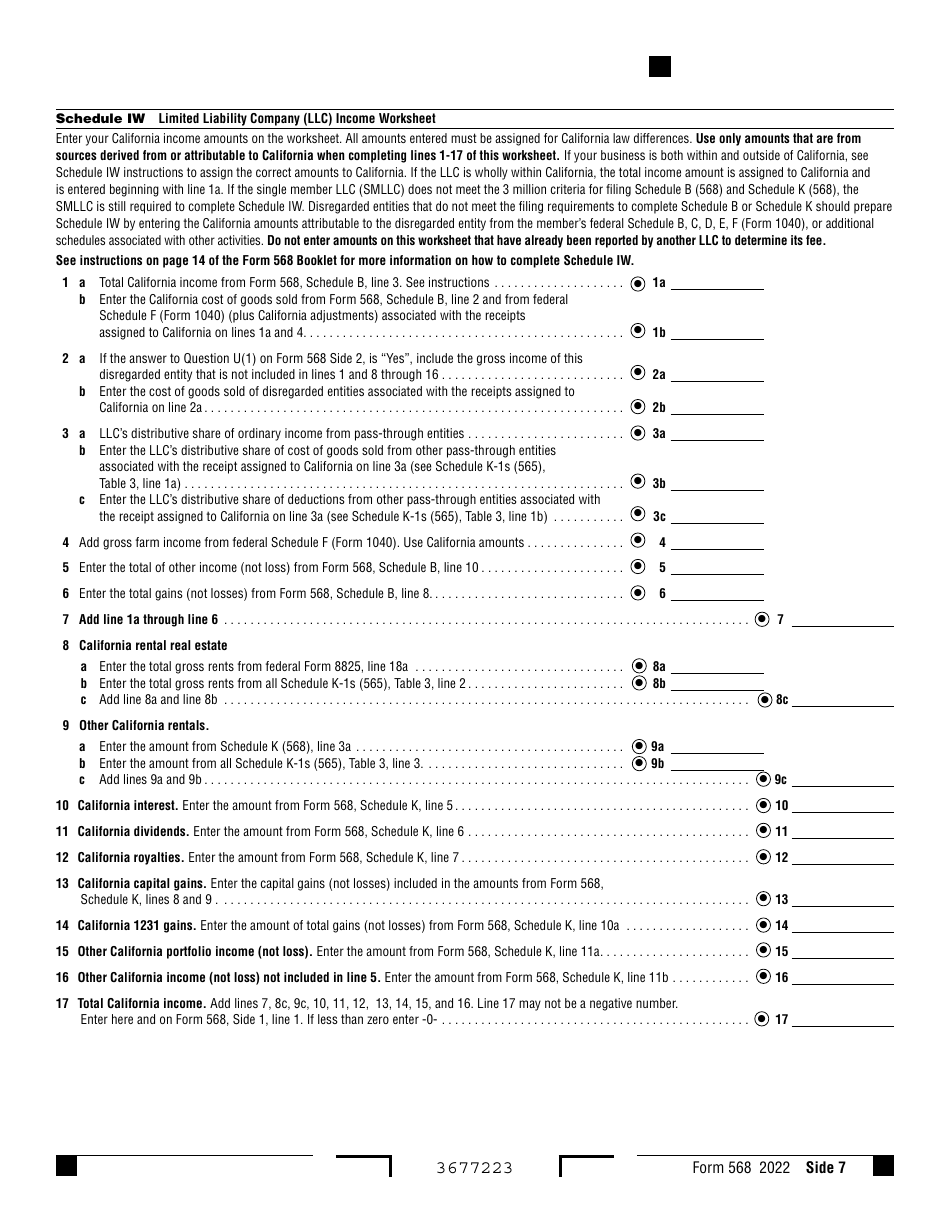

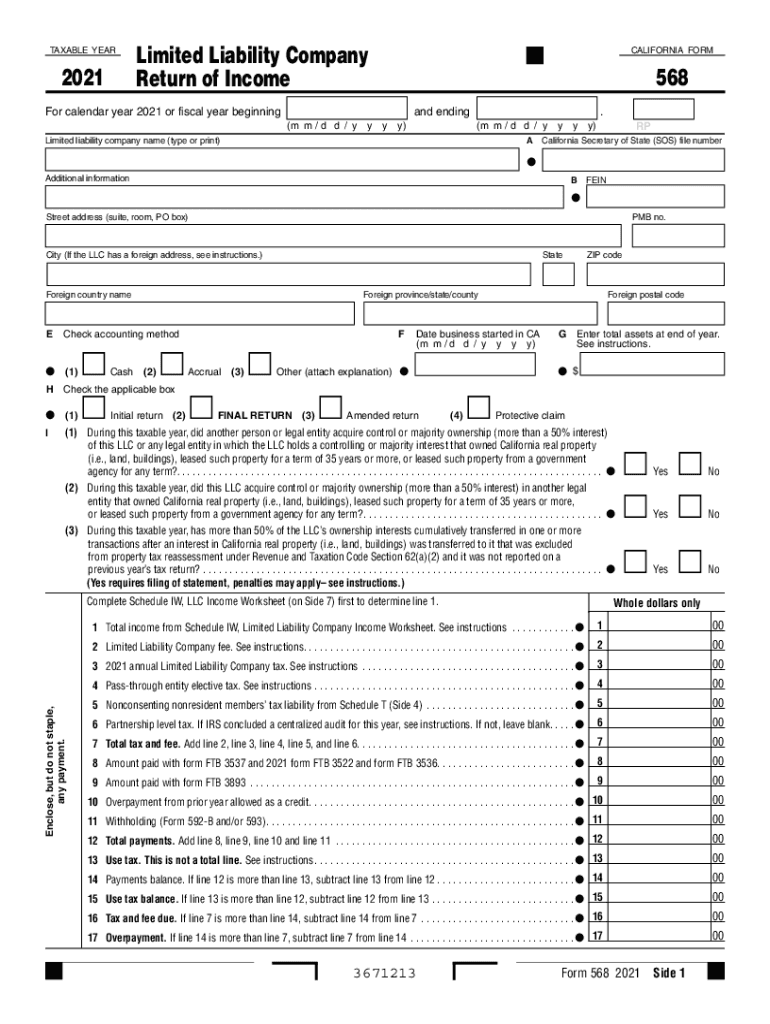

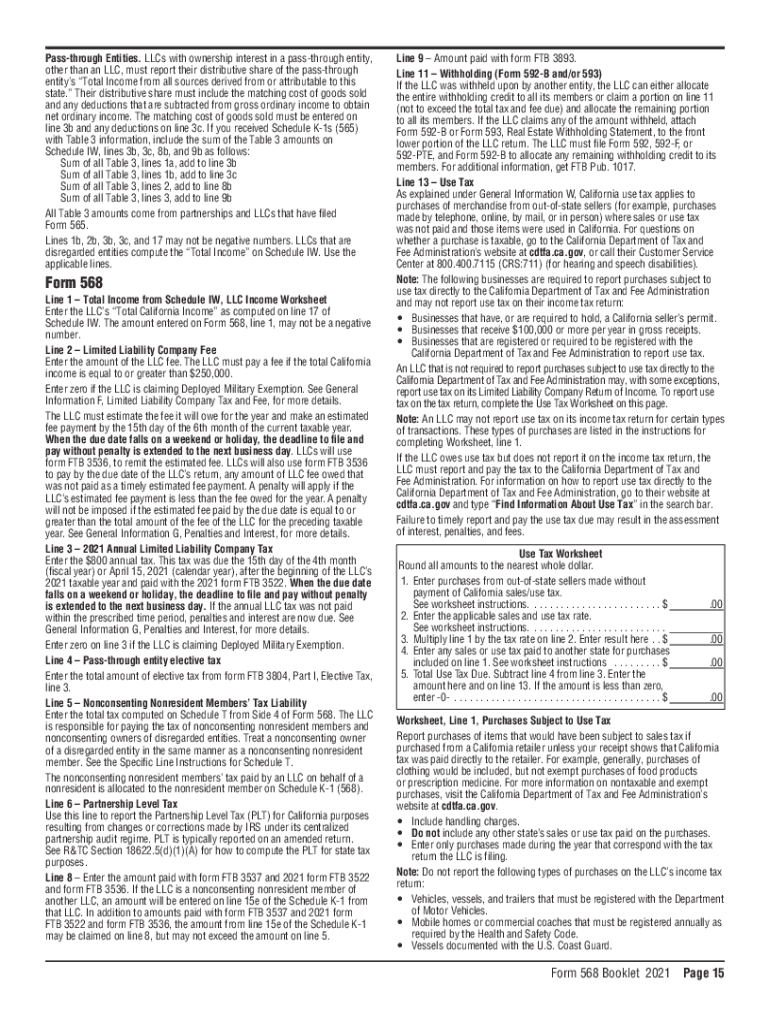

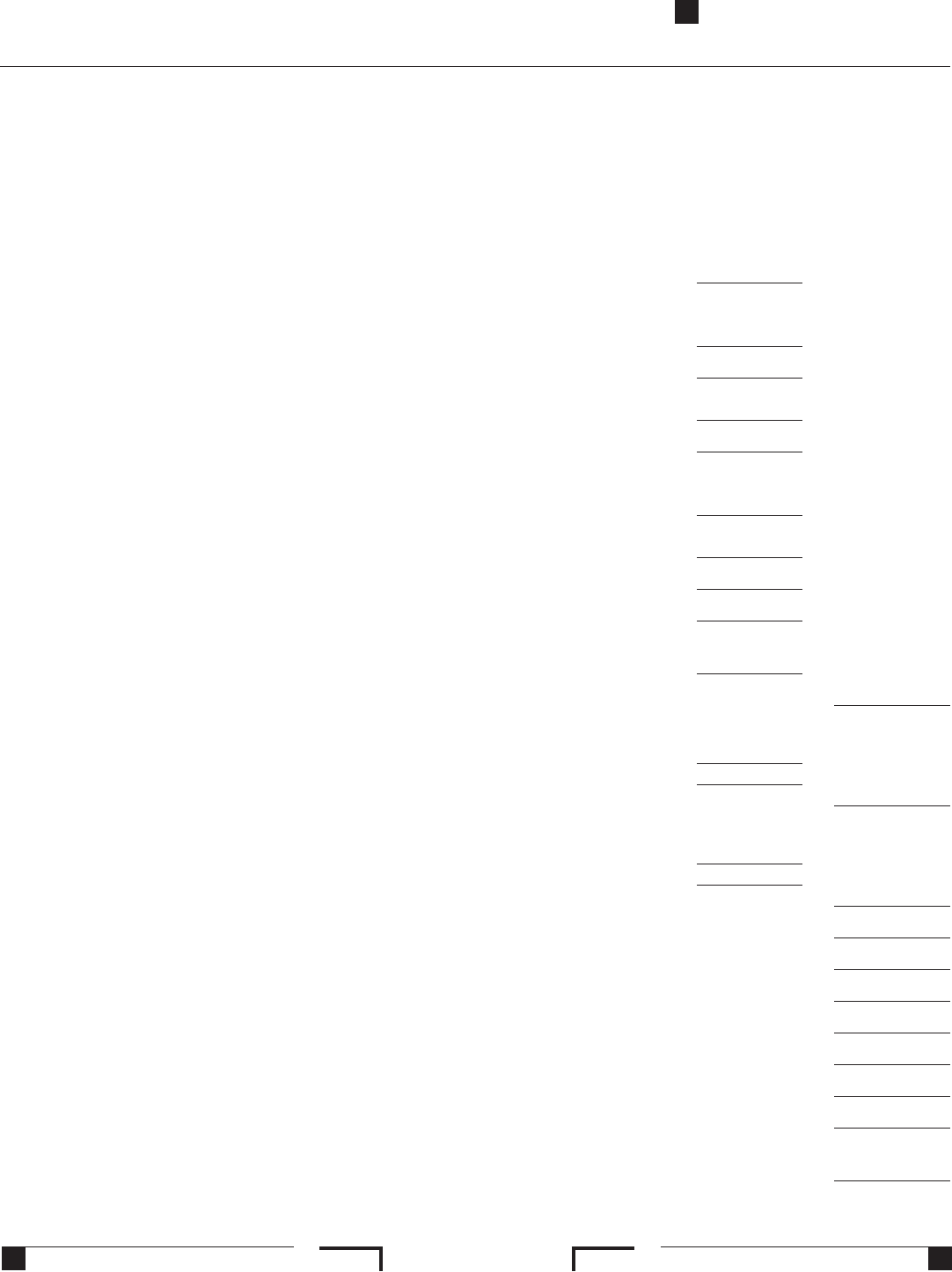

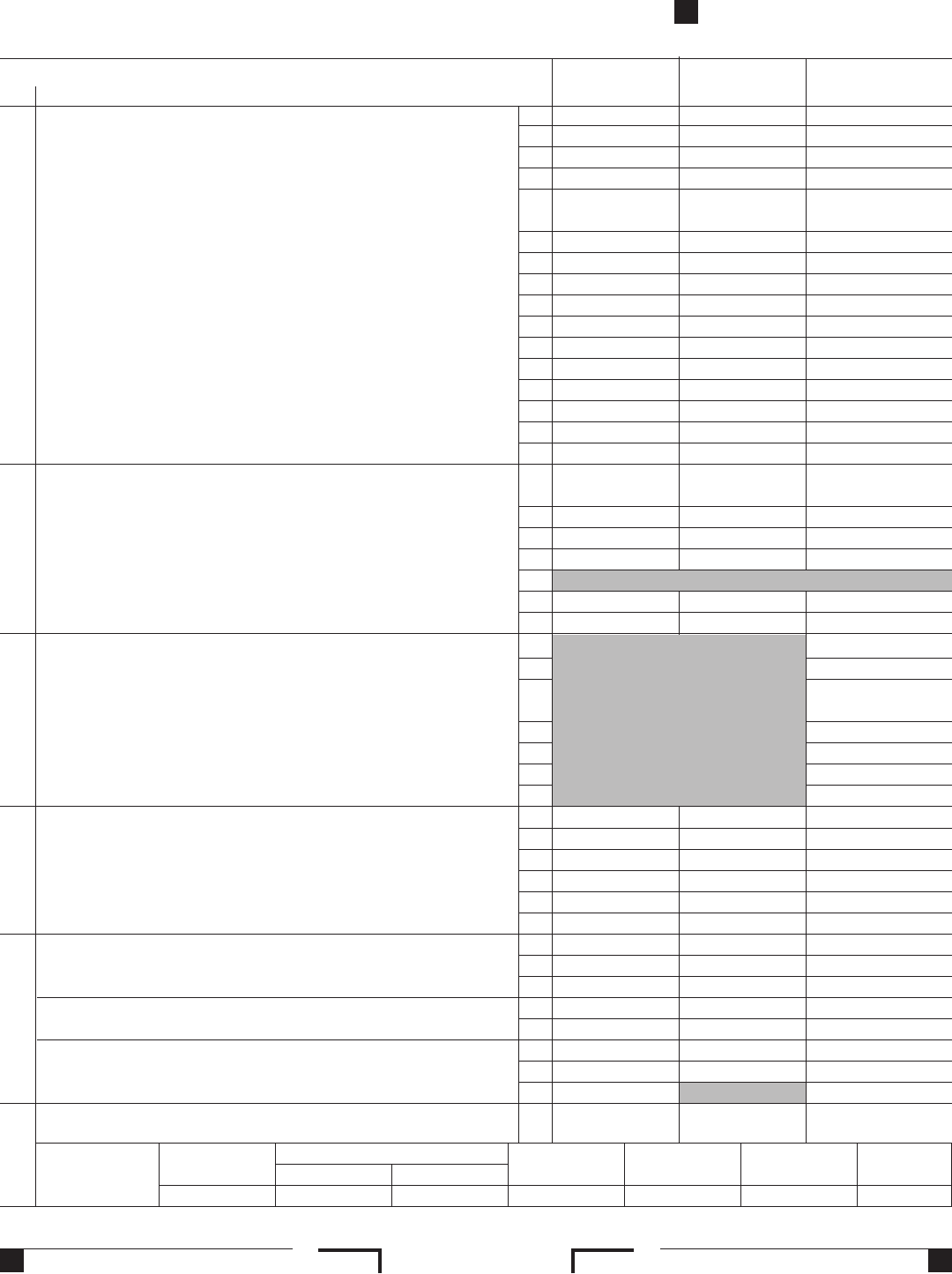

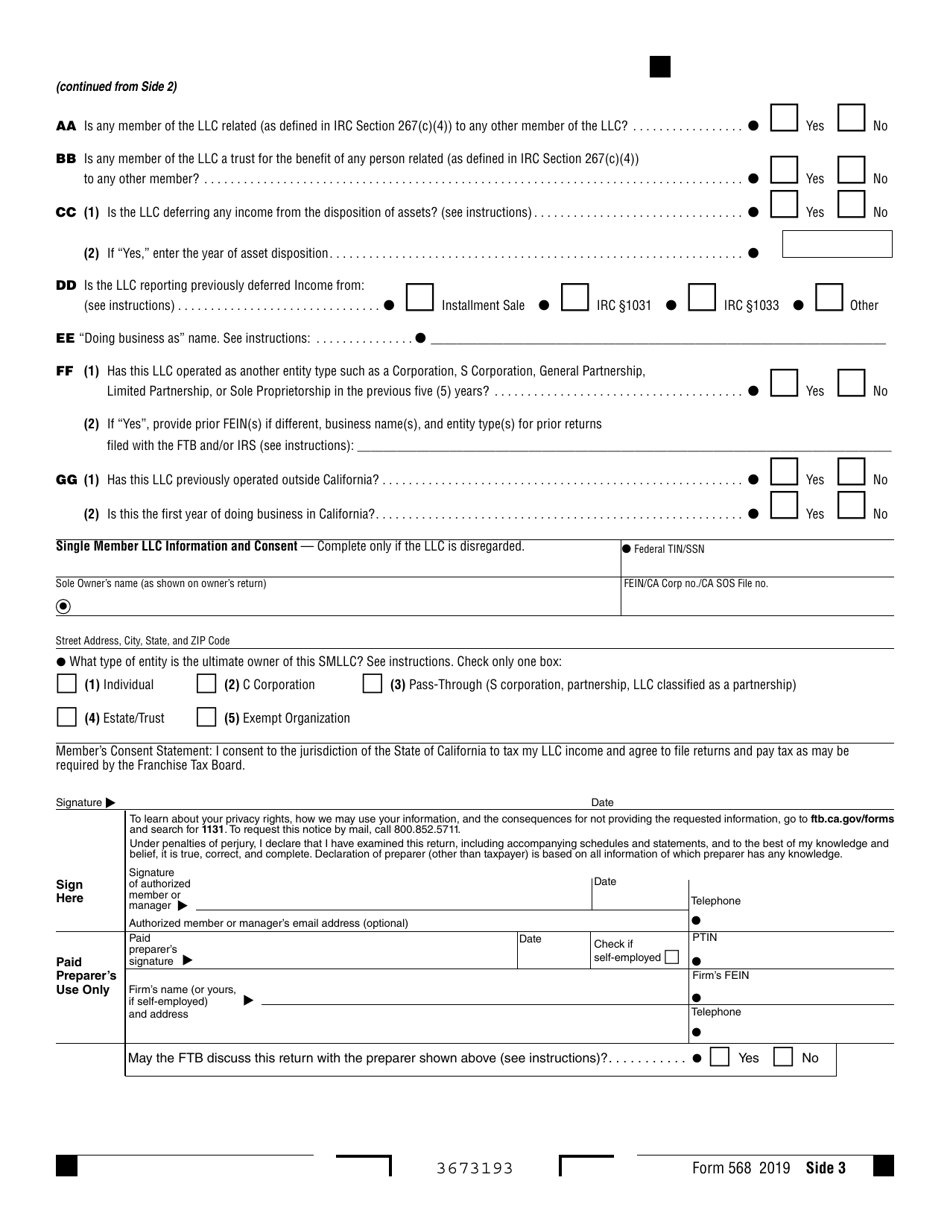

California Llc Tax Form 568 - The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. 2022 instructions for form 568, limited liability company return of income. This filing will take into account. References in these instructions are to the internal revenue code. Every year, your california llc will have to file an llc return of income (form 568). An llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. Limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority.

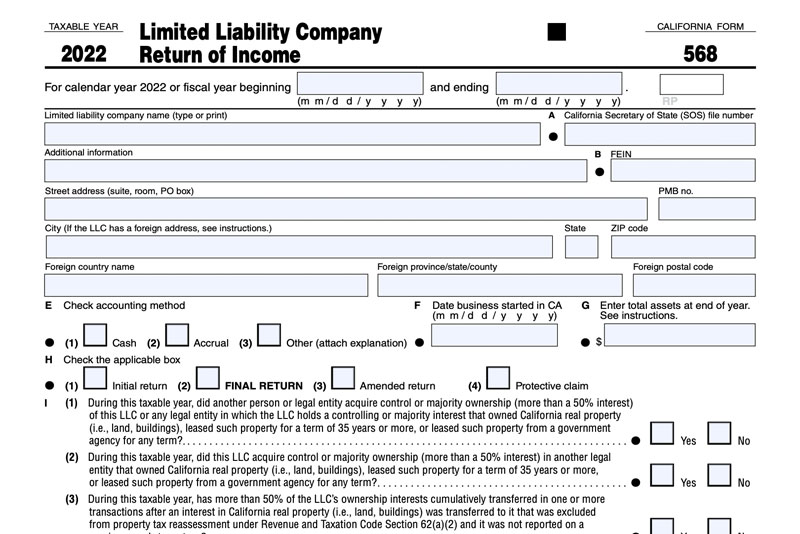

2022 instructions for form 568, limited liability company return of income. Limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. This filing will take into account. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. Every year, your california llc will have to file an llc return of income (form 568). An llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an. References in these instructions are to the internal revenue code.

This filing will take into account. 2022 instructions for form 568, limited liability company return of income. References in these instructions are to the internal revenue code. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. An llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an. Every year, your california llc will have to file an llc return of income (form 568). Limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total.

Form 568 Download Fillable PDF or Fill Online Limited Liability Company

Every year, your california llc will have to file an llc return of income (form 568). The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california.

Understanding California LLC Business Taxes A Friendly Guide

The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. An llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an. 2022 instructions for form 568, limited liability company return of.

2023 Form 568 Printable Forms Free Online

Every year, your california llc will have to file an llc return of income (form 568). 2022 instructions for form 568, limited liability company return of income. This filing will take into account. References in these instructions are to the internal revenue code. Limited liability company return of income i (1) during this taxable year, did another person or legal.

20212024 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank

You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. This filing will take into account. Limited liability company return.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

2022 instructions for form 568, limited liability company return of income. Every year, your california llc will have to file an llc return of income (form 568). The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. This filing will take into account. An llc must file.

2023 Form 568 Printable Forms Free Online

An llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an. References in these instructions are to the internal revenue code. This filing will take into account. Every year, your california llc will have to file an llc return of income (form 568). 2022.

Fillable California Form 568 Limited Liability Company Return Of

An llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. The llc income worksheet on form.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

This filing will take into account. Every year, your california llc will have to file an llc return of income (form 568). An llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an. The llc income worksheet on form 568, page 7 calculates according.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. Limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority. An llc must file form 568, pay any nonconsenting nonresident members’.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

2022 instructions for form 568, limited liability company return of income. References in these instructions are to the internal revenue code. Limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority. You must file form 568 if your llc is registered in california, even if it isn't actively.

An Llc Must File Form 568, Pay Any Nonconsenting Nonresident Members’ Tax, And Pay Any Amount Of The Llc Fee Owed That Was Not Paid As An.

The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. This filing will take into account. References in these instructions are to the internal revenue code.

Limited Liability Company Return Of Income I (1) During This Taxable Year, Did Another Person Or Legal Entity Acquire Control Or Majority.

Every year, your california llc will have to file an llc return of income (form 568). 2022 instructions for form 568, limited liability company return of income.