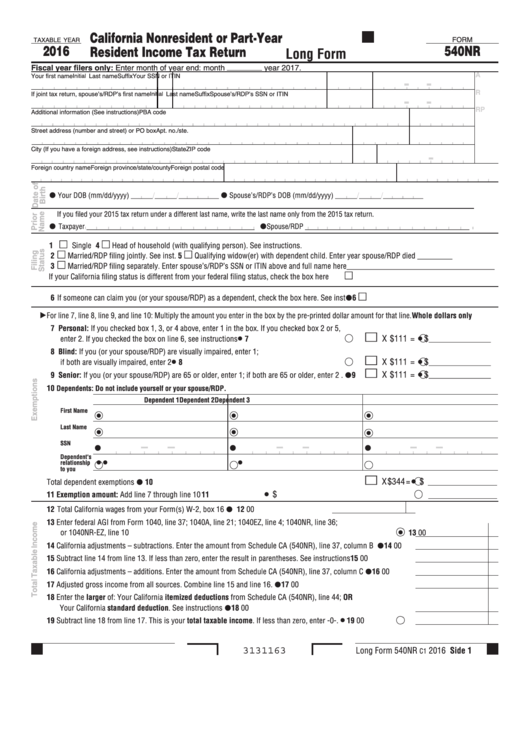

California Form 540Nr Instructions 2021

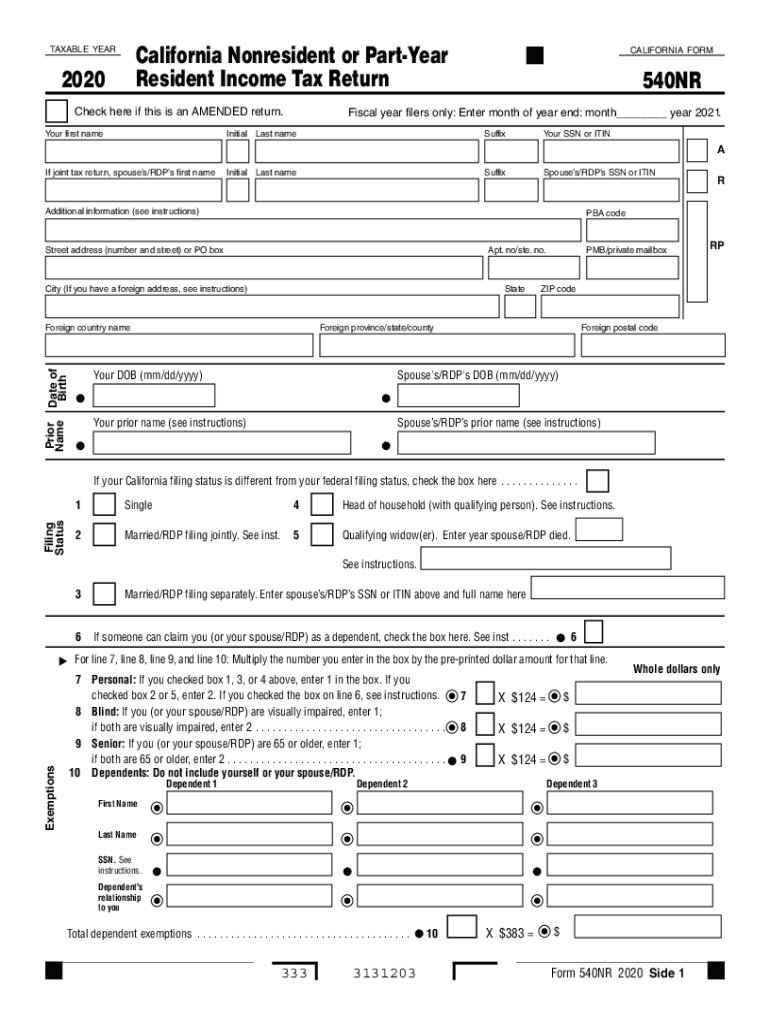

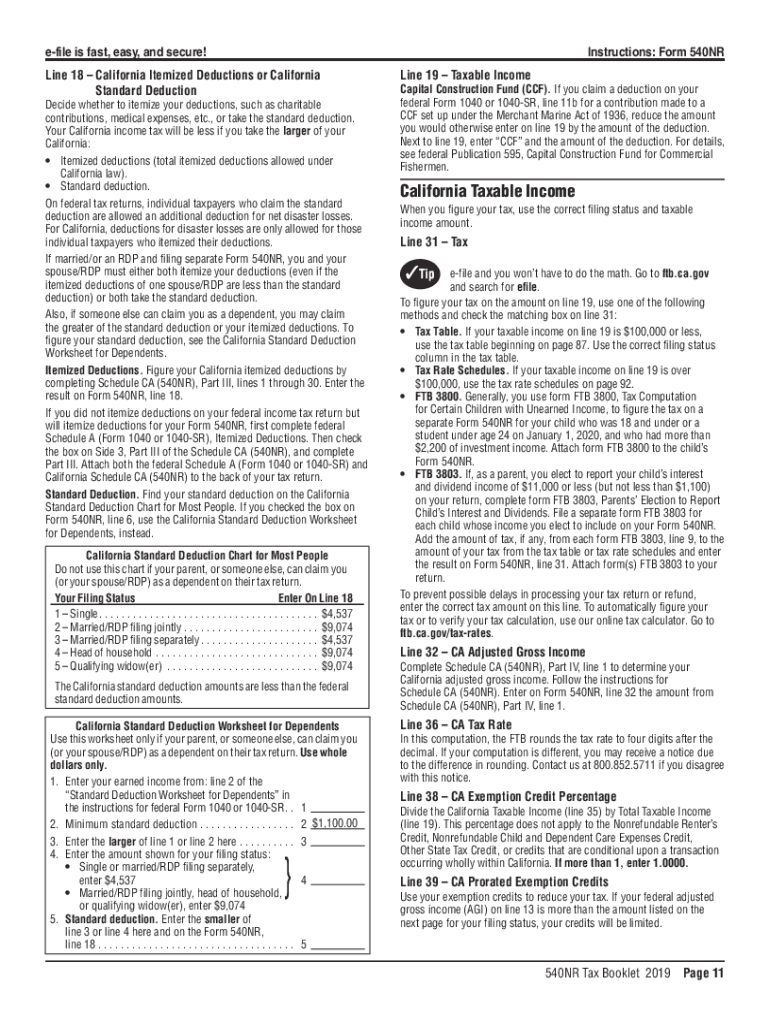

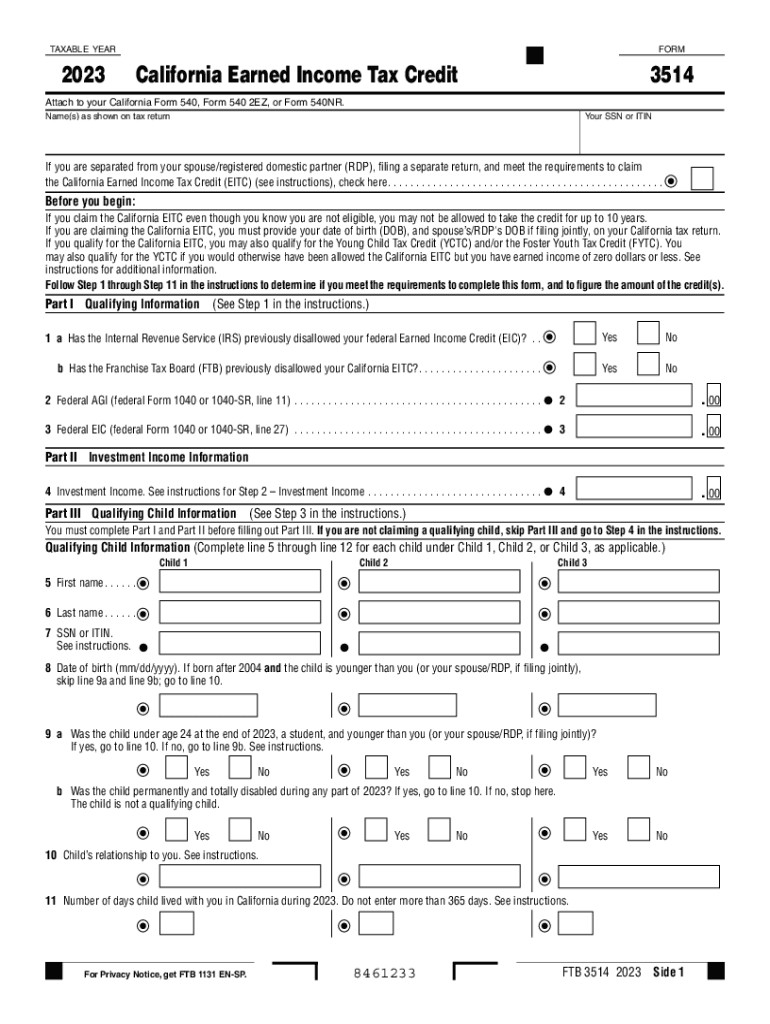

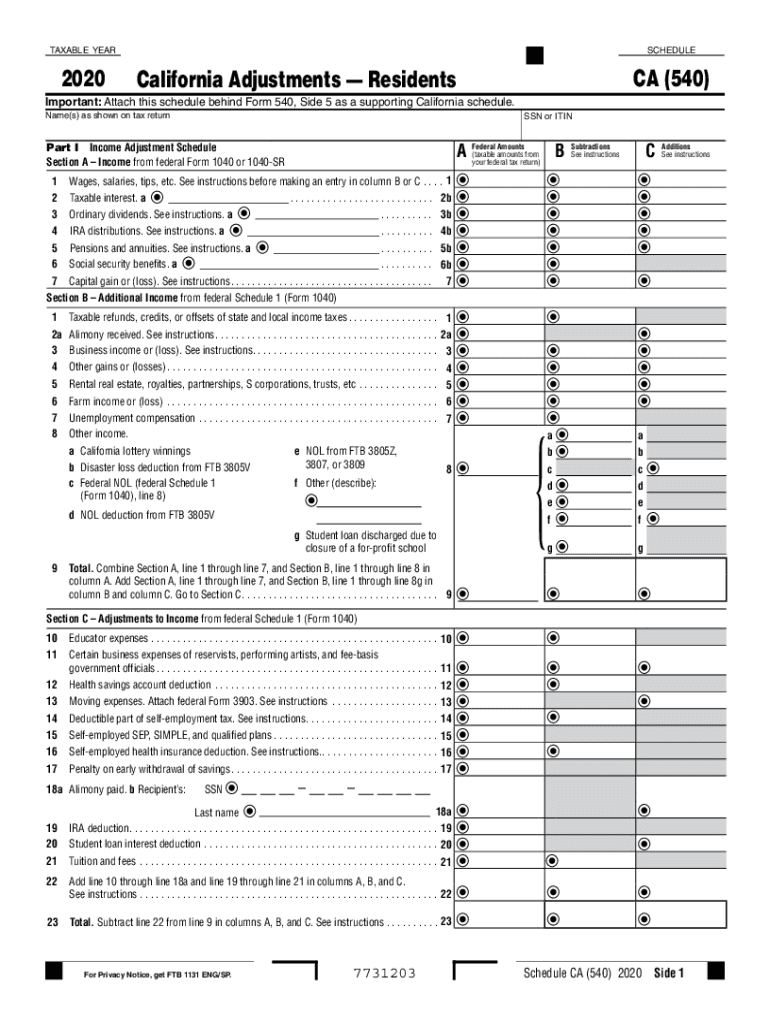

California Form 540Nr Instructions 2021 - Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. • see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. Or your california standard deduction. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Refund of excess state disability insurance.

Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. Refund of excess state disability insurance. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. • see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Or your california standard deduction. Your california itemized deductions from schedule ca (540nr), part iii, line 30;

Refund of excess state disability insurance. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. Your california itemized deductions from schedule ca (540nr), part iii, line 30; • see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Or your california standard deduction. Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs.

540nr 2021 Fill out & sign online DocHub

Or your california standard deduction. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. • see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions.

Year 20202024 Form Fill Out and Sign Printable PDF Template

• see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Eligible if resident for six months or more and agi from.

20192024 Form CA FTB 540NR Instructions Fill Online, Printable

Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. • see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Or your california standard deduction. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Refund of excess state disability insurance.

California State Tax Return Status Forms 540 & 540NR

Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. Or your california standard deduction. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Refund of.

California 540nr Fillable Form Printable Forms Free Online

• see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Or your california standard deduction. Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. Your california itemized deductions from schedule ca (540nr), part.

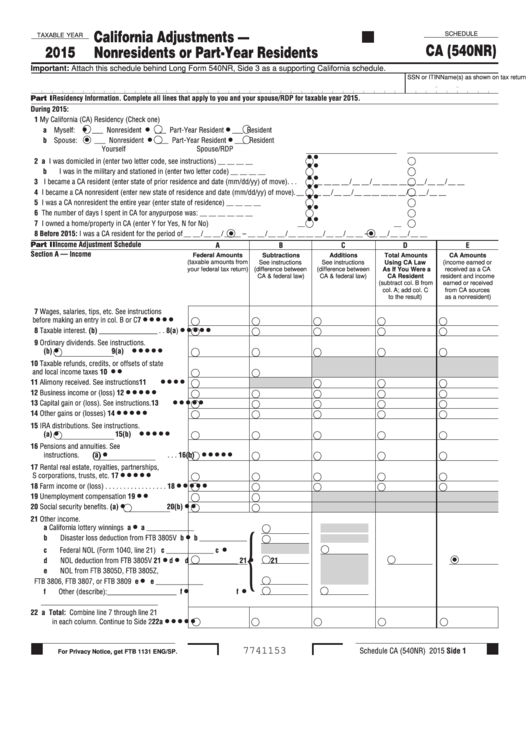

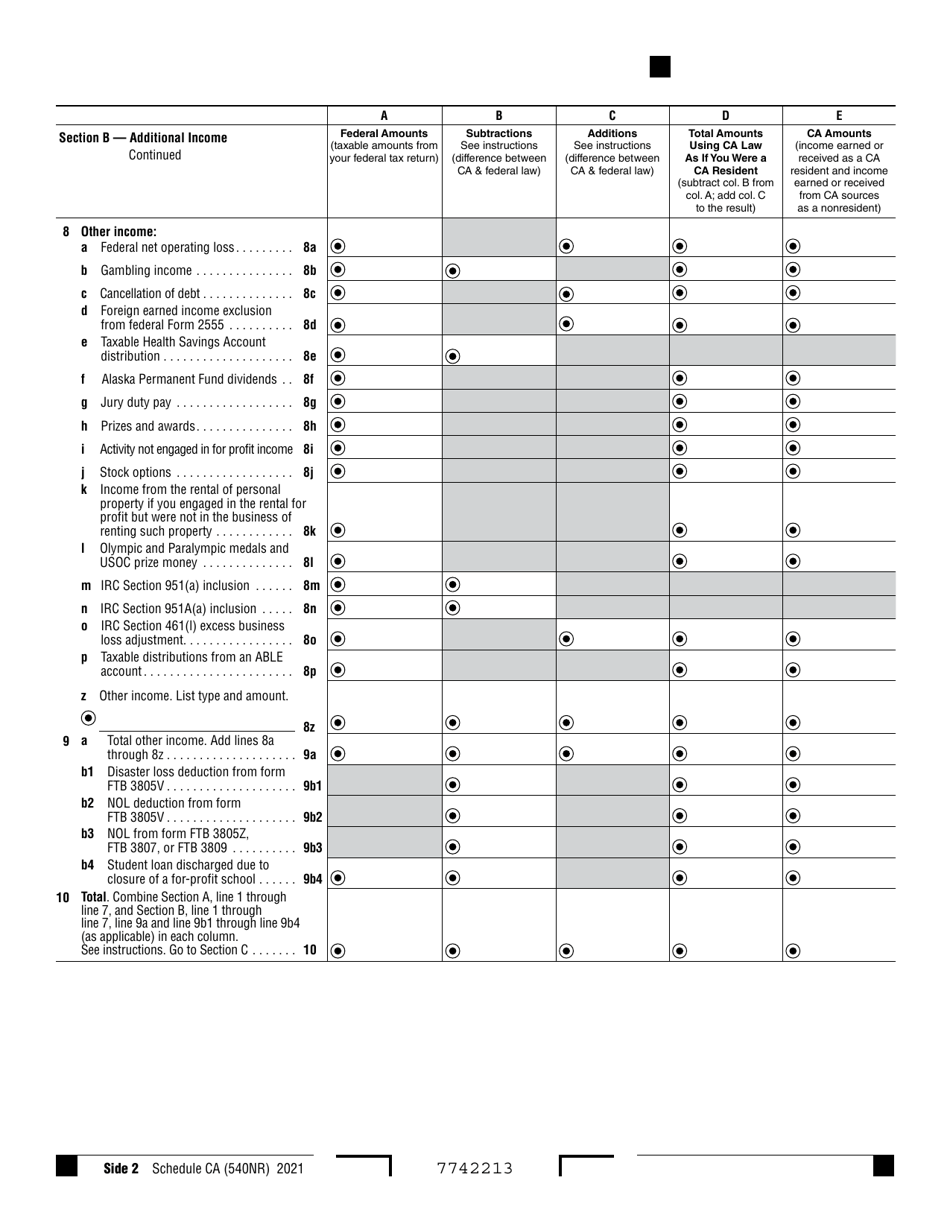

Form 540NR Schedule CA Download Fillable PDF or Fill Online California

Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. Or your california standard deduction. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. Your california itemized deductions from schedule ca (540nr), part iii, line 30; • see.

Fillable Online Solved Complete the 2021 tax return on form 540NR and

Refund of excess state disability insurance. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Or your california standard deduction. Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. • see form 540nr, line 18 instructions and worksheets for the amount.

20202022 Form CA FTB Schedule CA (540) Fill Online, Printable

Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. Or your california standard deduction. Refund of excess state disability insurance. • see form 540nr, line 18 instructions and.

Form 540nr California Nonresident Or PartYear Resident Tax

Your california itemized deductions from schedule ca (540nr), part iii, line 30; Or your california standard deduction. • see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514. Eligible if resident for six months.

How to File California Form 540NR for a PartYear Tax Resident YouTube

• see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Refund of excess state disability insurance. Or your california standard deduction. Instructions for form 540, california resident income tax return, line 76, and get form ftb 3514.

Instructions For Form 540, California Resident Income Tax Return, Line 76, And Get Form Ftb 3514.

Eligible if resident for six months or more and agi from all sources (form 540nr line 17) is $45,448 or less if single or mfs. Your california itemized deductions from schedule ca (540nr), part iii, line 30; Refund of excess state disability insurance. • see form 540nr, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim.