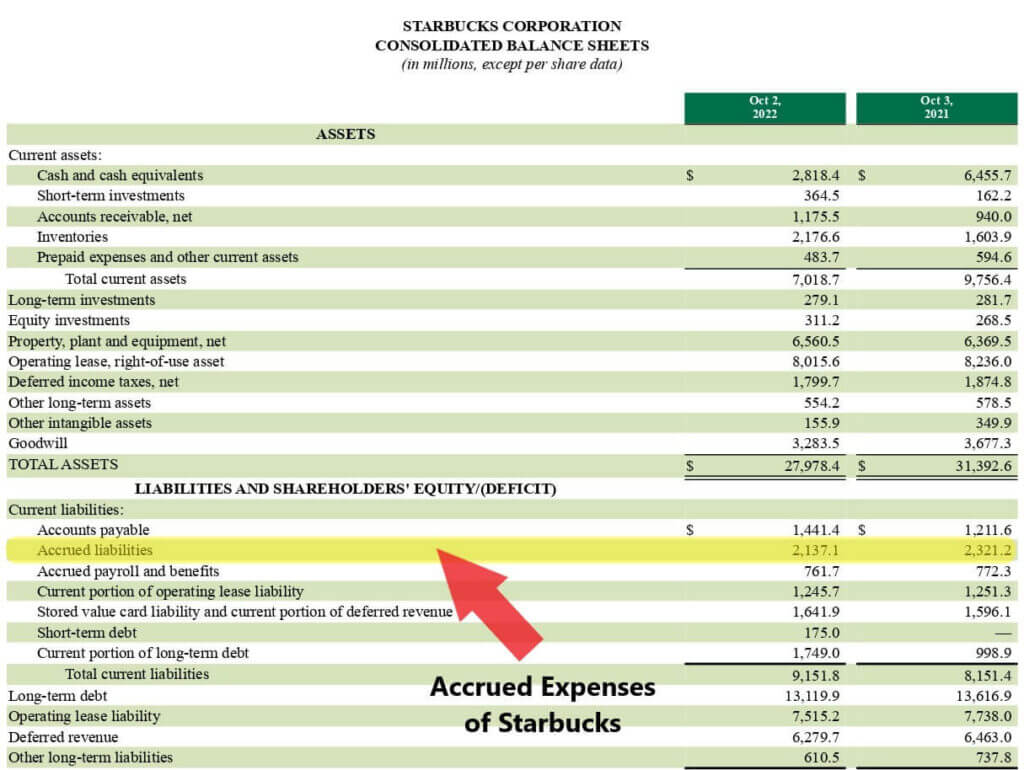

Accrued Expenses Are Ordinarily Reported On The Balance Sheet As

Accrued Expenses Are Ordinarily Reported On The Balance Sheet As - How much revenue should it record under the accrual basis of accounting? Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting?

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting? How much revenue should it record under the accrual basis of accounting? Which of the following is an example of an accrued expense?.

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting? How much revenue should it record under the accrual basis of accounting?

Accrued Expense Examples of Accrued Expenses

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting? Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting?

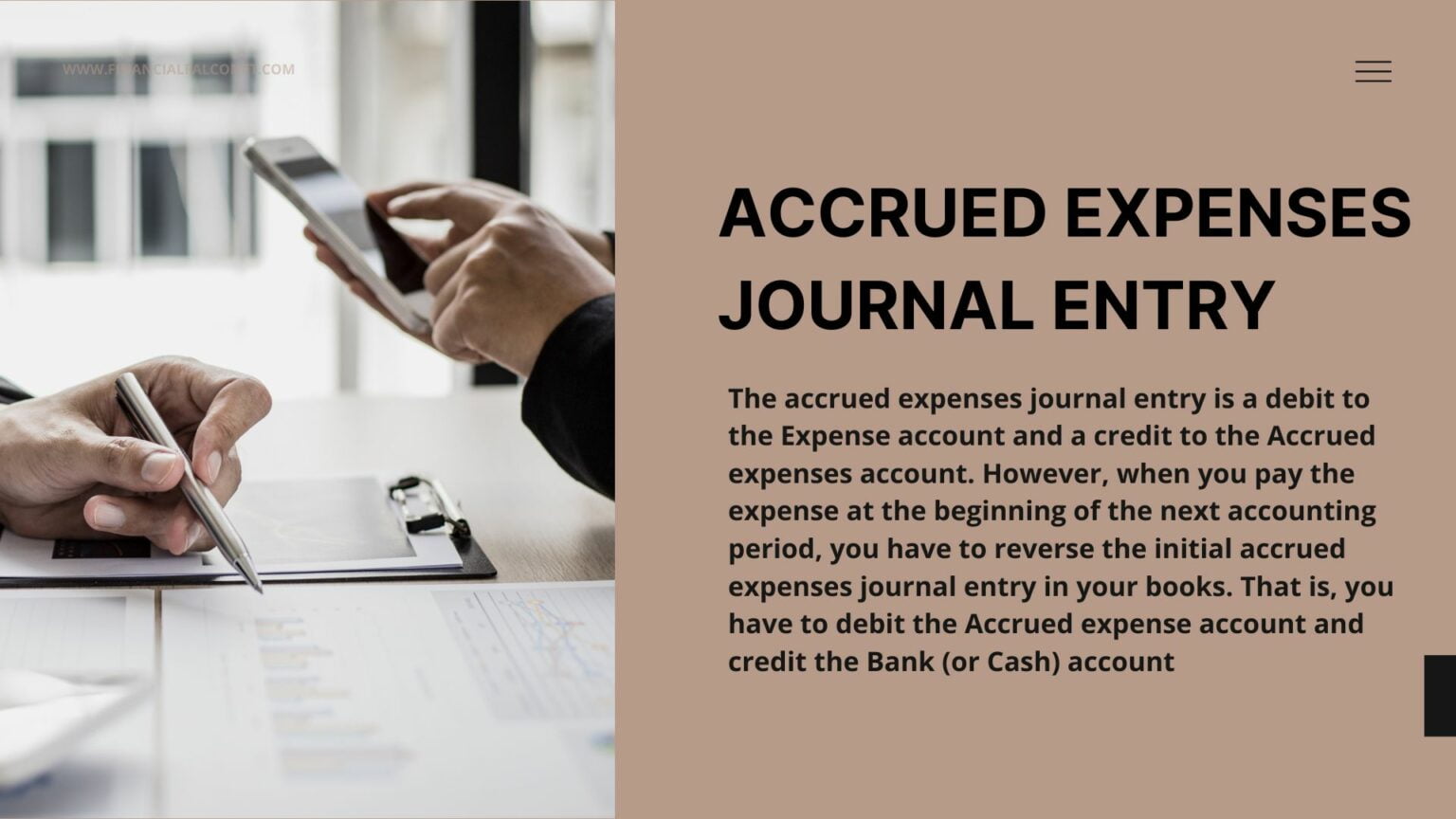

Accrued expenses journal entry and examples Financial

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting? How much revenue should it record under the accrual basis of accounting? Which of the following is an example of an accrued expense?.

Accrued expenses (accrued liabilities) a quick accrued expense guide

How much revenue should it record under the accrual basis of accounting? Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting?

Is accrued expense debit or credit in trial balance? Leia aqui What

Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting? Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting?

What are Accrued Expenses?

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting? How much revenue should it record under the accrual basis of accounting? Which of the following is an example of an accrued expense?.

What Is Accrued Expenses On A Balance Sheet LiveWell

How much revenue should it record under the accrual basis of accounting? Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting? Which of the following is an example of an accrued expense?.

Accrued revenue how to record it in 2023 QuickBooks

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting? How much revenue should it record under the accrual basis of accounting?

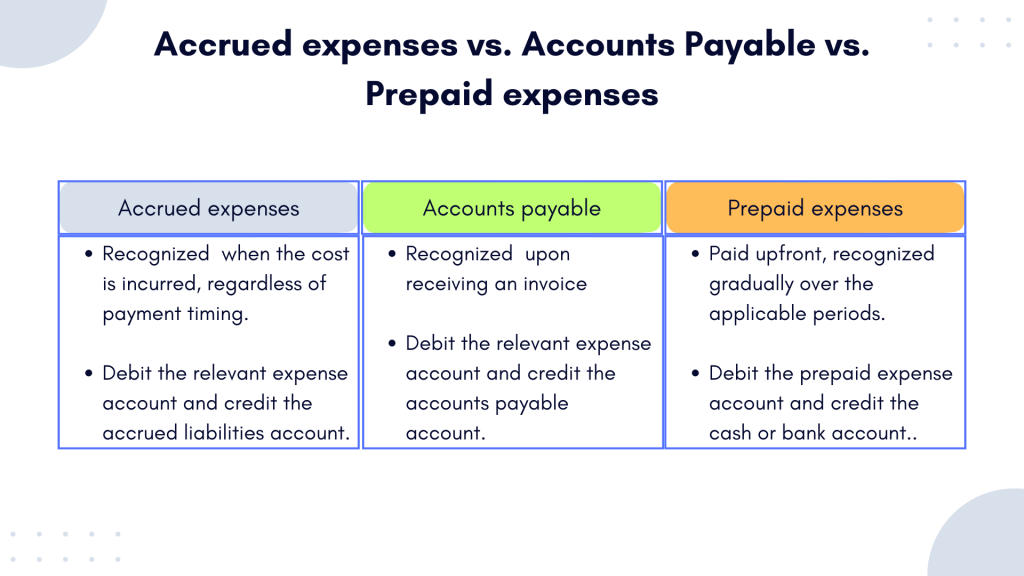

Accrued Expense vs Accounts Payable Differences in Accounting

Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting? How much revenue should it record under the accrual basis of accounting? Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period.

What Is The Difference Between Salaries Payable And Salaries Expense

How much revenue should it record under the accrual basis of accounting? Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting? Which of the following is an example of an accrued expense?.

Accrued Expense Meaning, Accounting Treatment And More

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. Which of the following is an example of an accrued expense?. How much revenue should it record under the accrual basis of accounting? How much revenue should it record under the accrual basis of accounting?

How Much Revenue Should It Record Under The Accrual Basis Of Accounting?

Accrued expenses are types of expenses that are incurred during the current period but remain unpaid at the end of the reporting period. How much revenue should it record under the accrual basis of accounting? Which of the following is an example of an accrued expense?.