Aca Explanation Form

Aca Explanation Form - Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. This will not affect anything on your return, but having the form there may get the irs to accept. You can try to enter $1 for the 1095. Please confirm that aptc was not paid to your. If you do not believe you should be required to complete form 8962 and attach it to your return, 1.

Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. You can try to enter $1 for the 1095. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. Please confirm that aptc was not paid to your. This will not affect anything on your return, but having the form there may get the irs to accept.

If you do not believe you should be required to complete form 8962 and attach it to your return, 1. This will not affect anything on your return, but having the form there may get the irs to accept. You can try to enter $1 for the 1095. Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. Please confirm that aptc was not paid to your.

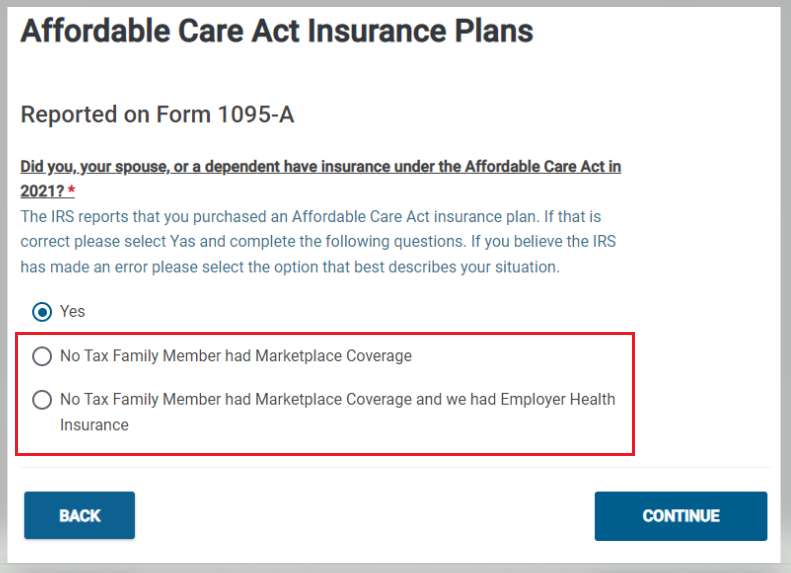

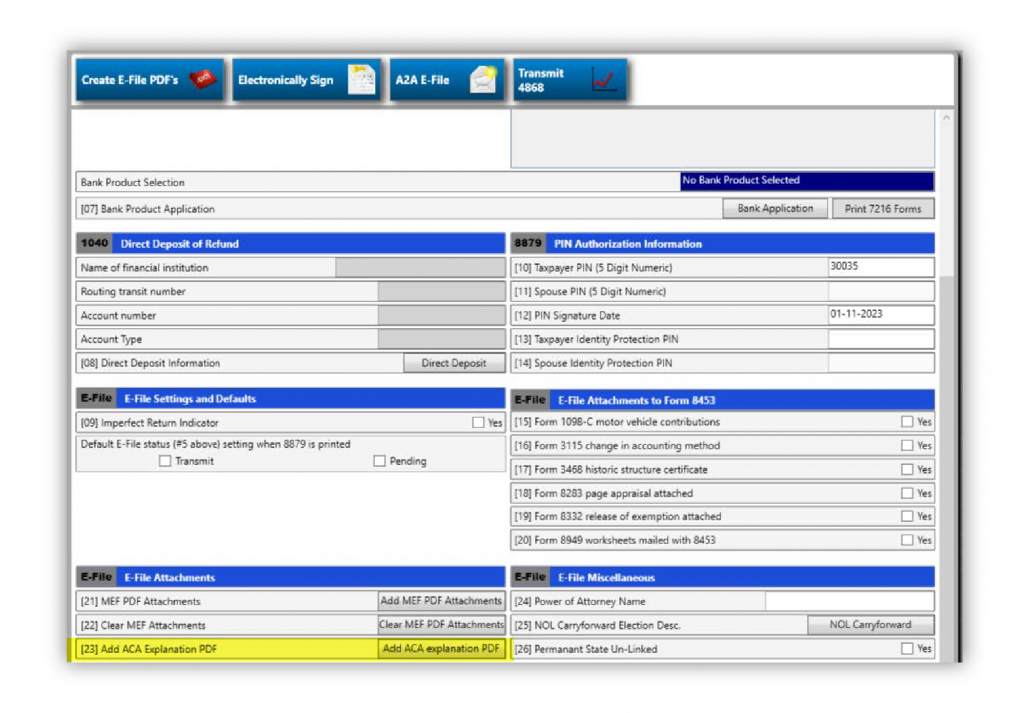

ProWeb Form 8962 How to add a statement regarding marketplace

This will not affect anything on your return, but having the form there may get the irs to accept. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. Please confirm that aptc was not paid to your. You can try to enter $1 for the 1095. Find health care.

IRS Business Rule F8962070 Taxware Systems

Please confirm that aptc was not paid to your. You can try to enter $1 for the 1095. Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. This will not.

ACA Obamacare and Taxes, Forms 1095A and 8962 YouTube

Please confirm that aptc was not paid to your. This will not affect anything on your return, but having the form there may get the irs to accept. You can try to enter $1 for the 1095. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. Find health care.

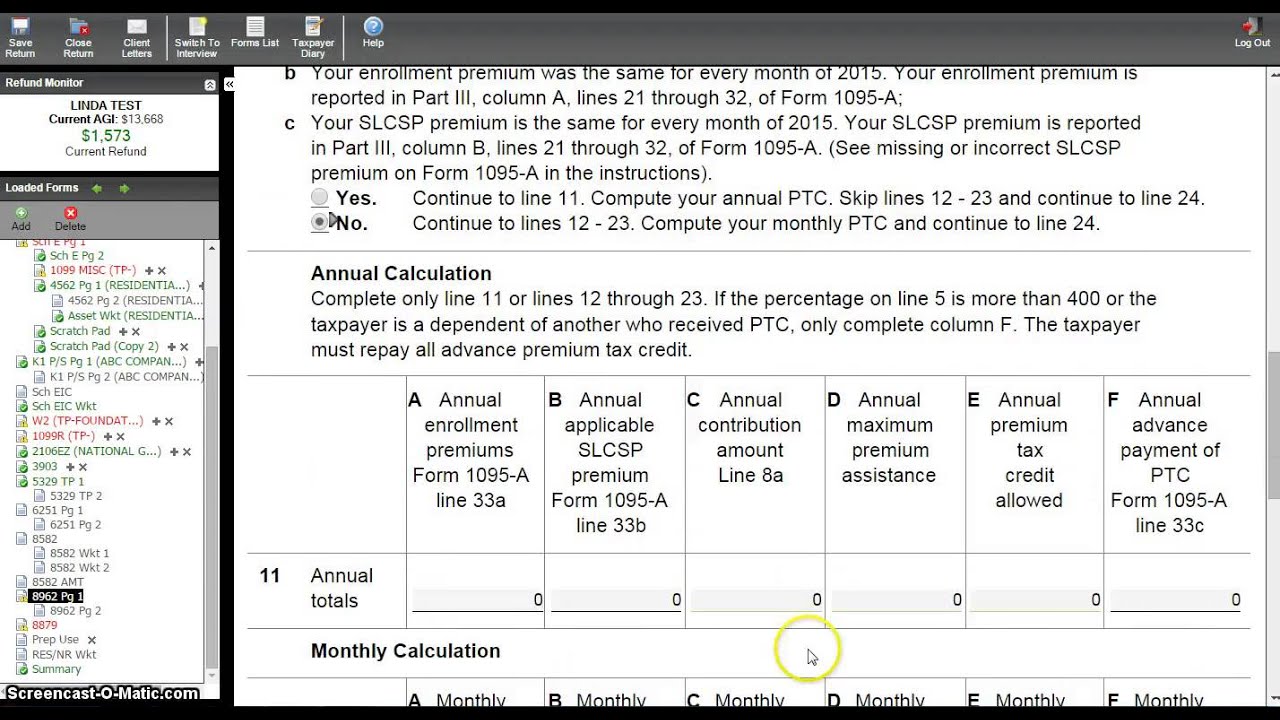

ACA Form 8962 YouTube

Please confirm that aptc was not paid to your. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. You can try to enter $1 for the 1095. This will not affect anything on your return, but having the form there may get the irs to accept. Find health care.

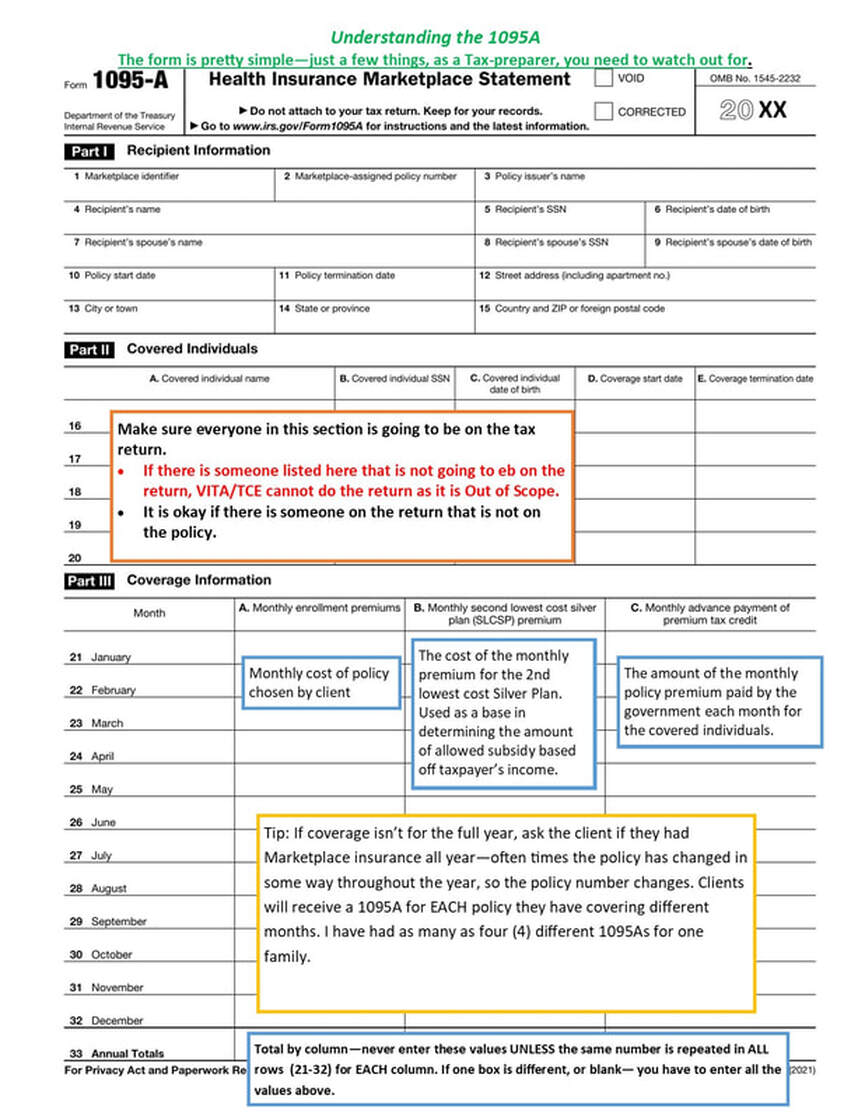

ACA Affordable Care Act Information

Please confirm that aptc was not paid to your. You can try to enter $1 for the 1095. This will not affect anything on your return, but having the form there may get the irs to accept. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. Find health care.

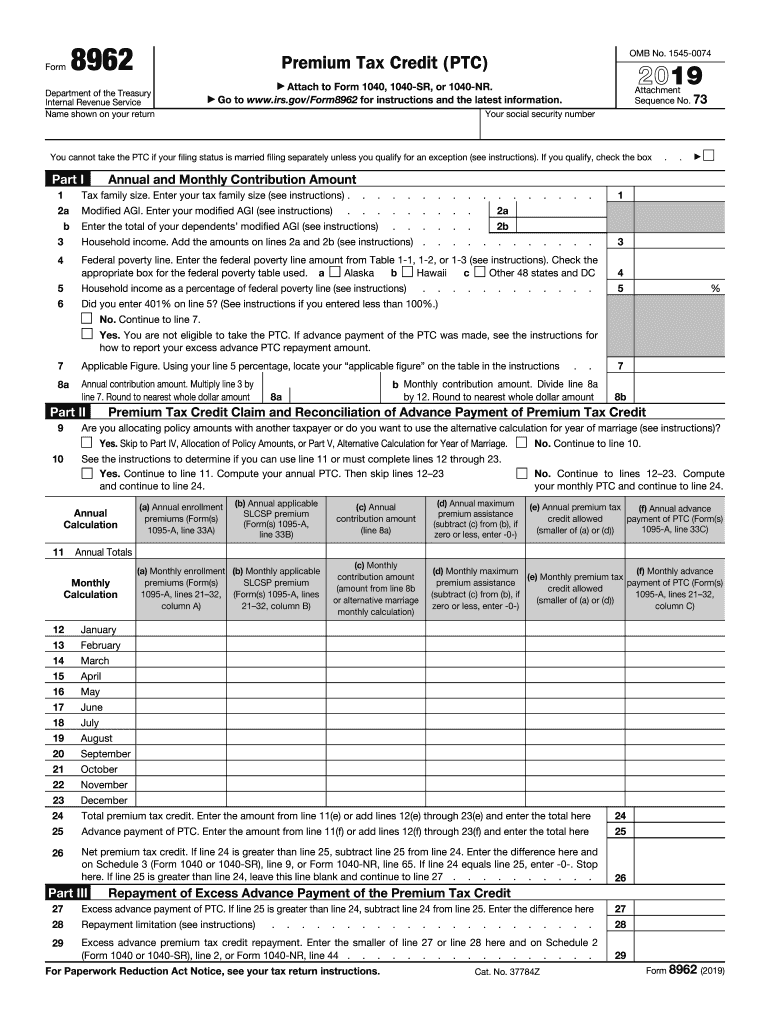

Tax Form 8962 Printable

Please confirm that aptc was not paid to your. Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. You can try to enter $1 for the 1095. This will not.

ACA Explained Levels, Exams, and Timing Demystified YouTube

You can try to enter $1 for the 1095. Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. This will not affect anything on your return, but having the form there may get the irs to accept. Please confirm that aptc was not paid to your. If you do not.

Sample 1095 1094 ACA Forms

You can try to enter $1 for the 1095. Please confirm that aptc was not paid to your. This will not affect anything on your return, but having the form there may get the irs to accept. Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax. If you do not.

IRS Business Rule F8962070 Taxware Systems

If you do not believe you should be required to complete form 8962 and attach it to your return, 1. This will not affect anything on your return, but having the form there may get the irs to accept. Please confirm that aptc was not paid to your. You can try to enter $1 for the 1095. Find health care.

Navigating ACA Reporting Forms 1094C, 1095C APS Payroll

You can try to enter $1 for the 1095. This will not affect anything on your return, but having the form there may get the irs to accept. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. Find health care tax forms and information on the individual shared responsibility.

This Will Not Affect Anything On Your Return, But Having The Form There May Get The Irs To Accept.

Please confirm that aptc was not paid to your. You can try to enter $1 for the 1095. If you do not believe you should be required to complete form 8962 and attach it to your return, 1. Find health care tax forms and information on the individual shared responsibility provision, exemptions, payments and the premium tax.