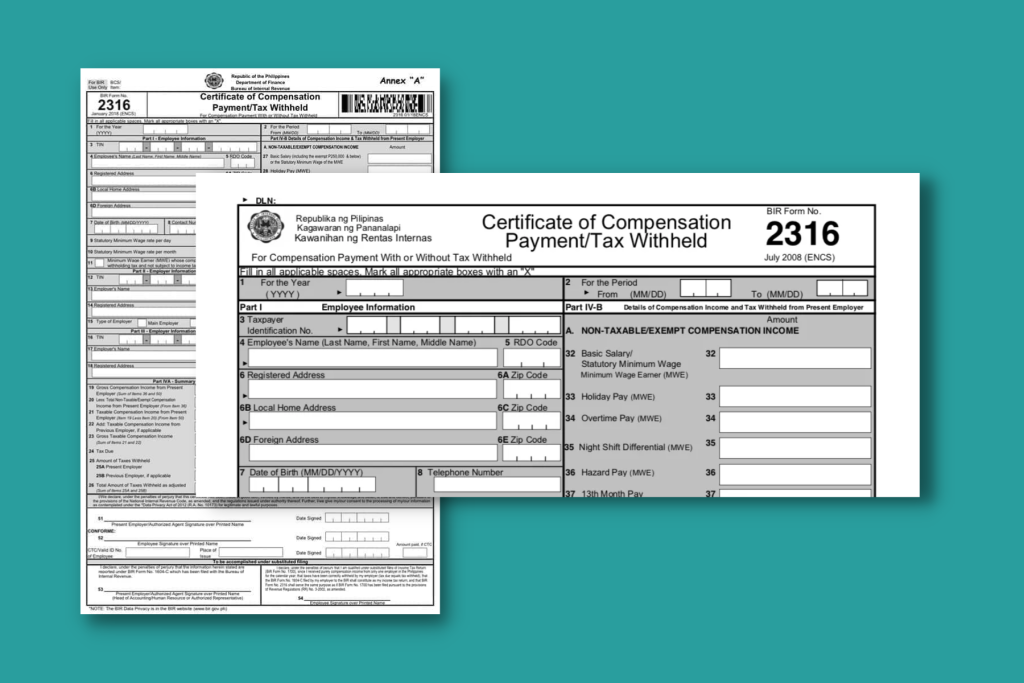

2316 Bir Form

2316 Bir Form - Electronic filing and payment system, ebirforms, etc.) that were. The bir website also serves as the gateway to all bir electronic services (i.e. The form contains details of non. Download and fill out the pdf form for compensation payment with or without tax withheld. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required.

Download and fill out the pdf form for compensation payment with or without tax withheld. The form contains details of non. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The bir website also serves as the gateway to all bir electronic services (i.e. Electronic filing and payment system, ebirforms, etc.) that were.

The bir website also serves as the gateway to all bir electronic services (i.e. Electronic filing and payment system, ebirforms, etc.) that were. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. Download and fill out the pdf form for compensation payment with or without tax withheld. The form contains details of non.

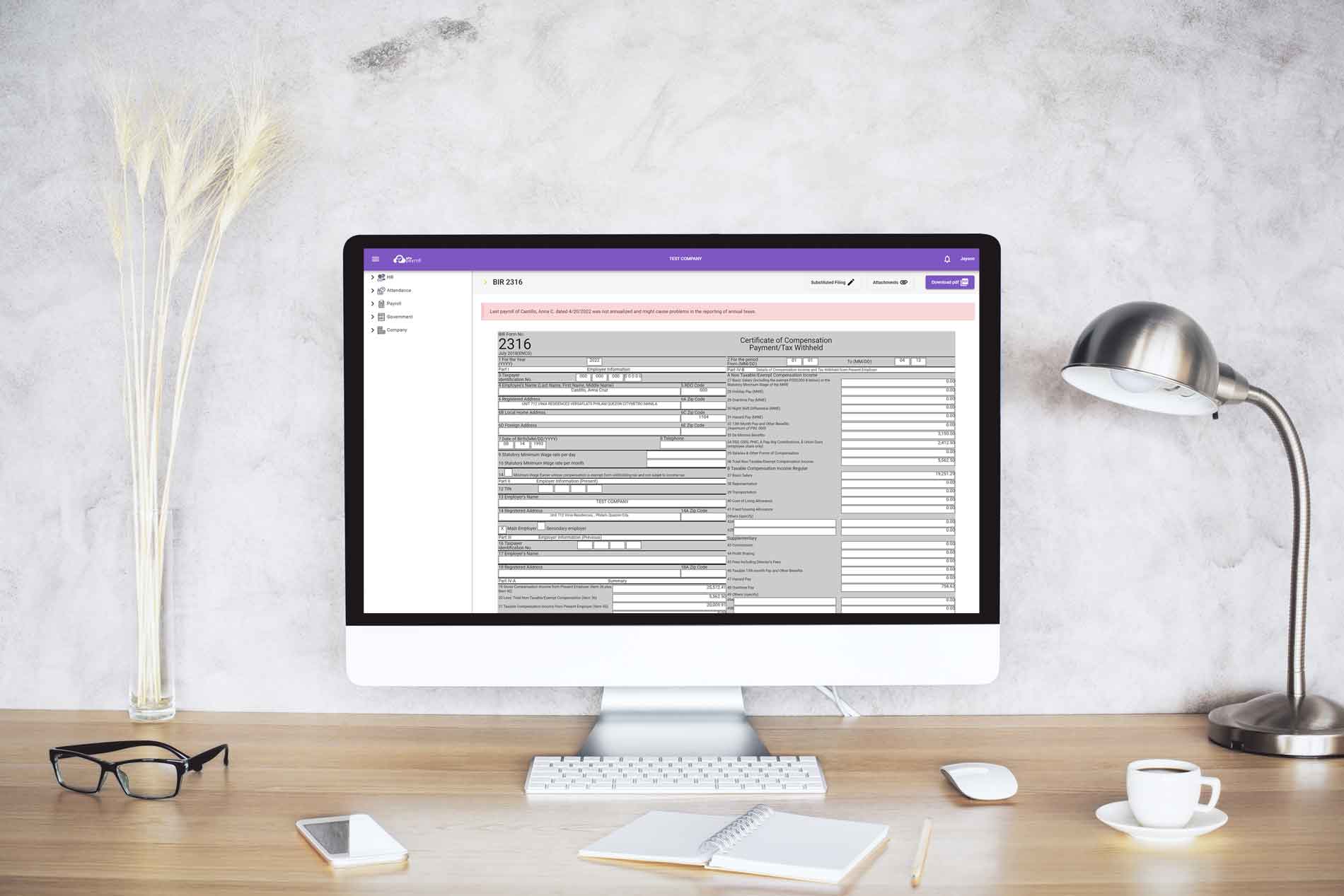

New Format of BIR 2316 on myHR Titanium Technologies Helpdesk

Download and fill out the pdf form for compensation payment with or without tax withheld. The form contains details of non. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The bir website also serves as the gateway to all bir electronic services (i.e. Electronic filing.

BIR Form Types Every Employer Must Be Familiar With eezi

The form contains details of non. The bir website also serves as the gateway to all bir electronic services (i.e. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. Download and fill out the pdf form for compensation payment with or without tax withheld. Electronic filing.

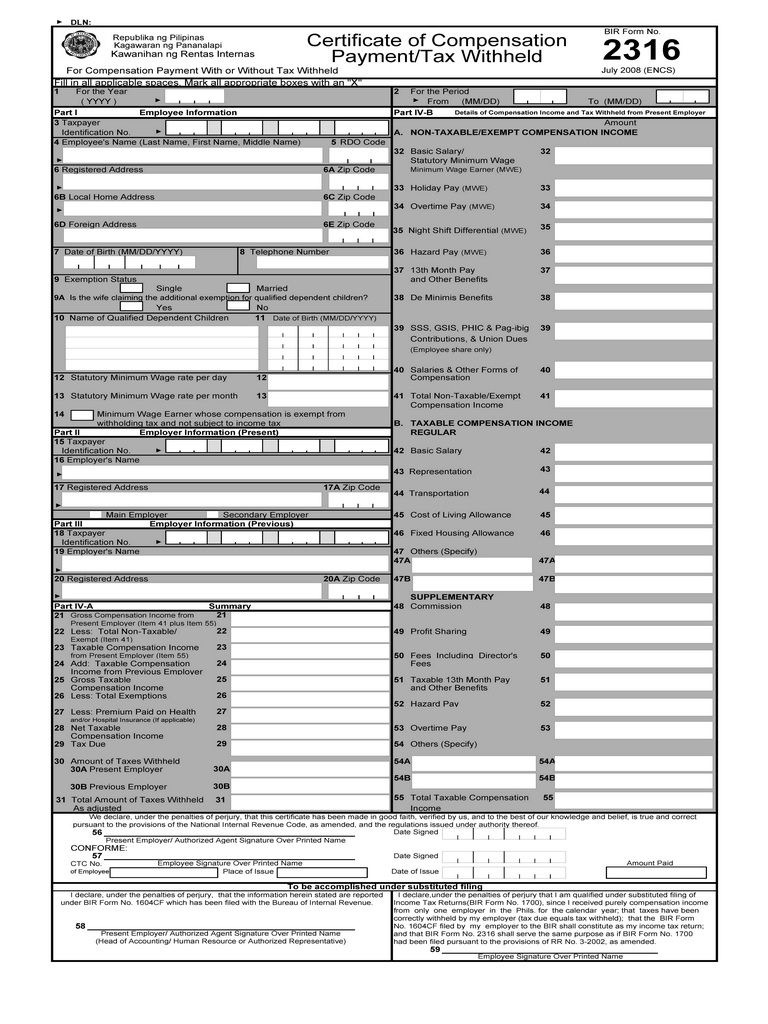

BIR Form 2316 Certificate of Compensation Payment

Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. Download and fill out the pdf form for compensation payment with or without tax withheld. The bir website also serves as the gateway to all bir electronic services (i.e. The form contains details of non. Electronic filing.

Ultimate Guide on How to Fill Out BIR Form 2316 FullSuite

Electronic filing and payment system, ebirforms, etc.) that were. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The bir website also serves as the gateway to all bir electronic services (i.e. The form contains details of non. Download and fill out the pdf form for.

BIR Form 2316 Everything You Need to Know FullSuite

Download and fill out the pdf form for compensation payment with or without tax withheld. Electronic filing and payment system, ebirforms, etc.) that were. The form contains details of non. The bir website also serves as the gateway to all bir electronic services (i.e. Learn what bir form 2316 is, who should prepare and submit it, when and how to.

Philippines Bir Form 2316

The bir website also serves as the gateway to all bir electronic services (i.e. Download and fill out the pdf form for compensation payment with or without tax withheld. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The form contains details of non. Electronic filing.

bir 2316 philippin news collections

Download and fill out the pdf form for compensation payment with or without tax withheld. The form contains details of non. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The bir website also serves as the gateway to all bir electronic services (i.e. Electronic filing.

BIR Form 2316 Everything You Need to Know FullSuite

Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The bir website also serves as the gateway to all bir electronic services (i.e. Electronic filing and payment system, ebirforms, etc.) that were. The form contains details of non. Download and fill out the pdf form for.

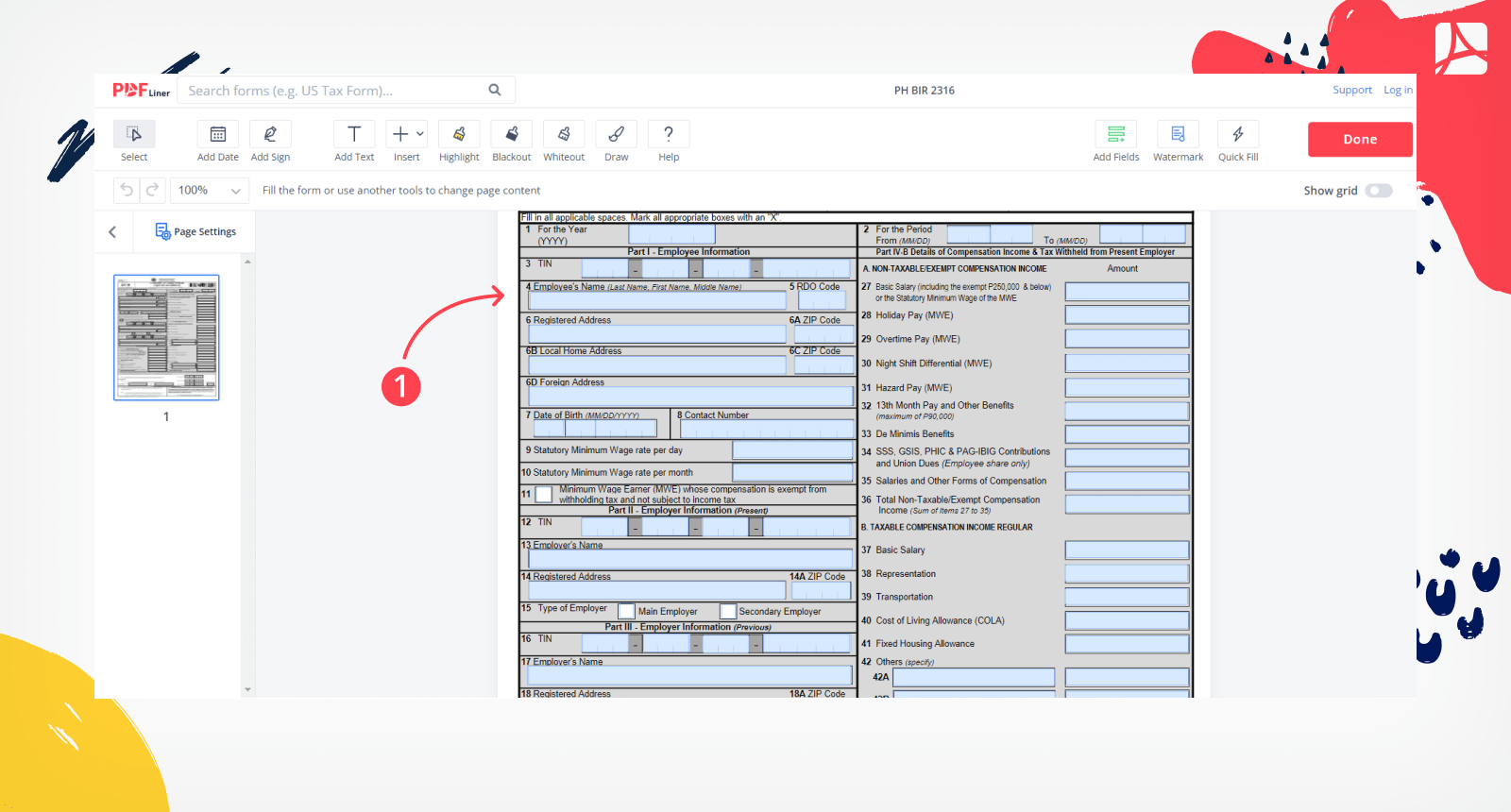

How To Generate Bir Form 2316 Printable Online

The bir website also serves as the gateway to all bir electronic services (i.e. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The form contains details of non. Electronic filing and payment system, ebirforms, etc.) that were. Download and fill out the pdf form for.

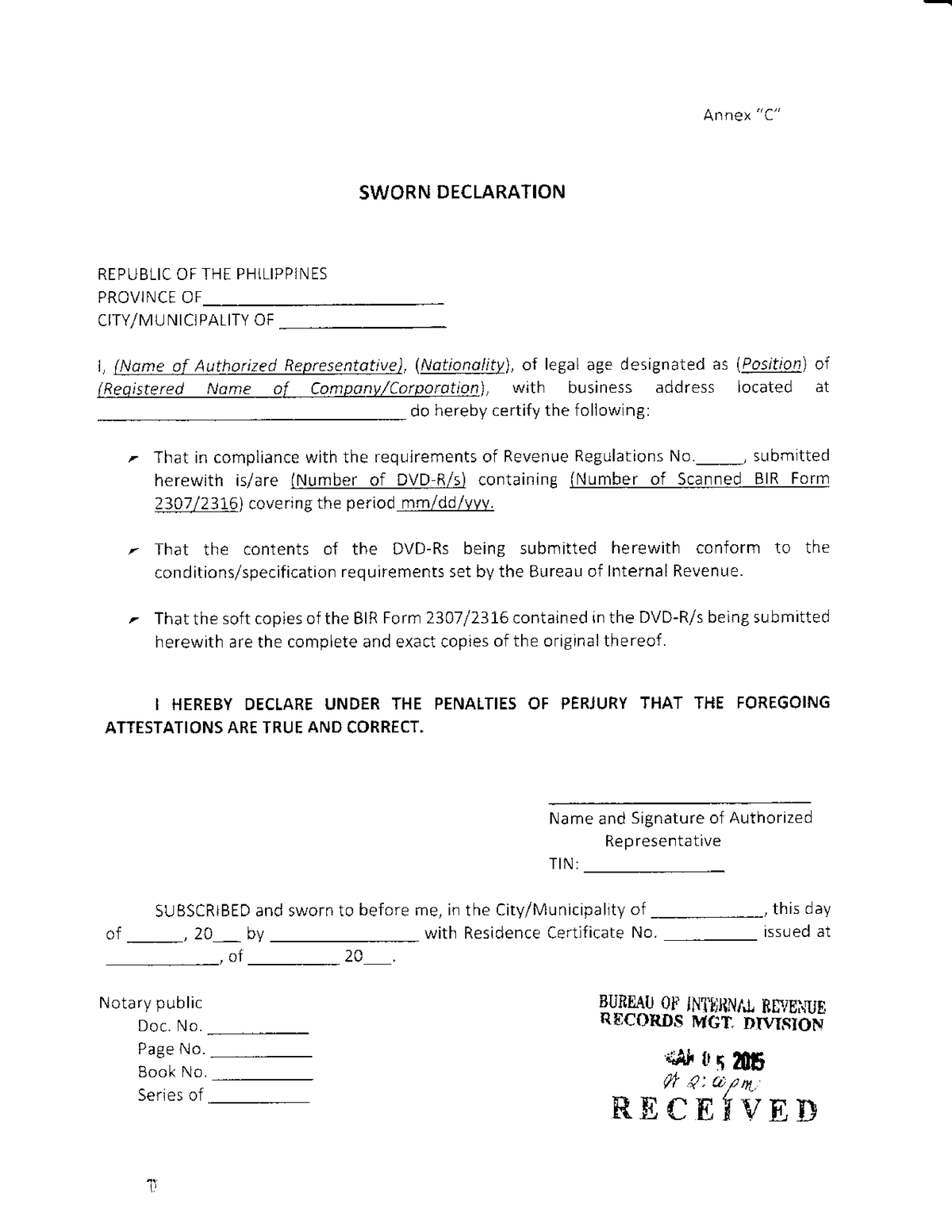

Annex C BIR Annex "C" SWORN DECLARATION l, lNome af Authorized

The bir website also serves as the gateway to all bir electronic services (i.e. Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. Download and fill out the pdf form for compensation payment with or without tax withheld. The form contains details of non. Electronic filing.

Electronic Filing And Payment System, Ebirforms, Etc.) That Were.

Learn what bir form 2316 is, who should prepare and submit it, when and how to do it, and what attachments are required. The bir website also serves as the gateway to all bir electronic services (i.e. Download and fill out the pdf form for compensation payment with or without tax withheld. The form contains details of non.