2021 Form 5695

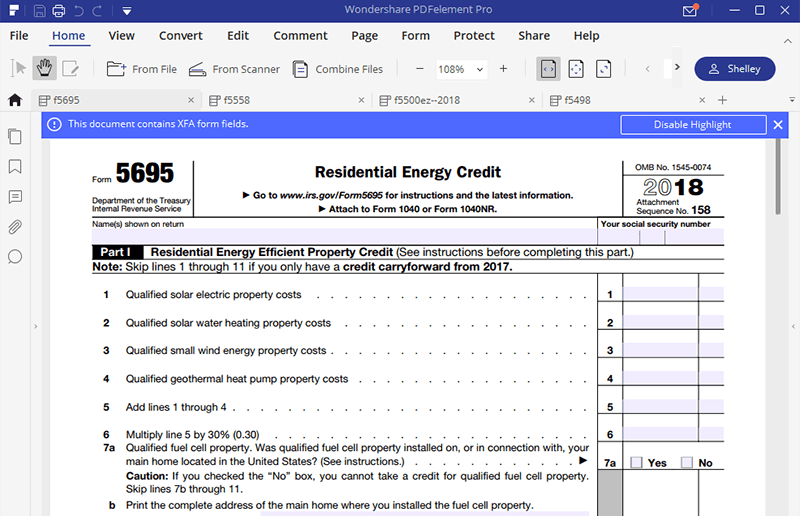

2021 Form 5695 - The nonbusiness energy property credit. The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: Use form 5695 to figure and take your residential energy credits. The residential energy credits are:

The nonbusiness energy property credit. The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. The residential energy credits are: Use form 5695 to figure and take your residential energy credits. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note:

2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: Use form 5695 to figure and take your residential energy credits. The nonbusiness energy property credit. The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. The residential energy credits are:

How to Claim the Federal Solar Investment Tax Credit Solar Sam

2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: Use form 5695 to figure and take your residential energy credits. The residential energy credits are: The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for..

Form 5695 2022 Lifetime Limitation Worksheet

The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: Use form 5695 to figure and take your residential energy credits. The residential energy credits are:.

Form 5695 For 2024 Keri Selena

The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. The residential energy credits are: 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: The nonbusiness energy property credit. Use form 5695 to figure and.

1099 Form California Printable Printable Forms Free Online

Use form 5695 to figure and take your residential energy credits. The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. The nonbusiness energy property credit. The residential energy credits are: 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions.

Form 5695 YouTube

The residential energy credits are: The nonbusiness energy property credit. Use form 5695 to figure and take your residential energy credits. The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions.

Form 5695 2022 Lifetime Limitation Worksheet

Use form 5695 to figure and take your residential energy credits. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: The residential energy credits are: The nonbusiness energy property credit. The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: Use form 5695 to figure and take your residential energy credits. The residential energy credits are:.

IRS Form 5695 Residential Energy Tax Credits StepbyStep Guide

Use form 5695 to figure and take your residential energy credits. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: The nonbusiness energy property credit. The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for..

Form 5695 For 2020, 2021 Energy Tax Credits YouTube

The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions before completing this part.) note: The residential energy credits are: Use form 5695 to figure and take your residential energy credits..

Claim a Tax Credit for Solar Improvements to Your House IRS Form 5695

Use form 5695 to figure and take your residential energy credits. The residential energy credits are: The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. The nonbusiness energy property credit. 2021 5695 158 part i 5695 residential energy efficient property credit (see instructions.

2021 5695 158 Part I 5695 Residential Energy Efficient Property Credit (See Instructions Before Completing This Part.) Note:

The bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for. The nonbusiness energy property credit. The residential energy credits are: Use form 5695 to figure and take your residential energy credits.