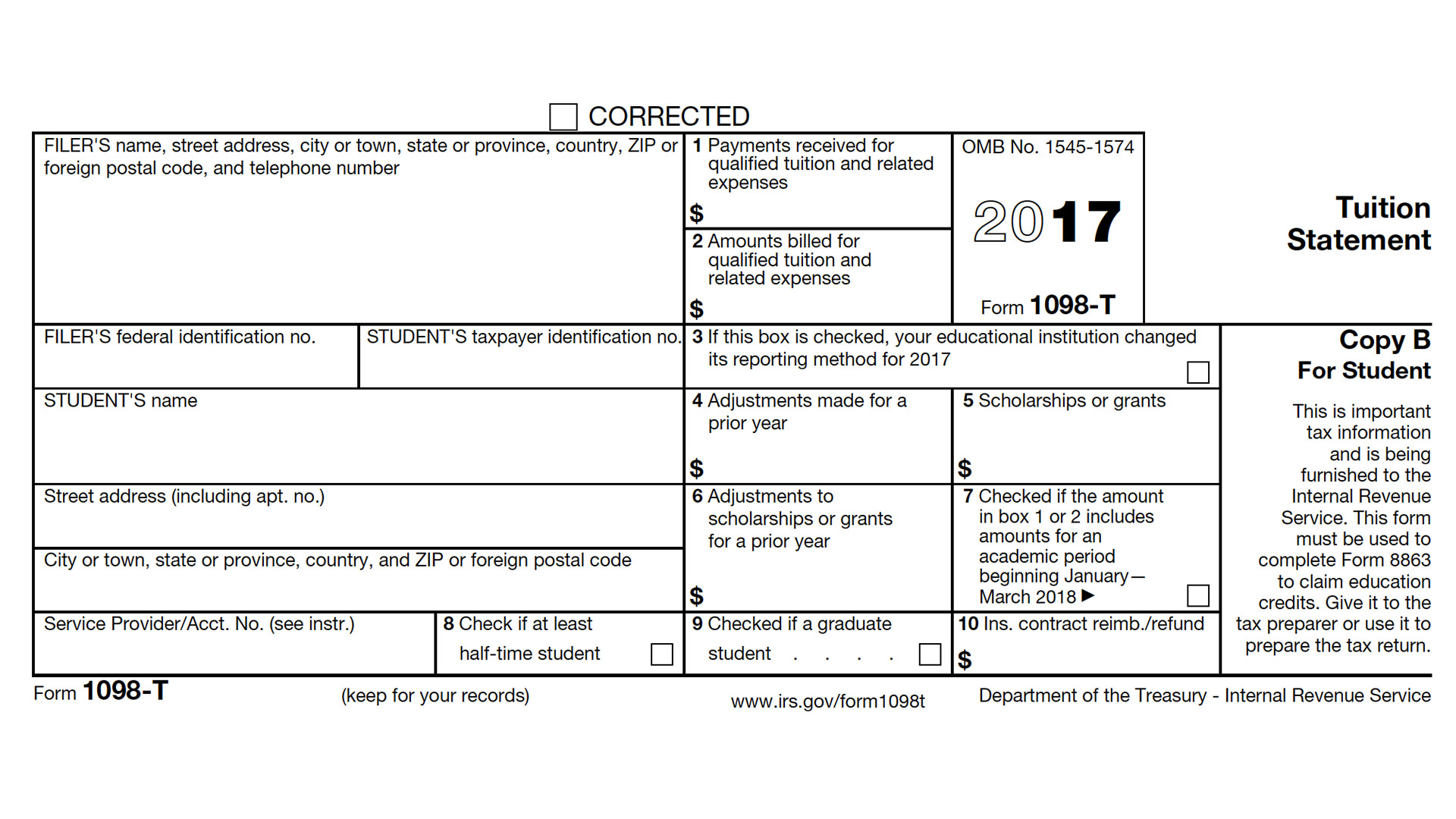

1098 T Form

1098 T Form - 2024 general instructions for certain information returns. You must file for each student you enroll and for whom a reportable. This form must be used to complete form 8863 to claim education credits. This is important tax information and is being furnished to the irs.

This is important tax information and is being furnished to the irs. This form must be used to complete form 8863 to claim education credits. You must file for each student you enroll and for whom a reportable. 2024 general instructions for certain information returns.

2024 general instructions for certain information returns. You must file for each student you enroll and for whom a reportable. This form must be used to complete form 8863 to claim education credits. This is important tax information and is being furnished to the irs.

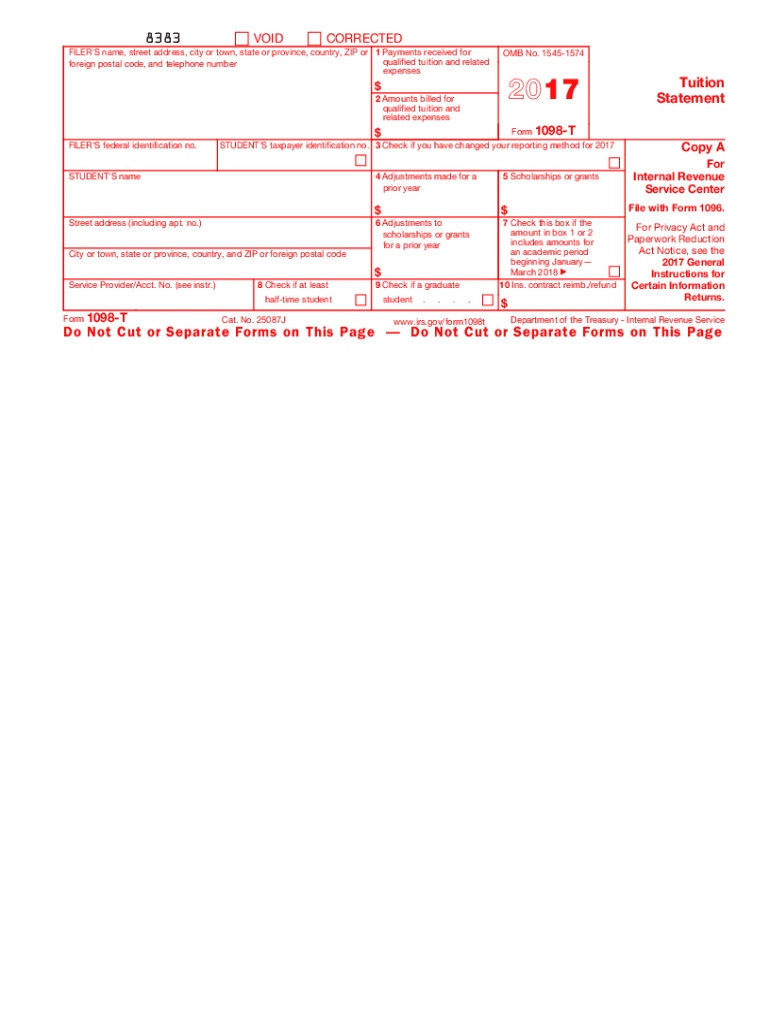

1098T Federal Copy A (L18TA)

You must file for each student you enroll and for whom a reportable. This is important tax information and is being furnished to the irs. 2024 general instructions for certain information returns. This form must be used to complete form 8863 to claim education credits.

Form 1098T Everything you need to know Go TJC

This is important tax information and is being furnished to the irs. 2024 general instructions for certain information returns. You must file for each student you enroll and for whom a reportable. This form must be used to complete form 8863 to claim education credits.

Do you get a 1098 T for student loans? Leia aqui Why didn’t I get a

This is important tax information and is being furnished to the irs. This form must be used to complete form 8863 to claim education credits. You must file for each student you enroll and for whom a reportable. 2024 general instructions for certain information returns.

1098 T Form Fill Out and Sign Printable PDF Template airSlate SignNow

This is important tax information and is being furnished to the irs. This form must be used to complete form 8863 to claim education credits. 2024 general instructions for certain information returns. You must file for each student you enroll and for whom a reportable.

Form 1098T 2024 2025

You must file for each student you enroll and for whom a reportable. This form must be used to complete form 8863 to claim education credits. 2024 general instructions for certain information returns. This is important tax information and is being furnished to the irs.

1098T IRS Tax Form Instructions 1098T Forms

This is important tax information and is being furnished to the irs. This form must be used to complete form 8863 to claim education credits. You must file for each student you enroll and for whom a reportable. 2024 general instructions for certain information returns.

1098T Forms for Education Expenses, IRS Copy A

This form must be used to complete form 8863 to claim education credits. You must file for each student you enroll and for whom a reportable. This is important tax information and is being furnished to the irs. 2024 general instructions for certain information returns.

Where to Find the 1098T Form

This is important tax information and is being furnished to the irs. This form must be used to complete form 8863 to claim education credits. You must file for each student you enroll and for whom a reportable. 2024 general instructions for certain information returns.

Form 1098T Information Student Portal

This form must be used to complete form 8863 to claim education credits. 2024 general instructions for certain information returns. This is important tax information and is being furnished to the irs. You must file for each student you enroll and for whom a reportable.

1098T Form How to Complete and File Your Tuition Statement

This is important tax information and is being furnished to the irs. You must file for each student you enroll and for whom a reportable. 2024 general instructions for certain information returns. This form must be used to complete form 8863 to claim education credits.

You Must File For Each Student You Enroll And For Whom A Reportable.

This is important tax information and is being furnished to the irs. This form must be used to complete form 8863 to claim education credits. 2024 general instructions for certain information returns.