1098 T Form Uc Berkeley

1098 T Form Uc Berkeley - If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. This form is issued by educational institutions in the united states to document educational expenses for. Forms are mailed to students who have chosen the paper. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security number (ssn) or individual.

If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security number (ssn) or individual. This form is issued by educational institutions in the united states to document educational expenses for. You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. Forms are mailed to students who have chosen the paper.

You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security number (ssn) or individual. This form is issued by educational institutions in the united states to document educational expenses for. If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. Forms are mailed to students who have chosen the paper.

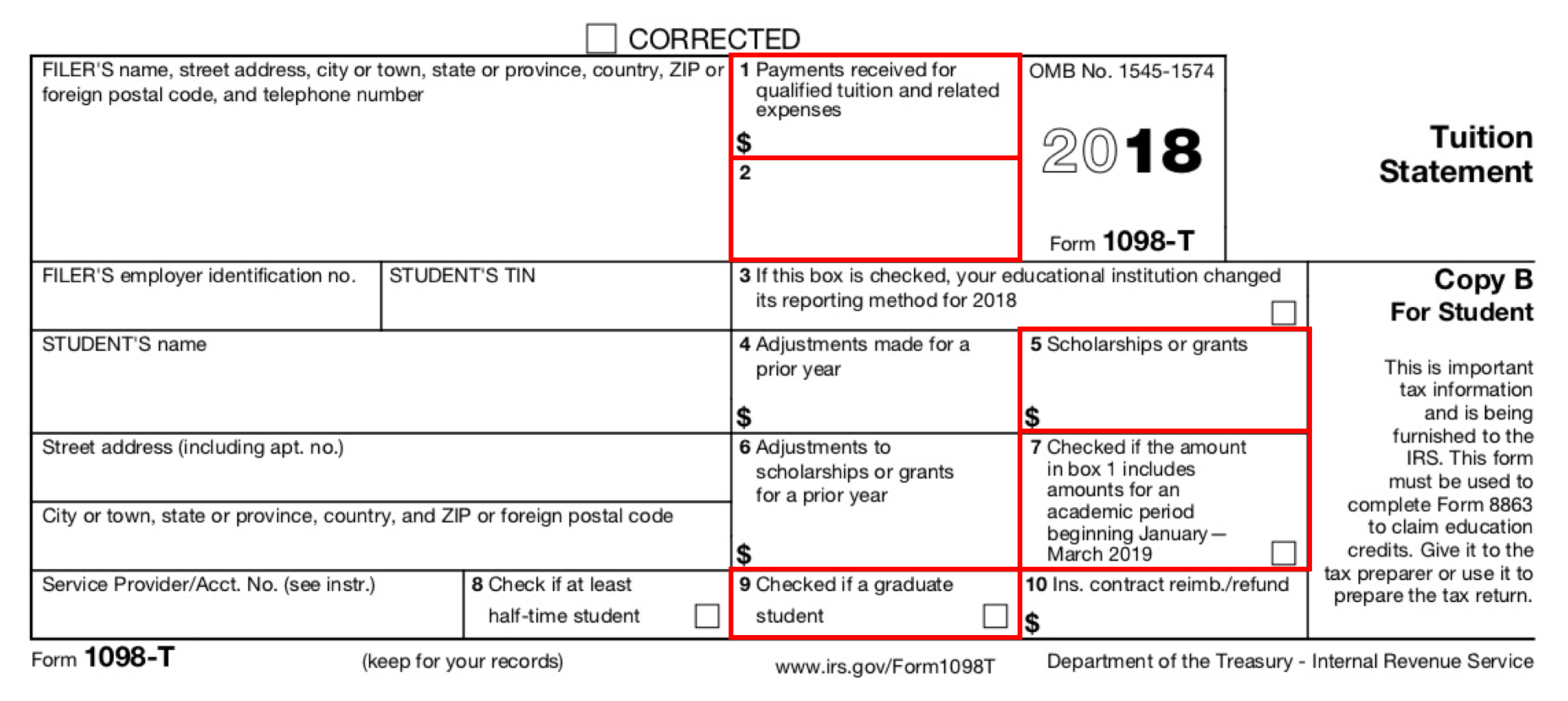

Form 1098T Still Causing Trouble for Funded Graduate Students

If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. This form is issued by educational institutions in the united states to document educational expenses for. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security.

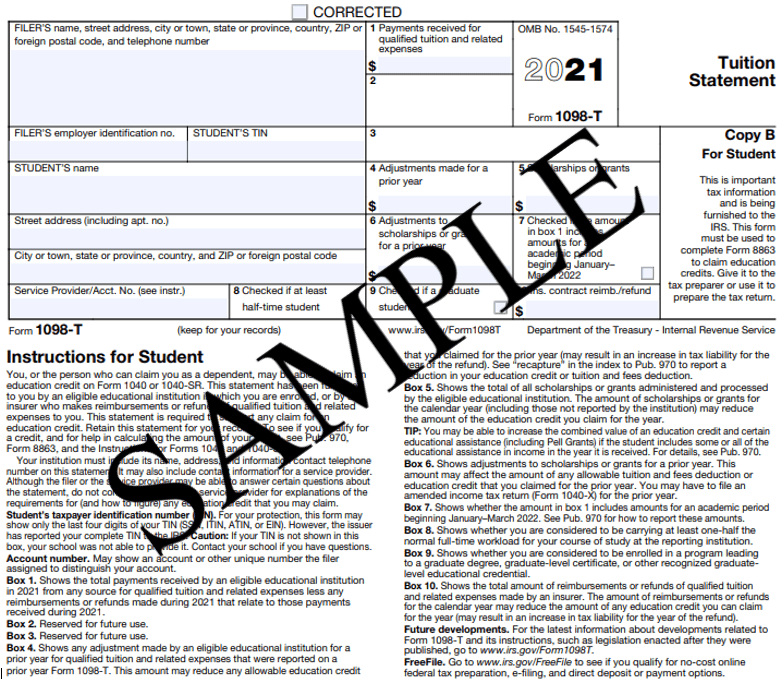

IRS FORM 1098T Woodland Community College

You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security number (ssn) or individual. Forms are mailed to students who have chosen the paper..

Where to Find the 1098T Form

You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. To verify your eligibility for education tax credits, uc berkeley.

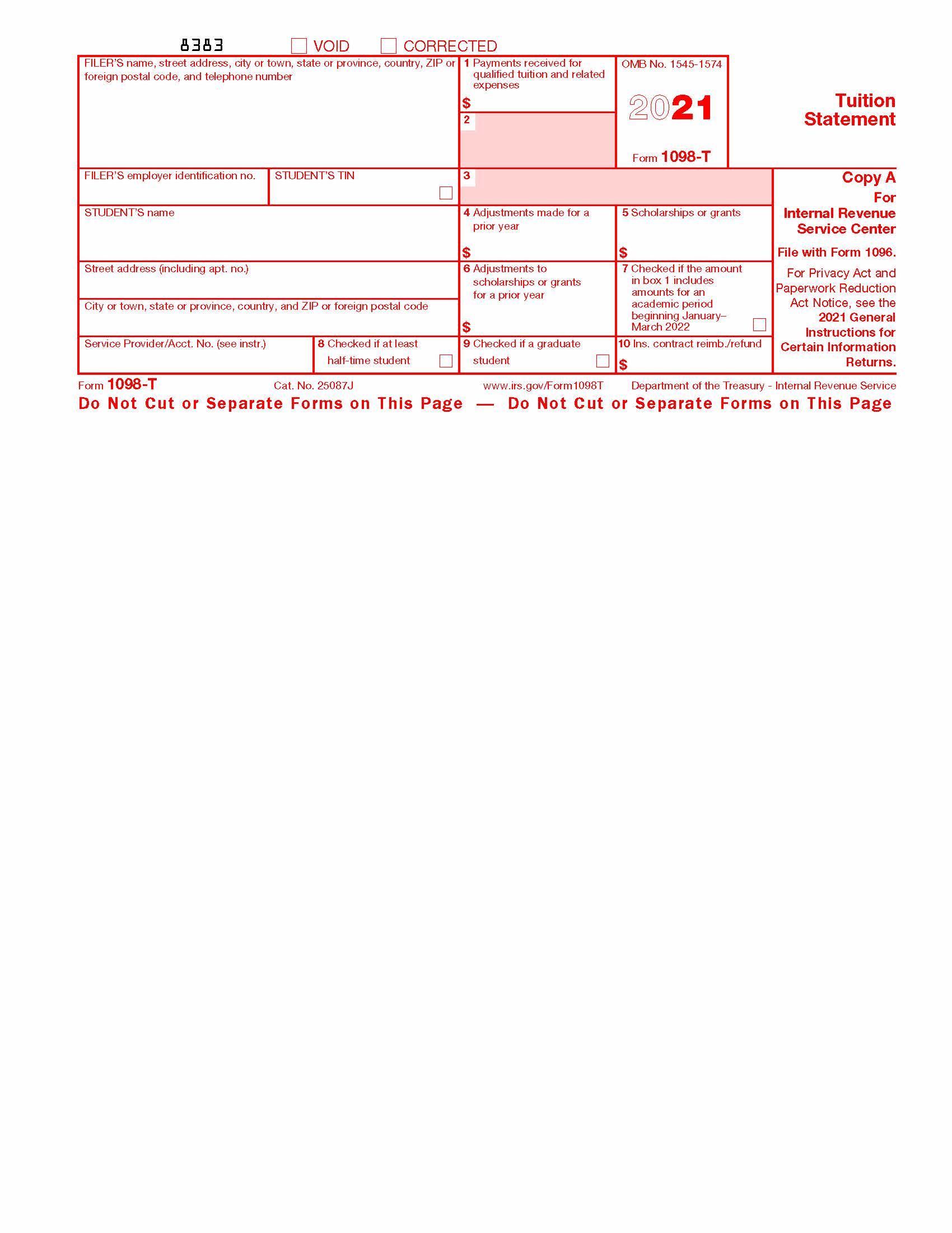

1098T Federal Copy A (L18TA)

Forms are mailed to students who have chosen the paper. If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security number (ssn) or individual. You have.

Students Printable 1098t Forms Printable Forms Free Online

If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. Forms are mailed to students who have chosen the paper. This form is issued by educational institutions in the united states to document educational expenses for. You have to file it as part of your taxes,.

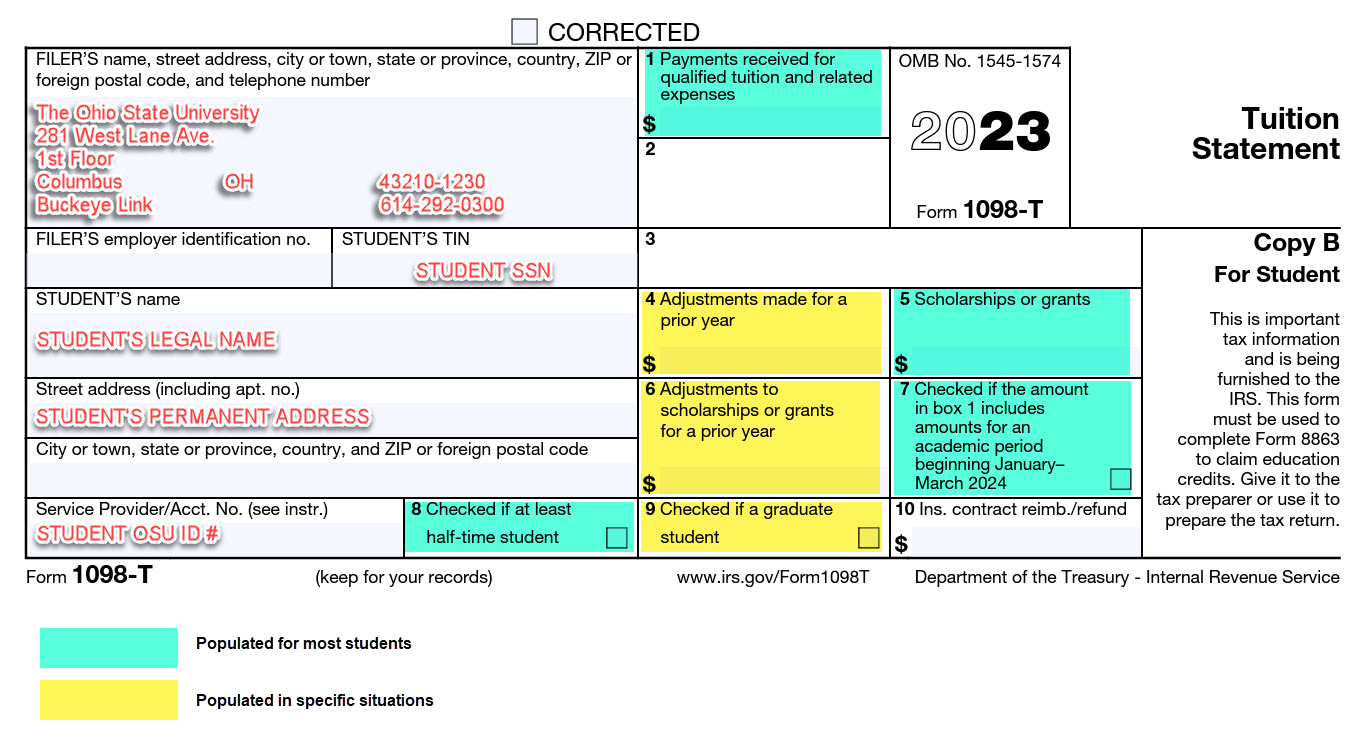

Tax Information 1098T Office of Business and Finance

To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security number (ssn) or individual. This form is issued by educational institutions in the united states to document educational expenses for. You have to file it as part of your taxes, especially if you or your parents want to claim education.

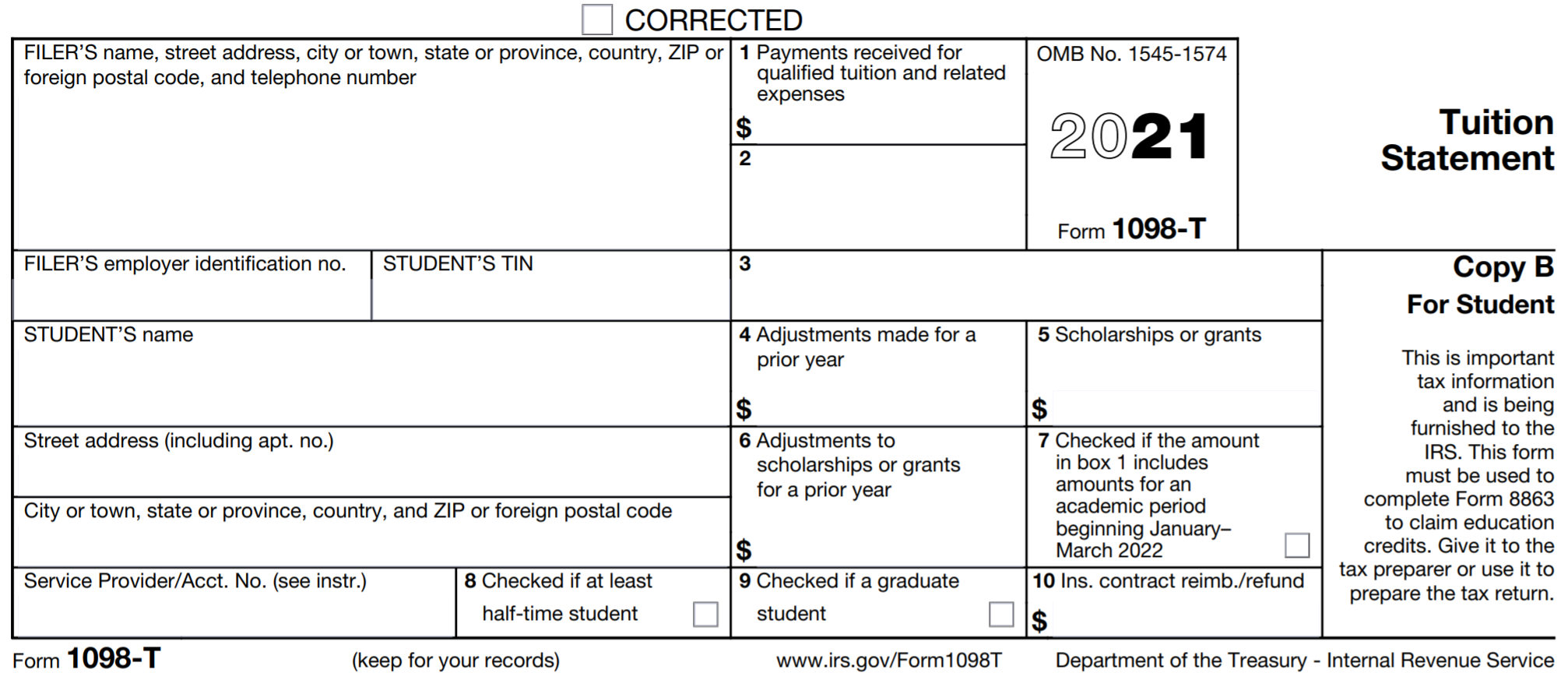

Education Credits and Deductions (Form 1098T) Support

You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. This form is issued by educational institutions in the united states to document educational expenses for. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your.

Bursar 1098T Tuition Statement Reporting Hofstra University

This form is issued by educational institutions in the united states to document educational expenses for. Forms are mailed to students who have chosen the paper. You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. To verify your eligibility for education tax credits,.

1098 Form 2023 Printable Forms Free Online

If you are a us resident for tax purposes and you have qualified charges and/or gift aid for the corresponding tax year, you may. Forms are mailed to students who have chosen the paper. This form is issued by educational institutions in the united states to document educational expenses for. To verify your eligibility for education tax credits, uc berkeley.

Bursar 1098T Tuition Statement Reporting Hofstra University

This form is issued by educational institutions in the united states to document educational expenses for. You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. Forms are mailed to students who have chosen the paper. To verify your eligibility for education tax credits,.

If You Are A Us Resident For Tax Purposes And You Have Qualified Charges And/Or Gift Aid For The Corresponding Tax Year, You May.

You have to file it as part of your taxes, especially if you or your parents want to claim education tax credits or adjustment to income. To verify your eligibility for education tax credits, uc berkeley is required by federal law to report your social security number (ssn) or individual. This form is issued by educational institutions in the united states to document educational expenses for. Forms are mailed to students who have chosen the paper.

:max_bytes(150000):strip_icc()/Form1098-30d7d922c32748bea2a293a28fbbe778.jpg)