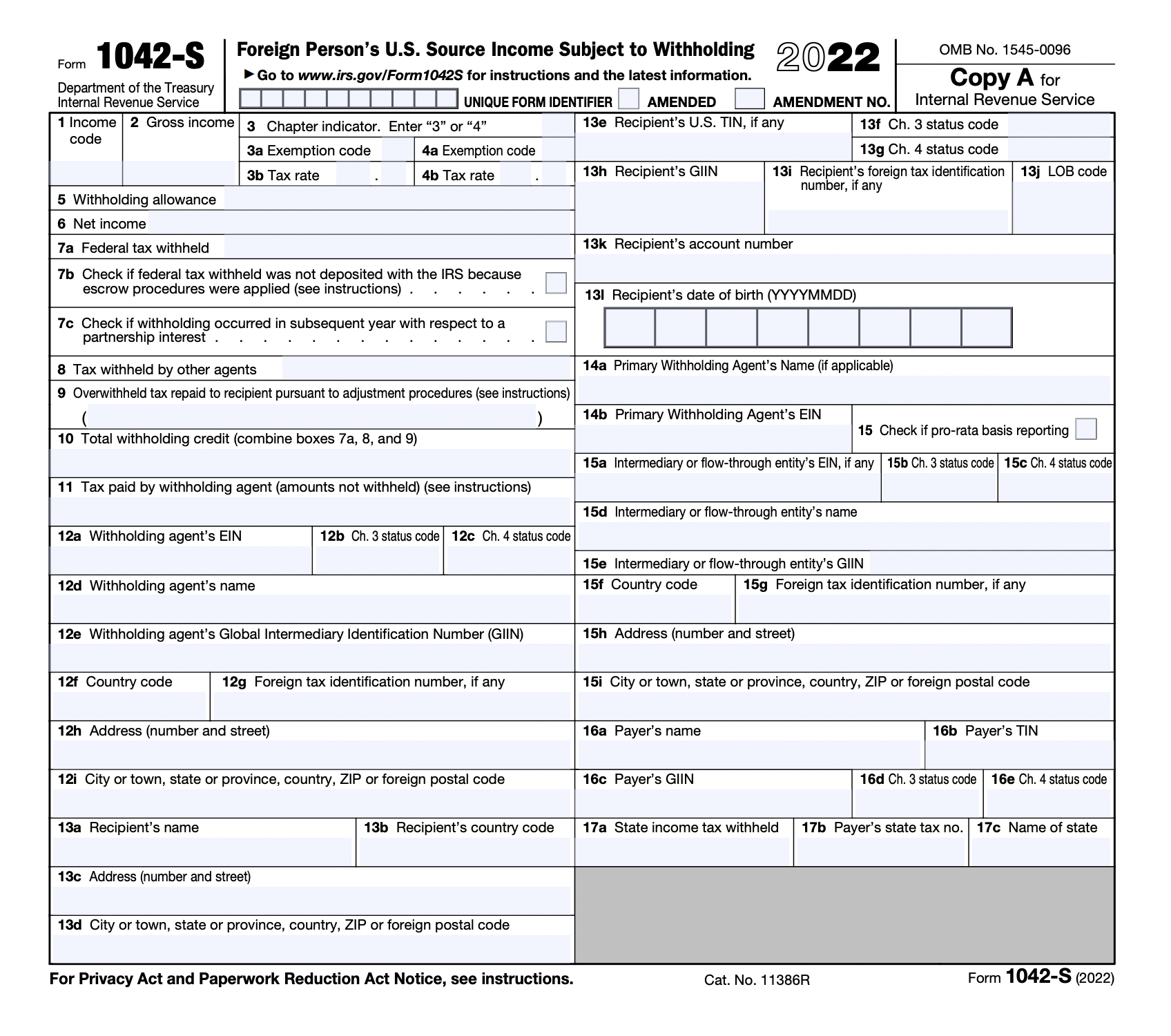

1042 S Tax Form

1042 S Tax Form - Income, including income that is effectively connected with the conduct of a trade. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Tax treaty or the internal revenue code, including the exemption.

Tax treaty or the internal revenue code, including the exemption. Income, including income that is effectively connected with the conduct of a trade. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Income, including income that is effectively connected with the conduct of a trade. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Tax treaty or the internal revenue code, including the exemption.

Instructions for IRS Form 1042S How to Report Your Annual

Income, including income that is effectively connected with the conduct of a trade. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Tax treaty or the internal revenue code, including the exemption. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.

What is Form 1042S? Tax reporting for foreign contractors Trolley

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Tax treaty or the internal revenue code, including the exemption. Income, including income that is effectively connected with the conduct of a trade.

Understanding your 1042S » Payroll Boston University

Income, including income that is effectively connected with the conduct of a trade. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Tax treaty or the internal revenue code, including the exemption. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s.

1042S 2018 Public Documents 1099 Pro Wiki

Income, including income that is effectively connected with the conduct of a trade. Tax treaty or the internal revenue code, including the exemption. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s.

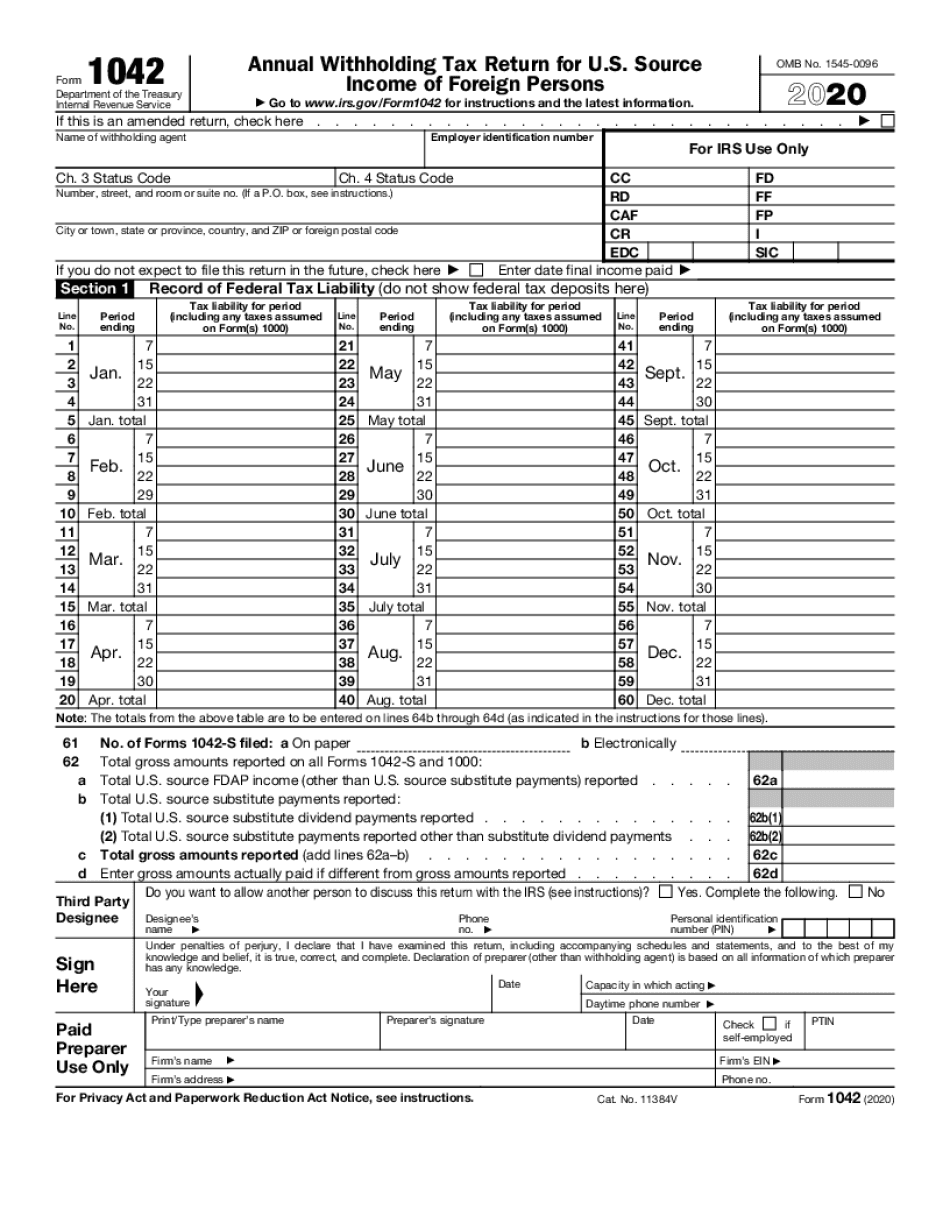

2020 Form 1042 Complete with ease airSlate SignNow

Tax treaty or the internal revenue code, including the exemption. Income, including income that is effectively connected with the conduct of a trade. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.

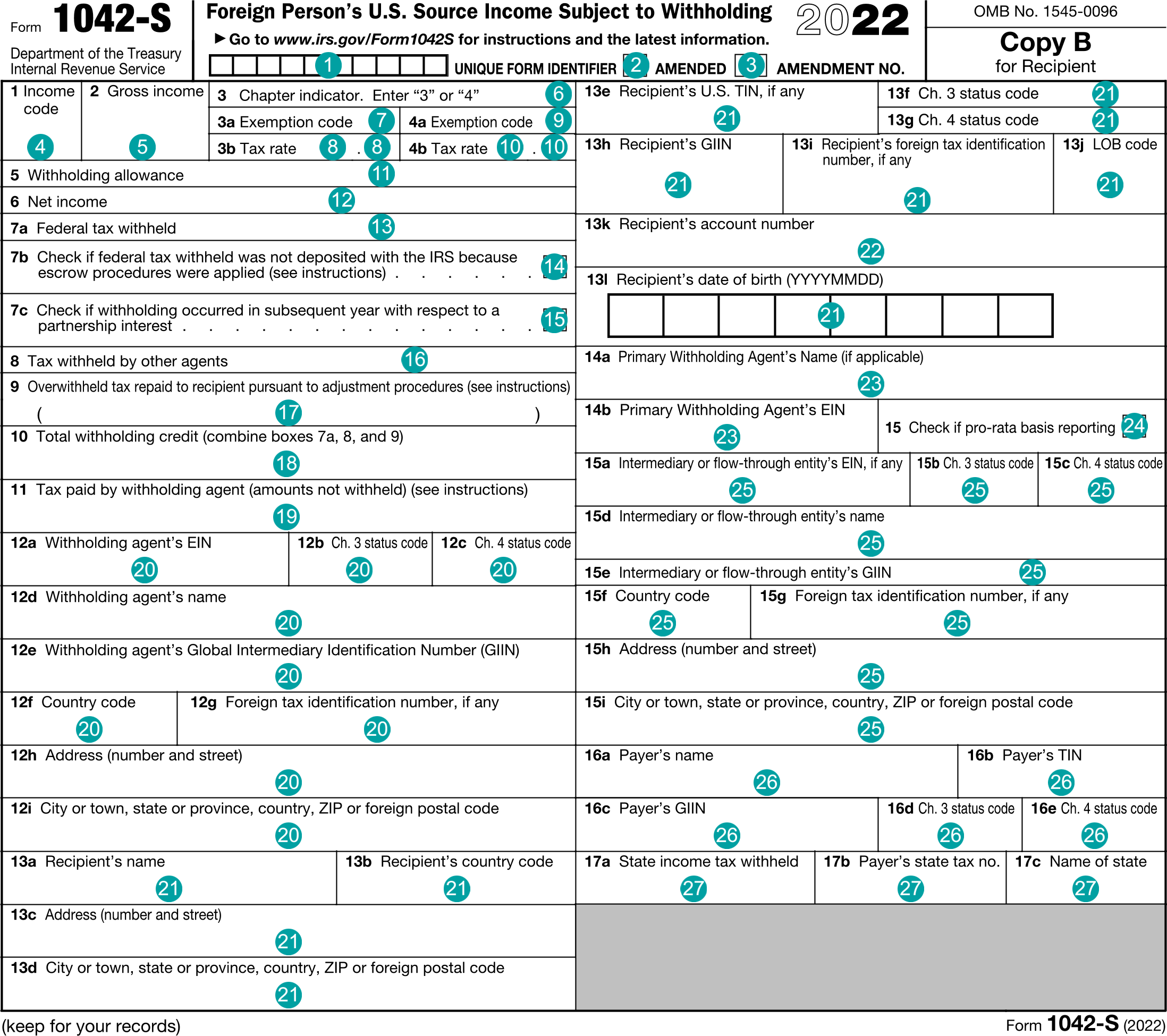

Form 1042S (Guidelines) Expat US Tax

Tax treaty or the internal revenue code, including the exemption. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Income, including income that is effectively connected with the conduct of a trade.

FDX

Income, including income that is effectively connected with the conduct of a trade. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Tax treaty or the internal revenue code, including the exemption.

【アメリカ留学中の税申告はこれをやれば大丈夫】「Form 8843」と「Form 1040NREZ」って?

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Tax treaty or the internal revenue code, including the exemption. Income, including income that is effectively connected with the conduct of a trade. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s.

Understanding Form 1042S American Legal Journal

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Income, including income that is effectively connected with the conduct of a trade. Tax treaty or the internal revenue code, including the exemption.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Tax treaty or the internal revenue code, including the exemption. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Income, including income that is effectively connected with the conduct of a trade. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.

Generally, Every Nonresident Alien Individual, Nonresident Alien Fiduciary, And Foreign Corporation With U.s.

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Income, including income that is effectively connected with the conduct of a trade. Tax treaty or the internal revenue code, including the exemption.